Company Description

Academy Sports and Outdoors (NASDAQ:ASO) – Consumer Discretionary – Specialty retailer

Founded in 1938, Academy Sports And Outdoors (“the company”) is a sport, outdoor, and recreational goods retailer that offers a vast selection of value-priced goods in the United States. Currently, it operates 270 locations under the Academy Sports And Outdoors name, most of them located in Texas and the southeastern United States, and its website. It operates under one reportable segment, which can be divided into four merchandise divisions:

- Outdoors (29.2% of TTM sales) – e.g., marine equipment and fishing rods.

- Sports and recreation (21.7% of TTM sales) – e.g., fitness equipment.

- Apparel (28.1% of TTM sales) – e.g., sporting apparel.

- Footwear (20.5% of TTM sales) – e.g., work and western boots.

- Others (0.6% of TTM sales) – e.g., gift cards.

Investment Thesis

Academy Sports And Outdoors is a shareholder-oriented, and cash-flow generative business that is trading at a significant discount to its intrinsic value.

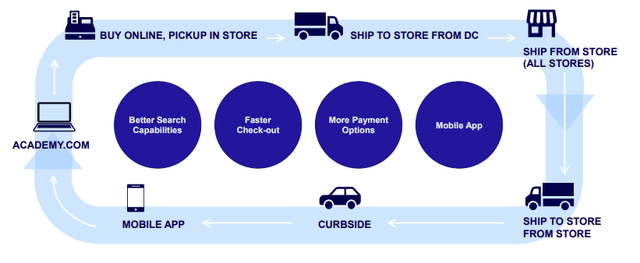

Under the leadership of former CEO Ken Hicks, Academy Sports And Outdoors was able to achieve significant operational improvement. An example of operational improvement implemented by Hicks is related to a more disciplined pricing strategy, which consists in offering a smaller discount on higher priced brands (i.e., Columbia), as the customers looking to purchase high-end brands are less price-sensitive while leaving lower-tier brands at the lowest price available in the market. The company was also able to effectively capitalize on the COVID-19 tailwind, boosting its e-commerce business, which grew from 5.1% in 2020A to 10.9% TTM of sales, even if the company’s real focus is selling retail goods via omnichannel.

Academy Sports and Outdoors Presentation

Fundamentally speaking, over the last four years, Academy Sports And Outdoors’s sales have grown at a CAGR of 9.8%, and same-store sales at a CAGR of 9.0%. The company also has the highest both sales and EBITDA margin per square foot versus the industry leader DICK’s Sporting Goods (DKS).

Over the next 4-years, the management set a growth strategy that seeks to expand its footprint by 40% (~100 new stores) in both the existing and especially in new adjacent markets (i.e., within the delivery distance from its three distribution facilities). Assuming an average sales per store of $20M, it may bring ~$2B in additional revenue over the next four years. Management also expects to improve sales per square foot to $365 vs $330 as % of TTM sales, as well as the operating cycle efficiency through a higher inventory turnover thanks to distribution efficiencies. The plan also envisions an expansion of the bottom-line margin to 10% by 2026, versus the current net income margin of 8.7% TTM. In my opinion, Academy Sports And Outdoors’ value proposition should support its long-term growth and help it gain a significant market share. Over the next 10 years, I expect the company’s top line to grow at a CAGR of ~7.91% by:

- Expanding its footprint in new adjacent markets where it can leverage the existing edges (i.e., local economies of scale).

- Selling more in old markets (i.e., higher same-store sales) driven by increased foot traffic and larger basket size.

- Improving operating cycle efficiency.

For what concerns the industry, Academy Sports And Outdoors operates in a highly fragmented and competitive market. Its competitiveness was one of the reasons for Decathlon pulling out from the US market. The market is estimated to be worth around $175B+, with the largest competitor being Dick’s Sporting Goods with a market share of ~7% followed by Academy Sports And Outdoors’s share of ~3.5%. The COVID-19 pandemic represented a big tailwind for the whole industry, with sporting apparel being one of the strongest consumer spending categories. All of this resulted in a significant boost to both the top line and bottom line. Today’s environment is different, with the economy slowly falling into the recession, which translates into weaker traffic for the industry, and with big-ticket durables categories being hit the most.

I don’t believe that Academy Sports And Outdoors will be immune to the challenges the industry is facing, but I do believe that its value proposition is what will make it a clear winner in the long run.

Business Performance

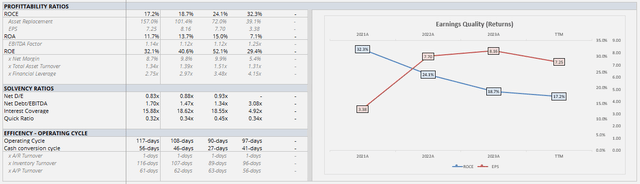

Cycle – Mature Growth

Academy Sports And Outdoors is a good company in a bad neighborhood, shareholder-oriented, which seeks to replicate its successful formula across the country and to impose itself as a true market leader.

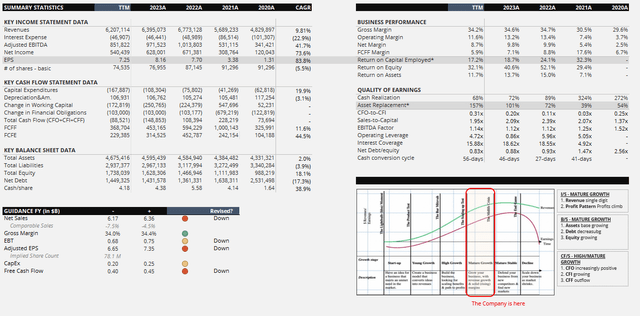

Author’s Estimates

Over the last four years, we have observed a positive business trajectory with sales growing at a CAGR of ~9.8%. Now that trend seems to be inverting trajectory, with sales being down in all four categories, driven by a significant decline in transactions and partially offset by an increase in ticket size. Gross margins are also under pressure due to a decline in merchandise margins and higher shrink costs, partially offset by lower freight costs. FCFF margin stands at 5.9%, below the historical 4-year average, and ROCE is at 17.2% TTM (in line with S&P 500 ROCE) which is well above the Company’s cost of capital of 10.88%. This underlines the fact that expansion creates value. ROE stands at 32.1% TTM, driven by a higher net margin and deleveraging process.

Author’s Estimates

The balance sheet is solid with a Net-debt/EBITDA of 1.70x and with interest coverage of 15.88x TTM (most of the interest-bearing debt is represented by operating leases). The cash conversion cycle is 56 days TTM, which is higher than the historical 4-year average due to lower inventory turnover. However, this is not something to worry about as the inventory is down on a unit basis (flat in dollar terms).

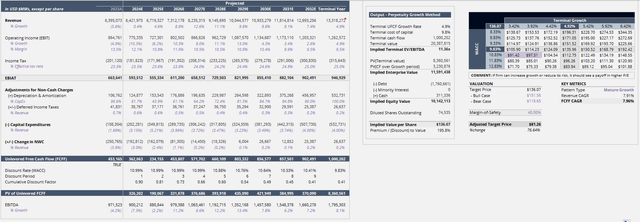

Valuation

Academy Sports And Outdoors trades at a discount to its intrinsic value.

Author’s Estimates

Under my conservative scenario, and incorporating a margin of safety of 40%, it suggests a target price of $81.26/share or a discount of 76.64% vs. the current price of $46.00/share. The current valuation gives an opportunity to purchase a cash-generative, shareholder-oriented, and dividend-paying company at a very attractive price.

Over the next 10 years, I assume sales will grow at a CAGR of ~7.91%, which is below management expectations as they do expect to hit the $10B sales milestone by 2027. On the profitability side, I expect the margins to revert to the historical industry average even if I am assuming that Academy Sports And Outdoors will be able to stay above that average by lowering its e-commerce fulfillment costs, leveraging existing distribution capacity, and larger private brand share.

Catalysts

In my opinion, the following should represent a potential tailwind

1 – Stronger than expected traffic and rebound in large ticket size categories

2 – In the new markets, lower-than-expected store sales maturity ramps

3 – Buybacks and a potential short-squeeze (the short-interest is 11%)

Risks

However, in my opinion, there are also a series of risks on the downside which we should consider:

1 – Greater promotional environment (i.e., pressure on margins)

2 – Slower than expected same-store sales

3 – Credit Rating downgrade. As stated by Moody:

The ratings could be downgraded if Moody’s adjusted debt/EBITDA is maintained above 2.75x or EBIT/interest expense declines below 3.5x.

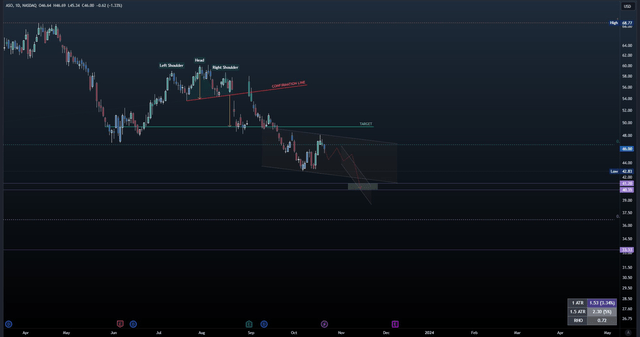

Technical Analysis

From a technical analysis point of view, in my opinion, a good entry price is around ~$40.0/share area. I am not observing any clear pattern forming yet, but based on the price action of Academy Sports And Outdoors’s competitors, it suggests that it is likely to be under pressure as well (driven by overall industry pessimism).

TradingView

Final Remarks

In my opinion, Academy Sports And Outdoors represents an appealing investment as it does offer enough margin of safety.

In the long term, the analysis suggests that the company is well-positioned to outperform the market as it seeks to replicate its successful formula across the country. In the short term, however, I do believe that the company may be under pressure due to the above-described industry headwinds. Overall, I do believe that the company is a good investment as it offers an appealing risk-reward opportunity.

Read the full article here