Enterprise Products Partners (NYSE:EPD) is my top pick in the midstream sector. The entire sector typically garners its fair share of investor love, K-1 tax form or not, due to the high distribution yields. But where EPD stands out is in its history of strong execution, which is evidenced by both the long distribution growth history, as well as its low leverage ratio. Despite already having best-in-class credit metrics, EPD has been allowing its leverage ratio to drop further, a move that may sacrifice on maximizing cash flow growth but in my opinion is the clearest path to unitholder upside. The market is pricing EPD at an elevated distribution yield in spite of the dominant market positioning, stellar stewardship, and conservative balance sheet. I reiterate my strong buy rating.

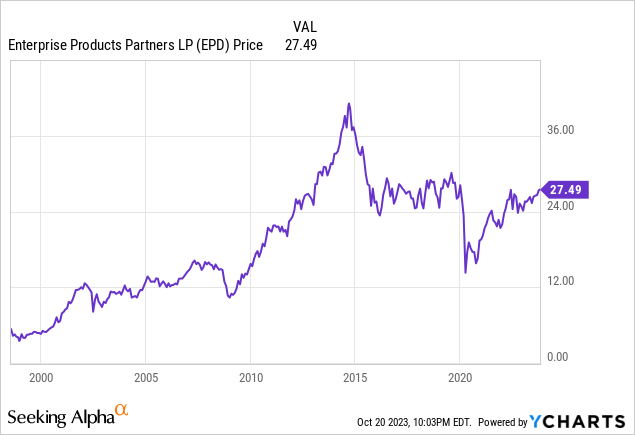

EPD Stock Price

EPD is trading well above pandemic lows but has gone nowhere over the past decade. That underperformance has created an attractive opportunity, as typically these high yield plays aren’t priced attractively enough relative to the broader market.

I last covered EPD in July where I named it my top pick in energy on account of the accelerating distribution growth. The stock has barely budged since then, but I am in no hurry as I look forward to reinvesting my distributions at these bargain-basement prices.

EPD Stock Key Metrics

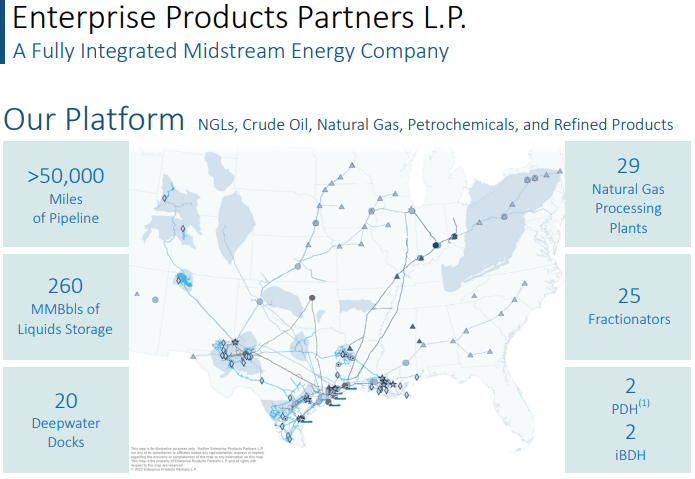

EPD is one of the largest midstream energy companies in North America, meaning it owns a comprehensive pipeline system to help transport and store commodities across the continent.

2023 Investor Update

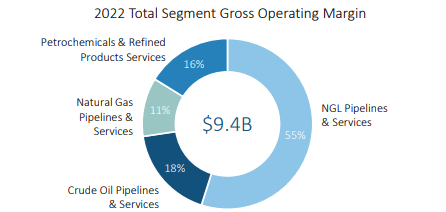

EPD is largely focused on NGLs and natural gas, with these making up 55% and 11% of total segment gross operating margin in 2022, respectively.

2023 Investor Update

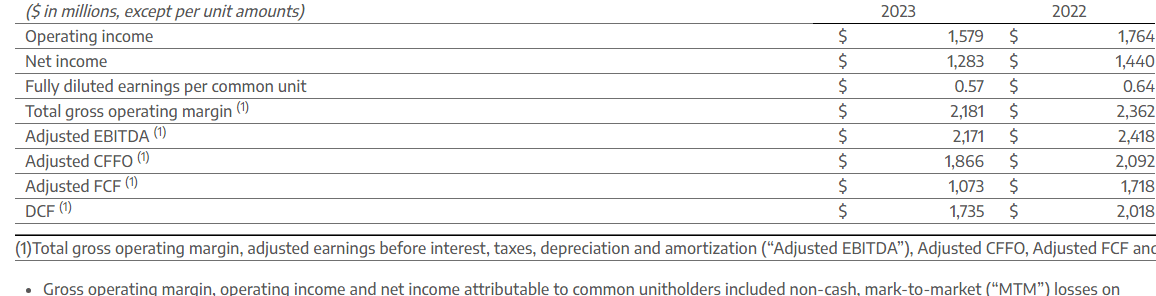

In the most recent quarter, EPD missed revenue estimates by $1.7 billion but its bottom-line numbers were much more resilient due to the company generating most of its cash flows from fee-based contracts. Even so, EPD still saw distributable cash flow (‘DCF’) decline 14% YOY to $1.7 billion.

2023 Q2 Press Release

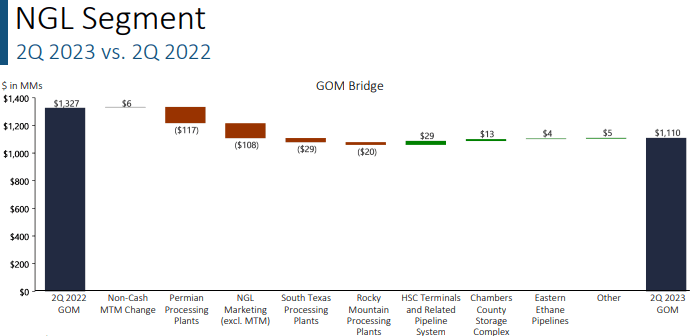

I should note that DCF was $1.6 billion and $1.76 billion in the 2nd quarter of 2020 and 2019 – this latest quarter’s DCF is thus still quite a solid result. The bulk of the weakness came from the NGL segment which saw a $217 million decline in gross operating margin.

2023 Q2 Slides

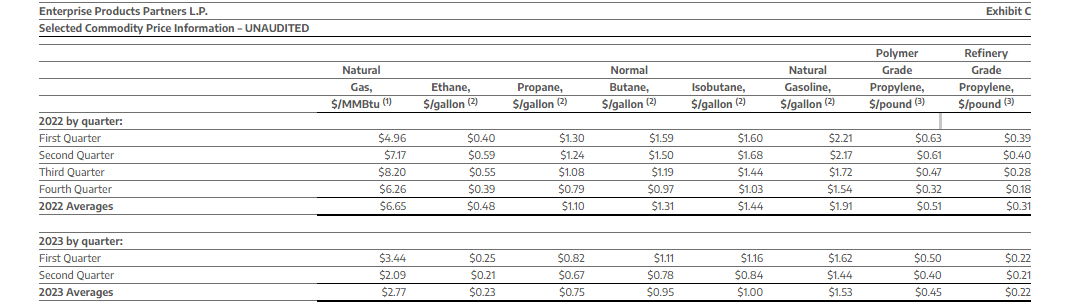

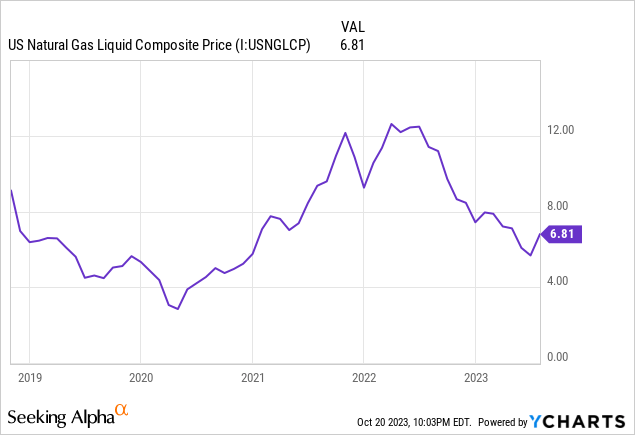

That result came in even as the company set 6 operational records in terms of pipeline volumes. The key problem was that prices for NGLs collapsed in the quarter.

2023 Q2 Press Release

I do not mean to sound any alarms though, as NGLs prices remain just around pre-pandemic levels – they had merely given up the post-pandemic gains.

On the conference call, management noted that they had already reached the fee floors for most of their contracts, meaning that moving forward we should see some stability even if commodity prices remain weak.

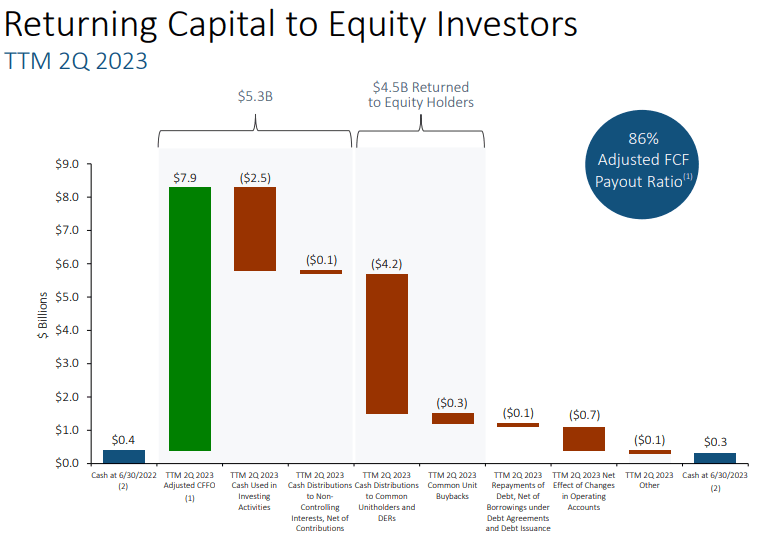

Over the last 12 months, EPD has been able to distribute $4.2 billion in distributions, repurchase $300 million in stock and pay down $100 million in debt, all while funding ambitious growth CapEx plans.

2023 Q2 Slides

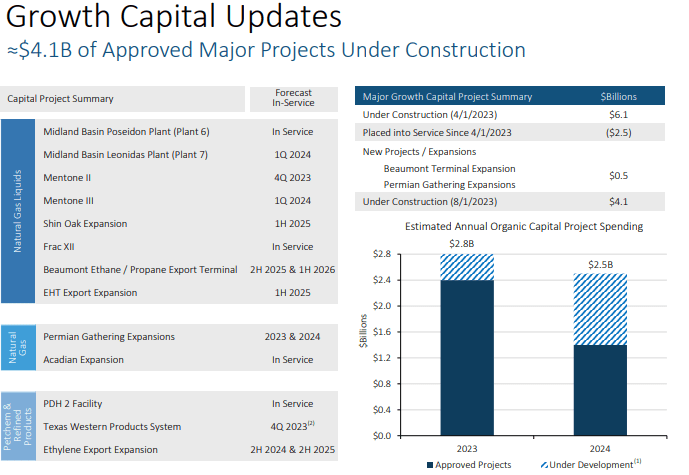

Management now expects to spend $2.8 billion in growth CapEx this year and $2.5 billion in the following year. Based on trends over the last several quarters, I wouldn’t be surprised if 2024 eventually sees growth CapEx matching or even exceeding this year’s number.

2023 Q2 Slides

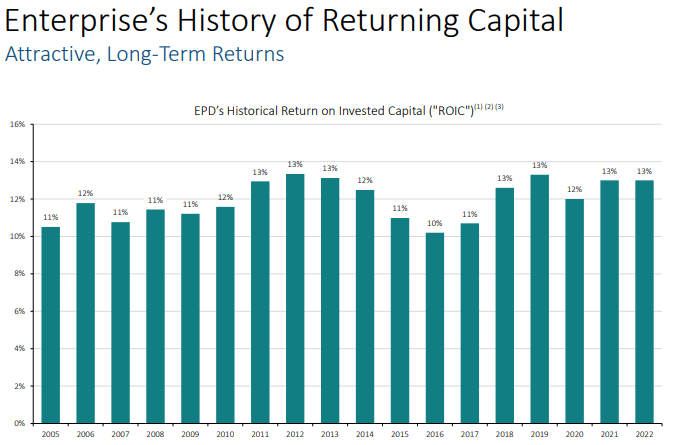

That may disappoint some investors given widespread hope for greater retained cash that can be put towards unit repurchases, but EPD is not built like other midstream names. Whereas many names in the sector have spotty records on execution, EPD has a long history of generating strong returns from their growth projects, as evidenced by their high ROIC.

2023 Q2 Slides

That strong execution is also evidenced by their best-in-class balance sheet, with leverage standing at around 3x debt to EBITDA, squarely within their target of 2.75x to 3.25x debt to EBITDA. Many names with higher leverage ratios try to explain the high leverage as being intentional, but in my view it instead reflects lower than expected ROI on past projects and acquisitions. It is also worth noting that 97% of their debt was fixed rate and the weighted average cost of debt stood at 4.6%. Management’s commitment to reducing leverage may help insulate the company from interest rate headwinds, something many other yield plays are facing.

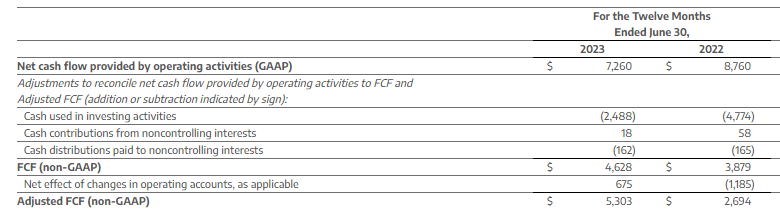

I note that while the headline free cash flow number declined YOY in this past quarter, but over the past 12 months FCF remained very strong at $5.3 billion.

2023 Q2 Press Release

Compare that with the $4.3 billion in distributions and the remaining cash (this already accounts for CapEx) can be used for unit buybacks and debt paydown.

Looking ahead, management expects processing margins to move higher after bottoming this past quarter. Management fielded many questions regarding how they intend to use the excess cash. Management hinted at increasing buybacks but seemed to be mostly constructive towards accelerating the distribution growth rate. The company’s latest distribution of $0.50 per unit represented a roughly 5% increase YOY, in-line with the pace prior to the slowdown of recent years. Given that the distribution growth rate had slowed down primarily due to the company wishing to achieve a self-sustaining cash flow model, I see no reason why the company would not maintain this 5% growth rate moving forward as that milestone has been long achieved.

Some analysts asked about whether management intends to eventually bring on additional leverage to increase their firepower. Management seemed hesitant (a positive in my view) as they cited wanting the flexibility to “be in a good position to execute” when opportunities come along. That said, management appeared to talk down their appetite for M&A, reiterating that they have strict acquisition criteria as they do not merely seeking to build “a collection of assets.” Surprisingly, that kind of rhetoric is not the norm in a historically M&A fueled midstream sector.

Is EPD Stock a Buy, Sell, or Hold?

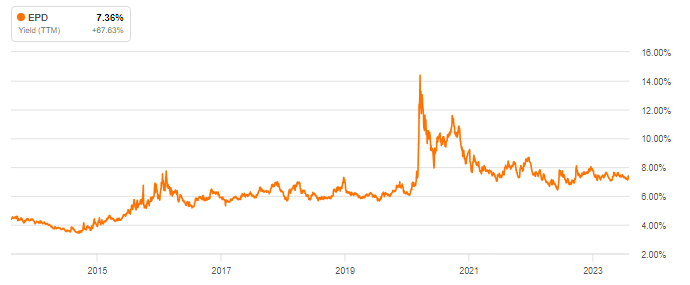

At recent prices, EPD continued to trade at a distribution yield just shy of 8%, which is among the highest over the past decade (excluding the pandemic lows).

Seeking Alpha

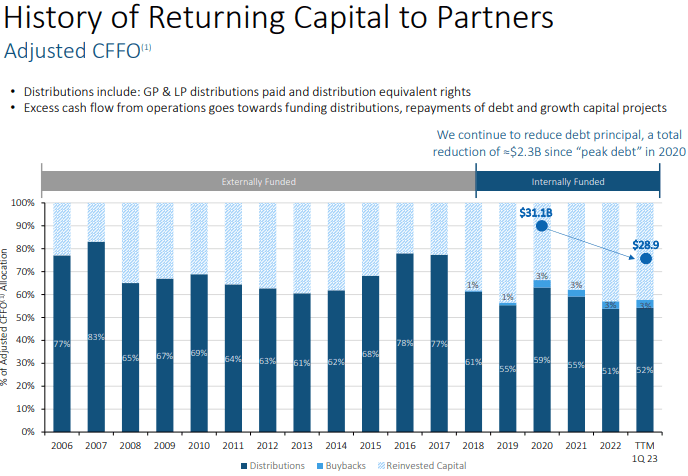

While the high yield is in part explainable due to the cyclical nature of the energy sector, I note that EPD appears to be experiencing a sort of “K-1 discount” as c-corp midstream peers like Williams Companies (WMB), Kinder Morgan (KMI), and even Enbridge (ENB) trade at premium valuations in spite of having higher leverage and (in my opinion) less exemplary management teams. EPD has been able to internally fund growth CapEx since 2018, all while reducing its debt principal since the peak of $31.1 billion in 2020.

2023 Q2 Slides

What’s more, I could make the argument that the K-1 tax form is actually deserving of a valuation premium due to the tax deferred treatment of the units in a taxable account, but I won’t belabor that point.

At the very least, we have a unique situation with EPD in that this is a name which may be able to grow the 7.3% yield at a 5% clip over the next decade, yet continue to trade at a depressed valuation (due to the K-1 tax form) and enable investors to reinvest distributions at the high yield. It isn’t every day that you are essentially “forced” into investing in a holding at double-digit returns, that forced discipline might be something that some investors welcome. Even so, I expect EPD to eventually trade up to a 6% yield with the main catalyst being execution on the 5% distribution growth and leverage continuing to go down lower.

What are the key risks? While EPD is more insulated from commodities pricing than typical energy companies, if the commodities market underwent a sustained downswing, then EPD’s counterparties may have trouble fulfilling their end of the contracts or renew at less favorable terms. Such a result seems unlikely given EPD’s heavy exposure to NGLs and natural gas (as crude oil seems most at risk) but anything is possible. Limited partners do not have the same voting rights as shareholders in corporations, meaning that there is the possibility of poor management governance. This risk seems unlikely as well, given that insiders own over 30% of units outstanding. Perhaps a potential risk is that of a “take under,” which might occur if EPD were to plunge to very low levels for a sustained period of time and Randa Duncan Williams decided to make an offer for the entire company. Current unitholders would find themselves underwater (at least relative to today’s prices) and might not appreciate such a result. I emphasize that due to the K-1 tax form (and also the energy sector), EPD might not deliver as much upside as other undervalued yield plays, as it might not be so trivial to spark multiple expansion here. That might not be negative for investors looking for long term growth in distribution income, but those hoping for a quick “bump” may be disappointed.

I reiterate my strong buy rating for the stock as the conservative balance sheet and exemplary management stewardship are not properly reflected in the valuation.

Read the full article here