The Obesity Investment Thesis Remains Impressive, Albeit Inflated

Novo Nordisk (NVO) is a pharmaceutical company that does not need any introductions indeed, with Wegovy/Ozempic already projected to well exceed the performance of the best-selling drug of all time, Humira.

For context, AbbVie’s (ABBV) Humira generated over $200B in overall revenues after 20 years of monopoly, with FY2022 bringing forth its peak revenues of $21.23B (+22.5% YoY).

For now, NVO’s Wegovy/Ozempic generated a robust top-line growth, with H1’23 revenues of DKK99.0 billion (+37% YoY) or the equivalent of $14.05B, “mainly driven by GLP-1 diabetes sales growth (+50% YoY) and Obesity care (+157% YoY).”

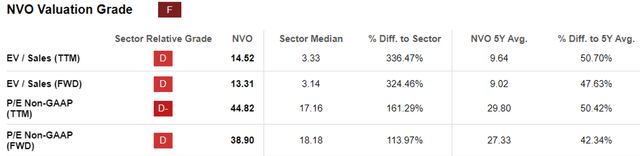

NVO Valuations

Seeking Alpha

As a result of its highly profitable growth trend, it is unsurprising that NVO’s FWD P/E valuation of 38.90x appears to be inflated compared to its pre-pandemic mean of 19.79x, 5Y means of 27.33x and sector median of 18.18x.

This is attributed to Mr. Market’s conviction that Wegovy/Ozempic may be its golden goose over the next decade, further aided by the therapies’ potential applications for new indications.

The same premium P/E valuations have also been observed with multiple pharmaceutical/biotech market leaders, such as Eli Lilly and Company (LLY) at 70.99x thanks to Mounjaro, Merck (MRK) at 33.83x thanks to Keytruda, and ABBV at its previous peak of 39.76x thanks to Humira.

In addition, Mark Purcell, a Morgan Stanley European Biopharmaceuticals analyst, projects a drastic expansion in the global weight loss drug market size from $2.4B in 2022 to $77B in 2030, increasing at an accelerated CAGR of +54.27%.

Based on this bullish projection, it appears that the optimism embedded in NVO’s valuations is somewhat reasonable indeed.

This is especially since Wegovy is patent-protected through 2041 for weight management in the US and potentially up to 2042 in the EU, based on the marketing authorization received in January 2022 and the conventional EU patent expiry of twenty years after the date of filing.

Assuming a two-horse race in the global weight loss market, with NVO sharing the limelight with LLY’s Mounjaro, we may see the former’s Wegovy/Ozempic generate a robust annual top-line of $38.5B by the end of the decade, if not more/earlier depending on the former’s production ramp up.

Thanks to the insatiable consumer demand, NVO has already guided limited supply of starter doses through 2024, with supply unable to keep up thus far.

It is not surprising then, that the management relied on new suppliers, Thermo Fisher (TMO), to boost production, since its original contract manufacturer, Catalent (CTLT), has been facing compliance issues. The management has also committed to a third partner by 2024 to accelerate supply growth.

We believe that the NVO management also understands the urgency of future-proofing its supply, with it hoping to “ward off the kind of troubles it’s encountered in getting supplies of its weight-loss medicine to the public,” attributed to the expansion of its production facilities in Denmark.

While the new expansion worth $2.29B may only come online by 2029, we believe that the decision has been prudent indeed, especially since NVO’s early clinical results for CagriSema, the next-gen type-2 diabetes and obesity therapy, prove to be highly promising.

Assuming an eventual clinical success and FDA approval, we may see its profitable growth cadence prolonged for another decade, cementing its global leadership in the obesity therapy market.

Naturally, with a success of this magnitude, competition is inevitable with many other pharmaceutical companies already developing multiple candidates as direct competitors to NVO’s Wegovy/Ozempic. This is similar to Humira’s patent expiry in early 2023, with nearly ten more biosimilars expected to enter the market at the same time.

However, we are cautiously optimistic that the latter may be able to enjoy a few more years of significant top-line growth before these candidates are approved by the US FDA, explaining the stock’s premium valuations at the same time.

So, Is NVO Stock A Buy, Sell, Or Hold?

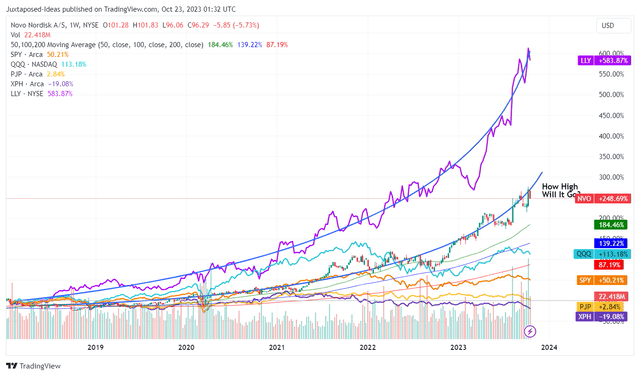

NVO 5Y Stock Price

TradingView

As a result of these promising developments, we are not surprised by the NVO stock’s impressive upward movement thus far, with the momentum appearing to still be robust.

The stock appears to be trading near its fair value of $99.97 as well, based on its FWD P/E of 38.90x and the management FY2023 profit guidance growth of +43% YoY at the midpoint to approximately $2.57.

Based on the consensus FY2025 adj EPS estimates of $3.22, we are looking at a speculative long-term price target of $125.20 as well, implying an excellent upside potential of +30% from current levels.

Unfortunately, this is where we may have to take a step back and question the longevity of NVO’s upside potential. With the company still expecting a supply headwind through 2024, we believe that most of its upside may already be baked in for the next few quarters.

In addition, investors must also note that its profitability tailwind is attributed to Wegovy’s inflated prices in the US at $1.34K compared to the Netherlands at $328, and Sweden at $296. Ozempic’s monthly list prices are also higher in the US at $936, compared to France at $83 and Australia at $87.

This naturally explains why NVO’s sales in North America increased by +45% YoY in the latest quarter, compared to the international segment’s growth at a mere +14% YoY.

While Wegovy/Ozempic have yet to be included in the proposed list of drugs to be renegotiated under the Inflation Act of 2022, we believe that it is a matter of time, since the US government spent $2.6B for the Medicare Part D reimbursement for Ozempic in 2021, with the sum likely to further increase moving forward.

With the US government determined to crack down on prescription costs from 2026 onwards, NVO’s success story may decelerate as soon as it begins, especially with the embedded stock premium.

As a result of the potential correction in its prospects, we concur with RBC analyst, Nik Modi, in that “market sentiments on GLP-1 agonist drugs has gone overboard.”

Lastly, investors must also note that NVO’s patents are about to expire in Brazil and China by 2026, potentially triggering further top-line headwinds ahead.

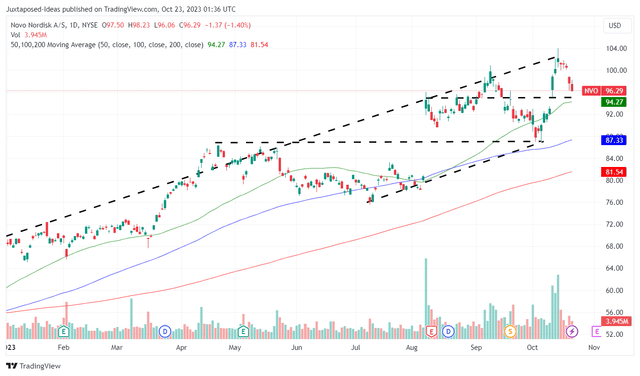

NVO YTD Stock Price

TradingView

Therefore, while we believe that NVO deserves its premium stock valuations and cautiously rate the stock as a Buy, this rating comes with a certain caveat indeed.

While some of the bulls may want to continue chasing at these levels, thanks to the speculative upside potential, we prefer to iterate a lower entry point.

Based on the NVO stock movement thus far, investors may be better off waiting for a moderate pullback, preferably to its previous support level of $88 for an improved margin of safety.

Patience is key here.

Read the full article here