Investment thesis

Motorola Solutions (NYSE:MSI) is a high-quality business operating in a niche where demand is resilient to adverse macroeconomic conditions. The company’s offerings serve agencies where the communication quality might be the question of life and death. From a secular perspective, MSI demonstrates steady revenue growth together with strong profitability expansion. The company fuels its growth with strategic acquisitions, and the current balance sheet looks strong enough to fuel this inorganic growth. Last but not least, my valuation analysis suggests the stock is substantially undervalued, with more than 20% upside potential. All in all, I assign the stock a “Buy” rating.

Company information

Motorola Solutions specializes in delivering essential first-responder devices, networks, and solutions to civil agencies such as police, fire departments, and emergency services.

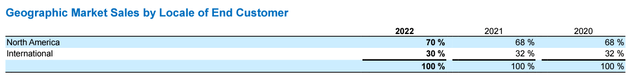

The company’s fiscal year ends on December 31. The business is operated via two segments: Products & Systems Integration [PS], and Software & Services [SS]. According to the latest 10-K report, PS revenue contributed 63% to the total annual sales in 2022. The lion’s part of sales is generated within North America.

MSI’s latest 10-K report

Financials

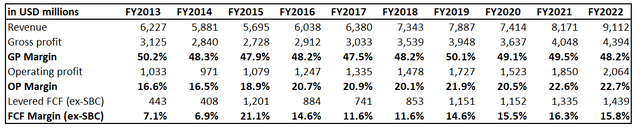

The company’s financial performance over the last decade has been solid. Revenue compounded at a moderate 4.3% CAGR, and key profitability metrics demonstrated positive dynamics. The gross margin was stable within approximately the 48-50% range. The operating margin expanded notably over the decade, from 16.6% to 22.7%. The strength in operating profits allowed the company to consistently deliver double digits in the free cash flow[FCF] margin ex-stock-based compensation [ex-SBC]. Expanding FCF margin as the business scales up is a solid bullish sign to me because it indicates that the management is efficient in managing growth.

Author’s calculations

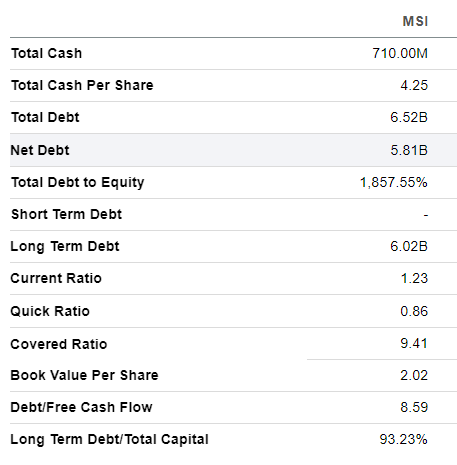

Having a wide FCF margin allows the management to balance investing in innovation, keeping shareholders happy, and maintaining a healthy balance sheet. While Motorola’s leverage ratio might look huge, it is crucial to add context here. First, the major part of the debt is long-term. Second, the covered ratio of above 9 looks very comfortable. Liquidity metrics are also in good shape, and I believe the company’s financial position is solid enough to continue innovating and fueling future growth. Over the past decade, MSI’s R&D to revenue ratio has been consistently above 8% each year, which I consider a solid portion of revenue to be reinvested in innovation. MSI also has a strong track record of stock buybacks and dividend consistency.

Seeking Alpha

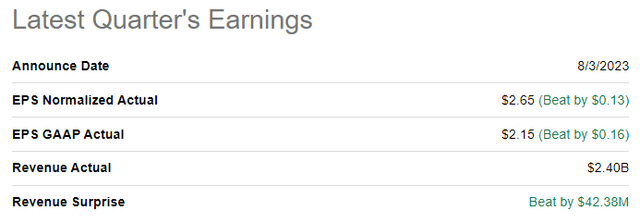

The latest quarterly earnings were released on August 3, when the company topped consensus estimates. Revenue demonstrated a solid 12.3% YoY growth, which looks impressive amid the current harsh environment. It is also crucial to underline that the operating margin expanded notably YoY from 19.2% to 22.8%.

Seeking Alpha

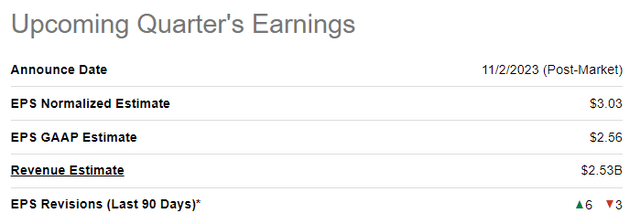

The upcoming quarter’s summary is scheduled for November 2. Consensus estimates project quarterly revenue of $2.53 billion, which indicates a 6.7% YoY growth. Revenue growth momentum remains solid despite notable deceleration. The adjusted EPS is forecasted to be almost flat YoY with a slight growth.

Seeking Alpha

I like the company’s strong performance amid the current uncertain environment. The fact that the company serves vital civil bodies like police or emergency protects it from economic cycles because communication devices for these agencies are crucial, and the quality of communication can often be a matter of life and death. That said, governments are unlikely to save money because of the deteriorating availability and quality of communication between police and emergency services. I expect solid growth momentum to sustain over the next quarters since during the latest earnings call the management revealed that MSI had a record backlog of $14.3 billion as of the reporting date.

Valuation

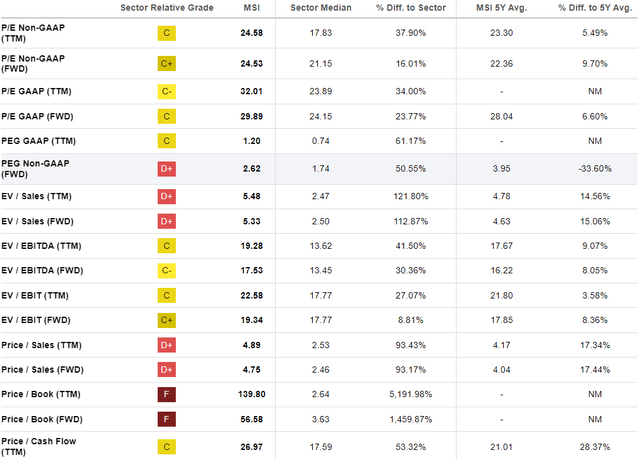

The stock rallied 9.5% year-to-date, underperforming the broader U.S. market. Seeking Alpha Quant assigns MSI a low “D” valuation grade because its current ratios are substantially above the sector median across the board. It is also important to underline that almost all current multiples are notably higher than the company’s historical averages. That said, from the multiples perspective, the stock looks overvalued.

Seeking Alpha

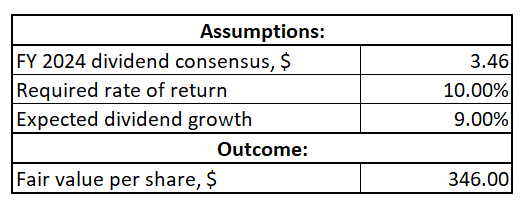

On the other hand, the company demonstrates stellar profitability and has a solid history of dividend growth, which compounded at a 12.4% CAGR over the past decade. Therefore, I have to look at the valuation from the dividend discount model [DDM] as well. I use a 10% WACC as a required rate of return. I prefer to be conservative about the dividend growth rate compared to the growth track record and implement a 9% dividend growth. Consensus dividend estimates forecast an FY 2024 payout of $3.46.

Author’s calculations

According to my DDM simulation, the stock’s fair price is $346. This indicates a 23% upside potential from the current levels. I think that given the company’s strong track record of dividend growth, the DDM analysis should prevail over ratio analysis. That said, the stock looks very attractively valued.

Risks to consider

Motorola fuels a notable part of its growth via strategic acquisitions. According to MSI’s latest 10-K report, there were seven acquisitions in FY 2022 only. Integrating different corporate cultures, systems, and processes can be complex and may result in inefficiencies in the newly combined business. These challenges can weigh on the expected growth and operational synergies. Having fewer benefits from acquisitions than expected will likely lead to long-term earnings projections downgrades, which will pressure the stock’s valuation.

According to the latest 10-K report, the company’s cost side has a massive international exposure. For example, 47% of the headcount was employed outside of North America as of the fiscal year-end. According to the management’s representations in the report, most of the company’s suppliers’ operations are outside the U.S. That said, the company’s supply chain and internal processes can be disrupted in case of changes in international trade regulations, tariffs, or escalation of geopolitical tensions in different parts of the world. Having a notable share of 30% of total sales generated outside North America also means the company faces significant foreign exchange risks.

Bottom line

To conclude, MSI is a “Buy”. It is a high-quality business operating in the recession-resilient niche because in case governments start saving money on the quality of communication between the police or emergency, this can lead to a massively adverse effect on the safety of each country’s citizens. I like how the management balances financing growth, keeping shareholders happy with dividends and buybacks, and maintaining its financial position in good shape. Moreover, the valuation looks very attractive based on my DDM calculations.

Read the full article here