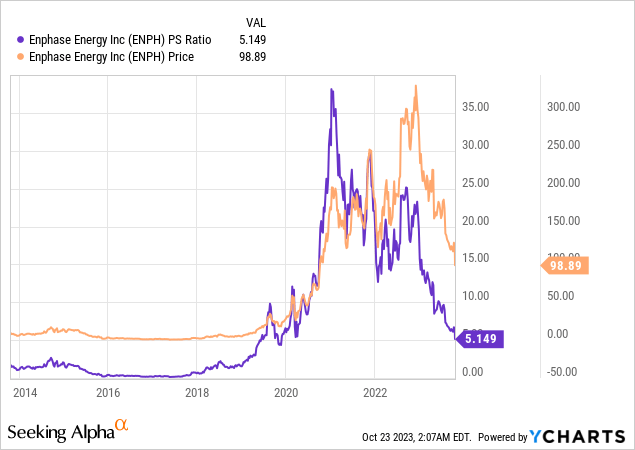

Enphase Energy, Inc. (NASDAQ:ENPH) is down 61% year-to-date to maintain a drawdown that has seen the poster boy of the solar revolution shed around $34 billion from its market cap from a winter 2022 peak. Enphase ascended as high as $325 per share just before the Fed embarked on a dramatic program to hike interest rates to their highest level in over two decades at 5.25% to 5.50% in order to bring inflation back down to their target. The impact of this on the renewable energy industry has been dramatic with previous euphoria over billions of dollars in tax credits from the 2022 Inflation Reduction Act now turned into material capital loss, delayed installations, and a collapse of investor sentiment.

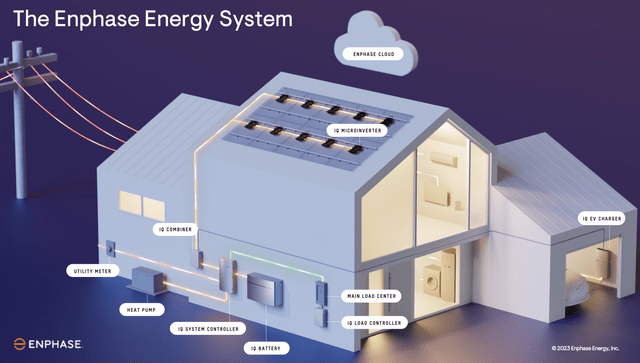

The Fed in trying to pull back inflation has wrecked the renewable energy euphoria. From SolarEdge (SEDG) to NextEra Energy Partners (NEP) and Hannon Armstrong Sustainable Infrastructure (HASI), 2023 will be remembered as the year when the green energy dream was turned into a nightmare for investors. Enphase is set to report its fiscal 2023 third-quarter earnings after the market closes on 26 October 2023, but its common shares have capitulated to lukewarm guidance from close peer SolarEdge. Enphase develops and manufactures solar micro-inverters, battery energy storage, and EV charging stations primarily for residential customers with a potential revenue per home that has swelled to $12,000 on the back of a full stack of product offerings.

Enphase July 2023 Investor Presentation

Enphase Energy’s Upcoming Third Quarter Earnings In The Specter Of SolarEdge’s Collapse

SolarEdge lost 27% of its value on intraday trading after the firm cut its outlook for its upcoming fiscal 2023 third-quarter revenues, gross margins, and operating income. This rightsizing of guidance was followed up with an expectation of significantly lower revenue in the fourth quarter. The firm cited slow installation rates and high inventories for driving cancellations and the pushout of its existing European order backlog. To emphasize how material this is and why the market reacted the way it did one just has to look at the financial literature before the Fed started raising rates. Renewable energy was billed as an immovable force and a perpetual macro trend that was meant to play out through to the end of the decade. This set investors’ expectations high and attached widely unrealistic multiples to companies like Enphase, whose price-to-sales multiple moved as high as 38x during the peak of the now deflated ESG bubble.

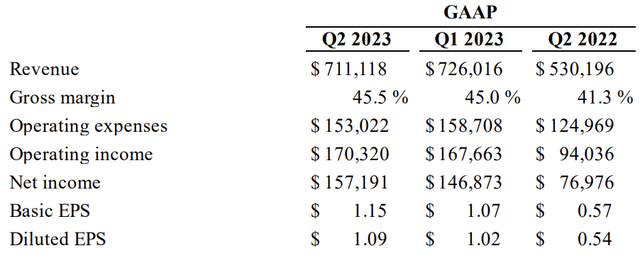

Enphase Energy Fiscal 2023 Second Quarter Press Release

Enphase reported second-quarter revenue of $711.12 million, a growth rate of 34.1% over its year-ago comp but missing analyst consensus estimates by $14.86 million. The company expects third-quarter revenue to be in the range of $550 million to $600 million, around a 5.5% year-over-year decline at the high end of guidance. This would be on the back of shipments of 80 to 100 megawatt hours of IQ Batteries. Critically, GAAP gross margin is expected to be in the range of 41% to 44%, around a 150 basis points sequential decline from the second quarter at the high-end. The company expects GAAP operating expenses to be in the range of $159 million to $163 million, higher than the second quarter by around $6 million at the low end.

Will Thursday Bring Carnage?

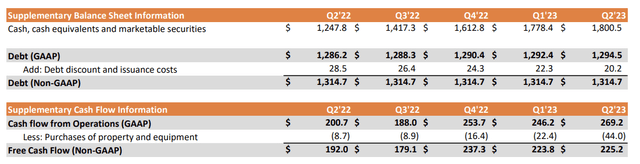

Enphase Energy Fiscal 2023 Second Quarter Supplemental

The U.S. market represented 76% of Enphase’s total revenue for its fiscal 2022, hence, the company is more insulated from headwinds flagged by SolarEdge, which generates around 21% of its revenue from the U.S. Further, Enphase has proved to be incredibly adept at generating cash with second-quarter free cash flow coming in at $225 million, up $33 million from the year-ago period with the company cash position ending the quarter at $1.80 billion. The company had a rising net cash position of around $480 million which insulates its underlying operations from the type of interest rate risk its peers face.

Pineapple Energy

The macro backdrop also remains positive with the IRA set to maintain a strong pace of U.S. residential solar installations through its extension of the ITC until 2032. This allows a qualifying homeowner to deduct 30% of the cost of installing residential solar systems from their federal income taxes. BMO expects Enphase to resume sequential revenue growth by the second quarter of 2024 but growth for the full year 2024 to only be ahead of 2023 by around 2% and for demand not to return to 2022 levels until 2025. That one of the poster boys of the solar revolution is set to see revenue essentially flatline for the next two years has reflected itself most markedly as a rapid contraction of Enphase’s sales multiple as short interest builds to 9%.

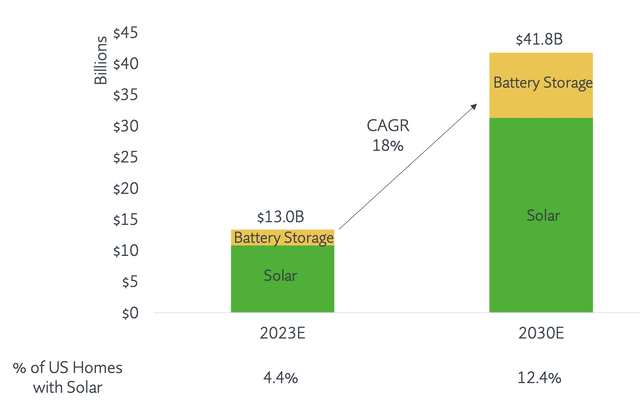

This is as the market of residential solar plus battery storage in the U.S. is set to realize an 18% compound annual growth rate through to 2030. Bears are betting that higher for longer will maintain pressure and flatlining revenue will throw up a few surprises to the downside in terms of negative guidance revisions. Against this, the selloff might still have some way to go, but Enphase’s isn’t a clear sell here on the back of already reset investor expectations and continued cash generation strength.

Read the full article here