Elephant In The Room

Rising interest rates are a phenomenon remembered by few market participants–the last time interest rates experienced sustained upward momentum was 40 years ago. The subsequent reduction of interest rates after the U.S. inflationary crisis of the 1970s both ushered in a bond bull market for the ages and attuned multiple generations of investors to the intoxicating (if untrue) notion that interest rates only move in one direction.

REITs, along with other capital and debt-intensive industries, were primary beneficiaries of this long-term trend, and have thusly been slapped in the proverbial face as interest rates rise. The office sector has been doubly slapped by rising interest rates and the COVID pandemic, which ushered in remote and hybrid work en masse. The sector has yet to recover to even a fraction of its pre-pandemic highs, and is now faced with the daunting prospect of refinancing debt at higher rates or sending keys to lenders in the mail.

Understanding the direness of the situation, management at W. P. Carey (NYSE:WPC) announced in September 2023 that the company would spin off its office properties into a new public company.

The method of the spinoff is the main contention here, as many Seeking Alpha analysts have pointed out. Essentially, W. P. Carey management did two things:

- Lowered the targeted dividend payout from 75% to 70% of AFFO.

- Announced that the new company’s goal would be liquidation of the assets and return of proceeds to shareholders rather than, you know, going forward as a regular business.

The first point here seems to be the cardinal sin. As Brad Thomas stated in his recent article on W. P. Carey:

We have never once seen a dividend cutter do well or outperform its peers after management slashed the payout.

This, we think, is true when placed in the proper context, which is the interest rate discussion we started this article with.

Yes–dividend cutters did not prosper in a falling rate environment. That only makes sense, right? After all, if you’re cutting your payout as your cost of capital is falling, then the overwhelming likelihood is that your business is suffering. Cutting payouts in a rising interest rate environment is a very different animal and, we would contend, a sign of prudent management.

Others have also pointed out what W. P. Carey did not slash its dividend in the Great Financial Crisis of 2007-2008, a line of reasoning intended to invoke in the reader a thought of “wow, things must really be bad, then.” In our view, this thinking is flawed. The GFC, as painful as it was and despite what our collective memories may tell us, did not have the same devastating force as the Great Depression, and active government intervention shielded many industries and companies from massive amounts of pain. Additionally, the GFC did not affect all asset classes equally, and, lastly, rates fell overall during the GFC, enabling companies to roll debt at even cheaper prices.

In response to a question about the dividend on W. P. Carey’s special call to address the office spinoff, CFO Toni Ann Sanzone had this to say:

I think over time, we’ve been trying to maintain our payout ratio. And as you well know, with our strategy in the long term, we’ve moved away from the investment management fee streams. And I think we’re looking at this as an opportunity to really reset the payout ratio at a level that we feel comfortable with and one where we can retain a higher amount of cash flow. I think certainly, in this environment, it’s an added source of capital for us that we can use to fund investments accretively and effectively lower our cost of capital. So I think that’s really the analysis that we did to kind of arrive at sort of the reset and it’s all driven by trying to get the payout ratio in the low to mid-70% range. And I think that will also align us with our peers and perhaps it can put us ahead of our peers and some of that in the net lease peer group.

So, yes, while dividend cuts are generally bad news, we think the rationale from management makes sense, especially in the long run.

The second issue–that the company’s spin-off would be meant to simply sell its assets over time–seems to us to just be an admission of reality on the part of management. The market for office space is unlikely to return to equilibrium anytime soon due to a massive imbalance of supply and demand. What, we ask, would you rather have in this situation? A lame-duck child company that limps along, in constant need of attention and funding, or a company designed to sell the assets and close up shop once the maximum amount of capital has been collected for investors?

We think the latter is a far better option.

Who Is This Attractive For?

Now, we don’t think the analysis conducted on this site regarding W. P. Carey is wrong, in the sense that long-term investors have every right to feel as jilted as they do. The stock has performed poorly, after all, and it is only natural that the office spinoff and dividend target reduction would feel like a rug-pull. Thus, today’s levels for sure represent an inflection point for long-term holders of W. P. Carey.

For new investors, however, we think the opportunity may be quite enticing.

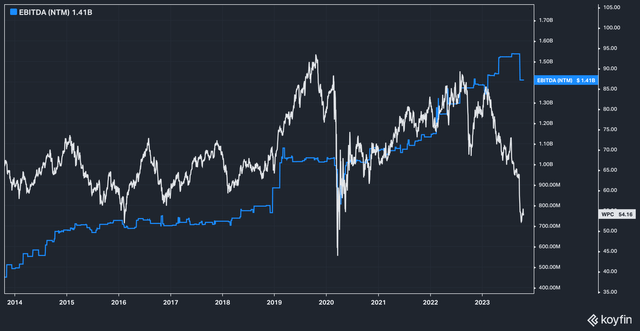

WPC Price vs Forward EBITDA (Koyfin)

First, an historic discrepancy has emerged between the company’s stock price and its forward EBITDA estimates. For most of the last 10 years (minus the start of the COVID pandemic), W. P. Carey’s stock traded well above its forward EBITDA expectations. Since the start of 2023, the stock has endured a precipitous decline while forward EBITDA estimates have moderately improved. (The most recent drop in EBITDA estimates appears to reflect the spinoff.)

The popular narrative surrounding W. P. Carey–that the company is slow-to-no-growth and that the primary reason for wanting to own it is for its dividend–also doesn’t appear to hold up particularly well.

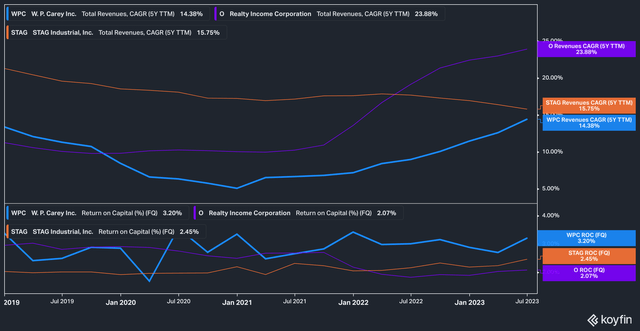

WPC vs STAG & O for CAGR, ROC (Koyfin)

Over the last five years the company has generated a 14.3% CAGR on sales. While, yes, this number is below best-in-class Realty Income (O) and slightly worse than STAG Industrial (STAG), it is also not insignificant and has been on the upswing.

Perhaps more importantly for those with a long term perspective, W. P. Carey has managed to produce a better return on capital for its shareholders, coming in at 3.2% for the latest quarter, a full 113 basis points above Realty Income’s quarterly ROC.

Lastly, according to Seeking Alpha, the stock is attractive on a forward P/FFO and P/AFFO basis. The stock currently trades hands at 9.79x P/FFO and 10.22x P/AFFO, which is 7% and 21% lower than the current sector median. This, we think, is a reflection of the negative sentiment swirling around the stock.

The Bottom Line

Year to date, W. P. Carey has been a disappointment for shareholders, delivering a 27% negative total return. While we understand why long-term holders of the stock may no longer find the story appealing, we think that newcomers to the company are likely to find a lot to like in the current valuation and outlook for the company post-spinoff.

Read the full article here