A Barbell Maturity Structure Can Capture High Front- and Back-End Yields

Historical and current analyses do not guarantee future results. For illustrative purposes only. *Hypothetical portfolio based on Bloomberg Municipal Indices. Barbell is 40% weighted in one- and three-year indices and 60% in 15- and 20-year indices. Concentrated holds 100% in the 10-Year Municipal Index. Ladder comprises equal weights of 12.5% in the one-year through 22-year municipal indices. As of September 30, 2023 (Source: Bloomberg, Municipal Market Data and AllianceBernstein)

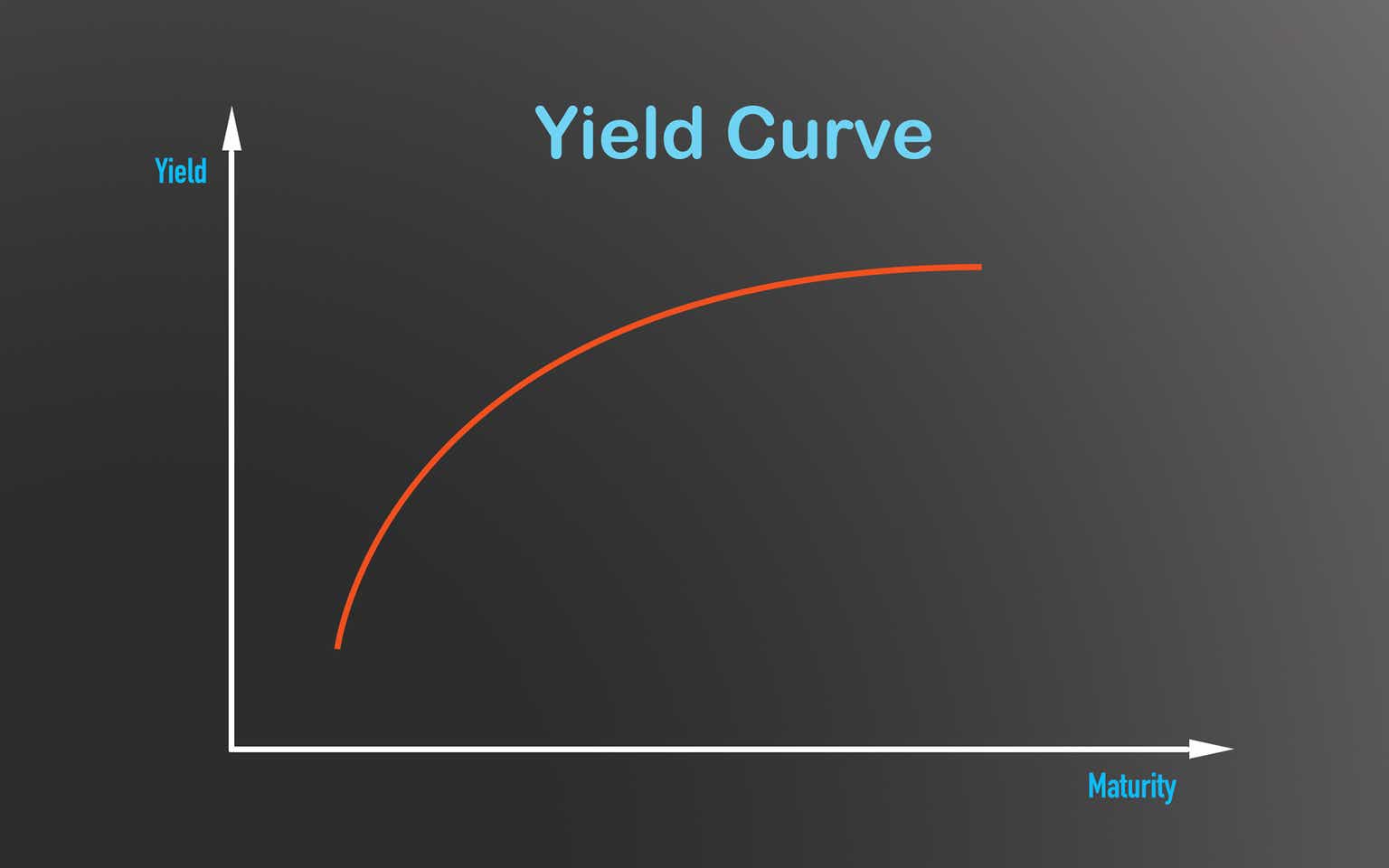

The muni yield curve has been inverted before, but not for any meaningful length of time – until now. With yields on short-term muni bonds still significantly higher than those on intermediate-term munis, what’s an investor to do?

In this environment, it’s possible not only to potentially increase yield, but provide higher return potential by investing along the short and long ends of the yield curve.

Known as a barbell maturity structure, this approach selectively invests in short- and longer-term muni bonds, while minimizing exposure to the middle of the curve.

So far this year, a barbell has cushioned muni losses more than concentrated and ladder structures have, while providing a higher yield—and with the same average duration!

Since bond prices rise when rates fall, total return potential also improves when the yield curve shifts back to normal and yields for short munis fall relative to other bonds, while intermediates rise, and long bonds fall or remain flat.

Of course, conditions may change, making a different maturity structure more attractive down the road. Municipal bond investors should remain flexible to take advantage of changing opportunities in a shifting landscape.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams. Views are subject to revision over time.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here