This Analysis Assigns a Buy Rating to New Found Gold Corp

This analysis suggests a Buy recommendation for New Found Gold Corp. (NYSE:NFGC) stock, although this should not be acted upon immediately as the probability of a more favorable market valuation in the near future is high.

Henceforth, this analysis will refer to this company simply as NFGC, which is the symbol by which its shares are identified and traded on the NYSE American.

NFGC is a Vancouver, British Columbia, Canada-based exploration company prospecting for gold deposits on mineral properties in the Canadian provinces of Newfoundland and Labrador, and Ontario.

The Outlook for NFGC

There is an excellent opportunity for this stock to benefit from a remarkably strong rally in the price of gold sometime in the near future, let’s say probably in 2024; but for now, this stock may remain under pressure due to the current macroeconomic situation, which risks further interest rate hikes.

So, the US Federal Reserve’s “higher for longer” approach to interest rates now dictates a good chance that NFGC shares could become cheaper relative to the prospect of a gold bull market.

Although NFGC is not yet producing gold, but rather laying the foundation for future production of the precious metal in Canada, the market is already linking NFGC’s shares to gold price dynamics, as is the case with companies that already produce and supply gold on a global scale.

NFGC stock is characterized by a strong positive correlation with the yellow metal, so when gold is rising, the stock is almost certainly in the uptrend as well. Of course, divergences may occur from time to time, but past results show that these are just exceptions.

Retail investors can use this feature to their own advantage, and if the conditions for a dramatic recovery in the gold market are present, the investor can expect a similar trend in the NFGC stock price.

There is no doubt that whenever there is bullish sentiment in gold, the market looks with even more interest to the projects NFGC is pursuing in its Canadian provinces. Let alone if, during a bull market, NFGC’s exploration activities, located on a mine site that appears to be teeming with significant gold occurrences, would result in promising new drill results. The combination would generate a fantastic positive fallout for the share price of NFGC.

The Outlook for the Gold Price and the Implications for the NFGC

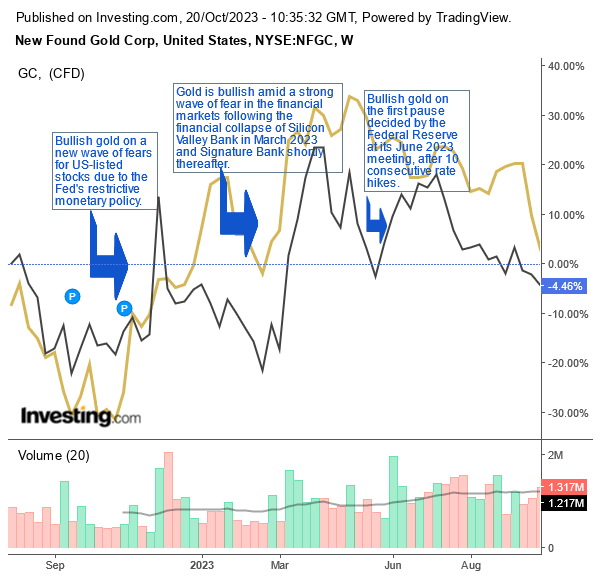

There is currently a very strong case for the gold price (at $1,980/oz on the London bullion market at the time of writing), to have another bull market like those seen in October 2022, March 2023, and June 2023.

During those three periods, gold had a powerful catalyst for rapidly rising prices in three macroeconomic factors that strengthened its safe haven properties.

These triggers consisted of:

- October 2022: A new wave of concern over US-listed stocks due to tightening monetary policy to limit the rapid rise in inflation. For a moment, many in the market harbored the illusion that the Fed was on track to reverse the rate hikes, creating a short-lived bullish mood in the stock market in the summer of 2022.

- March 2023: The financial collapse of Silicon Valley Bank in March 2023 and Signature Bank shortly thereafter. These failures led to fears that the crisis could spread to an entire sector and affect other banking institutions.

- The decision by the US Federal Reserve at its June 2023 meeting to pause the policy of raising interest rates against elevated inflation (the first pause after 10 consecutive hikes).

Source: Investing.com

Following the rise in gold prices, NFGC stock also experienced a strong recovery in the three periods mentioned above, and exposure to the yellow metal through NFGC resulted in investors earning high return margins.

Those who have been better at exploiting the cycles in the gold price have virtually dashed the hopes of those who believe it is absolutely worth it to patiently hold the position in NFGC. Since NFGC’s debut on the US market, investors who have maintained their position in NFGC stock despite fluctuations in gold prices are now in the red territory by 30%.

But there’s more: taking advantage of the strong positive correlation between NFGC’s share price and gold price volatility made it possible to overcome the 15.5% gain NFGC achieved over the past year and even outperform past year’s 18.3% increase of VanEck Gold Miners ETF (GDX) representing the entire sector of US-listed gold stocks.

By focusing on the gold price cycle, the investor was positioned to achieve return margins of 45% and over 30% in the October-December 2022 and March-May 2023 periods, respectively, taking advantage of the strong rally in gold as a safe haven against the relative headwinds.

Compared to a capital gain of up to 10% that an investment in NFGC stock could achieve in a few weeks by simply benefiting from the gold price rally following the Fed’s interest rate pause in June 2023, patiently holding NFGC for a year brought instead a slightly higher return margin of 15.5%. Holding GDX for a year also yielded more as the return was 18.3%.

However, the DOW (^DJI), which also represents capital-intensive industries such as gold mining and exploration, has underperformed with a +9.8% over the past year, compared to the +10% that, as shown, could be achieved through the NFGC by taking advantage of a rapid rise in the price of gold on the June 2023 Fed rate hike pause.

Due to fears about economic growth, both the rise in interest rates and the banking crisis were associated with the risk of devaluation effects on portfolios that could be hedged by an appreciation of gold and gold-based securities.

Instead, the pause in interest rate hikes in mid-June had a positive impact on the price of the yellow metal, as a stabilizing cost of borrowing determines an improvement in the opportunity cost but in favor of investments in gold or gold-based securities rather than fixed-income assets such as US bonds.

The Strong Positive Correlation Between Gold Price and NFGC

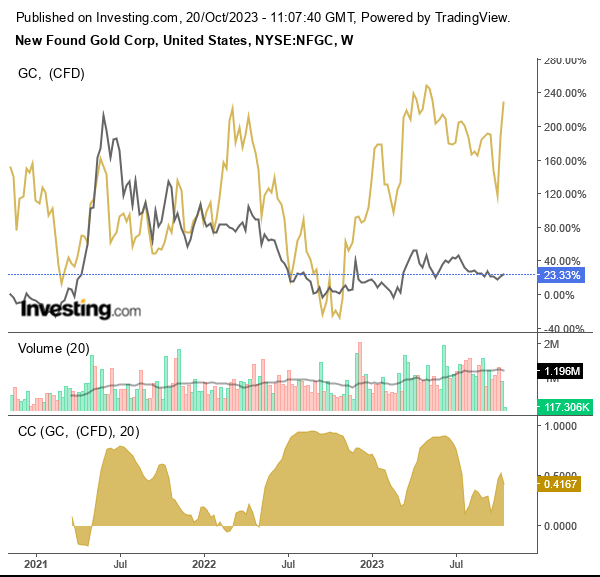

As the following chart shows, NFGC and the price of gold, which is represented in the chart by gold futures, are positively correlated and the relationship is also quite strong.

Source: Investing.com

The correlation is positive because the yellow area that appears in the lower part of the chart is almost always above zero and very often close to the upper limit of the -1+1 range of the indicator. Therefore, in addition to being positive, the correlation between NFGC and gold futures is also a very strong one.

This analysis also estimated how much NFGC’s share price could grow on average if gold were to experience new bullish sentiment.

For this purpose, the last 52 weekly returns of an investment in NFGC are placed in a linear relationship with the last 52 weekly returns of an investment in gold futures, with the former price changes being the output and the latter price changes being the input. The model, which has an acceptable coefficient of determination of R^2 of 25%, yielded a beta coefficient of 2.1x.

While the R^2 of 25% means that gold accounts for a significant portion of the change in NFGC’s share price, the beta gold coefficient of 2.1x means that a rising gold price has, on average, more than doubled the growth in NFGC’s share price.

Gold Price Predictions: The Upside Catalyst Could Be a Recession

In the foreseeable future, Trading Economics analysts expect the price of physical gold on the London bullion market to reach $2,023.71 in 12 months, reflecting an increase from the current level of $1,980. This means that the price of gold futures and US-listed gold mining stocks or gold exploration stocks like NFGC are also likely to rise.

Due to the strong positive correlation and beta coefficient, NFGC shares are expected to reinforce the expected bullish trend in gold prices and the share price could potentially reach significantly higher levels than current levels.

This time, the trigger for the sharp rise in gold prices could be the looming economic recession where modest consumption and investment could result, as rising financing costs along with stubborn core inflation continue to bite into US household balance sheets and corporate profit margins. Recession fears will reignite interest in the yellow metal’s safe-haven properties amid possible negative consequences of the significant deterioration in the economic cycle.

Some economists have long been predicting a recession in the US economy and these include Michael Pearce, the leading US economist at Oxford Economics, who predicted this in his research note on Thursday, September 26, 2023, Chryssa Halley, the CFO of the US Federal National Mortgage Association ( Fannie Mae), who expects the recession in a few months, and David Rosenberg, economist David Rosenberg of Rosenberg Research, who assigns the sharp slowdown a high probability of occurrence.

US private consumption, which accounts for nearly 70% of US GDP, is at risk not only because of high borrowing costs, restrictive credit conditions coupled with high core inflation. Now, the mainstay of the American economy is also under incredible pressure from a record $1 trillion in outstanding credit card debt with stellar interest rates and more than $1.7 trillion in federal student loan debt. In addition, the excess savings accumulated during the Covid-19 pandemic thanks to US government subsidies have almost completely dried up. Consumption is likely to remain sufficiently robust for some time perhaps up to and including the holiday shopping season in December as the labor market remains buoyant, but it is undeniable that the personal propensity to save money, which is at its lowest level since the beginning of the year, is objectively a wake-up call to the current mood of American consumers.

More expensive and difficult access to credit, as well as higher core inflation, are weighing not only on the consumer outlook – US consumer confidence is now below the recession threshold – but also on corporate investments, impacting companies’ growth projects. When it comes to sluggish corporate investing, this analysis provides some very telling examples drawn from the current earnings season. For example, giants like General Motors (GM), Tesla (TSLA), and Morgan Stanley (MS) are all struggling with prospects that have suddenly become very uncertain. In fact, for capital investment optimization reasons, GM must postpone its electric vehicle production plan to convert its Orion assembly plant to electric truck production until the end of 2025. Tesla is slowing down the planned construction of an electric car factory in Mexico as the owner fears continued high interest rates will continue to impact demand for electric cars and thus his company’s margins. Morgan Stanley shares (6.4% down over the past 5 days) are currently bearing the brunt of a gloomy outlook for its margin prospects as revenues from investment banking (M&A and IPO) and trading activities lag behind the expectations of the US bank giant in terms of demand for its products as investors currently view investment risk as too high.

The likelihood of an economic recession has increased lately as the Fed Chair hinted at high interest rates for longer on Thursday, October 19, 2023. To be fair, he didn’t even rule out the possibility of further interest rate rises as the economy proves more resilient than initially expected.

There are therefore still downside risks for consumption and investments.

The Stock Valuation

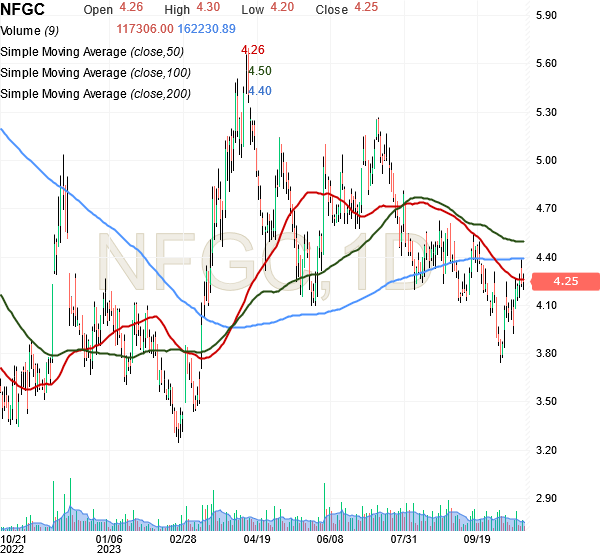

After the Fed’s rate hike by 25 basis points to a range of 5.25% to 5.50% at its meeting on July 26, 2023, and the prospects of “higher rates for longer”, which as seen does not bode well for the gold price, NFGC shares fell significantly from $5.30 apiece in late June 2023 and are currently trading around $4.25 apiece.

Source: Investing.com

Now it appears that shares are forming attractive entry points to position ahead of the forecast bull market for gold prices, as shares are trading roughly in line with the 50-day simple moving average of $4.26 but below the 100-day simple moving average of $4.50, and also below the 200-day simple moving average of $4.40.

Shares are also below the $4.475 midpoint in the 52-week range of $3.25 to $5.70. Thus, shares are objectively trading low compared to past performance.

The stock can also be compared to its most direct competitors, but since it is a gold explorer and not a gold supplier, its sales are meaningless and the company generates no profit, so metrics like EV/EBITDA or EV/Sales cannot be used.

However, the company needs cash and various other assets to conduct exploration activities on the properties in Canada, and these are as valuable as the mineral claims that will one day produce ounces of gold.

With respect to NFGC’s mineral properties, the Queensway Gold Project near Gander, Newfoundland is wholly owned by the company and is dependent on the success of exploration activities and gold price volatility.

It must be said that there is a historical resource estimate, derived primarily from drilling conducted after 1994. It appears that past drilling was concentrated in the southwestern part of the Queensway North mineral district. However, New Found Gold Corp does not consider these historical resource data to be an estimate of current resources as it appears that they do not meet the Canadian Institute of Mining, Metallurgy, and Petroleum standards for mineral resources and reserves. Because these historic resources have not been verified by a qualified professional and are not considered to be the mineral resources that currently could be located in Queensway North, the Canadian gold explorer is still required to undertake activities aimed at evaluating the mineral resources at the Queensway Gold Project.

However, the most recent quarterly balance sheet shows that NFGC has total assets of $54.7 million, which, net of liabilities of $10.9 million, gives it a book value of $43.8 million, or $0.24 per share because the stock consists of 182.3 million outstanding shares.

With a price-to-book ratio of 17.71x, NFGC is too far off the industry average of 1.56x, which at first glance might give the impression that the stock is overvalued, but that is not the case. To provide a better indication, this analysis compares NFGC with its closest competitors as follows. These competitors are also primarily gold prospectors, and their shares are traded on the same US stock exchange of the NYSE American Exchange. Additionally, they have a similar book value per share but have a much lower market valuation for the share on the NYSE American, thus more in line than NFGC with the sector’s median price-to-book ratio. But that still doesn’t make NFGC overrated.

Since more than 85% of NFGC’s total assets are in cash, which is now more valuable than ever in the market due to interest rates at the highest levels since the 2007/2008 financial crisis, a comparison between these companies would be more reliable if based on the price-cash ratio.

Whereby NFGC has a price/cash ratio of 16.9x versus TRX Gold Corporation (TRX)’s price/cash ratio of 14x, versus THM International Tower Hill Mines Ltd. (THM)’s price/cash ratio of 42.5x versus Northern Dynasty Minerals Ltd. (NAK)’s price/cash ratio of 32.5x.

Therefore, NFGC is not overvalued relative to its peers and in most cases appears to be better positioned relative to the mineral deposits as well.

TRX Gold Corporation has gold mineral projects in Tanzania, which has been classified as a high-risk country in the Sprott Mining Risk Heat Map 2023 based on the analysis of various factors such as investment, political stability, terrorist threats, ease of logistics, transportation, transparency, etc…

Instead, NFGC operates in Canada, which means minimal risk.

THM instead has mineral interests in Alaska and Nevada, which presents low investment risk but is losing the battle against NFGC based on price-to-cash fundamentals.

The same goes for the comparison with NAK, and here too the price/cash ratio plays in NFGC’s favor, while the company’s assets include exploration activities in North America and mineral resources that are still in an inferred stage of development.

Instead, NFGC’s flagship project of Queensway is located in the Canadian province of Newfoundland, 15 km west of the city of Gander. The 1,662 km² area where exploration activities take place extends north and south of Gander Lake and is therefore divided into Queensway North and Queensway South.

The area is well served by various infrastructures and communication routes including the Trans-Canada Highway and a facility for the production of electricity from renewable sources.

It is the possibility of exploiting a deposit that has mineralogical characteristics of a high concentration of precious metals in an ore unit, and with open pit mining techniques that should result in lower extraction costs compared to an underground deposit.

The two properties are therefore cut by two fault zones, called the Appleton fault and the JBP fault, along which additional significant precious metal deposits are discovered and which the company intends to further explore and evaluate with systematic drill testing over time.

The stock has significant growth potential as the current ongoing activity is primarily aimed at determining whether all high-grade discoveries can form the same gold system, which could act as an amazing catalyst for price increases as soon as there are updates on upcoming exploration and testing activities.

With the fault zone open to further expansion, both along strike and at depth, subsequent activity at JBP should provide good opportunities for positive price appreciation, potentially with any update from the field.

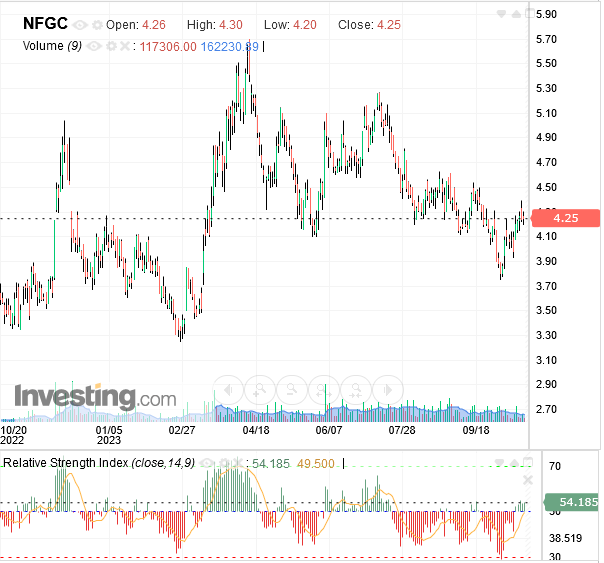

Given this outlook, NFGC stock could become even cheaper than current levels as the stock faces negative pressure from the Fed’s continued tight monetary policy, and the 14-day RSI of 54.185 actually suggests scope for a downtrend.

Source: Investing.com

A lower share price is possible in the current macroeconomic situation and would allow for much better positioning for the expected increase in the price of gold should an economic recession occur.

Please note that the trading volumes are not high: Avg Vol (3 months) of 240,837 indicates Seeking Alpha, so it may be difficult to soften the position or exit a position when necessary if the position is too thick.

Conclusion

New Found Gold Corp. shares are given a “Buy” rating, but this is not expected to be implemented soon as shares could become cheaper on growth prospects under the Fed’s interest rate policy of “higher for longer.”

Since the share price could move lower in a high-yield environment, and there is actually room to do so, investors may want to wait a little longer before diving into the stock.

The strong growth prospects are influenced by the stock’s strong positive correlation with gold futures and expectations of a bull market for the gold price. The yellow metal will be in high demand due to its safe haven properties against the economic recession that seems threatening due to the current macroeconomic situation.

The company owns the Queensway Gold Project in the Canadian province of Newfoundland, which appears to provide numerous opportunities for positive share price momentum through the results from exploration and testing activities.

Read the full article here