By Charles Hamieh, Shane Hurst, Nick Langley, & Simon Ong

Utilities Fundamentals Intact as Market Risks Rise

Market Overview

General equities as well as infrastructure retreated in the third quarter of 2023 as inflation, while it has fallen, is still above central banks’ targets, and recent rises in energy prices make it difficult for central banks to loosen monetary policy. Central banks have therefore adopted a higher-for-longer narrative for policy rates, triggering a sharp rise in government bond yields, with the U.S. 10-year real bond yield reaching the highest level since late 2009.

Accordingly, rate-sensitive utilities led the S&P 500 Index (SP500, SPX) down and were the main absolute detractors in the Strategy as renewable utilities in particular sold off. Infrastructure indexes underperformed global equities for the quarter. While we take a benchmark-unaware approach to managing the Strategy, the portfolio’s defensive tilt vis-à-vis the S&P Global Infrastructure Index remained a relative headwind as market consensus continues to overlook utilities’ ability to pass through higher interest rates and remains too rosy in its outlook, in our view. As higher rates begin to weaken corporate earnings, however, we believe our defensive tilt will be rewarded.

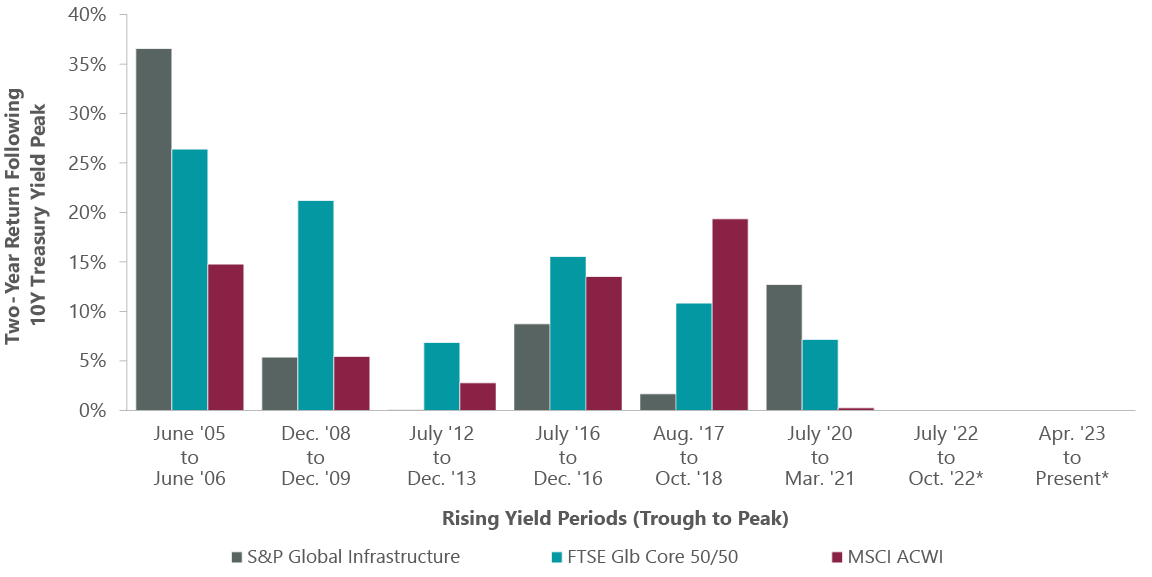

We have seen past periods of bond yield rises that were mostly due to rises in real yields on strong growth expectations, which saw utilities and infrastructure in general sell off versus equities. We believe this is short-term market sentiment and historically we have seen global infrastructure indexes outperform global equities over the subsequent two years (Exhibit 1). Over the third quarter of 2023, the rise in bond yields impacted all sectors: equities, REITS and infrastructure were all negatively impacted.

Exhibit 1: Infrastructure Versus Equities Following Selloffs Driven by Bond-Yield Rises

| *Two-year return not yet available. Source: ClearBridge Investments, FactSet. |

Portfolio Performance

U.S. electric utility Constellation Energy (CEG) was the top individual contributor. Constellation is primarily a nuclear generation company and the largest producer of carbon-free electricity in the U.S., serving states including New York, Illinois, Maryland, Pennsylvania and New Jersey. The company’s combined generation capacity is more than 32 GW and 90% of its annual output is carbon free. Shares rose as the market began to appreciate the potentially higher long-term margins the company can earn from providing baseload clean energy, which is being bid up at a premium by large customers such as Microsoft (MSFT). Summer volatility in energy prices in Texas also bodes well for the baseload generation capabilities of Constellation’s nuclear assets.

Elsewhere in the region, U.S. energy infrastructure company Cheniere (LNG) also contributed to quarterly performance. Cheniere, which owns and operates U.S. liquefied natural gas (LNG) export facilities along the U.S. Gulf Coast, saw its share price rally during the quarter due to a strong commodity price environment supporting the broader group of energy infrastructure stocks.

“Market consensus continues to overlook utilities’ ability to pass through higher interest rates.”

U.S. electric utility NextEra Energy (NEE) and U.S. communications company American Tower (AMT) were the largest detractors. NextEra Energy is an integrated utility business with a regulated utility operating in Florida and the largest wind business in the U.S. NextEra’s regulated business includes Florida Power & Light, which serves nine million people in the State of Florida. NextEra was impacted by NextEra Energy Partners’ (NEP) reduction in expectations, a function of long-term interest rates, which investors now fear may be a problem for NextEra and U.S. utilities more broadly.

American Tower is a leading independent owner, operator and developer of wireless and broadcast communications infrastructure. The company has 41,000 sites in the U.S. and a further 139,000 sites across 19 countries, predominantly in emerging markets (75,000 in India, 40,000 in Latin America and 18,000 in Africa). Shares underperformed as commentary suggested that the pace of 5G rollout was slowing. Additionally, the company faces headwinds from unfavorable moves in interest and FX rates.

Utilities’ Earnings Power Lags Rises in Bond Yield

Taking a step back, recent underperformance of regulated utilities and contracted renewables can be attributed to 1) the sharp rise in bond yields and the higher-for-longer rates narrative, which has reduced the appeal of utilities and their associated dividends; and 2) negative sentiment for the sector following NEP’s announcement, in particular around how higher-for-longer yields may impact financing needs and ultimately earnings over the next few years.

As we have previously highlighted, regulated assets generally have their allowed returns (whether real or nominal) adjusted at each regulatory reset. This leads to some lag to changes in bond yields, but tends to have an immaterial impact on fundamental valuations in the medium to long term. U.S. utilities are currently trading at their largest P/E multiple discount (over the next two fiscal years) relative to the S&P 500 Index since the Global Financial Crisis recovery began in 2009. Our modelling shows an annual average excess return of over 9.5% across the sector (calculated as expected five-year internal rate of return minus required return), which we find attractive.

Our view is that the fundamentals for our U.S. utilities (and utilities in general) remain intact. We are taking a disciplined approach, however, given the surprise move by NEP, and are retesting our assumptions around the medium-term financing needs of our companies before we look to take fuller advantage of the volatility by purchasing high-quality utilities at a discount.

Communications Towers: Still a Strong Signal

Communications towers have also come under pressure in 2023, with American Tower among top detractors in the quarter. These companies generally have inflation pass-throughs built into their contracts but have less flexibility to pass through higher financing costs over the longer term.

Concerns that a deteriorating economy might slow carrier investments in their networks and slow near-term growth has impacted sentiment. The sector was also impacted as the market shifted away from defensive sectors including communications towers with longer-term contracts and stable demand as U.S. equities generally rebounded on the expectation of a soft landing. However, we believe the long-term growth in capex spend remains an attractive tailwind for U.S. communications towers as wireless carriers roll out 5G, and we are optimistic on the long-term value to come from the role of towers in 5G, as well as eventually 6G.

Spanish communications company Cellnex (OTCPK:CLNXF), Europe’s leading independent infrastructure owner and operator for wireless telecommunication, was weaker amid rising bond yields coupled with market commentary on the consolidation of Europe’s telecoms. If more consolidation is approved by the European Commission, it could result in a net headwind for Cellnex due to fewer towers required. However, historically, these mergers have been rejected because of antitrust considerations. We are currently still waiting on a decision for the merger of telecoms providers Orange (ORAN) and MasMovil’s (OTC:MMBMF) Spanish operations by the European Commission.

Outlook

Despite the volatility, we are maintaining our defensive positioning as we believe the impacts of tightened financial conditions will eventually affect the economy and ultimately corporate earnings (we are starting to see weakness in earnings from higher interest costs). The Fed and other central banks around the world have to maintain their hawkish position and have started to accept recessionary risks as increasingly likely but necessary to combat the stubbornly high inflation.

We maintain this defensive positioning despite the economy’s robustness. There is a large debate on whether there will be a soft landing (no recession) versus a deeper recession. Monitoring the economic data will be key here, and the defensiveness of our portfolio positioning will depend on this. Although economic data and corporate earnings have been resilient, there is a clear dislocation between general market performance and what leading economic indicators are saying.

Our overarching view is that utilities can handle higher interest rates over the next couple of years. In a slowing growth environment, we believe their predictability of earnings makes utilities attractive compared to general equity sectors where earnings uncertainty results in less confidence among investors and higher volatility.

We think utilities valuations, like infrastructure broadly, are attractive now, and, versus the more optimistic consensus narrative, our contrarian view is that the risks of a deeper recession remain considerable.

Portfolio Highlights

We believe an absolute return, inflation-linked benchmark is the most appropriate primary measure against which to evaluate the long-term performance of our infrastructure strategies. The approach ensures the focus of portfolio construction remains on delivering consistent absolute real returns over the long term.

On an absolute basis, the Strategy saw negative contributions from all nine sectors in which it was invested (out of 11 total) in the third quarter, with the energy infrastructure sector the least negative and the electric and communications sectors detracting the most.

On a relative basis, the ClearBridge Global Infrastructure Value Strategy underperformed the S&P Global Infrastructure Index during the quarter. Overall stock selection contributed positively, while sector allocation detracted. Stock selection in the electric, toll roads and rail sectors and a rail overweight were beneficial, while stock selection in the energy infrastructure sector detracted, as did overweights to the communications and water sectors and underweights to the energy infrastructure and other infrastructure sectors.

On an individual stock basis, the top contributors to absolute returns in the quarter were Constellation Energy, Cheniere Energy, East Japan Railway (OTCPK:EJPRY), Union Pacific (UNP) and Fraport (OTCPK:FPRUF). The largest detractors were NextEra Energy, American Tower, Energias De Portugal (OTCPK:EDPFY), Cellnex Telecom and Transurban (OTCPK:TRAUF).

During the quarter we initiated positions in Brazilian rail operator Rumo Logistica and U.S. rail operator Norfolk Southern (NSC). We closed positions in Spanish electric utility Iberdrola (OTCPK:IBDSF) and Canadian energy infrastructure company TC Energy (TRP).

Charles Hamieh, Managing Director, Portfolio Manager

Shane Hurst, Managing Director, Portfolio Manager

Nick Langley, Managing Director, Portfolio Manager

Simon Ong, Portfolio Manager

|

Past performance is no guarantee of future results. Copyright © 2023 ClearBridge Investments. All opinions and data included in this commentary are as of the publication date and are subject to change. The opinions and views expressed herein are of the author and may differ from other portfolio managers or the firm as a whole, and are not intended to be a forecast of future events, a guarantee of future results or investment advice. This information should not be used as the sole basis to make any investment decision. The statistics have been obtained from sources believed to be reliable, but the accuracy and completeness of this information cannot be guaranteed. Neither ClearBridge Investments, LLC nor its information providers are responsible for any damages or losses arising from any use of this information. Performance source: Internal. Benchmark source: Morgan Stanley Capital International. Neither ClearBridge Investments, LLC nor its information providers are responsible for any damages or losses arising from any use of this information. Performance is preliminary and subject to change. Neither MSCI nor any other party involved in or related to compiling, computing or creating the MSCI data makes any express or implied warranties or representations with respect to such data (or the results to be obtained by the use thereof), and all such parties hereby expressly disclaim all warranties of originality, accuracy, completeness, merchantability or fitness for a particular purpose with respect to any of such data. Without limiting any of the foregoing, in no event shall MSCI, any of its affiliates or any third party involved in or related to compiling, computing or creating the data have any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) even if notified of the possibility of such damages. No further distribution or dissemination of the MSCI data is permitted without MSCI’s express written consent. Further distribution is prohibited. Performance source: Internal. Benchmark source: Russell Investments. Frank Russell Company (“Russell”) is the source and owner of the trademarks, service marks and copyrights related to the Russell Indexes. Russell® is a trademark of Frank Russell Company. Neither Russell nor its licensors accept any liability for any errors or omissions in the Russell Indexes and/or Russell ratings or underlying data and no party may rely on any Russell Indexes and/or Russell ratings and/or underlying data contained in this communication. No further distribution of Russell Data is permitted without Russell’s express written consent. Russell does not promote, sponsor or endorse the content of this communication. Performance source: Internal. Benchmark source: Standard & Poor’s. |

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here