Investment Thesis: I take the view that Volvo Group has the capacity to see further upside from here, based on a favourable P/E ratio and strong performance in terms of higher net sales and a lower COGS ratio.

In a previous article back in July, I made the argument that AB Volvo (OTCPK:VLVLY) could continue to see upside from here, on the basis of a decrease in the cost of goods sold ratio as well as continued growth in deliveries across the Trucks segment.

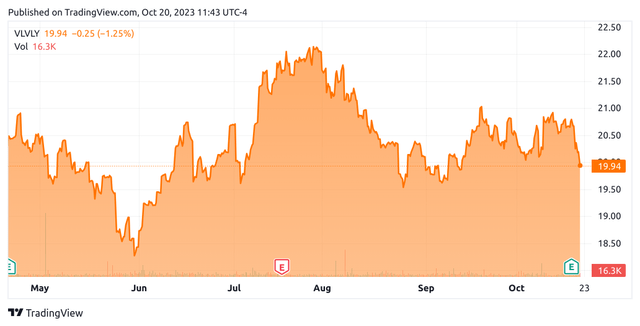

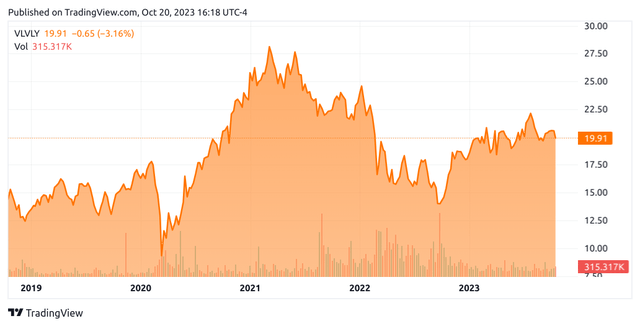

Since then, the stock has descended to a price of $19.94 at the time of writing:

TradingView

The purpose of this article is to assess whether Volvo Group has the ability to see continued growth from here taking recent performance into consideration.

Performance

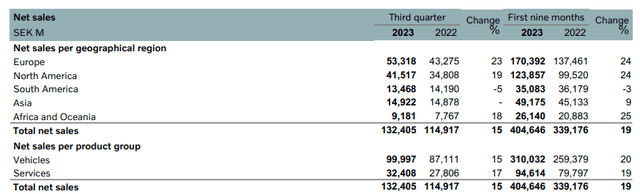

When looking at the most recent earnings results for Volvo Group, we can see that total net sales were up by 19% for the first nine months of 2023 as compared to that of the previous year. The vehicles group accounts for the majority of net sales and saw a 20% increase over this period.

Volvo Group: Report on the third quarter 2023

In addition, it is also encouraging that Europe – the largest geographical region by net sales – saw a 24% increase over the first nine months of this year as compared to last, with that of North America also up by 24%.

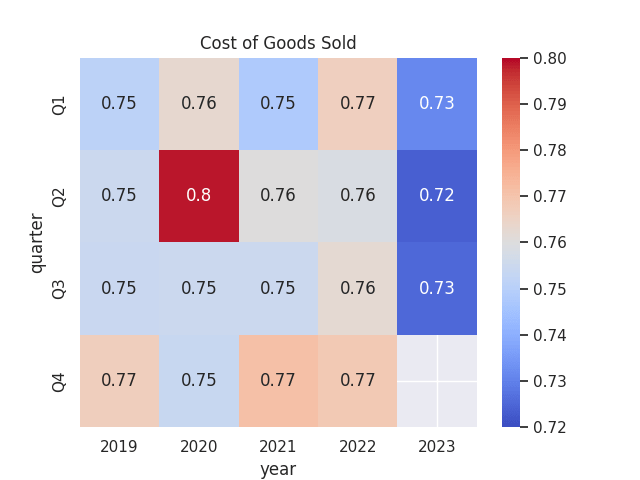

I had previously remarked that one metric Volvo Group had been performing notably well in has been the cost of goods sold ratio (calculated as cost of sales/net sales per quarter). Particularly, we can see that cost of goods sold for Q3 has continued to remain lower than that seen in the previous year – and has been so for all three quarters in 2023.

Cost of goods sold ratio calculated by author using quarterly sales and cost of sales figures sourced from historical Volvo quarterly reports. Heatmap generated by author using Python’s seaborn library.

The reason I chose to pay attention to this metric was that I had cited upward pressure on production costs as a potential risk for Volvo Group – which had the potential to hinder profitability in spite of a rebound in truck demand.

However, this risk does not appear to have materialised to date – and the cost to goods sold ratio remains lower in 2023 as compared to that of last year – and at the lowest levels seen in the past five years.

With regards to short-term liquidity, we can see that the quick ratio of Volvo Group (calculated as total current assets less inventories all over total equity and liabilities less total equity) has remained steady and has seen a slight increase from that of the last quarter. Figures provided pertain to that of the Industrial Operations segment.

| Dec 2022 | Mar 2023 | Jun 2023 | Sep 2023 | |

| Total current assets | 235840 | 244626 | 243555 | 240872 |

| Inventories | 75382 | 84503 | 92939 | 92695 |

| Total equity and liabilities | 431771 | 443505 | 449814 | 441624 |

| Total equity | 147439 | 158951 | 144134 | 155837 |

| Quick ratio | 0.56 | 0.56 | 0.49 | 0.52 |

Source: Figures sourced from Volvo Group: Reports for the first and second quarters of 2023. Quick ratio calculated by author.

While a quick ratio below 1 can ordinarily be a cause for concern (as it indicates that a company does not possess sufficient liquid assets to meet its current liabilities) – I take the view that given the capital intensive nature of Volvo’s industry as well as the fact that the cost of goods sold ratio has been falling, investors may be willing to overlook a low quick ratio if we continue to see an increase in net sales and a decrease in COGS.

My Perspective

As regards my take on the above results and the implications for the growth trajectory of the stock going forward, we have seen that while net sales and the COGS ratio has been showing improvement – this has not been reflected in the stock price.

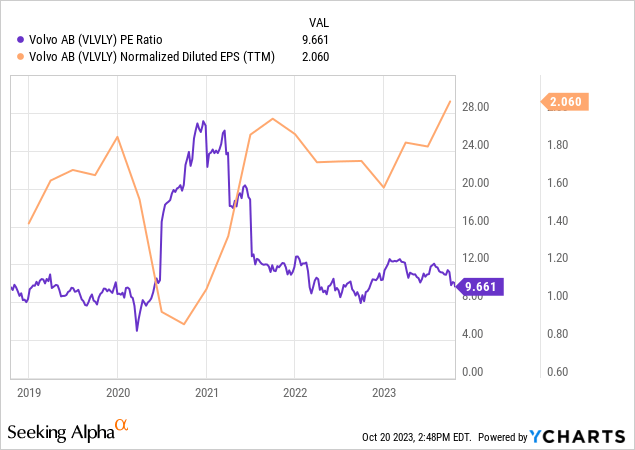

When looking at the five-year earnings trajectory for Volvo Group, we can see that the P/E ratio has descended back towards levels seen pre-2020, while earnings per share has continued to see new highs over the period:

YCharts

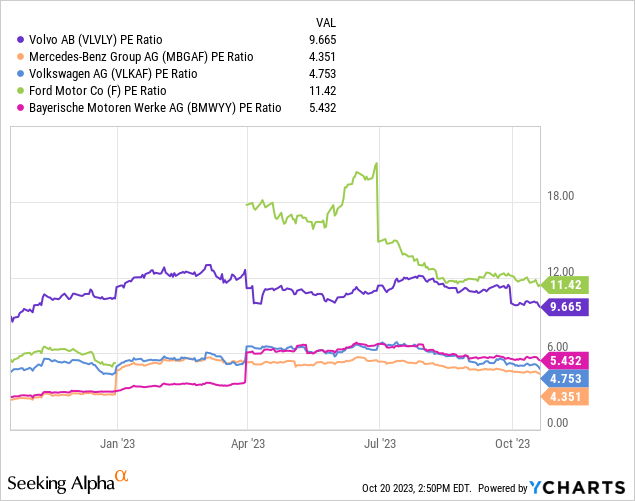

That said, we can see that as compared to its peers – Volvo shows the second-highest P/E ratio second to that of Ford Motor Company (F), while Bayerische Motoren Werke (OTCPK:BMWYY), Volkswagen AG (OTCPK:VLKAF) and Mercedes-Benz Group (OTCPK:MBGAF) all trade at lower P/E ratios.

YCharts

It is possible that this might be a contributory reason to the lack of growth in stock price for Volvo Group – investors may have the impression that the stock is trading at less attractive value than its competitors.

However, I do not see this as being the case and take the view that Volvo Group has room for upside should we see continued earnings growth. Specifically, I take the view that Volvo has the capacity to see a rebound in upside to the $25 mark – which the stock last reached in 2021 – earnings per share have since gone substantially higher since then.

TradingView

Additionally, the fact that we continue to see growth in operating margin across the Trucks segment highlights the continuing profitability growth across this vehicle group:

Volvo Group: Report on the third quarter 2023

On this basis, I take the view that Volvo Group has the capacity to see further upside from here.

Risks

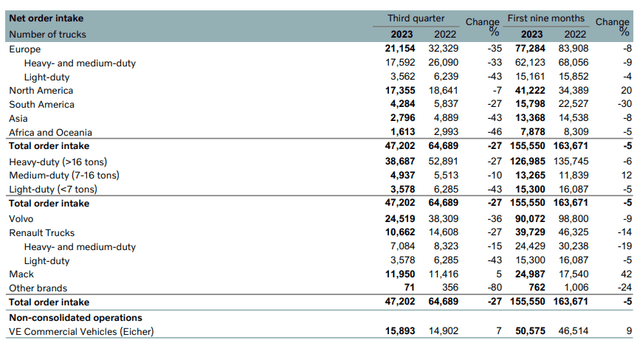

In terms of the potential risks to Volvo Group at this time, the main one in my view is the potential for sales growth to plateau as truck demand starts to normalize once again.

For instance, we can see that total order intake is down by 27% on that of the same quarter last year, and down by 5% as compared to the first nine months of last year.

Volvo Group: Report on the third quarter 2023

Volvo is expecting lower market levels for next year, but do not anticipate that deliveries will be particularly affected as the incidences of supply disturbances have been lessening.

With that being said, the truck market is showing signs of cooling globally – with companies such as General Motors (GM) delaying EV truck production for a year as a result of lower demand for electric pickup trucks.

Conclusion

To conclude, Volvo Group has seen encouraging sales growth and a lower COGS ratio. In spite of potential pressure on truck demand heading into next year, I take the view that Volvo Group has the potential to continue performing strongly and still take a bullish view on the stock.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here