In January, I rated Energizer Holdings (NYSE:ENR) a hold and remarked that it was okay to take profits. I followed my advice and was partially successful in selling my holdings. I sold part of my holding outright and tried to sell the rest using a covered call strategy. Unfortunately, the stock’s momentum faded as its revenues came under pressure due to volume declines; its stretched balance sheet and small-cap status did not help its cause. The calls never got assigned after multiple tries, but I generated income that amounted to a 4.5% yield over a few months.

In the future, I will look for more opportunities to sell a covered call, especially if the stock gains some positive momentum. But it would be difficult for the stock to rise in the face of a slowing U.S. economy, and the Federal Reserve determined to return inflation to its 2% target, which means rates may stay at the current level or climb higher. The 10-year U.S. Treasury recently yielded 5% before retreating. Investors sitting on profits should take the opportunity to reduce their holdings or sell covered calls to generate extra income.

Revenues under pressure.

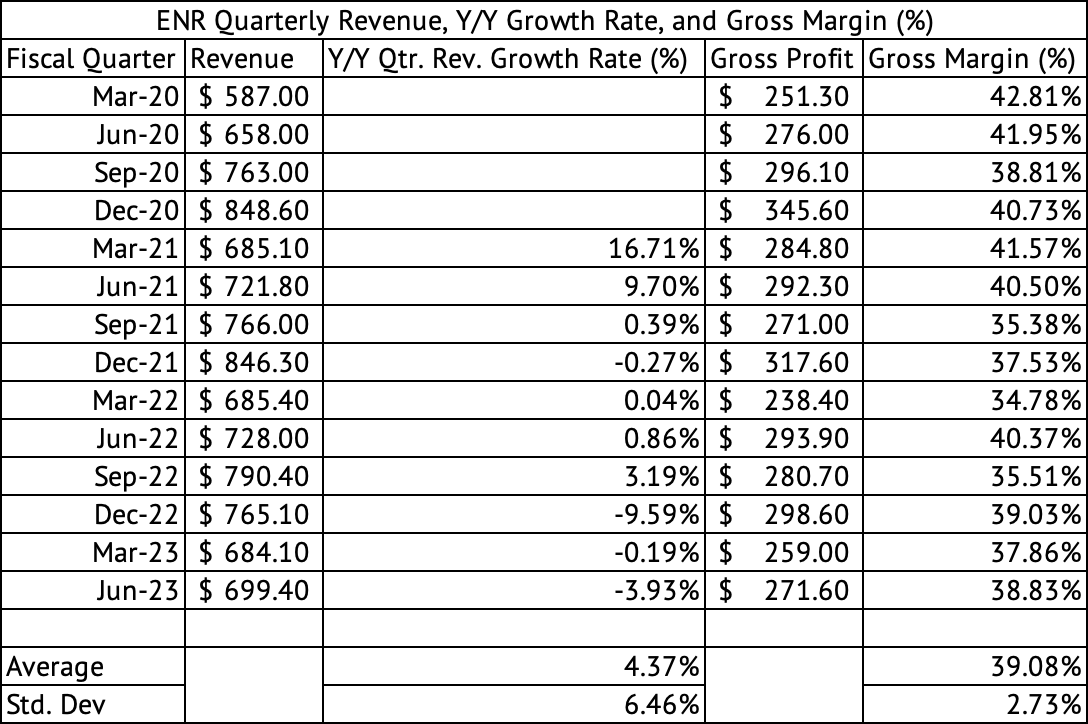

Energizer Holdings saw its quarterly revenue decline y/y. The heady growth days of 2022 are behind it. The company has seen a substantial y/y drop in quarterly revenue since December 2022, with a decline of 9.5%, 0.1%, and 3.9% in the December, March, and June quarters, respectively (Exhibit 1). The one bright spot in these quarterly declines is that the company’s annual revenues are running higher than in 2019, the pre-pandemic year.

Exhibit 1:

Energize Holdings Quarterly Revenue and Gross Margins (Seeking Alpha, Author Compilation)

The management mentioned that the proliferation of devices in the home has permanently lifted the demand for batteries. This argument will be tested if the U.S. economy enters a recession. Even if overall battery demand has increased, the private label brands continue to pressure brands such as Energizer and Duracell (owned by Berkshire Hathaway). These brands are perceived as premium and priced as such, so when consumers are pressured to curtail their spending, they turn to store brands with lower entry price points.

In Q3 FY 2023, a decline in organic revenue of 2.7% was the primary contributor to the revenue decline. This drop in organic revenue was due to volume declines in its battery and auto care business. Battery volumes declined by 4.5%, and auto care volumes declined by 3% in the third quarter. The company’s cost savings initiative, named Project Momentum, helped improve margins. The company improved its margins sequentially from 37.8% to 38.8%, a gain of 100 basis points.

Debt is the primary concern for shareholders.

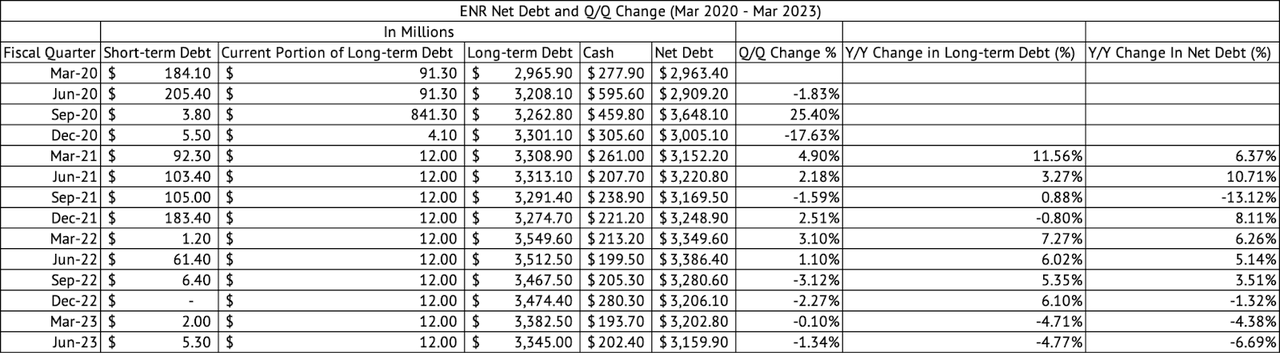

Energizer’s balance sheet remains a concern, although most of the debt is not due until 2027. Long-term debt is $3.34 billion, and its net debt (after cash) is $3.15 billion (Exhibit 2). The company reduced its net debt by about $200 million over the past year and has a 5.7x debt/EBITDA ratio. The most optimistic scenario is that the company can continue paying down its debt by $200 million annually over the next four years and thus reduce its debt by over $800 million. The company’s long-term debt would be approximately $2.54 billion in four years. Based on the trailing twelve-month data, If the company can continue its current EBITDA generation of $535 million, its debt/EBITDA ratio would be 4.7x.

Exhibit 2:

Energizer Holdings Debt (Seeking Alpha, Author Compilation)

Fortunately, the company’s dividend is not under immediate risk since its total dividend payment amounts to $86 million annually. In comparison, the company generated over $400 million in operating cash over the trailing twelve months. The company generates enough cash from its operations to continue paying its dividend. The stock yields 3.7% with a payout ratio of 44%.

The company cannot grow its dividend due to its debt load, and given the debt reduction rate, the management may not be able to increase the dividend for a while. The company has managed its capital expenditures to maximize its financial flexibility and debt reduction efforts. It spent just $47 million on capex over the past twelve months compared to $64.9 million in 2021 and $77.8 million in 2022. Given its debt load, this frugality might help the company. Still, it remains to be seen if the company compromises its long-term competitive, safety, or manufacturing position due to a lack of capex investments.

Inventory costs continue to decline.

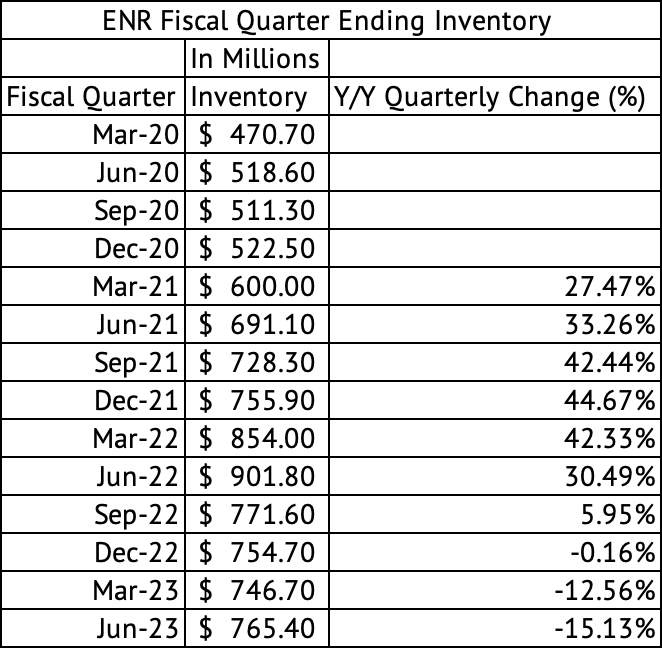

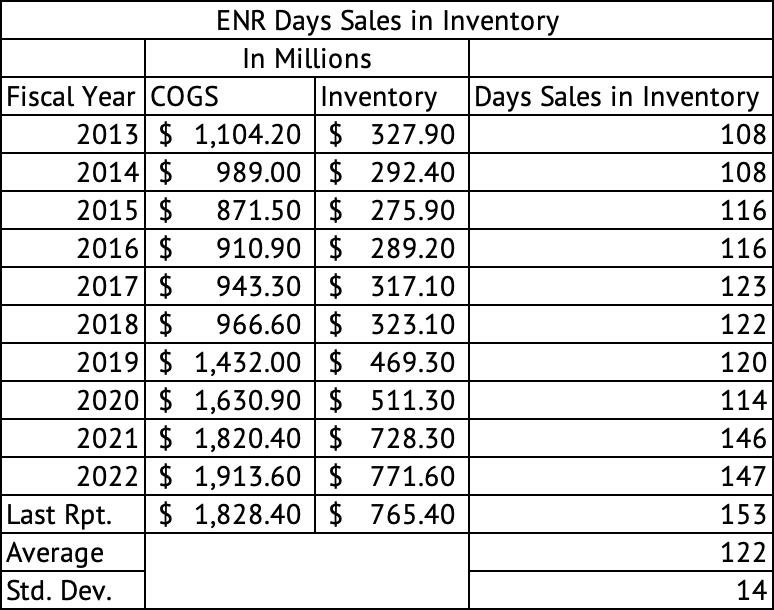

The company has also reduced its inventory costs from the highs of 2022. Although the inventory costs increased sequentially from the March to June quarter in 2023, it has reduced y/y by a double-digit rate in both those quarters (Exhibit 3). The company carried 153 days of inventory based on the latest quarterly earnings compared to its average of 122 days over the past decade (Exhibit 4). Since inflation has started fading and as the demand environment normalizes, inventory costs should continue to slide lower.

Exhibit 3:

Energizer Holdings Quarterly Inventory Costs (Seeking Alpha, Author Compilation)

Exhibit 4:

Energizer Holdings Day’s Sales In Inventory (Seeking Alpha, Author Calculations)

The stock may have more downside due to its debt load.

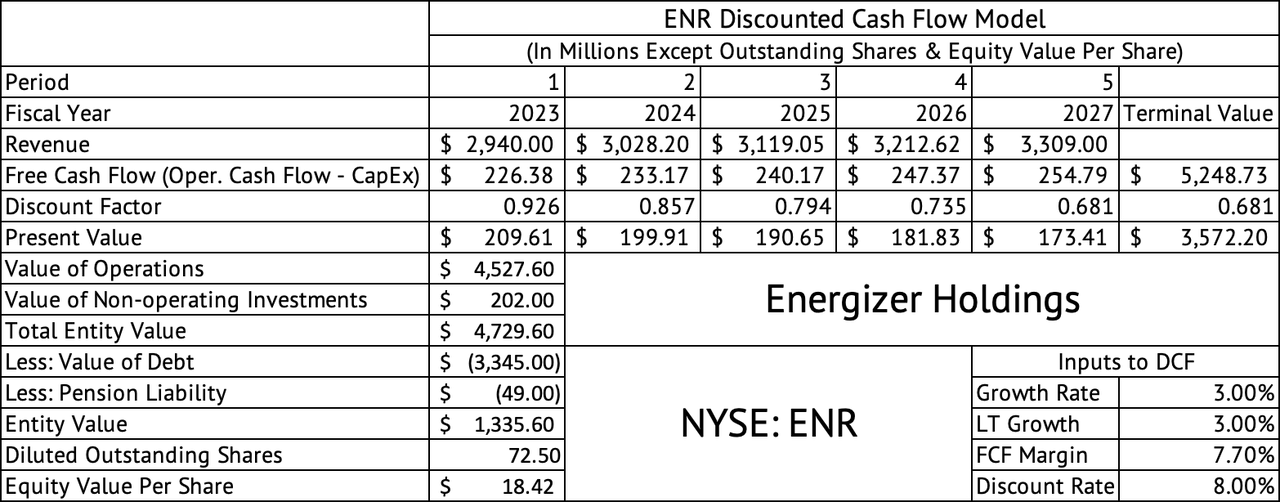

The stock trades at a forward GAAP PE of 10.6x compared to the consumer staples sector median of 16.6x. Its five-year average forward PE is 12.8x. The stock trades at a forward EV/EBITDA multiple of 9.5x compared to its five-year average of 9.9x. Although the stock is trading at a slight discount to its long-run average based on PE and EV/EBITDA multiple, the high debt load makes it look overvalued even at current levels. A discounted cash flow model estimates the per-share equity value at $18.42 (Exhibit 5). This model assumes a free cash flow margin of 7.7%, its average over the past decade, a 3% revenue growth rate, and an 8% discount rate. Any further drop in revenue growth could further pressure its free cash flows and push the stock lower. The stock’s 52-week low is $26.20, about 19% lower than its current price.

Exhibit 5:

Energizer Holdings Discounted Cash Flow Model (Seeking Alpha, Author Calculations)

The stock has performed well over the past year, but its momentum has faded, dropping nearly 5% over the past three months. In the short term, the stock may have more downside due to the potential for a slowdown in the economy.

The poor state of the business.

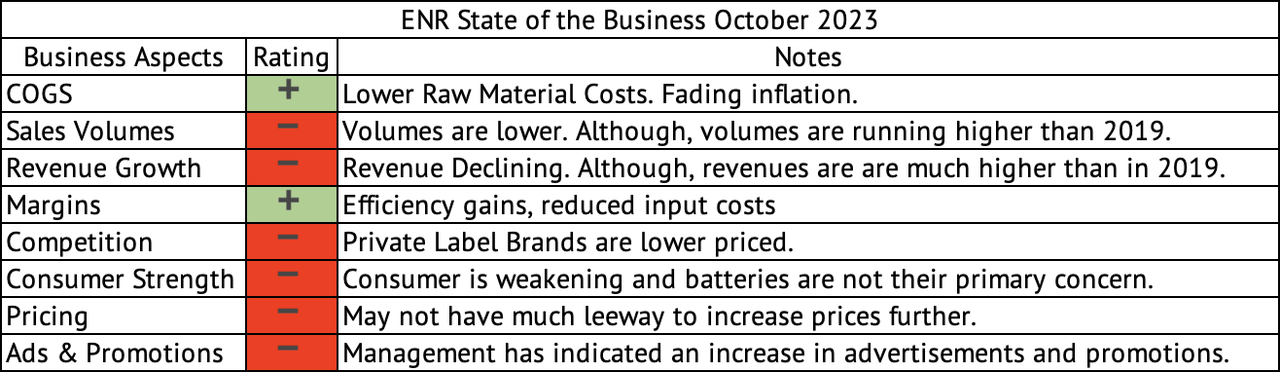

In summary, here’s how I would rate the various dimensions of Energizer’s business (Exhibit 6). The lower inflation has helped reduce COGS, which is a positive. The cost reduction efforts are another positive for the company. The rest get a negative rating and are a drag on free cash flows.

Exhibit 6:

Energizer Holdings Ratings Across Business Dimensions (Author)

New investors should only accept the stock if it trades at a steeper discount to its current valuation and offers a higher yield than 4%. Below $30, the stock would yield above that level. Even then, the stock should be considered a speculative investment and not make up more than a percent or two of the entire portfolio. Existing holders with gains should consider selling covered calls to generate income and celebrate the realized gains if they get called away. Investors should pay close attention to the company’s free cash flow and balance sheet during each earnings release. I would continue to rate Energizer Holdings a hold.

Read the full article here