Since I wrote in July that Geron Corporation (NASDAQ:GERN) prices then were unlikely to return, the stock has nearly halved. This has prompted people to ask me whether I meant the price was never going to go back up. I hope that’s a joke – even if on me – because Geron has a PDUFA next year, and it will be terrible if the price doesn’t cross my buy price. 2023 is a terrible year for biopharma, and it is difficult to make sound predictions based on data and fundamentals alone. Market perception plays a major role in troubled times, and the perception these days is that the entire sector is up for a toss.

Geron is another of those last-generation stocks that has toiled on for over a decade to bring its once-revolutionary telomerase inhibitor imetelstat to the market. Imetelstat now finally has a PDUFA on June 16, 2024, targeting lower risk myelodysplastic syndromes. We were expecting a priority review because imet has a fast track designation, however, the FDA didn’t think so [Note: Imet has fast track designations for both the treatment of adult patients with transfusion dependent anemia due to Low or Intermediate-1 risk MDS that is not associated with del(5q) who are refractory or resistant to an erythropoiesis stimulating agent, and for adult patients with Intermediate-2 or High-risk MF whose disease has relapsed after or is refractory to janus associated kinase (JAK) inhibitor treatment]. In fact, there is also going to be an advisory committee meeting before the PDUFA, so expect a lot of regulatory and KOL clarity on this wonder drug by about May 16, 2024.

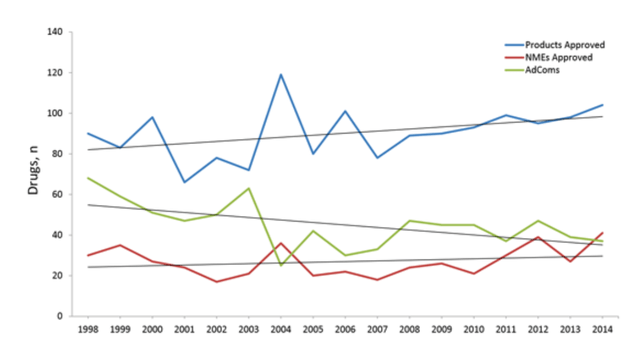

It is interesting that the FDA has asked for an adcomm for imetelstat. Imet is a new molecule entity or NME, so a review of an NME needs clarity. The FDA often, but not always, asks for an adcomm for NMEs. Below is a chart showing how many products were approved by the FDA, how many of them were NMEs, and how many required adcomms [thanks to SA user Trailblazer7 for this information]:

proedcomblog

In the last 10 years, about a third of all NMEs were preceded by an adcomm, and the FDA generally, but not always, follows an adcomm suggestion. Therefore, it is not going to be a straightforward approval for imetelstat, that’s for sure. Expect to be surprised; I cannot say whether that is going to be a positive surprise or a negative one.

In the wake of the FDA’s granting a standard review instead of a priority review, there was a large selloff in GERN shares. The gains it made after submitting the marketing application in June were completely eroded, and the upshot is that I am down 30% after going up 30% at one point in my Geron career. Luckily, I have a strict policy of profit-taking when I hit my first 30%, so I managed to take some money off the table. Geron does have a high burn rate, so these 4 months of delay translates to quite a few tens of millions of dollars in extra funds that they will need to spend. They do not actually need extra cash before launch, but the CEO may just decide to do an offering. I just hope it is from a position of strength.

CEO John Scarlett, the former CEO of Proteolix who joined Geron as CEO in 2011, confirmed that they plan to launch imetelstat in H1 2024 itself, or within weeks of approval. I noted earlier that they began hiring a marketing team back in January, and their manufacturing is all figured out, so I guess an early launch is quite possible, especially since nothing is early enough after a 33 year struggle to get its first drug to the market.

Goldman Sachs’ analyst Corinne Jenkins thinks that imet will be approved in this first indication, and has set a price target of $4. Ms Jenkins expects peak sales of $1.5bn in this indication. She also says that the recent label expansion of Reblozyl in a first line setting in anemia in adults with MDS will not hurt imet’s prospects, given its second line setting. Thus, she considers the selloff a buying opportunity. I concur with this opinion. Wedbush also calls this selloff a buying opportunity.

Financials

GERN has a market cap of $952mn and a cash balance of about $400mn. Research and development expenses for the three months ended June 30, 2023, were $35.5 million, while general and administrative expenses were $16.5 million. Thus, they spend around $50mn per quarter. At that rate, they have a clean 8 quarters of cash runway, which gives them ample time to launch and start earning. I think, though, that they will try to bring in some funds when the drug is approved. I think that implies a dilution between now and approval.

Bottom Line

Geron Corporation is a high risk-reward stock. I will hold on to my shares until approval.

About the TPT service

Thanks for reading. At the Total Pharma Tracker, we offer the following:-

Our Android app and website features a set of tools for DIY investors, including a work-in-progress software where you can enter any ticker and get extensive curated research material.

For investors requiring hands-on support, our in-house experts go through our tools and find the best investible stocks, complete with buy/sell strategies and alerts.

Sign up now for our free trial, request access to our tools, and find out, at no cost to you, what we can do for you.

Read the full article here