Ares Capital Corp (NASDAQ:ARCC) has long been my favorite overall Business Development Company (i.e., “BDC”)(BIZD), in large part due to its impressive total return performance alongside its very high and consistent dividend payout. However, it is no longer my favorite overall BDC. In this article, I discuss three major reasons why.

Why ARCC stock used to be my favorite BDC

ARCC was my favorite BDC for many years due to its consistent and attractive dividend payouts, stellar total return performance across various market and economic conditions, and the competitive advantages it derives from its manager (Ares Management Corporation (ARES)).

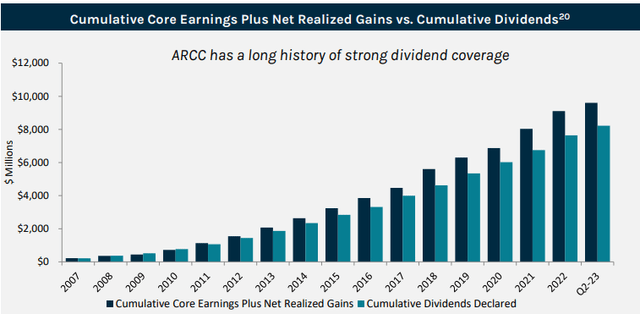

For example, ARCC’s base quarterly dividend has held steady and even increased over the past 14 years, a time period in which many of its peers have had to cut their dividends quite steeply. This performance has been driven by very strong core earnings plus net realized gains coverage of its total dividends paid out over time:

ARCC Investor Presentation

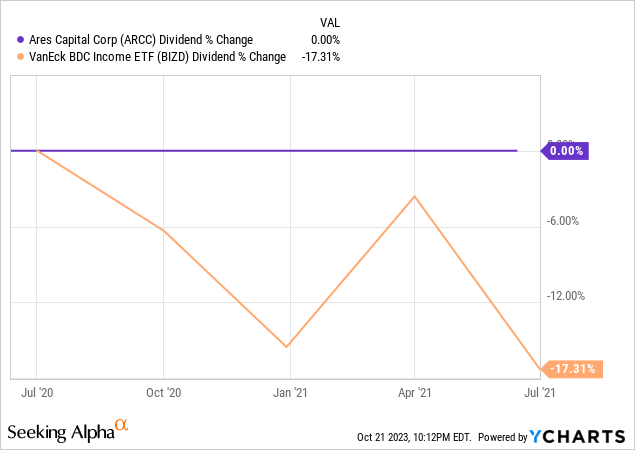

This impressive dividend track record contrasts quite sharply with periods where there has been a noticeable dip in the broader sector’s dividend payout. For example, in the wake of the COVID-19 outbreak, the sector-wide dividend plunged by over 17% while ARCC’s dividend held steady:

Given that BDCs are viewed primarily as income instruments, this sort of reliability is invaluable to most investors and worth paying a premium for.

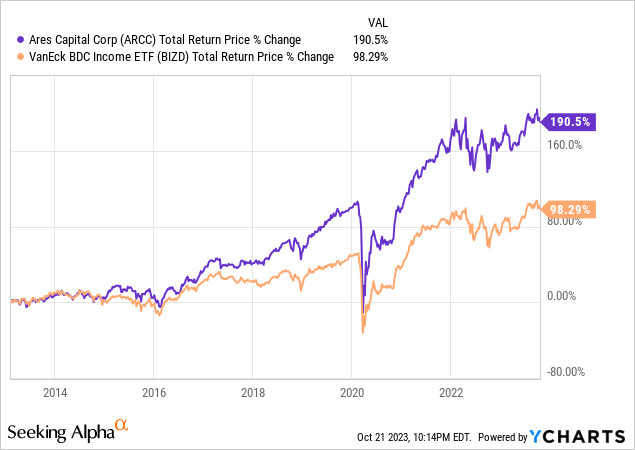

Moreover, its total returns have crushed those of the broader BDC sector over time:

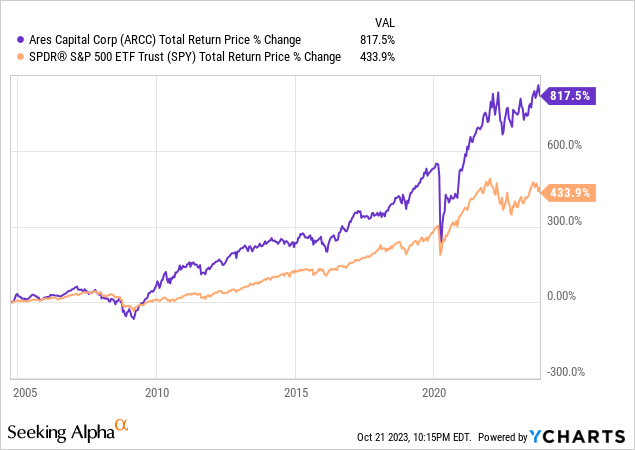

ARCC has even crushed the total return performance of the S&P 500 (SPY) since its inception, which is remarkable given that this index has achieved remarkably strong performance over that period of time due to a prolonged mega-cap technology stock boom:

Finally, this strong dividend and total return performance track record has been made possible in large part due to its very strong underwriting skill via its relationship with its manager ARES. ARES’s direct lending team, with ARCC as its main fund, is the leading force in U.S. direct lending. Their unmatched origination, scale, and infrastructure are supported by a large team that efficiently tracks and monitors portfolio companies. Moreover, they have systems that evaluate credit profiles and have built strong relationships with both sponsor and non-sponsor companies over time. As a result, the value that ARCC derives from ARES’s sourcing, origination, and underwriting is significant.

However, as with all investments, dynamics change, and with changing macroeconomic conditions, so does my opinion. As a result, while I still like ARCC (and we own it in one of our portfolios), when comparing it with some of its peers, it is no longer my favorite BDC. Here are three reasons why:

1. ARCC is not as defensively positioned as it should be right now

ARCC’s allocation to first-lien senior secured loans is pretty low at just 41.7% and its second-lien senior secured allocation is a mere 23%, resulting in total senior secured loan exposure of a relatively unimpressive 64.7%. While its much higher exposure to equity and riskier loans have helped to boost its total return performance during periods of economic prosperity, the stormy clouds currently on the horizon may soon drive ARCC’s 1.1% (at fair value) non-accrual rate higher, particularly relative to more conservatively positioned peers.

For example, Golub Capital BDC (GBDC) has a 93.6% exposure to senior secured loans, Oaktree Specialty Lending (OCSL) has an 87.1% exposure to senior secured loans, Blackstone Secured Lending (BXSL) has a whopping 97.3% exposure to senior secured loans, and Blue Owl Capital Corp (OBDC) has an 83.2% exposure to senior secured loans. Even FS KKR (FSK) – not known for being one of the blue-chip BDCs – has 76.4% exposure to senior secured loans.

ARCC does have an investment-grade credit rating and a reasonable leverage percentage of 51.15%. However, each of these aforementioned (and several other) peers have investment-grade balance sheets as well with similar leverage ratios, so ARCC fails to stand out there as being particularly conservative either. Yes, ARCC has a proven track record of excellence in underwriting, but several of these other firms have equally impressive teams backing them, so we do not see ARES’ team as providing enough of an edge to offset ARCC’s more risky capital structure exposure.

2. ARCC’s dividend outlook is not as robust as some of its peers’

ARCC’s dividend track record is excellent and it easily covered its dividend per share with net investment income by a healthy ratio of 1.19x during its latest quarter. However, there are plenty of other BDCs – such as OBDC, FSK, BXSL, GBDC, and Main Street Capital (MAIN) – that have similarly strong (and in several cases even stronger) quarterly base dividend coverage.

Moreover, on its latest earnings call, management was asked about what it thought about raising its quarterly base dividend further after not having raised it since Q4 of 2022 along with a lack of any special dividends this year. However, management mostly dodged the question and simply focused on how it feels strongly about the safety of its current dividend. In contrast, peers like BXSL, OBDC, MAIN, FSK, and GBDC have all been growing their dividends and/or paying out substantial special dividends this year and appear poised to continue doing so moving forward.

3. ARCC’s valuation is not particularly attractive right now

Last, but not least, ARCC’s valuation is not particularly attractive right now, especially when you take into account that the management fee that ARES charges ARCC shareholders is fairly high. Yes, ARES’ excellent management of the fund makes the fee worth paying, but when other well-run funds like GBDC, OBDC, and FSK are trading at meaningful discounts to NAV, ARCC’s current premium to NAV makes it appear relatively unappealing, especially considering that management has been mum on any further dividend growth/special dividends in the near term and the BDC itself is not particularly defensively positioned.

Investor takeaway

BDCs can be great income investments, and ARCC’s track record along these lines has been exceptional. As a result, I have held it in high regard for years as my favorite overall BDC, combining its blue-chip qualities with a very attractive dividend yield and a relatively attractive valuation relative to its NAV.

That said, given that we appear to be headed into an environment where defensiveness should be given priority, ARCC does not look particularly appealing at the moment. Moreover, other BDCs offer greater exposure to senior secured loans with similar balance sheet strength, similar or better dividend coverage and growth potential, and similar or better stock prices relative to NAV. As a result, ARCC is no longer my favorite overall BDC as I prefer many of the other BDCs discussed in this article at the moment.

Read the full article here