Investment thesis

From the secular point of view, I am a big fan of the U.S. stock market because it has a stellar growth history over the long term. But past profits are not a guarantee of future success, especially if we talk about the foreseeable future. The current environment is very tough, and I agree with JPMorgan’s (JPM) CEO, Jamie Dimon, that we are currently amid the most dangerous time’ for the world in decades. Corporate profits of the S&P 500 (NYSEARCA:SPY) companies representing the largest American businesses are poised to demonstrate a decline for the fourth quarter in a row, and I see several red flags indicating that the rebound is unlikely to happen in the next quarter. The Fed is fighting with inflation with the help of a very tight monetary policy and the current situation in the energy commodities market does not add optimism regarding the timing of the Fed’s pivot. All in all, I assign SPY a “Strong Sell” rating.

Introduction to SPY

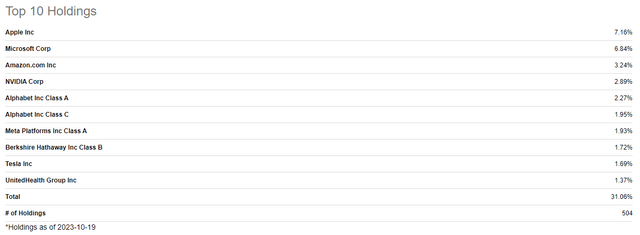

SPY is an SPDR S&P 500 ETF, meaning the fund invests in the largest U.S. 500 companies. The ETF has massive exposure to sectors mainly represented by growth stocks: Technology, Consumer Discretionary, and Communication. The total weight of these three sectors in the index is about 48% at the moment, which is massive. Looking at the top-10 holdings, we can see that eight out of them are apparent growth stocks. That said, the movement in the ETF price heavily depends on how these biggest growth stocks perform.

Seeking Alpha

What are the red flags?

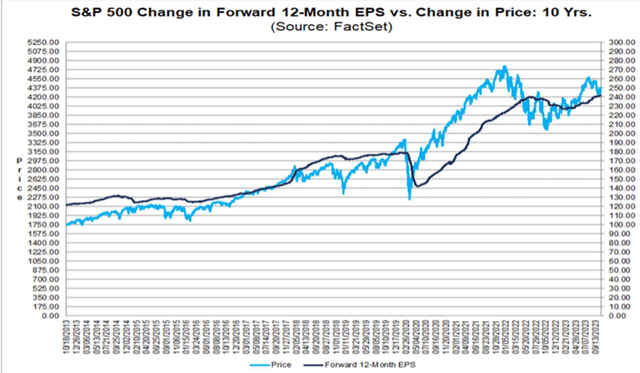

As an investor who believes only in fundamental analysis, corporate profits matter the most to me. And they are obviously deteriorating. According to FactSet, “the S&P 500 is currently reporting a year-over-year decline in earnings for the fourth straight quarter”. I know that earnings season has just started recently, and more than 80% of the companies are still to report Q3 financial results, I do not like the trend overall. According to the same report from FactSet, the portion of companies so far to beat EPS estimates is lower than 5-year and 10-year averages. While the valuation looks reasonable as the 12-month forward P/E ratio for the S&P500 is 17.7, I think that corporate profits are poised to suffer over multiple quarters.

FactSet

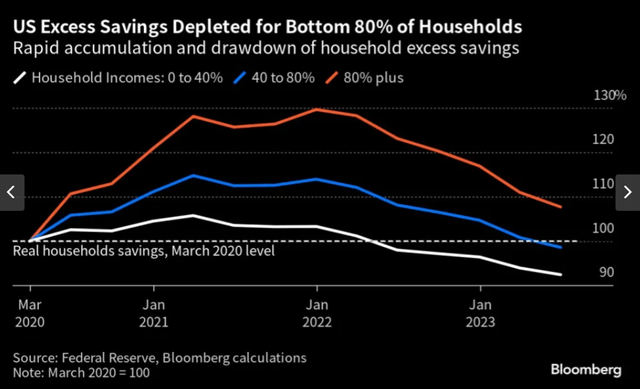

I am bearish regarding corporate profits for the near term mainly because of the massively unfavorable macro environment for businesses. The massive inflation of 2021-2022 drained consumers’ pockets, and energy prices are still flying high, which is a red flag for household’s financial strength in the foreseeable future. According to Bloomberg, U.S. household’s savings deteriorated massively from January 2022 peaks.

Bloomberg

Less household savings means consumers can either tighten their belts or use credit to continue consuming at the same rate. But increasing debt levels of households cannot last infinitely and we already see warning signs here also as credit card delinquency rates are rising at a notable pace. Looks like a big red flag also, especially considering that the U.S. total credit card debt surpassed one trillion dollars a couple of months ago. That said, consumers are very unlikely to start increasing spending in these circumstances.

High Federal funds interest rates mean borrowers have to spend more resources to service their financial liabilities, which also weighs on the overall wealth of households and businesses. And the Fed still looks hawkish and I do not expect any rapid pivot in the monetary policy after Jerome Powell’s latest public speech:

It may just be that rates haven’t been high enough for long enough.

And I can agree with Mr. Powell that it is likely to take several quarters of high interest rates to make the inflation capitulate finally. Crude oil price is one of the biggest inflation drivers in my opinion, and according to Goldman Sachs analysts, oil prices can hit triple digits again soon. This forecast looks reasonable to me because OPEC and Russia demonstrated multiple times this year that they can react aggressively to changes in demand by production cuts. Massive ongoing military conflicts with large oil producers involved directly and indirectly also do not add optimism regarding the oil price dynamic in the near future. War in Ukraine and in the Israel-Hamas conflict seems to be far from ending, as U.S. President Biden seeks a $100 billion package to aid these two countries. Increased governmental spending also does not help in bringing inflation down.

Inflation is expected to continue flying high meaning that the monetary policy is highly likely to remain high over the next multiple quarters. Elevated rates are a big red flag for growth stocks since future cash flows are now discounted at higher discount rates, which significantly diminishes their present value of. As we have seen at the beginning of this article, the lion’s part of the S&P500 index consists of growth stocks. Having higher rates for longer means that valuations of growth companies will be under significant pressure until the Fed pivots.

Risks to my bearish thesis

We live in a rapidly evolving environment where new jaw-dropping technological breakthroughs occur periodically. At the beginning of this year, generative AI was a hot topic that fueled vast optimism for the U.S. stock market. It is difficult to forecast when the new “next big thing” is going to pop up. Therefore, there is always a risk of an unexpected introduction of a new product or technology which can add a lot of optimism to investors.

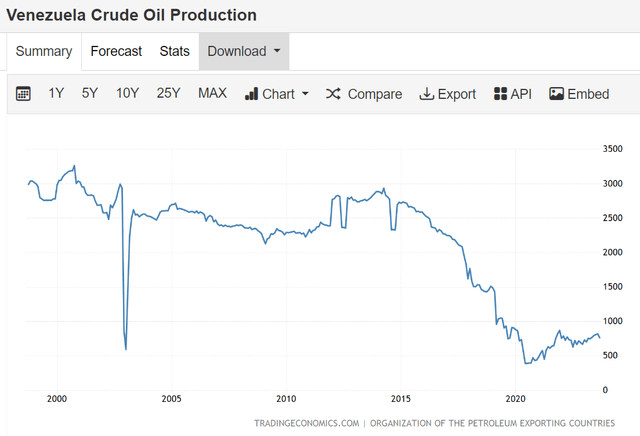

While I consider expensive oil as an unfavorable factor for the U.S. stock market, it is crucial to keep in mind that commodity prices depend on politics a lot. There are several global political issues that keep oil prices elevated and if one of them loosens it can unlock new oil supply channels which will pressure down the price. For example, the U.S. is easing sanctions on Venezuelan oil, which can be a big catalyst to bring oil prices down. Despite being a country with the largest proven oil reserves in the world, Venezuela is far from being the biggest player in terms of oil production. For example, in August 2023, daily oil production volume was 730,000 barrels per day. To add context, Saudi Arabia’s oil production over the same period was more than twelve times higher. But we should look at the potential here. During peaks of the early 2000s, before sanctions from the U.S., Venezuela produced more than 3 million barrels per day, which looks significant.

Trading Economics

It is obvious that it will take time to return to all-time highs, but with cutting-edge technologies from American oilfield services companies, the gap can be closed relatively rapidly, I believe. Improved balance in the supply-demand equation for crude oil will drag down commodity prices and will ease inflationary pressure across the world.

Bottom line

To conclude, in the near term perspective SPY is a “Strong Sell”. The environment is tough and drags down consumer spending as households’ savings are draining at a rapid pace and credit card delinquencies are rising. The hawkish Fed looks fair to me because inflation is still likely to remain elevated as energy commodities are dancing around triple digits.

Read the full article here