Thesis

Alibaba Group (NYSE:BABA) has long been the poster boy of Chinese e-commerce. It has been called “China’s Amazon” countless times as investors had hoped for a repeat of the success of Amazon’s (AMZN) stock. However, in recent years due to the tech crackdown by the Chinese Government and the Zero Covid policies in China, Alibaba has fallen from its once unstoppable image. Recently, there are notable signs that management is doing everything it can to make Alibaba great again. Alibaba’s most recent earnings were exceptionally strong even as China’s reopening has been lackluster in many respects. Additionally, with the upcoming restructuring and other catalysts, Alibaba is poised to benefit from new tailwinds. Despite the turnaround being already underway, Alibaba shares trade at their lowest valuation since being listed on the NYSE. Although there are risks such as data privacy concerns, I believe Alibaba is currently undervalued at current levels and deserves a Buy rating.

Earnings

Overview

Alibaba Investor Presentation

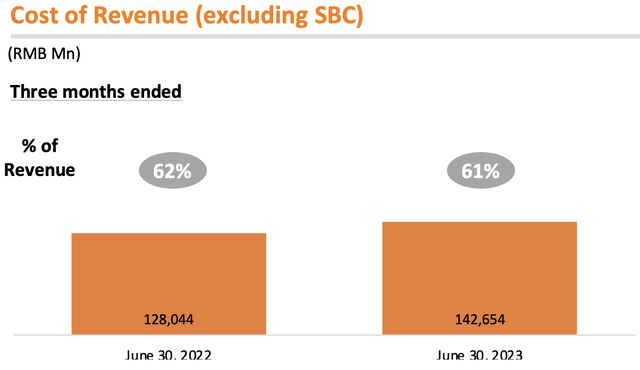

Alibaba reported its June Quarter 2023 results in August. They reported consolidated revenue of RMB234.156 billion which is up 14% YoY. Their income from operations was RMB42.490 billion and is up a whopping 70% YoY. This translates into a adjusted EBITDA of RMB45.371 billion up 32% YoY, and a net income of RMB33.000 billion up 63% YoY. As for expenses, cost of revenue and operating costs were virtually unchanged YoY in terms of their percentage of revenues. From these figures, we arrive at a FCF of RMB39.089 billion which is much higher than RMB22.173 billion in the prior year quarter. From my analysis, it is clear that Alibaba showed strong results that are demonstrating their resurgence as a result of the end of China’s Zero-Covid policies. Revenues and earnings were up YoY across the board and in my view show that the worst is over for Alibaba.

Taobao & TMall Group

Alibaba Investor Presentation

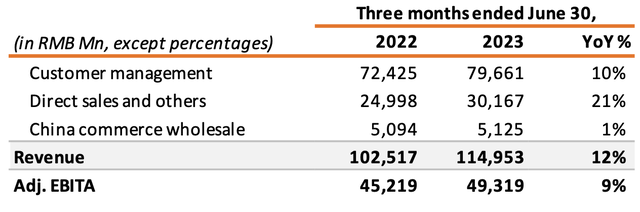

For this segment, their China commerce retail business revenue was up 13% YoY to RMB109.828 billion. Within this unit, customer management revenue is up 10% YoY to RMB79.661 billion. This was mainly due to an increase in merchant willingness to invest in advertising, an increase in online physical goods gross merchandise value (GMV) generated on Taobao and TMall. For their Direct Sales and Others unit, revenues were up 21% YoY to RMB30.167 billion as there were strong sales from consumer electronics. Moving to China Commerce Wholesale, revenues were up only 1% YoY to RMB5.125 billion. As a whole, this segment reported adjusted EBITDA of RMB49.319 billion which is up a moderate 9% YoY due to an increase in profit from customer management services. Other highlights included Taobao’s DAUs increasing 6.5% YoY as a result of effective user acquisition programs and improved retention of users. In my view, this segment showed very respectable results as figures showed resilience and even growth in key areas. Growth was visible across the board and demonstrates a strong quarter.

Alibaba International Digital Commerce Group

Alibaba Investor Presentation

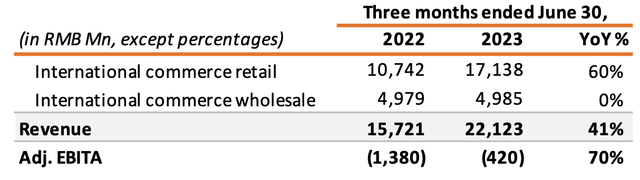

For this segment, their International Commerce Retail business reported revenues of RMB17.138 billion which are up 60% YoY. This is a result of strong combined order growth of retail business due to solid performance in all major retail platforms as well as improved monetization. For their International Commerce Wholesale business, revenues were virtually unchanged YoY at around RMB4.985 billion. They reported an adjusted EBITDA loss of RMB420 million versus a RMB1.380 billion loss in the prior year quarter. This is the result of improved margins in Trendyol and Lazada. Trendyol showed strong order growth, robust revenue growth and also improvement in operating efficiency and Lazada showed improvements in monetization. Overall, I believe this segment demonstrates that Alibaba’s turnaround is underway despite showing a negative EBITDA. All figures showed signs of a turnaround for Alibaba and that the worst is over for this segment.

Local Services Group

For this segment, revenue was reported to be RMB14.450 billion which is up an impressive 30% YoY. This was mainly due to robust GMV growth in Ele.me and positive unit economics per order, as well as Amap’s rapid order growth due to increased market demand. The Local Services segment reported an adjusted EBITDA loss of RMB1.982 billion versus a RMB2.834 billion loss in their prior year quarter. To-Home business highlights include Ele.me benefitting from improving consumer demand and showing an increase in number of active merchants. It is also improving its capacity and focusing on diversifying the availability of items beyond restaurant categories. For its To-Destination business, highlights include Amap adding additional capabilities and reporting a strong recovery in commuting and travel demand. In my view, despite the EBITDA loss, this segment has rebounded significantly from prior years as its loss is quickly narrowing and its revenues growing at an impressive rate.

Cainiao Smart Logistics Network Limited

For this segment, revenues were reported to be up 34% YoY to RMB23.164 billion as a result of an increase in revenue from international fulfillment solution services and domestic consumer logistic services. This translated into an adjusted EBITDA of RMB877 million versus a RMB185 loss in the prior year quarter. In June, Cainiao started operations at three new international sorting centres and that brings the total overseas sorting centres to now eighteen. Cainiao is also expanding its value-added services in China to enhance consumer experiences as well as working to achieve Half-Day and Next-Day delivery in key strategic cities. From my analysis, it is clear that this division has a had an enormous turnaround. From an EBITDA loss last year, Cainiao was able to turnaround and show a strong positive EBITDA in this quarter whilst also showing large revenue growth.

Cloud Intelligence Group

For this segment, revenue was up 4% YoY to RMB25.123 billion as growth was driven by Alibaba-consolidated businesses and customers within financial services, education, electric power, and automobile industries. This segment reported adjusted EBITDA of RMB387 million and is up a whopping 106% YoY. This was a result of reduced colocation and bandwidth costs of DingTalk due to normalization of usage. Business highlights in this segment included its generative AI efforts, as new features were released for Tongyi Qianwen as the audio transcription platform Tingwu was upgraded with AI powered meeting analysis capabilities. Lastly, they also launched generative AI text-to-image model Tongyi Wanxiang. I believe this segment was one of Alibaba’s strongest as its adjusted EBITDA showed enormous gains from the prior year quarter. As well, their AI efforts seem to be gaining traction and that will also provide tailwinds for this segment.

Digital Media & Entertainment Group

For this segment, revenues were up 36% YoY to RMB5.381 billion as there was growth in their online entertainment business as well as a strong recovery in the offline entertainment business. They reported an adjusted EBITDA of RMB63 million versus a loss of RMB907 million in the prior year quarter due to increased revenues from Alibaba pictures and Damai. Damai has shown a strong revenue recovery as a result of increasing demand for offline entertainment events while Alibaba Pictures’ movie and online platform revenue growth was due to strong China box office demand. Overall, I believe this segment was another great example of Alibaba’s resurgence as they turned an adjusted EBITDA loss from the prior year into a positive figure this year. Of course a lot of that has to do with Zero-Covid ending but it still shows the magnitude that Alibaba’s business has rebounded.

All Others

Revenue for all their other segments was reported to be RMB45.541 billion which is only 1% up YoY. They attributed this to revenue growth in Alibaba Health, Fliggy, Freshippo, and Intelligent Information Platform. They did show an adjusted EBITDA loss of RMB1.204 billion but it was still much better than the prior year’s loss of RMB2.275 billion. This was mainly a result of improved operating results from Freshippo, Lingxi Games, and Fliggy. Again, they were able to narrow their losses sharply compared to last year’s results and I believe they are well on their way to a strong recovery in this segment as well.

Catalysts

According to a Seeking Alpha news post on September 12th, Alibaba’s new CEO Eddie Wu Yongming is focusing the company on pursuing a user-first and an AI-driven direction. He stated that “new technologies such as AI are emerging as the new engine of global business growth,” and that “if we don’t keep up with the changes of the AI era, we will be displaced” in an internal letter. With this direction, Alibaba will be making large investments in technology-driven platforms, AI-driven tech businesses, and global commerce networks. In my view, it is clear that Alibaba’s new CEO is focused on making the company competitive in the AI era and that it intends to be at the bleeding-edge of AI development.

In a news post on September 18th on Seeking Alpha, Alibaba is said to have invested $2 billion in Turkey. It is reported that Trendyol formally announced the investment after the meeting between Alibaba President Michael Evans and Turkish President Recep Tayyip Erdogan. Investments include a data center and logistics center in Ankara, and an export operation center at the Istanbul Airport. It is reported that details on the investment calendar has not been given yet. I believe this investment demonstrates that Alibaba is committed to growing its business internationally. Despite the current challenges they are experiencing, they are focused on the long-term big picture and making investments despite being in the midst of a large restructuring.

Lastly, another catalyst could be Alibaba’s spinoff plans. According to a Seeking Alpha news post on September 26th, Alibaba is spinning off its Cainiao logistics unit via an IPO on the Hong Kong stock exchange. However, it is reported that Cainiao will remain a subsidiary of Alibaba as it will hold more than 50% of Cainiao’s shares post-spinoff. This spinoff and the other upcoming ones, including Alibaba Cloud Group, could be a catalyst for Alibaba as its then CEO Daniel Zhang stated that “the solid quarter also showed promising early results of our reorganization, which is beginning to unleash new energy across our businesses” in the conference call. On September 22nd, following a report of the Cainiao IPO Alibaba shares were up 4% on the HKEX and 4% pre-market in New York. I believe this shows that investors likely share the optimism that this spinoff and future spinoffs can be a catalyst and tailwind for Alibaba.

Valuation

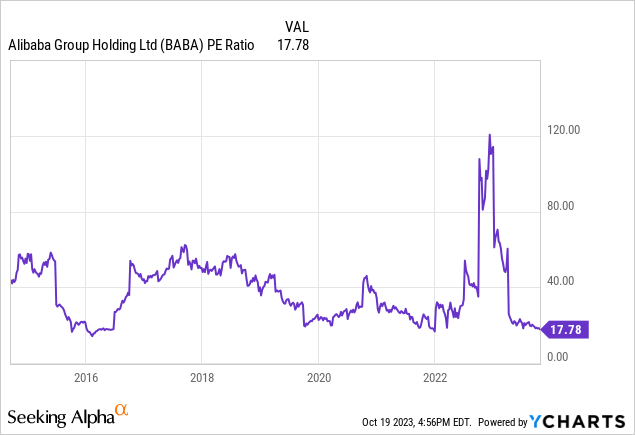

Alibaba is currently trading at a P/E of approximately 18 which is virtually the lowest P/E it has had since it has traded on the NYSE. Admittedly, Alibaba has its challenges as the Chinese Government is a great source of its uncertainties and the Chinese economy is still recovering from Zero-Covid. However, in my view, this rock-bottom valuation is unjustifiable based on my analysis above and therefore Alibaba is significantly undervalued based on the P/E.

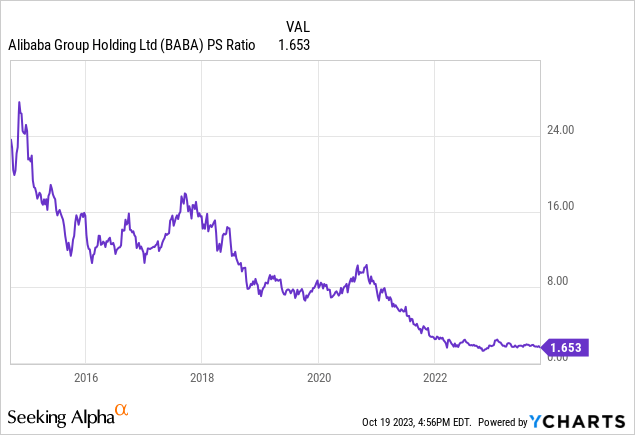

It is a similar story with the P/S ratio. It is at an all-time low despite the recovery in Alibaba’s earnings and growth. With the tech crackdown seemingly over, and a potential for a much more supportive government, the uncertainties from the past few years have mostly dissipated. Yet, Alibaba is trading at levels that reflect an impending doom.

From my analysis, I believe that Alibaba is highly undervalued as its turnaround and restructuring efforts deserve more credit. At a minimum I believe Alibaba would be correctly valued at around a P/E of 30 and a P/S of 7 as that would reflect a valuation that is slightly lower than average pre-pandemic levels. I believe that to be a fair valuation as admittedly, there are still more uncertainties and challenges in its business than in the pre-pandemic era but its current efforts and growth prospects show it is highly undervalued based on both P/E and P/S ratios at current levels. Therefore I believe Alibaba deserves a Buy rating.

Risks

According to a Seeking Alpha news post on October 5th, the Belgium intelligence agency has been monitoring Alibaba’s logistics hub at the cargo airport in Liege for almost 2 years because of espionage concerns. It is reported that the concern is mostly on the software system’s collection of sensitive data of the supply chain ecosystem and final consumers which could then be turned over to the Chinese Government because of a data law in the country. That law forces Chinese companies to share info with the government. Cainiao denies any wrongdoing as the data from the Liege hub is stored in servers in Germany. I believe this is a significant risk to Alibaba in this specific case as well as in a broader sense as they have to guarantee users’ data privacy if they want to maximize their international expansion. Cases like these could negatively affect their reputation and with the increasing attention on Chinese companies’ data policies Alibaba will need to address this to ensure international markets welcome their presence.

Another risk could be valuation concerns with their spinoff plans. On September 8th, a Seeking Alpha news post expressed that Alibaba is pausing the Hong Kong IPO of its Freshippo Supermarket chain. It is reported that Alibaba has spoken to potential investors and from the feedback has determined an estimated valuation of $4 billion which is much lower than what it was hoping. Alibaba was reportedly targeting a valuation of $6-10 billion. I believe this is a potential risk for Alibaba as this shows that its restructuring plans could be impacted by a weak IPO market and low valuation. It is not clear what Alibaba’s other business could be valued at when they spinoff in the near future and so there is some uncertainty as to whether Alibaba will have to delay its restructuring plans. As described above, the restructuring is a major catalyst for Alibaba and in my view, a delay could hamper its growth prospects.

Conclusion

Alibaba has had a rough few years. Macro and geo-political factors took its toll on Alibaba in the past years as the Chinese Central Government decimated its growth with high regulatory scrutiny and the Zero-Covid policies dampened the Chinese economy’s growth significantly. However, as these uncertainties have receded, Alibaba is poised to become great again. Its most recent earnings proves that, as revenues grew across the board and all adjusted EBITDA figures were improved from the prior year quarter. In addition, Alibaba has many catalysts including major restructuring that promises to unlock further value for shareholders. Despite the massive turnaround, the market is valuing Alibaba like it is primed for failure. Its P/E and P/S ratios are at all-time lows while its fundamentals continue to improve. Despite some risks like data privacy concerns, Alibaba is in a strong position to continue to grow. Therefore, I believe Alibaba is undervalued and is a Buy.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Best Value Idea investment competition, which runs through October 25. With cash prizes, this competition — open to all contributors — is one you don’t want to miss. If you are interested in becoming a contributor and taking part in the competition, click here to find out more and submit your article today!

Read the full article here