|

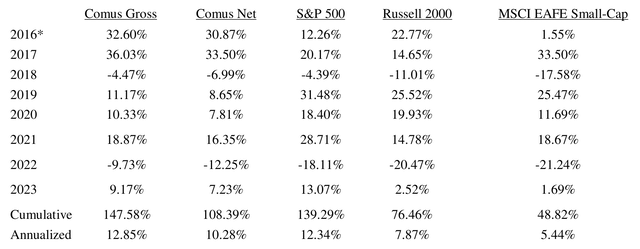

*April 1st – Dec 31st, 2016 The compounded performance figures represent all realized and unrealized losses and gains in the firm’s brokerage account after commissions and on a currency-adjusted basis over the specified period, as recorded by InteractiveBrokers. Index returns represent total return including dividends. |

Dear Partners,

In the third quarter of 2023, our investments experienced a total return of 3.45% before fees and 2.82% after fees, versus -4.26% for our comparable benchmark, the MSCI EAFE Small Cap Index, and -3.27% for the S&P 500 (SP500, SPX). At this point, you will have received reports with the details on your balance, fees, holdings, and performance from InteractiveBrokers for the past quarter.

Two wins for us this quarter boosted results despite losses in Hong Kong. Early this year, Advanced Holdings, a Singaporean producer of petrochemical testing equipment, sold most of its operating subsidiaries, leaving it with a net-cash position of 3x its market cap. In my opinion, management acted unscrupulously in the past and others likely agreed. After the disposal they expressed some desire to invest in an animal feed facility, which I (and I assume everyone else) was opposed to, but they slyly noted the potential of a distribution in a public response to shareholder questions. Given this uncertainty and the fact that the company was too small for many others to buy in, the stock didn’t move. For a few months, we soaked up most of the available shares at that price, until the board decided to pay out the cash in August, leaving us with a quick 200% gain. The second stock was a Japanese steel producer which sold a chunk of land for a gain exceeding its market cap at the time of the announcement, as it had written the land to zero over the decades. The company was posting bad results, and the land sale was entirely unpredictable, but these gains occur every now and then when buying at such a large discount to net worth. Our Japanese auto suppliers (primarily to the beleaguered Nissan, which is now sharply improving) have also done well but were kept as small positions since many of them carry higher debt-loads.

It was a difficult quarter for our two primary markets by weighting, with the Hang Seng falling another 6%, and the Nikkei dropping 7% in USD. For all the talk surrounding Japan, it’s up 8% YTD for Americans as the Yen’s weakness has sliced profits. Although the deep-value space is drying up, a boost in the Yen would bring major gains. In contrast, Hong Kong is now truly the orphan of Asia, as foreign investors flee at a record pacein downright panic of the Chinese property sector, with year six of its unending bear market right on track. Mainland Chinese investors have kept the Shanghai index afloat despite these issues, but they haven’t been able to mitigate the foreign outflow in HK, leaving shares without support. Foreign funds are not only unable to raise money for investment in greater China, but are actively selling to limit exposure, regardless of industry. With the news coming out of developers such as Country Garden, who can blame them?

A frequent question I’ve received from outsiders is why buy anything in HK, when markets are so weak, and when real estate is falling apart? It’s a good question, and to use an example in response, why would anyone buy Build-a-Bear stock in 2009, given the fears of US property and a weak economy? Were those teddy bear investors just clueless of their surroundings?

The extent of potential damage to the property sector is unknown but the chaos has been brewing for about a decade now, with people posting Youtube videos of Chinese ghost cities from overbuilding as far back as 2014. Since then, investors paid higher prices as problems were developing; now prices are cheap, and everyone is fully aware of the risk. To buy low, others have to turn their noses up at a stock/market. There are many unrelated and improving companies at all-time lows, which are frequently important suppliers to US firms, so we depend more on the strength of the American consumer than regional real estate. Many HK-located firms have been buoyed by the recent spike in local consumption and tourism, with our retailers showing sharp improvement.

Investors appear certain of an upcoming Chinese depression as they make clear in their stock pricing, and if correct, our companies will endure with ample liquidity (as will the many American companies and consumers which depend on China). With widespread systemic risk affecting the price of all HK-listed stocks, I’ll gladly support the under-appreciated companies. It’s a good time to buy and sow investments, but clearly a bad time for taking profits, posting good numbers or fund-raising. In aggregate, Japanese companies are posting the greatest improvement, but HK’s fundamentals aren’t bad, with almost half of all listed companies showing YOY profit growth, which is similar to the rate in the U.S. Among micro-caps, special dividends and suggestions of buybacks are popping up at a remarkable rate, which is helpful if prices don’t rise.

As always, feel free to contact me with any questions or comments you have.

Best,

Aaron J. Saunders, Owner & Manager, Comus Investment, LLC.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here