Investment Thesis

I have a positive outlook for FLEETCOR Technologies, Inc. (NYSE:FLT) and anticipate substantial growth in overall revenue and adjusted EPS through 2024, primarily due to enhancements in the Fuel business. I also see Corporate Payments as a source of potential revenue and EPS growth. Looking ahead, I identify several favorable trends that could benefit FLEETCOR, especially the ongoing global digitization of payment processes, particularly in key markets like the U.S., the U.K., and Brazil. Still, I recognize the risk associated with investing at this time, given that the stock has already been trading significantly higher than peers and to its own 3-year average. There are some risks associated with investing in the company with above-average cyclicality, execution risk related to electric vehicle EV adoption, and ongoing litigation concerns. Therefore, I currently assign a hold rating to the stock.

Company Background

FLT is a global company that offers solutions for managing business expenses and vendor payments. The company’s services aim to reduce overall spending by improving expense management processes. Many businesses struggle to effectively track their purchases and often rely on paper-based methods to approve and make payments, which can lead to wasted time and money due to unauthorized or unnecessary spending, fraud, or data entry errors. In essence, FLT specializes in providing B2B payment solutions designed to help clients tackle these challenges and, in the end, cut costs by better controlling their purchasing and payment processes.

2Q23 Review and Outlook

FLT reported second-quarter 2023 revenue of approximately $948 million, representing around 10% organic growth, and adjusted earnings per share of $4.19, surpassing consensus estimates and landing near the upper end of guidance. The Fleet segment performed well despite challenging fuel comparisons and stricter credit standards, with credit losses offsetting some headwinds. The Corporate Payments segment saw organic growth due to a shift towards higher-yield products and channels. Other segments performed as previously anticipated. The company’s FY23 outlook was raised significantly following the second-quarter outperformance, with a strong focus on fourth-quarter growth and margin expansion. FLT aims to achieve a 200-250 basis points increase in EBITDA margin in the fourth quarter, consistent with its full-year target of 150 basis points. The adjusted EPS is expected to exit the year at 16%. The positive sentiment is driven by strong new bookings, suggesting increased investment to maintain a robust sales funnel and attract desirable prospects.

B2B Deals Expand Payment Solutions

FLEETCOR generates nearly $1 billion in annual cash flow and maintains a strong financial position, which provides robust support for the company’s plans for growth through acquisitions. One logical area for expansion is in B2B payment software. While the first half of the year was relatively quiet in terms of share buybacks, there’s a potential for increased buybacks in the third quarter, fueled by proceeds from the sale of the Russian business, which could contribute to a $450 million share repurchase program.

I believe FLEETCOR is likely to pursue additional acquisitions to enhance its capabilities in B2B payment software. While its expertise in virtual cards can contribute to the digitization of payments, the primary challenges in corporate payments often revolve around labor-intensive manual processes and a lack of automation in related workflows. Recent acquisitions have helped in building comprehensive accounts payable solutions, and there’s potential for expansion into accounts-receivable automation, given the company’s extensive network of over 4 million suppliers and vendors.

FLEETCOR has a strong track record in successful deals and cross-selling. The company’s past acquisitions have generally aimed at either adding new customer segments or entering new geographical markets for existing services, or strengthening its B2B payment solutions for existing clients.

Company Presentation

Financial Outlook & Valuation

FLEETCOR has already taken steps to focus on growth areas like corporate payment automation and to diversify its business to mitigate risks associated with the decline of fossil fuels in its Fleet segment. Nevertheless, its ongoing strategic review might lead to a more optimized corporate structure, potentially resulting in the spinoff or sale of certain business units. FLEETCOR generates approximately $1 billion in annual free cash flow, providing it with ample resources for ongoing share buybacks and investments in acquisitions. The addition of CFO Tom Panther, with his expertise in transactions, is expected to facilitate accelerated deal-making. The strategic review, which involves activist investor D.E. Shaw, could open up opportunities for expansion within the core businesses and the divestment of non-core assets. FLEETCOR earlier completed the sale of its Russian operations to a local investment group in August and initiated an accelerated share repurchase program of $450 million, with plans to utilize the proceeds by the end of the third quarter.

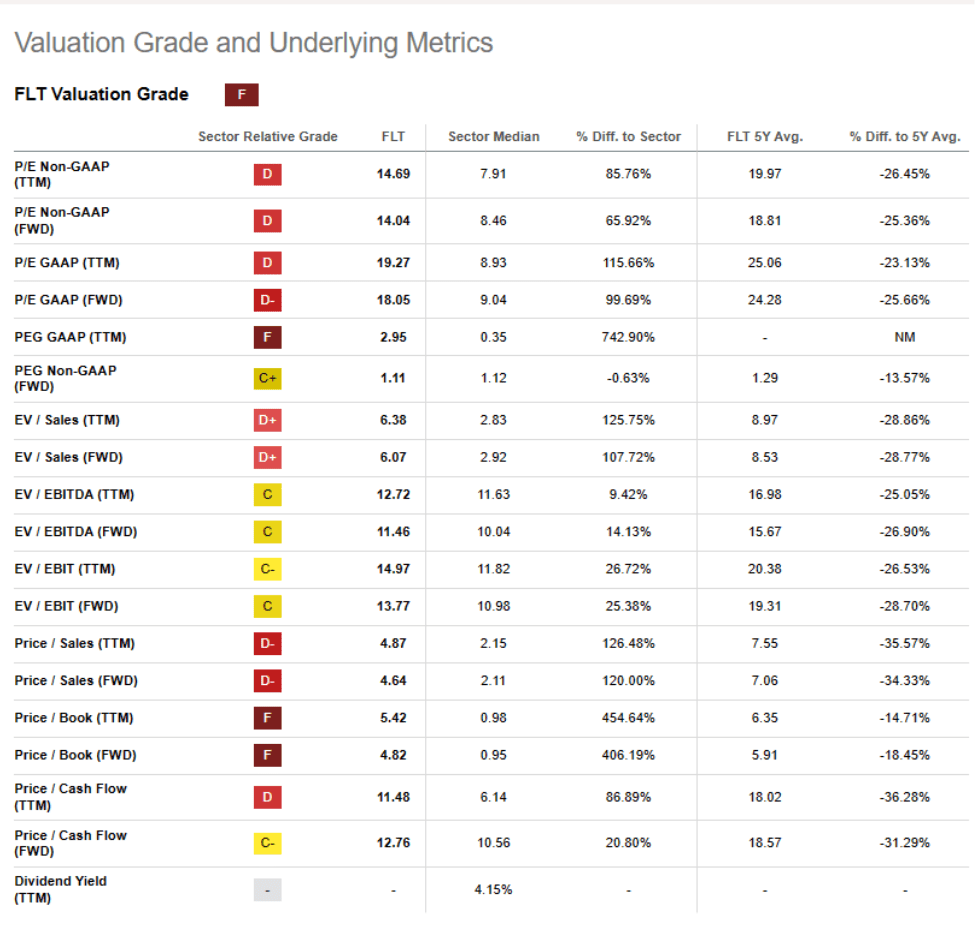

FLEETCOR is expected to achieve mid-teen growth in EBITDA, making it an above-average grower. I consider FLEETCOR’s strong management track record, especially in integrating acquisitions, and the positive trends in the B2B sector. FLT trades at a significant premium at a forward PE of 18x compared to the sector median of 9x. I believe this premium is justified given FLEETCOR’s robust revenue growth trajectory and the potential EPS growth over the medium term. Still, I recognize the risk associated with investing at this time given that the stock has already been trading significantly higher to peers and to its own 3-year average, along with above-average cyclicality risk, execution risk related to electric vehicle EV adoption, and ongoing litigation concerns, which is why I currently assign a hold rating to the stock.

Valuation Grade

Investment Risks

I believe that FLEETCOR’s diverse sources of revenue offer some protection during a shorter economic downturn. However, if fuel prices remain low for an extended period and there’s a continued decrease in lodging and corporate payment activity, it could hinder the company’s growth. Around 13% of FLEETCOR’s revenue is directly linked to the actual price of fuel. Moreover, FLEETCOR has the necessary resources to cater to the needs of mixed and electric vehicle EV fleets. Still, the widespread adoption of EVs, especially in a Fleet context, should be a long-term discussion that may present challenges.

Conclusion

FLT is expected to post robust growth in both overall revenue and adjusted EPS until 2024, primarily driven by improvements in the Fuel business. Moreover, with an annual free cash flow of approximately $1 billion, FLEETCOR has the financial capacity for continued share buybacks and strategic acquisitions. However, the stock is currently trading at a significant premium to the sector average, which is why I currently recommend potential investors to stay on the sidelines and look for a better entry point in the future.

Read the full article here