There’s always the allure of a high-risk, high-reward opportunity. It is akin to the thrill of a game of chance. Century Casinos, Inc. (NASDAQ:CNTY) stands at the intersection of these worlds, offering investors a somewhat risky proposition in the casino and gaming industry. Like a gambler contemplating their next move, investors are now faced with the question – is it time to bet on Century Casinos, or is it wise to fold and seek greener pastures?

A Pessimistic Outlook

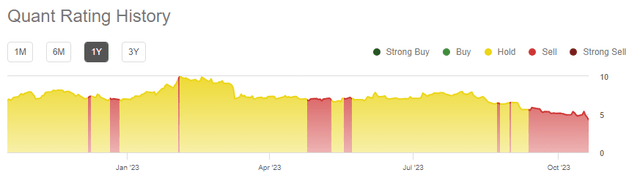

Let’s not beat around the bush; the verdict from financial analysts is rather grim. Century Casinos has been rated a “sell,” primarily due to a myriad of weaknesses that are seemingly outweighing its strengths. It’s essential to explore these weaknesses before deciding whether there’s any hope for a turnaround.

Seeking Alpha

The company operates casinos in Maryland, Nevada, West Virginia, Montana and Colorado in the U.S., along with six casinos in Canada and one in Poland.

It’s a company that is largely focused outside of Sin City in Las Vegas, with only one casino in Nevada, based in Reno-Sparks. So, this isn’t your typical Vegas casino we are looking at. This company is diversified by different regions, different countries and different operations ranging from traditional slot machines, to sportsbooks, racetracks, hotels, and event venues.

When it comes to the “sell” ratings, there’s a few key areas that stand out.

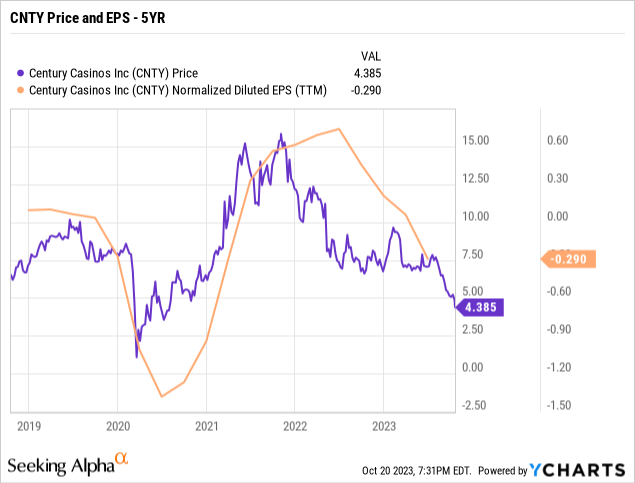

1. Plummeting Earnings per Share (EPS)

The company recently experienced a stark decline in its earnings per share, especially when compared to the previous year. This troubling trend has persisted over the last 12 months, and analysts predict that it’s not about to change course. In the last fiscal year, Century Casinos reported earnings of $0.25 per share, significantly lower than the $0.66 per share in 2021. But analyst expect this trend to continue in 2023. Looking ahead, analysts are expecting a staggering contraction in earnings, projecting only $0.01 per share.

It’s crucial to keep in mind that EPS is often a key factor that investors consider when evaluating a stock’s performance and growth potential. A consistently declining EPS is a red flag.

The positive news in earnings is that these analysts are expecting a rebound in 2024, back up to near 2021 numbers with $0.55 per share.

2. Falling Net Income

The company’s net income has taken a severe hit in comparison to the S&P 500. The net income has plunged compared to the same quarter a year ago, plummeting from $8.86 million to a concerning loss of $1.96 million. This dramatic decrease is an alarming sign, potentially indicating financial troubles in my view.

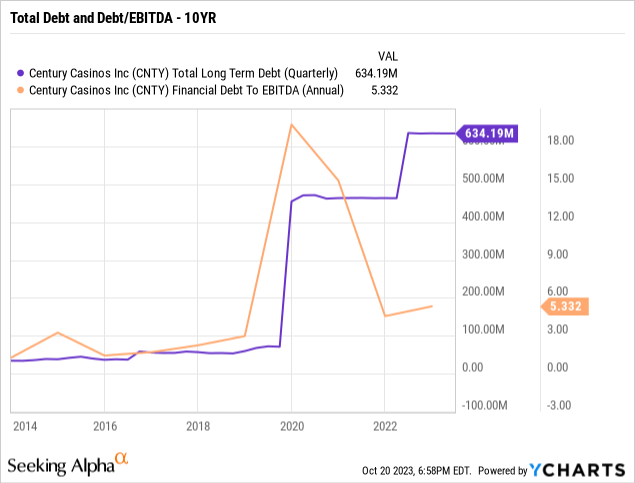

3. High Debt Management Risk

The overarching theme of Century Casinos’ financial weaknesses has been characterized by high debt management risk. With declining earnings, deteriorating net income, and a weak operating cash flow, the company’s debt management position appears to be on the high end.

But, despite elevated levels of debt, improving EBITDA in recent years helped keep debt levels manageable overall, based on a debt/EBITDA ratio of 5.3x.

Debt initially exploded in 2019, in part due to the acquisition of Isle Casino Cape Girardeau and Lady Luck Caruthersville located in Missouri, along with Mountaineer Casino, Racetrack and Resort located in West Virginia. It further expanded in 2022 with the acquisition of Smooth Bourbon LLC, which leases the land and building for the Nugget Casino Resort in Reno-Sparks, Nevada that the company recently acquired in April 2023.

While these acquisitions caused the company’s debt levels to increase rapidly, it also is funded short-term growth. This supported EBITDA and helped improve the debt/EBITDA ratio to keep it at a low rating.

High debt levels are something that are always going to be a part of the casino industry, in my opinion, since they operate large hotels and facilities that are capital intensive. Be sure to keep an eye on debt metrics to make sure it remains manageable based on the company’s latest financial position.

A Bleak Performance Over the Past Year

Despite potential investment fluctuations, Century Casinos’ stock performance has been consistently underwhelming. Over the last year, it has tumbled by 25.61%, faring worse than the S&P 500. This decline in stock price is mirrored in the earnings per share, which has plummeted by a staggering 121.42% compared to the same quarter of the previous year.

Despite the gloomy performance, there is a silver lining. This steep decline could be seen as a positive factor for future investors. It has made Century Casinos more affordable compared to its earnings over the past year, presenting a relatively attractive proposition in terms of valuation. However, this one glimmer of hope should be considered in light of other concerns that continue to weigh heavily on the company’s prospects.

Valuation: A Deep Discount

Considering the company’s challenging financial circumstances, Century Casinos’ valuation reveals an interesting picture. The stock’s P/E ratio is negative, due to the company currently operating with negative earnings. I believe this is another sign of potential financial distress.

When looking at other key valuation criteria, Century Casinos proves to be trading at a significant discount compared to investment alternatives:

– The price-to-book ratio is at 0.97, signifying a substantial discount compared to the S&P 500 average of 4 and a discount versus a group of its competitors that average of 3.5.

– The price-to-cash flow ratio is well below averages from its peers as well, which ranged from 3.69, up to 74.79. This once again indicates a considerable discount.

In essence, Century Casinos seems to be on sale, but investors should approach this discount with caution given the many challenges and weaknesses the company faces.

The Big Question: To Bet or Not to Bet

Century Casinos Inc. presents investors with a complex decision. The company’s financial weaknesses are undeniable, with declining earnings, deteriorating net income, weak cash flow, and a significant debt management risk. The stock has underperformed the market, and the company’s negative P/E ratio reflects its troubles.

However, the sharp decline in the stock price over the last year may be an opportunity for some investors. It has made Century Casinos more affordable when considering its earnings over the past year. This suggests that there may be potential for a value play if the company can turn its fortunes around.

Investing in Century Casinos is akin to taking a high-stakes gamble – there may be a chance of reward, but the risks are considerable.

Investors contemplating Century Casinos must carefully assess their risk tolerance and consider whether they are prepared to bet on a potential turnaround in the face of multiple weaknesses. In the world of investing, as in gambling, fortunes can change quickly. Only time will tell whether Century Casinos can beat the odds and stage a successful comeback in the gaming industry.

Read the full article here