Investors,

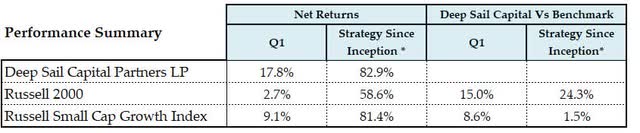

For the first quarter of 2023 Deep Sail Capital Partners (the “Fund”) returned 17.8% net of fees while averaging 74% net long exposure. Please consult your individual capital account statements for your individual net returns.

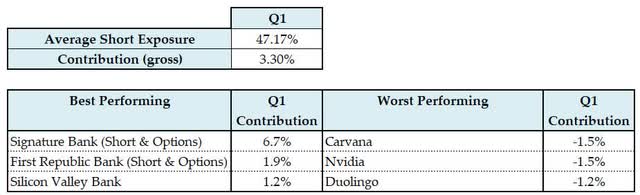

In the first quarter, the fund outperformed all our benchmarks by a significant margin. The main driver of our outperformance in Q1 was strong performance in our top holdings, MercadoLibre (MELI) and Atlas Engineering Products. The long portfolio outpaced all our benchmarks in Q1. The short portfolio also had a positive contribution in Q1, driven by the funds short and options positions in the failed banks Silicon Valley Bank (OTC:SIVBQ) and Signature Bank (OTC:SBNY).

Market Commentary

At this point in the cycle, it has become clear to me that a recession in the fall is much more likely than not. The recent banking crisis has all but confirmed my long-standing assertion that ZIRP (zero interest rate policy) was a policy that was kept in place for way too long. ZIRP should be an emergency policy that is used for short periods of time. If ZIRP is left in place too long (as it has since the GFC), it creates economically unnatural behaviors that can spur the next crisis. That is exactly what we are dealing with today: distorted investment and lending behaviors driven by the Fed’s policy decisions.

We have pulled forward a significant amount of demand over the last 15 years since the GFC. Banks and other financial institutions are dealing with significant issues on both the asset and liability sides of their balance sheets. Lending, consumer credit, and thus consumer demand is bound to be hurt going forward. On top of this banking credit crunch, consumers are all but running out of their COVID savings surplus, and near-term demand is bound to slump.

I think the idea that recessions are self-fulfilling makes logical sense. As recessions are more and more discussed in the media, business leaders start to worry about demand, thus, they cut their labor force, cut bonuses, shore up their balance sheet, eliminate wasteful spending, and are more hesitant to spend on capital expenditures. These actions in turn cut revenues and demand for other companies that service them, and then those companies go through a similar cost cutting exercise, which propagates through the economy. This recent banking crisis likely fast-forwarded this effort, as many CFOs will panic on the back of concerns about cash availability, causing some additional belt tightening.

I continue to believe now is a time to be cautious and avoid any companies that have significant debt or rely heavily on consumer debt to fuel their sales. I continue to position the fund’s short and long portfolios to support this cautious outlook on markets.

Long Portfolio Summary

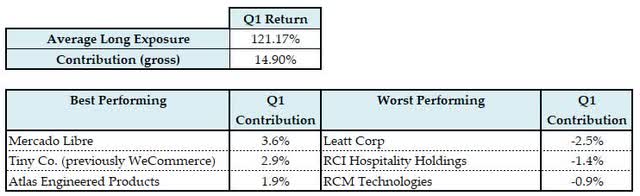

In the first quarter, the long portfolio had several strong contributions from both our microcap and quality focus areas. MercadoLibre was up 46% in Q1 and has become our top holding, driven by strong revenue and earnings growth across their six business segments.

WeCommerce announced in January that it would be combined with Tiny through a reverse merger. The agreement was driven by the current major stakeholders of both Tiny and WeCommerce, Andrew Wilkenson and Chris Sparling, who were looking to consolidate their technology and software businesses under one public entity. The transaction valued

WeCommerce shares at $5.12 CAD, which was a significant premium to the trading price prior to the deal announcement of ~$2.00 CAD.

The worst detractor in Q1 was Leatt Corp. (OTCQB:LEAT). I highlighted my long thesis for Leatt Corp. (Leatt) in our Q4 Investor Letter, which you can find on our website, http://www.deepsailcapital.com. Leatt reported worse than expected revenue growth and net income in their Q4 earnings, which drove the stock down significantly. Leatt reported Q4 revenues of just $10.9m which was 53% below their 2021 Q4 revenues, and a Q4 net income loss of $1.1m. The major concern of mine with my investment in Leatt was always the short-term industry weakness in the Moto and MTB sectors. COVID had a large positive impact on both the Moto and MTB sectors. COVID pulled forward some demand for new equipment, which has now completely rolled over. With Leatt’s launch of their 360 turbine technology helmets in Q1 of 2022, I believed that helmet category penetration would help offset the declines in overall sales volumes, as was largely the case for all of 2022 until Q4. Helmet volumes clearly helped Leatt’s business in 2022, with overall growth of 60% year over year, but that wasn’t enough to fully offset a decline in the neck brace and body armor product categories in Q4. Overall, I believe the long thesis is still intact, and most of the declines have more to do with industry dynamics than Leatt specific issues. In Q1, we added to our position in Leatt and plan to continue to hold it going forward.

The fund closed four long positions and opened six long positions in Q1. We closed two positions in Q1 after successfully exploiting the January small cap effect. Our position in Radius Global Infrastructure (RADI) was closed after the company received a buyout offer. In Q1, we opened a large position in RCM Technologies (RCMT), a talent placement serial acquirer trading at a P/E of 6, with a history of strong capital allocation and a large share buyback program in place.

Current Position: MercadoLibre

MercadoLibre is an internet, technology, and payments company that services Latin America. MercadoLibre went public in 2007. Since the IPO, the company has grown from an eBay-like clone geared towards Latin America to a full suite of e-commerce, shops, payments, and logistics. MercadoLibre is a unique company that might be best described as 1/3 Alipay, 1/3 eBay, and 1/3 Amazon of Latin America (Latam). Aside from that, MercadoLibre is essentially Latin America’s sole e-commerce and internet behemoth.

Latam has lagged the rest of the world, especially compared to North America, in terms of adoption of the internet, e-commerce, and investment in internet startup companies for the last 15 years. But that adoption has accelerated in the last 5 years. Specifically, in the last 3 years, the Latam VC landscape has exploded, with a multitude of new Latam startups emerging to service the growing internet users of the region. Many of these startups were founded by former MercadoLibre employees. I mention this to highlight the key position that MercadoLibre holds within the Latam market; it provides the payments, logistics, and credit that allow these startups to scale.

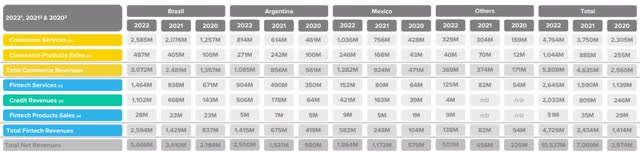

MercadoLibre’s business is broken into six verticals: MercadoLibre (marketplace), Mercado Envios (logistics), Mercado Shops, Mercado Pago (payments), Mercado Credito (credits), and Mercado Ads. While the overall business is still running at extremely high growth rates (+40% yoy) even after some deceleration post-COVID, the most exciting part of the business for me is Mercado Pago, the payments segment. Mercago Pago is a payment system modeled after the successful Chinese payment system Alipay. Mercado Pago recently focused on expanding payments off the MercadoLibre exchange. It has seen its off-exchange payment volumes grow by 122% in the 3Q to $21 billion. This off-exchange payment growth is just beginning. Coupling the payments business with MercadoLibre’s high-moat businesses in Marketplace and Logistics sets MercadoLibre up to be the backbone of commerce in Brazil, Mexico, and other Latam countries for many years to come.

High Quality Business Model:

MercadoLibre’s product segments all have adjacent network effects. If a user uses one of their products, then using a second product within MercadoLibre is more valuable for that user. For example, Mercado Logistics drives logistics revenues but also provides its Mercado Shops or Marketplaces with an easy way to ship and deliver products to customers. Mercado Pago’s payments system is the interconnecting tissue that binds merchants and customers both on and off of their platform. Mercado Pago is used for not only payments but has extended into investments, savings, credit, and other financial services. Engagement in one vertical can quickly extend to other verticals, as you can see by the progression of revenues in each of their major markets and verticals over the last three years.

MercadoLibre IR, Q4 2022 Earnings Presentation

MercadoLibre has built its business in a similar fashion to how Amazon has built its business, but a key distinction is that MercadoLibre has been able to grow into broader verticals than Amazon. This was largely due to the lack of competition in Latam eCommerce over the last 20 years.

Outstanding Management:

Marcos Galperin is the founder, chairman, and current CEO of MercadoLibre. Galperin founded the company in 1999 while attending Stanford University to get his MBA. Galperin is exactly what I look for in an outstanding manager. He has some skin in the game, as he still owns about 10% of the company through the Galperin Trust and his own equity. Dis brother is highly involved in the oversight of the company as a board member while at the same time taking no board compensation. Galperin has built a culture at MercadoLibre that is entrepreneurially driven and technology-first. Historically, Galperin has shown great skill in managing through difficult times, including through the tech bubble burst in 2000, the GFC in 2008, and extensive geopolitical stress in Latam countries over the last 20 years. He has been able to take on eBay and Amazon in Latam and remain the market leader in eCommerce. MercadoLibre has built its own logistics network in response to entrants like Amazon and Sea, which are pushing heavily into Brazil and Mexico. Outside of Galperin, the CFO, Pedro Arnt, has a long tenure with MercadoLibre. He has been with the company since 2000 and the CFO since 2011. Galperin and Arnt have a long track record of successfully executing on their stated strategy.

Substantial long-term growth prospects:

MercadoLibre generates two types of revenue: commerce and fintech. Commerce is your traditional e-commerce revenues from marketplaces and product sales, while fintech revenues are from newer segments like payments, point of sale systems, financial services, and other financial products. Commerce revenues have been growing consistently in the mid-20s to mid30s since COVID started, similar to other e-commerce companies. Fintech revenue has been growing at a high rate for the last few years, around 80-100%, driven by their expansion in their payments offering. Mercado Pago’s off exchange growth aligns well with the rise of the PIX system in Brazil. PIX is an electronic payments system in Brazil that allows consumers to pay directly from a bank account for all sorts of goods. For those not familiar with the Brazilian PIX system, here is a quick primer (Pix: Brazil).

While competition has been entering their markets, specifically Amazon and Sea, MercadoLibre still sits as the sole eCommerce giant in Latam. They are in the driver’s seat to shape the face of eCommerce in Latam in the near term, and I expect them to continue to expand into adjacent verticals over time and leverage their central role in e-commerce to provide additional services to the next generation of Latam startups.

Reasonable Valuation:

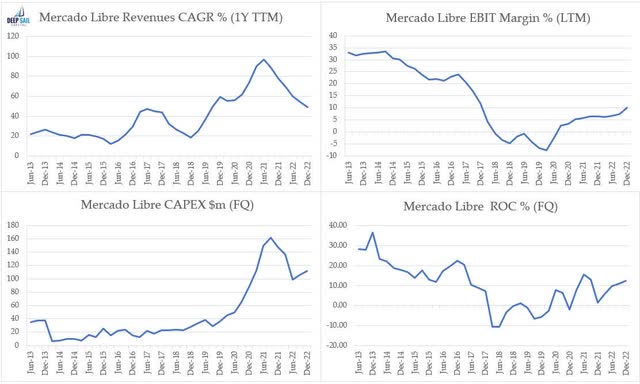

MercadoLibre has seen improving financial metrics alongside fast growth and moderating capital expenditures since the middle of 2021. 2021 was a key turning point for them, as their capex peaked after they ramped up capex to help build out their logistics network in 2018-2019. While continued investment is needed to further build out their logistics networks in other countries outside of Brazil and Mexico, I expect more cash to flow to the bottom line in the years to come as a percentage of revenue than in the last 5 years.

MercadoLibre is currently growing revenues on a FX neutral basis at 58% y-o-y, or 40% y-o-y adjusting for FX. Margins and cashflow have materially improved since they started to reduce the amount of quarterly capex spend in late 2021 (logistics-driven). Consensus estimates are currently forecasting $3.4B of EBITDA and $2.8B of EBIT in 2025. I believe those are likely conservative forecasts, but even on that basis, MercadoLibre is trading at an 18x 2025 EBITDA multiple and a 22x 2025 EBIT multiple. Considering where MercadoLibre sits in the ecommerce ecosystem, I view their valuation as high but justified.

MercadoLibre – Historical Financials

Koyfin, Company Financials

Short Portfolio Summary

The short portfolio significantly outperformed our benchmarks in Q1. Low quality and junk stocks saw a huge rally in Q1 off the lows they set in Q4. Several of the positions we were short going into 2023 saw a material rebound in 1Q, including Carvana (CVNA), Nvidia (NVDA), and Duolingo (DUOL), which were the short portfolio’s worst-performing positions in 1Q. On the bright side, our short position in Signature Bank finally paid off, as the company was put into receivership in 1Q. Since the banking crisis started in early March, we have added several regional bank shorts to the portfolio, as I do not believe the banking crisis is over. The issues that caused Signature Bank, Silicon Valley Bank, and First Republic Bank (OTCPK:FRCB) to fail are the same structural issues that other regional banks are facing. Even if many of these regional banks avoid receivership, I think the earnings power of these banks will be materially degraded going forward, as they have had to raise capital and reduce lending in the short term to deal with liquidity uncertainty.

Overall, I don’t view the current environment as ripe for easy short-term targets. Many of the high-flying SPACs, IPOs, and moonshots that we have focused on shorting for the last 2 years have already deflated to more reasonable valuations. We continue to keep short positions in companies in the electric vehicle industry, the alternative energy industry, and industries that rely on consumer debt.

Top Holdings & Current Exposure

At the end of the Q1 the fund held 25 long positions and 33 short positions.

The fund ended the quarter with an exposure of 118% long and 47% short or a 71% net long exposure.

Sincerely,

Sean

Disclaimer

Deep Sail Capital LLC (“Deep Sail Capital”) is an investment adviser to funds that are in the business of buying and selling securities and other financial instruments. This information is provided for informational purposes only and does not constitute investment advice or an offer or solicitation to buy or sell an interest in a private fund or any other security. An offer or solicitation of an investment in a private fund will only be made to accredited investors pursuant to a private placement memorandum and associate subscription documents. Past performance is no guarantee of future results.

“Deep Sail Capital Partners” returns in this document are shown as net returns or gross returns where stated. Historical net returns assume a 1.5% and 15% management and performance fee, respectively. For Net Returns of fees and expenditures figures please reach out to the fund manager at the email [email protected].

“Deep Sail Capital LLC” name was changed on April 7th 2022 from the previous name “Organon Capital LLC”.

“Deep Sail Capital Partners LP” name was changed on April 6th 2022 from the previous name “Westropp Funds LP”.

* – “Strategy Since Inception” refers to the Strategy inception date of July 2016. Deep Sail Capital Partners LP’s predecessor incubator fund, “Westropp Funds LP” pivoted from a Value Investment style to a Growth at a Reasonable Price (GARP) style fund on that date. For more details on this transition or the calculation behind the “Strategy Since Inception” returns please reach out to the fund manager at [email protected].

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here