Dear readers,

Enagás, S.A. (OTCPK:ENGGF) is a Spanish provider of mission-critical natural gas infrastructure in Europe. The company owns legacy infrastructure in Spain but has recently diversified into several higher growth projects to secure the long-term viability of its 10%+ dividend. The stock is primarily an income (bond-like) investment in natural gas and the Spanish government and provides good inflation protection thanks to the high double-digit yield.

I started my coverage on Enagás with a detailed article called Enagas: Recession-Resistant With A Dependable Dividend in April with a BUY rating at EUR 18 for the native shares (ticker ENG traded in Madrid). In particular, I discussed why the company was well-positioned for a potential recession. Since then the stock price has fallen below EUR 16 per share and the company has reported several more quarters of results, most recently Q3 2023.

Enagás Overview

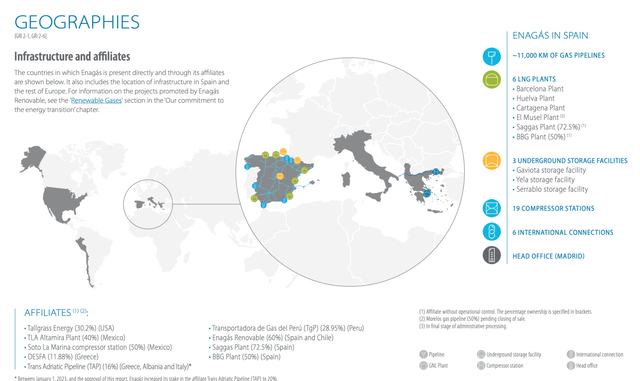

The first thing you need to know is that Enagás owns and operates key infrastructure, which is absolutely necessary for a functioning natural gas network. And this infrastructure isn’t going anywhere which provides a certain level of safety. This includes over 11,000 km of natural gas pipelines, six LNG terminals, three massive underground storage terminals, and a number of international connections. Notably, the natural gas that Enagás transports is sourced almost entirely from directions other than the east (i.e. outside of Russia).

Enagás has a monopoly on natural gas transportation in Spain and holds stakes in several international projects with higher growth prospects than the legacy network. These include:

- a recently increased 20% stake (16% previously) in the Trans-Adriatic Pipeline (TAP) which connects Turkey to Italy

- a recently acquired 10% stake in Hanseatic Energy Hub, an LNG terminal project in Germany

- a 30.2% stake in Tallgrass Energy LP, which is an owner of natural gas and oil pipelines in the US

- a couple of JV investments in Latin America (Mexico, Peru, and Chile).

These higher growth projects are important because the volume of natural gas transported through the legacy infrastructure in Spain has been on a decline as a result of moving to green energy. Consequently, Enagás has had to look elsewhere for growth to ensure the sustainability of their dividend.

Enagás Presentation

Enagás is also a major player in the development of a major H2Med hydrogen corridor connecting France, Spain, and Portugal. Over the long-term, this can benefit Enagás by putting them at the forefront of hydrogen transportation as 80% of existing pipelines coincide with planned routes for the hydrogen corridor, and 30% of existing pipelines can be used to transport hydrogen already, if need be.

But here’s the thing.

Hydrogen is still in very early stages and it will take a very long time before Enagas and others see any form of earnings from these projects. In the meantime, they are spending significant CAPEX today. With the revised version of the green deal passed in February and RePower, it is likely that a large portion of funding will come directly from the EU. Nonetheless, for now, hydrogen remains more of a talking point than a real source of earnings.

Recent Results

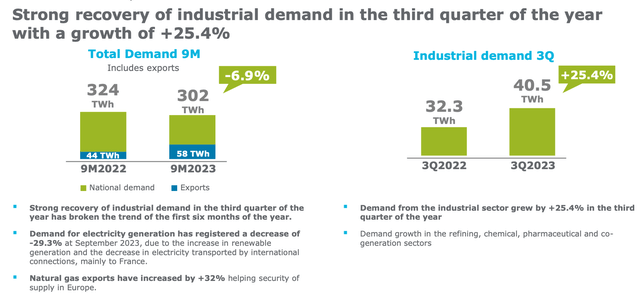

During the third quarter demand for natural gas fell by 6.9% YoY to 302 TWh, despite a strong 25% YoY rebound in industrial demand. The drop was entirely attributable to lower demand for gas for electricity generation. JV projects have grown by 8-10% YoY.

Enagás Presentation

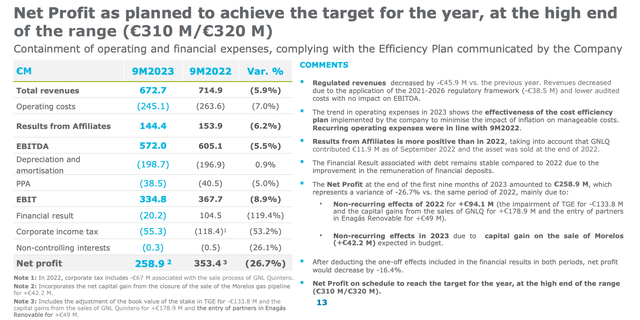

As a result, revenues and EBITDA have declined by about 6% year-over-year. On the bright side, management has delivered on their plan to keep OPEX under control as over the first 9 months of the year it has been flat. Net income has declined by 27% YoY to EUR 260 Million mainly due to increased financing costs (discussed later).

Enagás Presentation

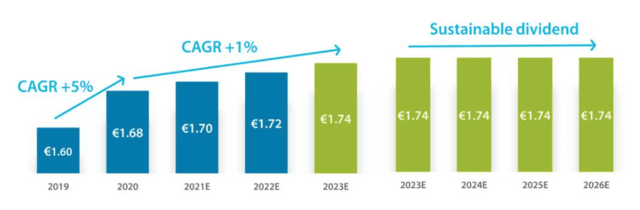

Management has confirmed their guidance for the full year for a net profit of EUR 310-320 Million and a EUR 1.74 per share dividend. In fact, the dividend has been confirmed at this level all the way until 2026.

I’ve explained in my initial article why FCF coverage is more important than earnings coverage and I continue to believe that Enagás will be able to cover the dividend (about EUR 450 Million) with FCF of EUR 600-700 Million by 2025. At the same time though, I expect no dividend growth whatsoever here, not now and likely not even post 2026. But at an 11% yield, that’s OK.

Enagás Presentation

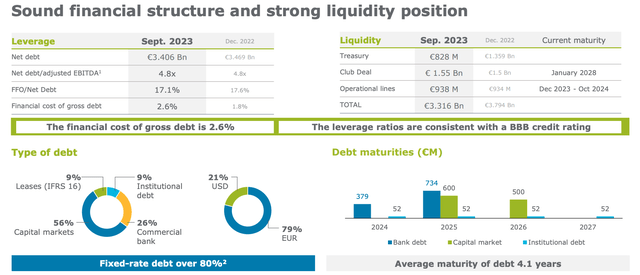

One of the main risks is related to the balance sheet. Enagas is BBB rated and has about 80% of their debt fixed, but their leverage is quite high at 4.8x EBITDA and their cost of debt has increased from 1.8% to 2.6% in just 9 months. Going forward, the cost of capital is likely to continue increasing as long as interest rates remain high and will put pressure on earnings and dividend coverage. That’s why growth from JV projects is so important so that it can offset at least part of the net interest increase.

Enagás Presentation

Bottom Line

I like Enagas’ assets a lot because they are essential. The company is executing on its long-term plan, keeping OPEX under control, disposing of non-core assets, and diversifying into higher growth projects.

Assuming a 10% required rate of return, a dividend discount model yields a fair value of EUR 17.40. That’s comfortably above today’s price of EUR 15 per share, potentially leaving some upside above the double-digit dividend.

The one risk to be aware of is high leverage and rising cost of capital which can put dividend coverage in jeopardy. Since the stock yields 11% and trades almost like a bond, the dividend is absolutely critical to our investment thesis.

According to my estimates, the dividend will be covered by FCF, but I don’t expect it to grow at all. If you’re looking for a bond-like investment into natural gas with a double-digit yield, Enagas can provide that.

I reiterate my BUY rating here at EUR 15 per share.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here