I rated Westlake Corporation (NYSE:WLK) a buy in June when it traded at $112. Since then, the stock has been on a roller coaster ride, rising to $137 in July and making a round-trip back to $115. The company still generates good free cash flow and has plenty left over for capital return to shareholders. Based on forward PE and EV/EBITDA multiples, the stock looks fully valued. The dividend yield of 1.7% is also too low for investors at this time, given the risk-free U.S. Treasuries yield of 5%. But the company has grown the dividend at a double-digit pace over the past five years and recently increased its dividend by a whopping 40%. The company has a strong balance sheet and a net debt-to-EBITDA ratio of just 0.7x. I recommend buying the stock below $110 and using the dollar-cost averaging strategy to acquire more if it dips below $100, at which point the stock is fully valued. I rate it a hold.

Volume declines put revenues under stress

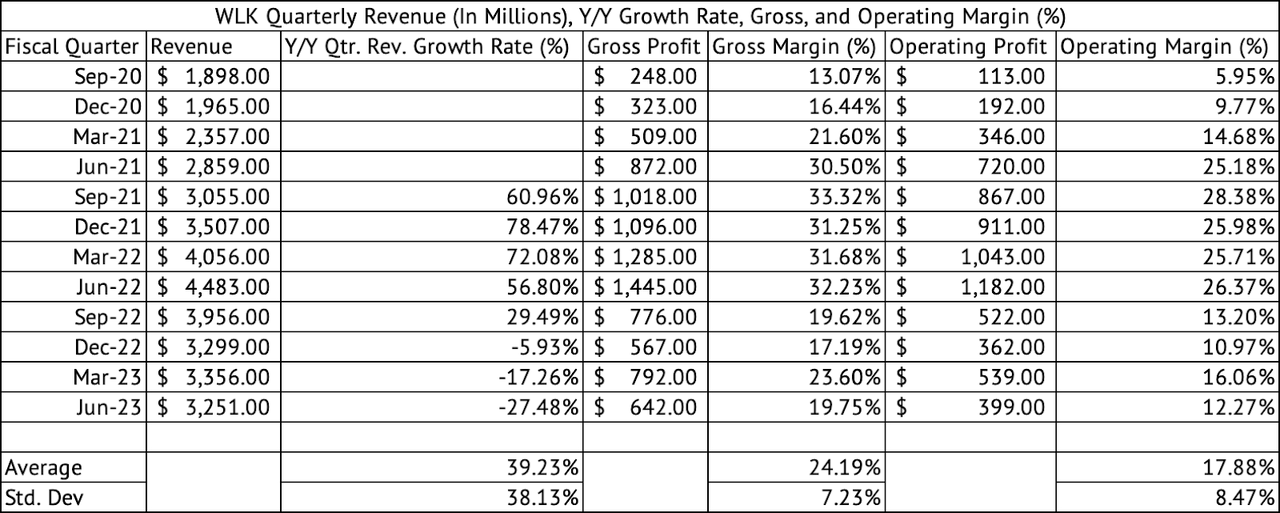

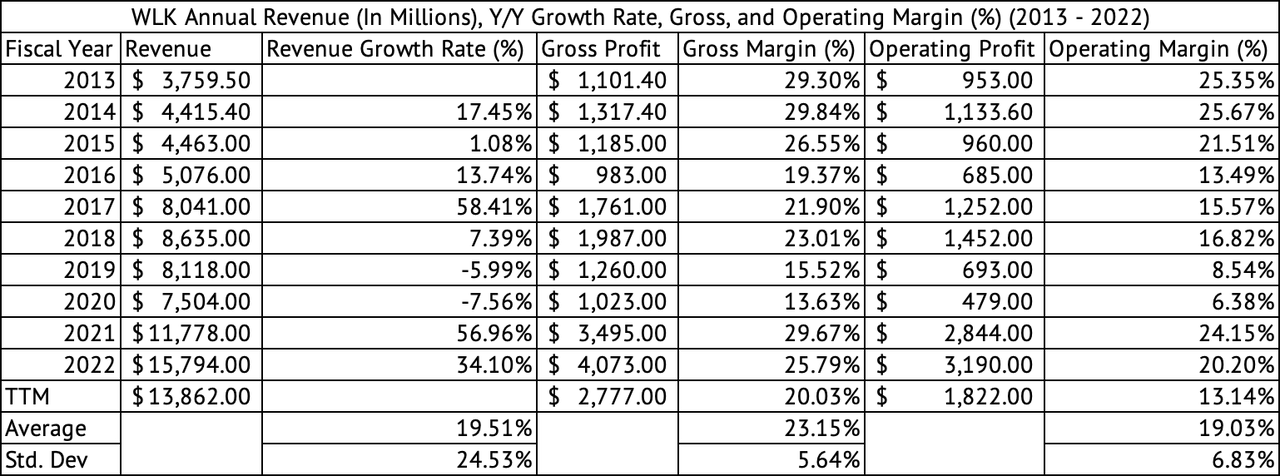

The high growth rates achieved by the company in 2021 and 2022 may never return, but that may not matter. Even as y/y sales decline double-digit, the company generates immense cash flows. Sales declined by 6%, 17%, and 27% y/y in the December 2022, March, and June 2023 quarters (Exhibit 1). The trailing twelve-month data points to a steep decline in revenue from $15.7 billion in 2022 to $13.8 billion (Exhibit 2). The consensus revenue estimate for the full year 2023 stands at $12.9 billion, more than a billion lower than the trailing twelve-month data. Gross margins, above 30% in 2021 and the first half of 2022, have declined below 20% in the June quarter.

Exhibit 1:

Westlake Corporation Revenue, Gross, and Operating Profits (%) (Seeking Alpha, Author Compilation)

However, the margins could go even lower based on historical data. In 2019, the company registered 15% operating margins in 2019 (Exhibit 2). The company showed a q/q improvement in operating cash by managing its inventory. Operating cash was $555 million in June compared to $512 in March.

Exhibit 2:

Westlake Corporation Annual Revenue (Seeking Alpha, Author Compilation)

The Housing and Infrastructure Products segment holds up against a challenging residential construction backdrop

The company operates under two segments, Housing and Infrastructure Products [HIP] and Performance and Essential Materials Segment [PEM], serving a wide range of industries, including wind power, aviation, housing, automotive, medical, and other industries. Both segments have suffered during this downturn, but surprisingly, the HIP segment has held up well, given that mortgage rates in the U.S. have skyrocketed, putting the residential housing market into a recession.

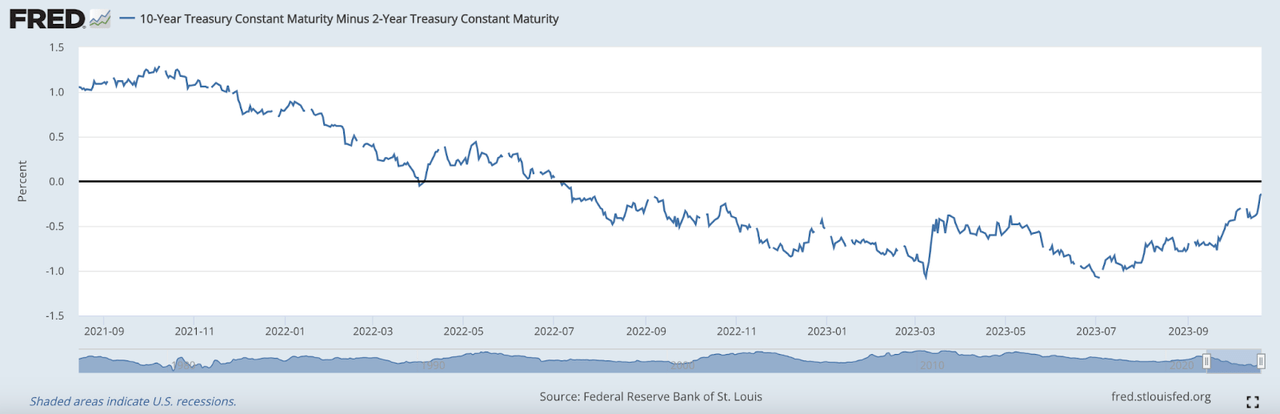

In July, the yield curve was inverted by over 100 basis points, a startling number (Exhibit 3). Equally startling is what happened in the ensuing 3.5 months. The yield curve has nearly flattened, and the flattening pace has surprised many market observers. The long-end bonds executed the flattening, with the U.S. 10-year bond yield rising from 3.3% in April to 4.9% in October, gaining 160 basis points. During the same period, the 2-year bond yield has gone from 3.7% to 5%, gaining 130 basis points. Recently, Bank of America upgraded petrochemical names such as Dow (DOW), Huntsman Corporation (HUN), and LyondellBasell (LYB) while downgrading downstream companies such as Westlake Corporation, Sherwin-Williams (SHW), and Albemarle (ALB).

Exhibit 3:

U.S. 10-Year Treasury Minus 2-Year Treasury (St. Louis Federal Reserve (FRED))

The core PCE inflation, which excludes volatile food and energy, stood at 3.9% in August. Inflation is still running higher than the Federal Reserve’s target of 2%. But the Federal Reserve has refrained from raising rates further in recent meetings and has opted to watch the impact of its fastest rate increases in history. The Federal Reserve cannot take its eyes off the ball given the various uncertainties across the globe, from the continuing war in Ukraine to the Hamas-Israel conflict, which could still have unpredictable consequences on the prices of various commodities and the inflation rate.

The high interest rates are taking a toll on the global economy with subdued industrial activity. The HIP segment was relatively strong, with a seasonal increase in residential construction and lower raw material costs helping counteract a volume decline. The company mentioned that a soft global manufacturing and industrial activity drove lower sales volumes and average selling prices for its PEM segment. The PEM segment saw a q/q decline of 4% in sales volumes in Q2 (June 2023), while the HIP segment saw sales volume increase by 13% during the same period. The company forecasts weak sales and earnings in its PEM segment due to poor global macroeconomic conditions. The company is much more hopeful for the prospects of the HIP segment due to its diverse product set across varying price points.

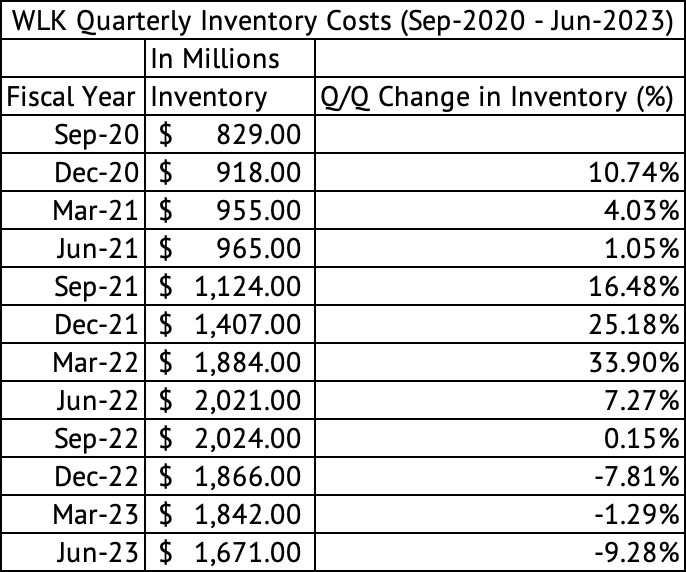

Reducing inventory costs and boosting operating cash flows

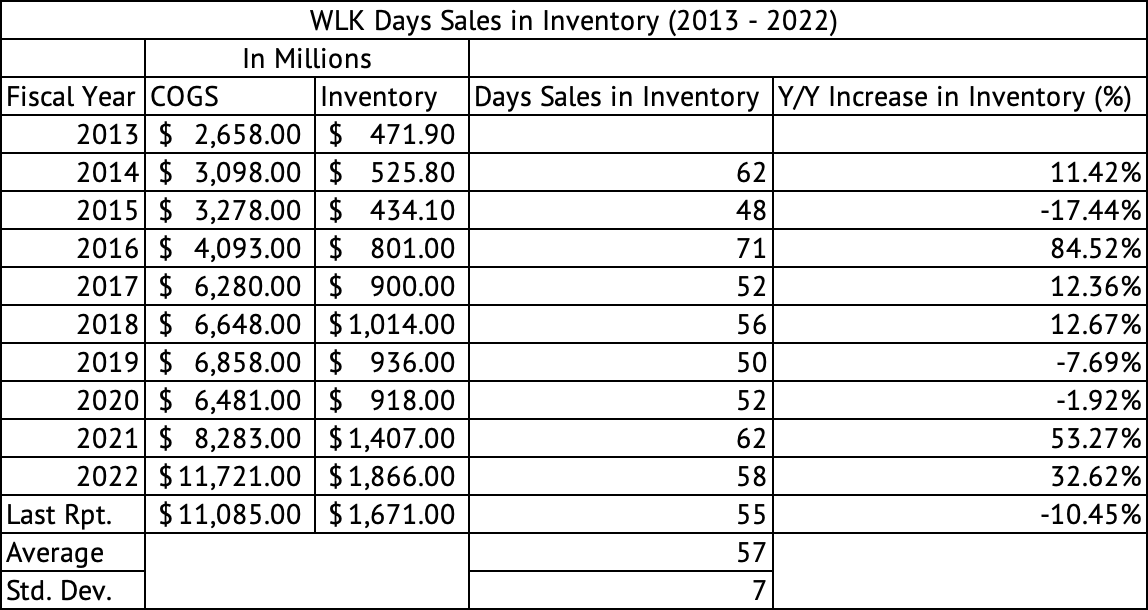

The company reduced its inventory costs from $1.84 billion in March to $1.67 billion in June, a change of about $170 million. This inventory reduction helped the company stabilize and bolster its operating cash. The company saw a 10% decline in inventory costs q/q (Exhibit 4). The company carried 55 days of inventory based on trailing twelve-month data, compared to its average of 57 over the past decade (Exhibit 5). In 2019, the company had just 50 days of sales in inventory. This shows that the company may have more opportunities to reduce its inventory costs in the coming quarters, which should aid its cash flows.

Exhibit 4:

Westlake Corporation Quarterly Revenue (Seeking Alpha, Author Calculations)

Exhibit 5:

Westlake Corporation Annual Inventory (Seeking Alpha, Author Compilation)

Westlake is fully valued, given the harsh economic conditions

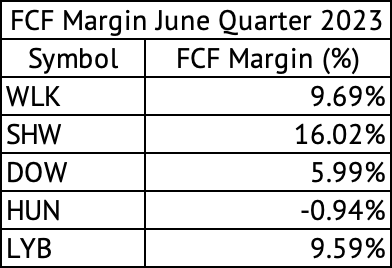

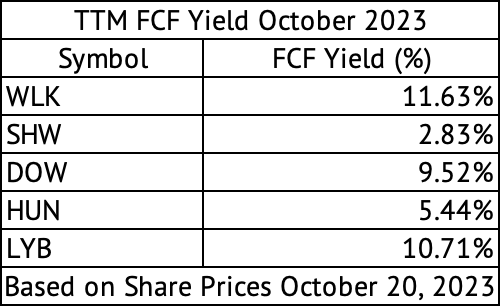

Even in a down market, the company generates excellent free cash flow (operating cash flow – CapEx). In the latest quarter, the company had a free cash flow margin of 9.6%, comparable to LyondellBasell and much higher than Dow and Huntsman (Exhibit 6). Westlake’s free cash flow yield is among the highest across these five companies (Exhibit 7). The stock yields 11.6% in free cash flow. Sherwin Williams’ expensive valuation is on full display with its minuscule yield of 2.8%.

Exhibit 6:

Material Companies Free Cash Flow Margin (Seeking Alpha, Author Calculations)

Exhibit 7:

Free Cash Flow Yield (%) (Seeking Alpha, Author Calculations)

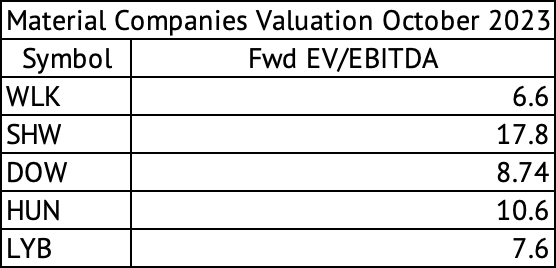

The company is valued at a forward GAAP PE of 13.2x, compared to its five-year average of 14.2 and the sector median of 13.9x. Westlake looks fully valued based on this metric. The company trades at a forward EV/EBITDA multiple of 6.6x compared to its five-year average of 6.4x and a sector median of 7.5x. The stock looks fully valued based on its metric, too. However, the stock looks a tad undervalued compared to its peers, especially compared to LyondellBasell (Exhibit 8).

Exhibit 8:

EV/EBITDA Multiple (Seeking Alpha)

Westlake Corporation is one of my favorite materials companies due to its conservative management, strong balance sheet, and good free cash flow yield. Any weakness in the stock, close to $100 or below, would be a good buying opportunity. The only drawback is its low dividend yield, but the company has grown at a double-digit pace over the past five years. However, the high interest rates globally are taking a toll on manufacturing and industrial activity, and the Fed’s fight against inflation may not be over. Given these reasons, Westlake Corporation is rated a hold.

Read the full article here