Investment thesis

Tomra Systems (OTCPK:TMRAY) has seen its shares correct significantly over the last 12 months. We believe the company will continue to experience weak order demand for its Recycling and Food business segments, and the flagship Collection business will experience decelerating earnings growth with a rising cost base. With limited upside risk but fair valuations, we upgrade our rating from a sell to a hold.

Quick primer

Tomra Systems is the world’s pioneer in recycling plastic bottles with its reverse vending machines. It also provides sorting and recycling machines for mining and waste management sectors, and sorting machines for the wholesale food sector for fresh fruits (e.g. blueberry, cherry, and kiwi) and processed food (Tomra has an 80% global share in French fries sorting machines). Core geographic markets are Europe (Scandinavia and Germany) and North America.

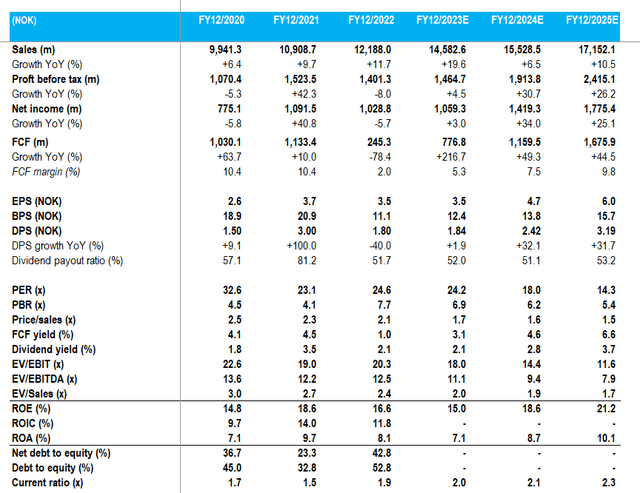

Key financials with consensus estimates

Key financials with consensus estimates (Company, Refinitiv)

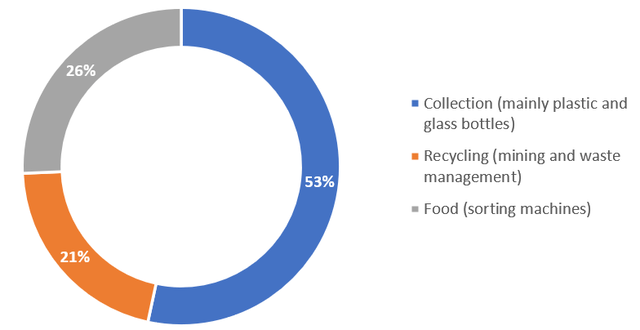

Sales mix by business segment – Q1-3 FY12/2023

Sales mix by business segment – Q1-3 FY12/2023 (Company)

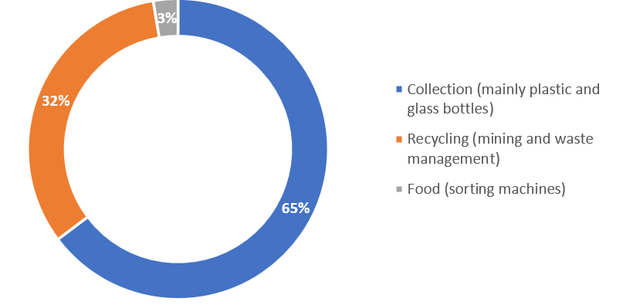

EBITA mix by business segment – Q1-3 FY12/2023

EBITA mix by business segment – Q1-3 FY12/2023 (Company)

Updating our view

We are updating our view from September 2022, where we rated the shares as a sell with concerns over inflationary pressures dampening revenue growth, and high market expectations resulting in expensive valuations.

Tomra has experienced a significant slowdown in earnings as the company experienced component shortages and cost increases which dampened margins in FY12/2022. Whilst regulatory tailwinds have ensured sustained revenue growth in the Collection business, order visibility has fallen in both Recycling and Food. Normalized operating costs have increased by 28% YoY during Q1-3 FY12/2023 (page 4), versus only 3% revenue growth YoY due to cost inflation and business expansion costs. The company also experienced a cyberattack on July 16 2023 affecting its domain and internal IT systems.

We want to assess the business outlook and see whether the share price correction points to a buying opportunity.

Business outlook is mixed

Tomra’s business is geared toward the adoption of a circular economy, and the Collection business remains its flagship operation as more European countries such as Romania and Hungary introduce deposit refund systems for plastic and glass bottles, as well as metal cans. The outlook here remains stable with new market development but the opportunity for profitability expansion appears limited as the cost base increases to grow and support the business. Progress is slower in expanding markets in North America and the rest of the world, and despite previously high hopes market development in China has seen very limited progression.

The Recycling business segment saw orders drop 10% in Q3 FY12/2023, where hurdles were said to be high YoY. Whilst recycling is seen as recession-proof due to the continued need for consumption and waste management, during 2008 recycling programs across the US suffered as a result of falling prices for recycled materials. As a capital goods business, we believe Tomra will see continued negative order trends into FY12/2024, as we expect the availability of financing to decline, and continued falling prices for recycled plastics such as high-density polyethylene (HDPE) lowers the need for market capacity to expand further.

The Food segment business has seen the weakest performance at the company, with Q3 FY12/2023 orders falling 22% YoY. This was somewhat of a surprise given the generally stable nature of consumer staples, but demand from fresh food processing businesses has fallen due to the challenging macroeconomic environment and weak harvests. We do not expect to see a major recovery into FY12/2024 as we believe the cost of living crisis will continue which pushes up demand for cheaper processed products, and with general food prices remaining at high levels and increasing YoY albeit at a slower pace.

Overall, we do not see a major upturn in the order outlook for Tomra into FY12/2024.

Valuation

The share price has corrected approximately 50% since our sell rating, which indicates that most of the current negatives have been priced in. The shares are trading on PER FY12/2024 18.0x on consensus forecasts – these estimates look too optimistic given that profit before tax is expected to grow by 30% YoY, despite a low sales growth target of only 7% YoY and limited opportunities for cost reductions.

As we are expecting no major recovery in the order outlook in FY12/2024, if we assume flat growth YoY the shares would be trading on around PER 24x. We believe the shares are fairly valued, as we consider Tomra’s market-leading status in the Collection business and its long-term runway for growth.

Thesis catalysts

Order visibility continues to be weak into Q4 FY12/2023, and consensus revises down earnings expectations into FY12/2024. However, these events are not major negative surprises and the shares did not react.

Risks to the thesis

The company has frontloaded investment costs for Collection and Recycling during FY12/2023, and there is a major upturn in profitability YoY despite relatively mild sales expansion YoY. The Food business sees demand returning as fresh food processing demand recovers ahead of expectations.

Conclusion

Tomra remains a key thematic stock in the ESG arena but its business has been impacted significantly by a macroeconomic slowdown. With high financing costs, we believe capex priorities have been lowered at its customer base in the Recycling and Food segments, and Collection has become more costly to operate. We believe there is limited upside risk for the company’s fundamentals, and on a fair valuation rate the shares as a hold.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here