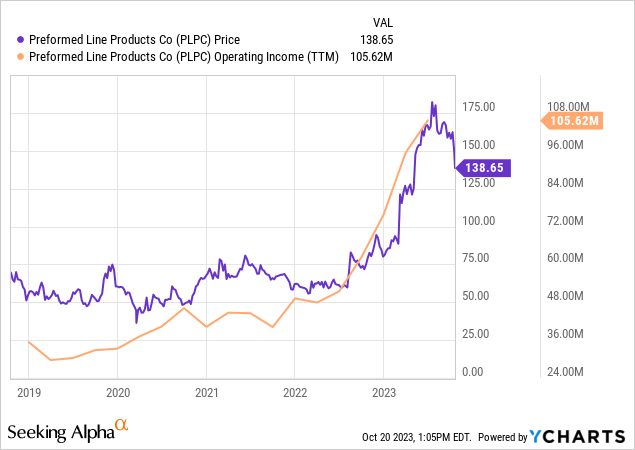

Preformed Line Products Company (NASDAQ:PLPC) has notable and well-covered tailwinds from U.S. infrastructure spending. For a business like Preformed Line Products (“PLP”) that sells products and parts for energy and communications projects, this will bolster demand and margins over the course of the next decade. On top of this spending, recent high oil and commodity prices have led to higher spending on infrastructure projects internationally. PLP’s operating income has risen over 200% since 2019 as a result of these tailwinds. Its stock has roughly followed and is up around 150% in that time.

These tailwinds in the U.S. are likely to continue for many years as the energy and communications projects that will be financed by the government, as dictated by the 2021 Infrastructure Deal, will fuel sufficient demand. However internationally, demand is a bit more difficult to predict as it is largely dictated by commodities. For example, PLP’s revenue from the EMEA region grew over 40% in 2022 and continues to grow at a rate similar to sales from the USA region because oil producing economies in those regions are growing quite well. This must continue for the company to maintain its elevated margins but it’s difficult to predict due to cyclicality in commodity prices.

I do think these tailwinds will continue for the next 12-18 months which, combined with a very reasonable valuation compared to my estimate of 2024 EPS, makes the stock attractive at its current price. Longer term however, operating margins must hold up to give the stock a good margin of safety. This is much more unclear as almost half of the company’s sales are international sales that don’t have long term tailwinds from a large infrastructure bill like the U.S has.

Despite this uncertainty, I am assigning the stock a buy rating and a $225 price target based. I arrive at this target by taking the middle ground between my EPS estimate and my estimate of the company’s intrinsic value. In this report I will provide a background on the company and its past financials, and I will discuss the thought process behind my price target in more detail.

Past Financial Results

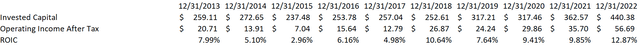

PLP has generally been average to below average over the past decade as judged by its returns on invested capital. This is often the case for relatively capital intensive businesses that provide products to businesses in cyclical industries. The parts that PLP manufactures are often commoditized but individual companies can have competitive advantages that relate to their ability to manufacture high quality products consistently and deliver them in a timely manner. Given the company’s longevity and size, it is safe to assume that they have some of these advantages.

The company’s average ROIC over the past decade was dragged down by its returns from 2013 to 2017. 2013 through 2017 earnings were negatively affected by reduced demand due to a lack of investment by developed countries to upgrade their electrical grids and communication networks. In the 2017 annual report, the company blamed the lack of investment partially on low oil and commodity prices. Oil prices began to rise again in 2017, but were on a 3 year decline before that.

Preformed Line Products ROIC (Created by Author)

The most dramatic rise in the company’s returns on invested capital have come in the most recent years. The chart above shows ROIC through 2022 but I estimate ROIC in 2023 will be around 18%.

While ROIC is a backwards looking metric, it demonstrates management’s skill in allocating capital and business quality and if it has been consistently high for a long period of time there is a good chance that it will be high going forward. However PLP’s ROIC has not been sustainably elevated. The company’s recently high returns on invested capital are primarily a result of the current demand environment as the business has not changed significantly in that time. Simply, there is higher demand for its products which is pushing volume and prices up for the company’s products which in turn is raising profits. This makes it important to consider whether the current demand environment is sustainable as that will have the greatest impact on the company’s returns on incrementally invested capital.

It may be tempting to confuse these recent high returns with high business quality but it seems that the board of directors is not even convinced that the business is very high quality. Annual incentive awards for the management team are dictated by whether the company’s return on equity is within in the range of 3-11%. I will discuss management’s incentive pay more below, but I think this threshold says quite a bit about the company’s expected long-term returns.

Demand Backdrop

I think there are signs that are indicating that the demand tailwinds that have bolstered the company’s recent returns will continue at least over the next 12-18 months. The main signs are the infrastructure bill in the U.S. that will keep investment in energy and communications projects high over the course of the next decade, and high oil prices that are boosting oil producing economies internationally.

In 2016, the annual report specifically pointed out that “sales in the energy market continued to decline due to a slowdown in the number and scale of transmission projects in North America” which contributed to the decline in earnings in that year. In 2022, the Biden administration announced that it advanced three large transmission projects to connect more clean energy to the grid. These project are a smaller part of the large push to achieve the goal of a “100% clean energy grid by 2035”. In late 2022, the Biden administration announced billions in expanded funding to modernize and expand the U.S. power grid.

This are just two examples of the many projects that the U.S. government will fund over the next decade. Other projects are related to U.S. energy infrastructure and projects to help expand internet access. These will all be clear tailwinds for PLP over the next decade.

Internationally, the long-term demand picture is less clear and will likely be much more cyclical. Non U.S. revenue made up more than 45% of revenue in 2022 so it is a significant portion of the business that will have a large part in determining earnings over the next decade. In fact, the region that has grown the most recently has been the Europe, Middle East and Africa (EMEA) region. On a constant currency basis, this region grew 44% year-over-year in 2022 and 30% year-over-year in the first half of 2023. The most recent 10-Q attributes this growth to volume increases in communications sales in the region.

Why has volume grown so much in this region? With high oil prices, many economies in Africa and the Middle East are booming. For example, oil accounts for 40% of Nigeria’s GDP, 70 percent of budget revenues, and 95 percent of the country’s foreign exchange earnings and the country has recently announced a plan to being investing more in their infrastructure. PLP has a South Africa subsidiary that serves the “electrical and communications markets in South Africa, as well as in neighboring territories such as Kenya, Namibia, Nigeria, Zimbabwe, Botswana, Mozambique and Swaziland” and it has been successfully in capturing profit from these increased investments.

The company doesn’t mention specifically which countries in the Middle East it operates in, but its PLP Great Britain subsidiary “serves communications and electrical utilities, contractors, cable manufacturers, and trading houses throughout the United Kingdom, Europe (including Eastern Europe), the Middle East and Africa (excluding South Africa).” With so many oil producing economies in the Middle East, it makes sense that these countries are using this opportunity created by high oil prices to invest in their infrastructure.

I expect this dynamic to continue for the next 12-18 months however longer term it is difficult to predict where oil prices will be. With no infrastructure bill backdrop in these countries, demand for PLP services will likely be more cyclical and dependent on the global economy.

Price Target

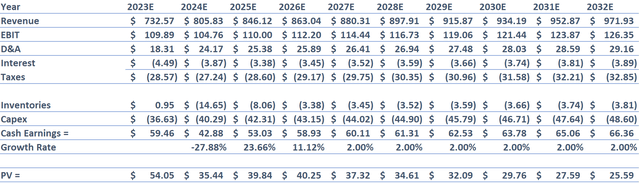

My model for PLP’s intrinsic value takes some of this cyclicality into account as I assume revenue growth falls to the rate of GDP and operating margin compresses closer to its long term average.

Preformed Line Products DCF (Created by Author) Preformed Line Products DCF Continued (Created by Author)

In this model I assume:

- Revenue grows 15% in 2023, 10% in 2024, 5% in 2025, and 2% thereafter

- EBIT margin is 15% in 2023, and 13% thereafter

- The company’s interest expense gradually declines to a constant 5% of net debt

- The company maintains net debt equal to half of EBITDA

- The company’s tax rate is a constant 26%

- D&A is equal to 2.5% of revenue in 2023, and 3% of revenue thereafter

- Inventories are equal to 20% of revenue

- Capital expenditures are a constant 5% of revenue

- The company’s weighted average cost of capital of 10%

- The company’s terminal growth rate is 2%

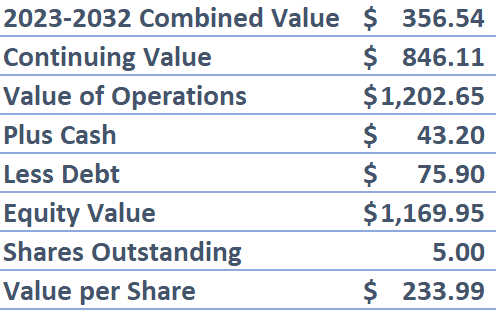

These assumptions lead to an intrinsic value estimate of $234.

With those same assumptions, I estimate that 2024 EPS will be $14.73. With a 15x multiple, the stock will trade for $220. Taking a blended approach between these two targets, I am assigning the stock with a $225 price target and a buy rating as it provides a solid margin of safety with 60%+ upside from the current price.

Risks

The cyclicality from international economies that I mentioned above is the biggest long-term risk for the business. Maintaining margins are the biggest question mark in my model and I do assume some margin compression from current levels, but if they fall closer to their historical average, the company’s intrinsic value will fall drastically. For instance, if the company’s operating margin falls to 9% in 2025, its pre-pandemic high, the company’s intrinsic value would fall to $136. The operating margin is largely dependent on continued demand that would keep pricing power relatively high despite new entrants that would be attracted by the high industry returns.

As I mentioned above, the company’s board of directors still benchmarks management’s incentive pay to its past lower returns. This supports the idea that margin compression to the historical average is a risk. The current annual incentive cash reward is paid out depending on the company’s return on equity. The target range which would allow management to earn this reward is 3-11%. This scale was actually lowered from 4-15% in 2016, the year after the company’s ROE was 8%, its lowest in some time. If the company similarly raises the threshold for its annual incentive pay in 2023, that would be a bullish sign that would indicate the company expects its profits to remain elevated.

Final Thoughts

PLP’s fortunes have changed for the better in the past few years. From 2013-2017, the business suffered due to a lack of investment in energy and communications projects internationally. This reduced investment was partially caused by lower oil and commodity prices which hurt many oil producing economies worldwide. Today, and over the past few years, the opposite has been true. High oil prices has boosted economies internationally, especially in Africa and the Middle East and oil producing countries in these regions are able to spend more on infrastructure investments because of this. PLP has benefitted from this dynamic greatly as sales in the EMEA region have grown significantly on a constant currency basis.

On top of this, the recent U.S. infrastructure bill will provide tailwinds at least for the next decade as higher demand will allow for higher margins without the need for more incrementally invested capital. This tailwind, along with tailwinds from high oil prices that I think will continue at least for the next 12-18 months, makes the stock attractive at its current price. With this in mind, I estimate 2024 EPS will be $14.73 and with a 15x multiple, the stock would trade for $220.

Longer-term, the intrinsic value of the business depends on maintaining high margins. This will largely be determined by international infrastructure investment over the next decade. My model assumes some margin compression as oil prices remain cyclical and international economies, especially in Africa and the Middle East, reduce investments on infrastructure due to this cyclicality. Even with this assumption, my estimate of the company’s intrinsic value is $234. Taking a middle ground between these two estimates I am assigning the stock with a buy rating and a $225 price target.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Best Value Idea investment competition, which runs through October 25. With cash prizes, this competition — open to all contributors — is one you don’t want to miss. If you are interested in becoming a contributor and taking part in the competition, click here to find out more and submit your article today!

Read the full article here