After almost 3 years of full lockdown, Macao’s casinos finally opened in full in 2023. Their economy is mostly founded on tourism and in particular gambling tourism. Macao is known for its casinos and can be considered the Las Vegas of Asia. Studio City International Holdings (NYSE:MSC) owns and operates one of the largest casinos in Macao, with more than 250 tables, and a resort, with more than 1,600 luxury hotel rooms. Of course, they will be a main and direct beneficiary of this reopening and the (strong) comeback of tourism in 2023 and beyond. We believe there is an opportunity under certain conditions and assumptions, but we also need to be conservative considering the high debt load that weighs on the company.

The business and the lockdown years

As everyone knows, Covid did no good to the leisure industry. Macao in particular adopted a very strong lockdown policy for much longer than many other countries, in a policy alignment with China. Studio City International suffered a lot as it lost nearly all its revenues, while costs were still there to be paid. We need to look at how this affected the company and its balance sheet to understand the implications for future growth and valuation.

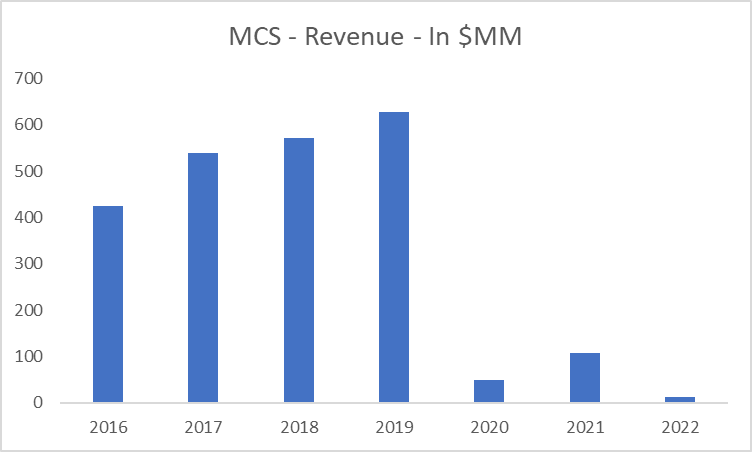

Revenue (Seeking Alpha)

These are revenues during the last 8 years. After a small pickup in 2021, the lockdowns came back in 2022 with a harsher-than-expected China policy on Covid. This forced MSC to continue to use debt to finance the increasing cash burn. Since 2019, net debt increased by around $1 billion, and this of course translates into much higher interest expense.

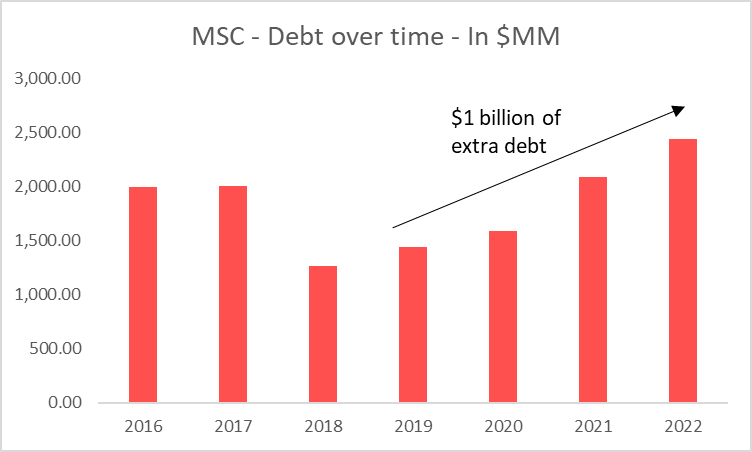

Debt (Seeking Alpha)

The relatively good news is that the debt structure is very clean and simple. Plus the company was wise enough to issue much debt at fixed interest in 2021, while interest rates were very low.

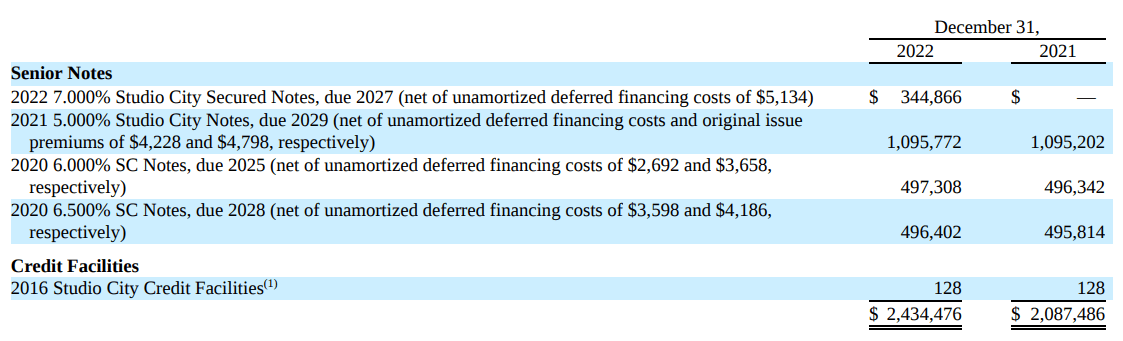

Debt Structure (Latest earnings filing)

And indeed we see that 2021 5% notes of more than $1 billion make up around 40% of the total debt outstanding. The company relies very little on expensive revolvers or other forms of short-term debt. This takes away a lot of uncertainty over interest payments, and makes everyone’s job much easier. The average cost of debt is then in the 5-6.5% range, which makes it also relatively cheap to finance close to $3 billion of high-risk assets like casinos and resorts.

The way forward: forecasting the future of MSC

We believe that in the current valuation of MSC there are several assumptions embedded. First of all, the market expects higher revenues compared to the pre-Covid period. Since tourist numbers are not expected to explode compared to 2019, this means that the gains must come from pricing power. Studio City must show its ability to align the prices to the inflationary wave that we experienced in the last 2 years, and it must thus pass on the increased costs.

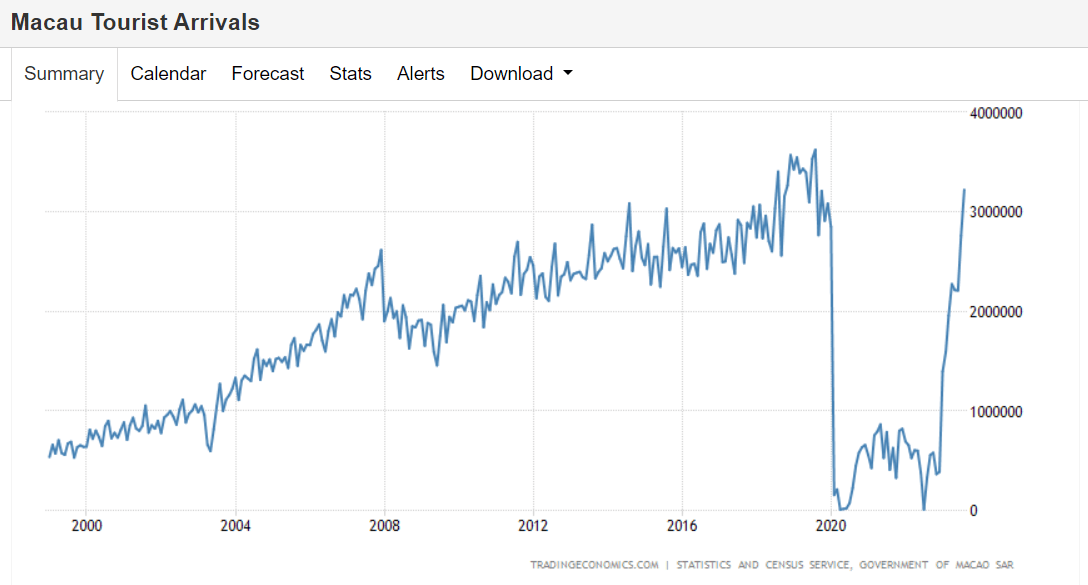

On the other hand, the very rapid comeback in touristic activity is a big help in restoring confidence in the stock.

Macao Tourist Statistics (Tradingeconomics.com)

This shows the tourist arrivals over the last 25 years. After a huge decline and depression in the 2020-2022 period, 2023 started as the best year since 2019. This will definitely be reflected in the year-end’s results.

However, we remain focused on margins. To justify the new $3 billion valuation (EV), MSC will need at least $300 million of EBITDA to remain in line with the industry’s average multiples. For the last 6 months ended June 30, 2023, the company only reported around $30 million of EBITDA, well far away from that target.

On the cash flow side, there is also much work to do. Changes in WC contributed to some pressure on cash from operations, which are still negative by some $30 million. This is on top of almost $70 million of Capex for the six months ended in June.

But we believe the market is right in expecting much higher margins and revenues, and we will try to forecast these into the next years. Our assumptions for the model are the following:

-

Revenue growth starting at 20% and decreasing gradually to 4% from 2024 and beyond following an estimation based on around $650 million of revenues for FY2023 (estimated by annualizing the six-month results).

-

EBITDA margin slowly expand in the next 3 years from 14% in 2023 to a normalized rate of 48% from 2025 and beyond. This is based on pre-Covid historical margins in the 50% range, plus accounting for the cost of larger scale.

-

Capex is estimated to be a cumulative 18% of revenues for the next years, at approximately $180-200 million per year. This is somewhat of an average considering that capex spending is cyclical.

-

WACC of around 9% given that debt is very cheap, so it is mostly impacted by the high cost of equity which however only affects ⅓ of the total capital structure.

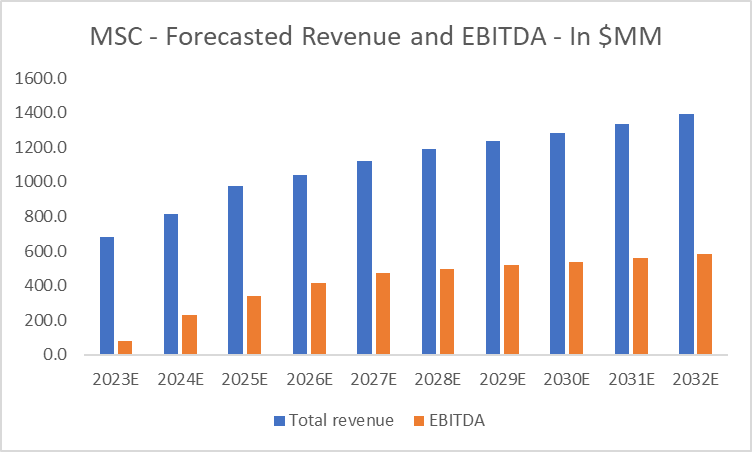

Forecasted Financials (Author’s DCF Model)

This is the outcome of our forecasting of revenues and EBITDA for the next 10 years. EBITDA margin gains will be slow to pick up as the company is also facing scaling up costs as it adjusts for higher structural demand. However, we believe that the pre-Covid margins of around 50-55% are signaling that there is a huge room for expansion even at much higher revenue levels.

Our results conclude that fair EV should be around $4 billion, which is roughly $1 billion more than the current valuation. This misprice greatly benefits shareholders, who stand to benefit from a fair value per share of around $10.6, offering an upside potential of 100%.

Risks: why something can still go wrong

We highlighted some concerns at the beginning of the article around the higher debt loans than before the pandemic. The company needed that additional $1 billion of liquidity to make it through 3 years of virtually zero revenues. This debt is also relatively close to refinancing, with two notes expiring in 2025 and 2027 for a total of $850 million to refinance. We do not know the level of the interest rates so far into the future, but we need to be ready to estimate that they could be much higher. This would take away value from the shareholders in terms of interest expense.

On top of this, we also need to be aware of two major risks: (1) political risks associated with China, and (2) the intrinsic cyclic nature of their business. If China were to continue to impose restrictions on Macao to follow a political agenda of cuts to leisure or other reasons, MSC would greatly lose potential. Plus there is the possibility of a recession both in Asia or the US, which would negatively impact the company given its high dependence on tourism and consumer spending.

Conclusion

MSC is sitting in a unique position to be one of the main beneficiaries of the strong reopening of Macao as a key international touristic destination. The company survived 3 years of zero revenues and is now ready to go back and beyond the pre-Covid revenue and EBITDA levels.

We believe that while some concerns exist around debt and demand risks, the future should look bright for MSC, with a suggested upside potential of around 100% from the current price.

Read the full article here