Introduction

Who likes to root for the underdog? In the world of finance, there’s a captivating story unfolding, and it’s all about small banks battling giants in the financial industry. It’s a true David and Goliath sort of story. The small banks versus the huge ones.

Jack Henry & Associates (NASDAQ:JKHY), the company we’ll explore today, is an unsung hero in this tale, the software “arms dealer” that changes the game for small banks and allows them to go head to head with the giants.

If you haven’t heard of Jack Henry, you’re not alone. They’re not a flashy tech giant or a trendy startup, instead, they’re a relatively boring tech conglomerate. However, their role in transforming the banking landscape is significant. Jack Henry has been the backbone of small banks and credit unions, providing them with the technology and tools they need to compete against industry titans.

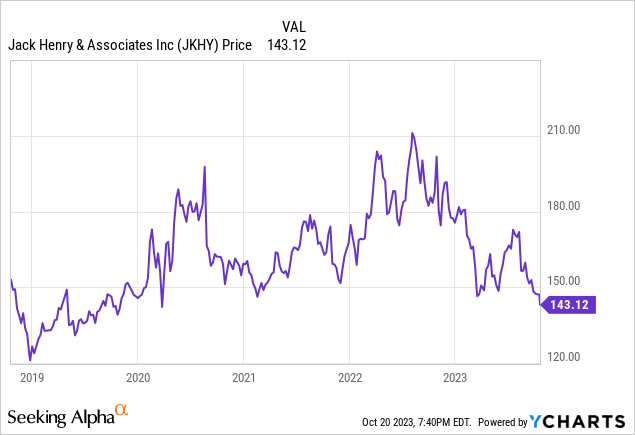

But here’s the kicker: the market has recently shunned the company despite its phenomenal track record. In the midst of all the buzz surrounding big-name tech stocks, Jack Henry has been a high-growth compounder for years, often overshadowed by the more prominent big tech players. The real excitement, however, lies in the recent events that have seen the stock price take an unexpected nosedive.

In this article, we’ll dig deep into the Jack Henry story. We’ll explore the company’s history, dissect recent updates, and examine its financial performance. By the end of this piece, you’ll have a comprehensive understanding of Jack Henry & Associates and a grasp of whether this sleepy compounder is truly an investment opportunity you won’t want to miss.

This article serves as a follow-up to my prior article “Vertical Market Software Is Eating The World” which focused primarily on Constellation Software (OTCPK:CNSWF).

Vertical Software and Jack Henry

Vertical software is a specialized category of software designed to cater to the specific needs of a particular industry or niche. Unlike general software applications, vertical software is tailor-made to address the unique challenges and requirements of a specific sector, offering enhanced functionality, efficiency, and often compliance with industry standards.

Jack Henry & Associates excels in the realm of vertical software. The company has carved a niche as a leading provider of technology solutions for small and mid-sized banks and credit unions.

By focusing on this specific vertical, they have developed a deep understanding of the intricate needs and regulatory demands of the financial sector, offering a comprehensive suite of software solutions to enhance operational efficiency, customer service, and compliance for their clients.

Jack Henry’s software acts as the great equalizer for small banks, empowering them to stand toe-to-toe with their larger counterparts. Jack Henry helps small banks offer digital experiences and mobile apps that rival the largest banks. To replicate the same offering would likely take millions of dollars in investment, something the smaller banks usually cannot afford on their own. This helps to level the playing field a bit, enabling smaller banks to access the same cutting-edge services.

Compared to other vertical software companies like Constellation Software or Roper (ROP), Jack Henry is laser-focused on the banking/fintech vertical. This reduces their investable opportunities but has likely resulted in a superior understanding of the niche compared to larger industry-agnostic consolidators.

Continuous Acquisitions

I believe Jack Henry has earned a reputation as a “Serial Acquirer” through a consistent and strategic approach to acquiring software companies year after year. Their history is a testament to their appetite for growth through acquisitions, expanding their portfolio of offerings, and enhancing their competitive edge. By consistently seeking out synergistic businesses in the financial technology space, Jack Henry has not only broadened their product range but has also cemented their position as a consolidator in the industry.

An example of this strategy in action would be its 2022 acquisition of payment software firm, Payrailz. According to the company’s press statement, the acquisition of Payrailz is in alignment with Jack Henry’s technology modernization strategy, strengthening their ability to help banks and credit unions compete effectively in a rapidly evolving landscape, fostering faster innovation, and meeting the evolving demands of consumers and commercial account holders. Furthermore, they believe this acquisition bolsters Jack Henry’s payments-as-a-service strategy, extending their commitment to open banking and enabling embedded finance and fintech solutions.

While I don’t believe the acquisition is a game-changer by any means, it’s another company that fits right into Jack Henry’s wheelhouse and incrementally improves its offering.

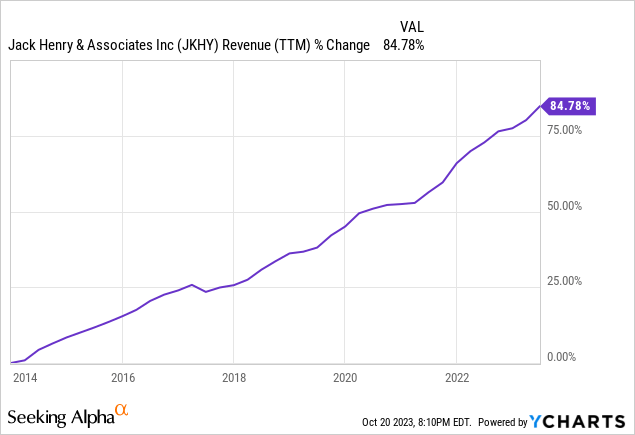

Importantly for investors, acquisitions just like these have resulted in consistently strong revenue growth.

Those tuck-in acquisitions and incremental enhancements have resulted in Jack Henry nearly doubling its revenue over the past decade. Impressively, the revenue growth has increased in a nearly straight-line fashion indicating the enduring demand of their product offering regardless of market cycle.

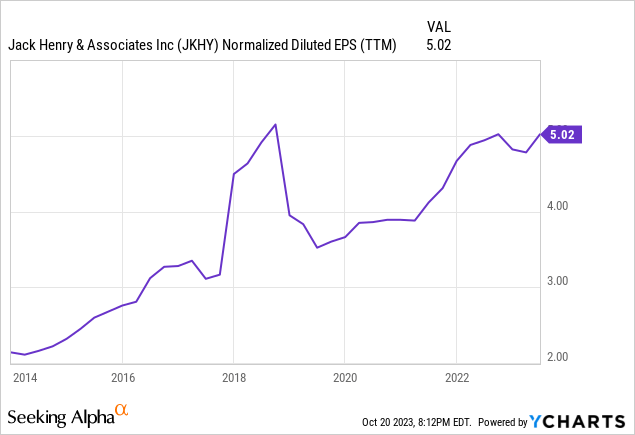

But it’s not just revenue growth, EPS has dramatically risen over the past decade having increased…

Earnings per share have actually more than doubled since 2013 from around $2 a share to now over $5 a share. This is stellar growth in the face of what has been a challenging economic environment for many businesses. Given the large number of software companies within the fintech niche apart from the further stress among the small banks, I see no reason why this trajectory can’t continue.

Recent Events: The Small Bank Meltdown

On the note of small bank stress let’s take a look back at events that occurred earlier this year. Over the course of just five days in March 2023, three small- to mid-size U.S. banks faced a dire fate, and this had a ripple effect that directly hurt Jack Henry’s customers: small banks. Silicon Valley Bank struggled when it had to sell its Treasury bond portfolio at a significant loss, causing a bank run as depositors worried about the bank’s liquidity.

This event, along with the failures of two other mid-sized banks triggered a decline in global bank stock prices and an urgent regulatory response to prevent potential global financial contagion.

In response to these bank failures, major U.S. federal bank regulators announced measures to ensure the honoring of all deposits at Silicon Valley Bank and Signature Bank. The Federal Reserve established the Bank Term Funding Program to provide loans to eligible depository institutions, helping stabilize their positions by using qualifying assets as collateral. This program has likely kept other banks alive that might have otherwise reached a similar fate to SVB.

These events, while perhaps crucial for averting a financial crisis, raised concerns for small banks, many of which are using Jack Henry’s services, as they now face a more complex and volatile financial landscape due to these failures and regulatory interventions.

As such, it’s my view that fewer small banks would directly, and negatively impact Jack Henry’s future growth plans. I believe that this is the greatest risk facing Jack Henry today.

Returns on Invested Capital

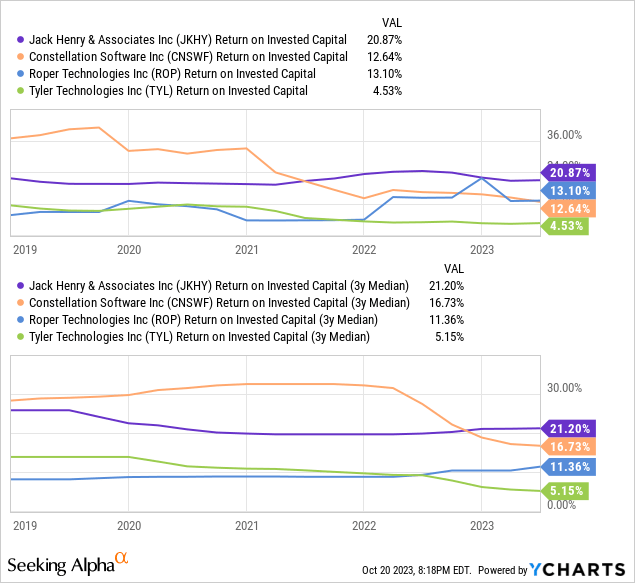

As a “Serial-Acquirer,” I believe it’s absolutely critical that potential investors keep track of the company’s long-term ability to deploy capital at attractive rates.

Luckily for investors, Jack Henry boasts one of the best track records of deploying capital compared to almost any company, including the VMS niche. Average around 21% over the past decade Jack Henry is miles ahead of other VMS peers like Tyler (TYL) which has historically deployed capital in the 4-5% ROIC range. Perhaps even more impressive is that the company is deploying capital at higher returns than the ever-so-popular, Constellation Software.

Valuation

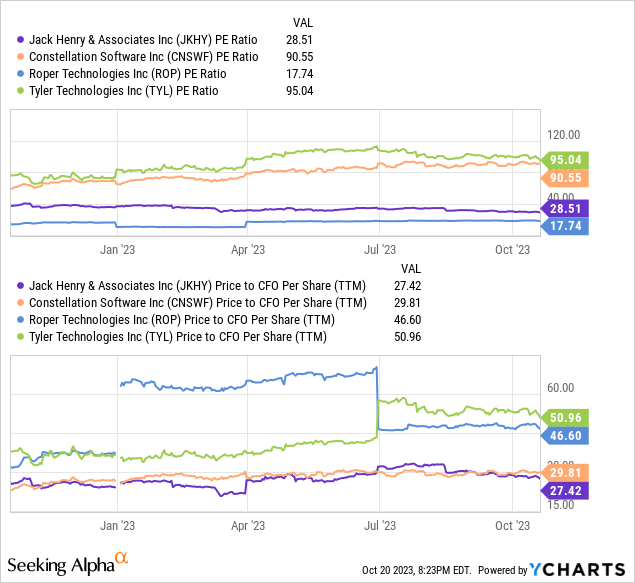

At a PE ratio of 28.5x and Price to Cash Flow From Operating Activities of 27.4x Jack Henry is at the low end of a relatively expensive niche of the market. On a PE basis, only Roper is valued at 17.8x, and on a PCFO basis only Constellation comes close at 29.8x.

Compared to the rest of the market the vertical market software niche, along with most other tech stocks, sports much higher PE ratios than the market overall. So while Jack Henry may be a value compared to the other companies highlighted it’s still more expensive than the market overall which is currently around 24x PE ratio.

This is partly why, my analysis of this company, as with most of my analyses should be interpreted as long-term calls, not short-term tactical moves. When you invest in a high PE stock you must have confidence that the long-term earnings will come in at such a level that it justifies the price you pay today.

Given Jack Henry’s consistently high returns on capital, I have increased confidence that they have the ability to execute over the long term. This is why I see its current stock price dip as opportunistic for long-term investors.

Conclusion

To sum it all up, despite recent events impacting its customer base, the company’s consistent growth, smart capital deployment, and impressive returns on invested capital make Jack Henry a standout in the VMS niche. Trading at a PE ratio of 28.5x and Price to Cash Flow From Operating Activities of 27.4x, JKHY offers investors a compelling opportunity that’s been somewhat overlooked in the market as of late. Its specific focus on small banks and credit unions gives it a unique edge for future success.

I rate Jack Henry stock a Buy.

Read the full article here