A market downturn doesn’t bother us. It is an opportunity to increase our ownership of great companies with great management at good prices. – Warren Buffett

Introduction

My entire investment philosophy is based on finding a few top-tier companies in sectors with high entry barriers, strong long-term earnings power, pricing power, significant economic importance, and low risks of technological disruption – among other factors.

Once I’ve found these companies, I stick to them and buy whenever the market offers opportunities, which is why I started this article with a quote from the Oracle of Omaha.

Having said that, one of my favorite long-term investments is Norfolk Southern (NYSE:NSC).

This Atlanta-based railroad hasn’t done so well lately.

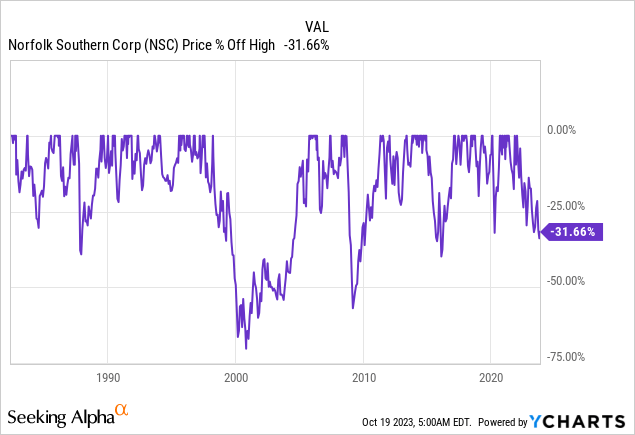

The railroad is currently down 32% (excluding dividends), making it one of the worst sell-offs since the 1980s. Since the Great Financial Crisis, the 2015/2016 manufacturing recession was slightly worse. The pandemic was only briefly worse, as it was mainly a flash crash that quickly rebounded.

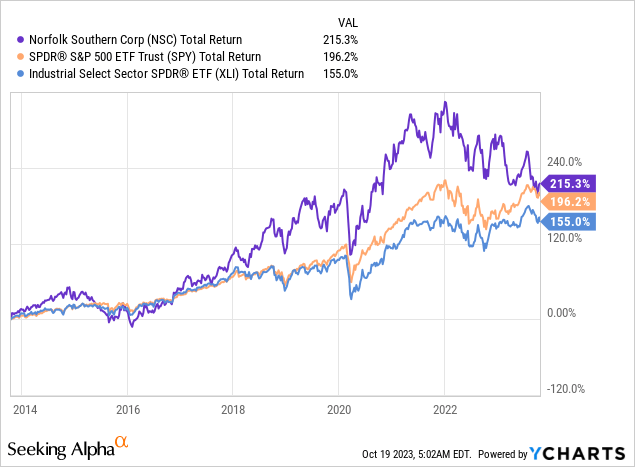

Nonetheless, despite these steep sell-offs, NSC is still beating the market when it comes to the total return of the past ten years, which is due to its ability to rebound during economic expansions.

The company has also benefitted from its ability to improve operating efficiencies, pricing power in times of elevated inflation, economic re-shoring, and the fact that railroads are incredibly efficient, which helps companies to reduce their supply chain carbon footprint, and it benefits from labor tightness in trucking markets.

Unfortunately, most of these factors are gone – at least for the time being.

Economic growth is down, a weak consumer has resulted in tremendous intermodal weakness, high inflation is doing a number on operating costs, and the derailment in East Palestine, Ohio, caused investors to doubt Norfolk’s safety and potential exposure to liabilities.

In this article, we’ll discuss all of this, especially as we head into the company’s third-quarter earnings release on October 25.

So, let’s get to it!

Buying Into A Mess

As its >30% stock price decline may suggest, NSC isn’t doing so well.

The company is dealing with slower economic growth, a related decline in consumer sentiment, and sticky inflation.

Like all railroads, NSC is highly cyclical. After all, when economic growth declines, the need for transportation declines.

Norfolk Southern’s services cover 60% of consumption in the U.S. and 50% of manufacturing!

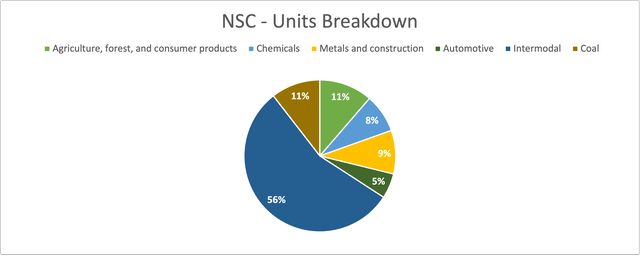

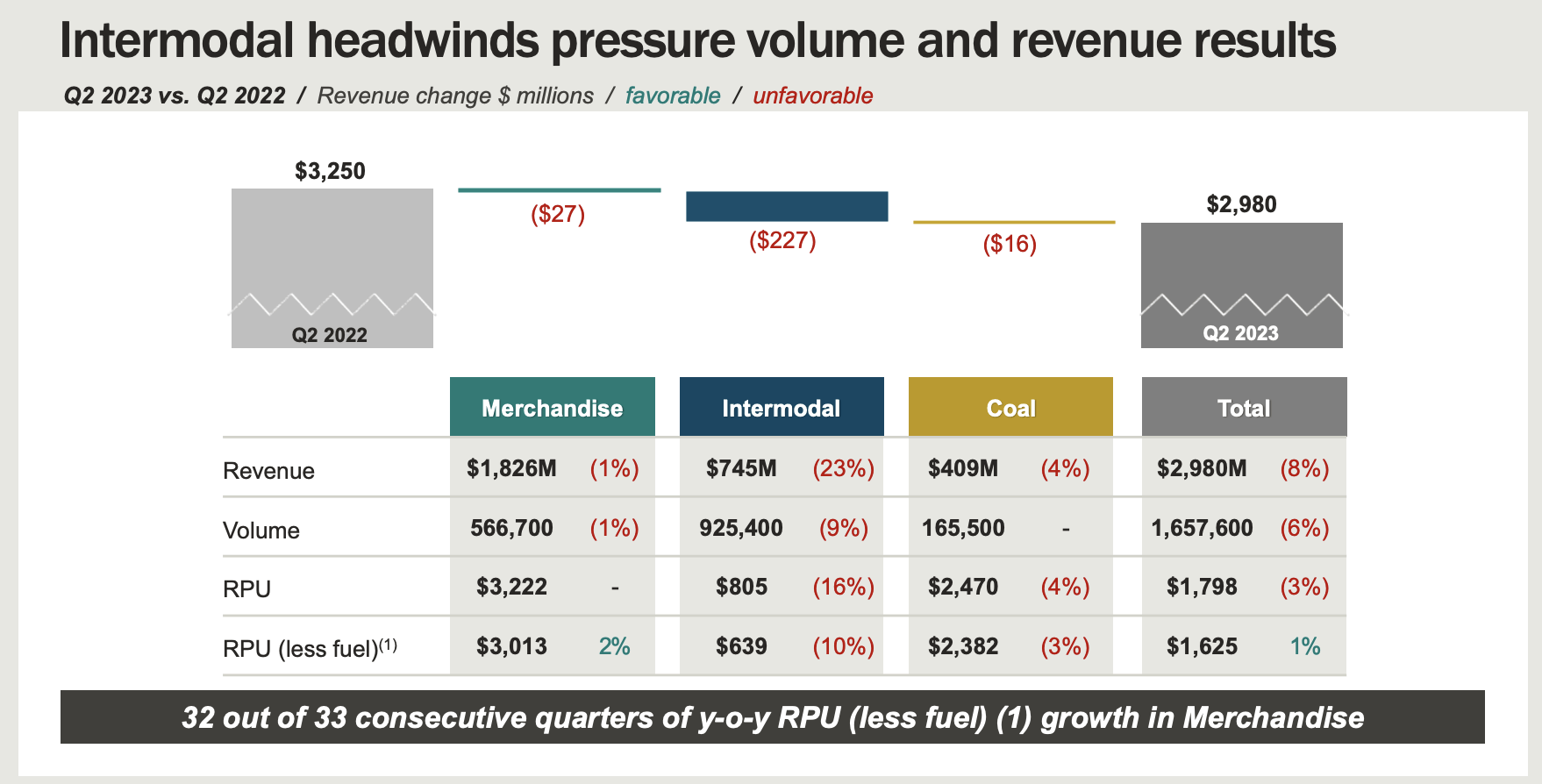

The one thing that makes Norfolk Southern special is its footprint in intermodal. In 2Q23, 56% of its volumes were intermodal shipments. Norfolk Southern is the largest intermodal railroad behind Buffett-owned BNSF.

Leo Nelissen (Raw data: Norfolk Southern)

However, intermodal is a low-margin business. For example, last quarter, the company made roughly $4,000 per chemical unit. It made just $890 per intermodal unit.

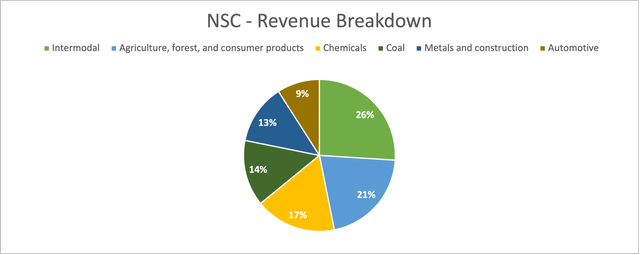

As a result, a 56% volume share drops to a 26% share of revenues.

Leo Nelissen (Raw data: Norfolk Southern)

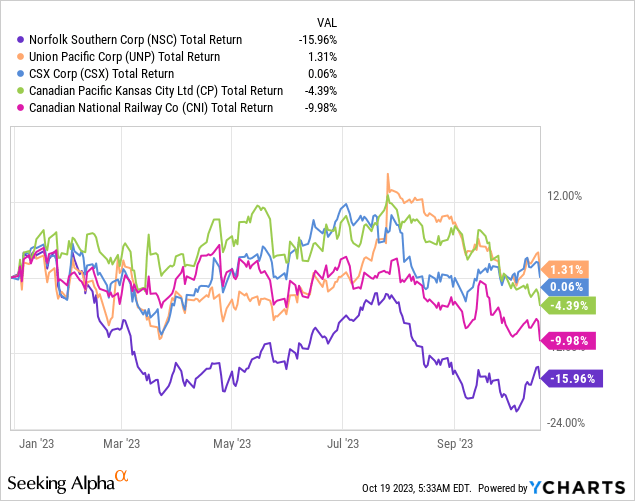

Other railroads, like CSX (CSX), Union Pacific (UNP), and the two Canadian giants, have a much larger footprint in non-intermodal segments, allowing them to outperform NSC.

Year-to-date, NSC is the worst performer.

I would even make the case that it’s the worst Class I railroad on the market – right now.

And yet, I’m buying (with both hands!).

See, most problems are temporary, and the market is doing a great job pricing in weakness, allowing me to buy an attractively valued railroad.

Before I get to the good news, let’s take a quick look back.

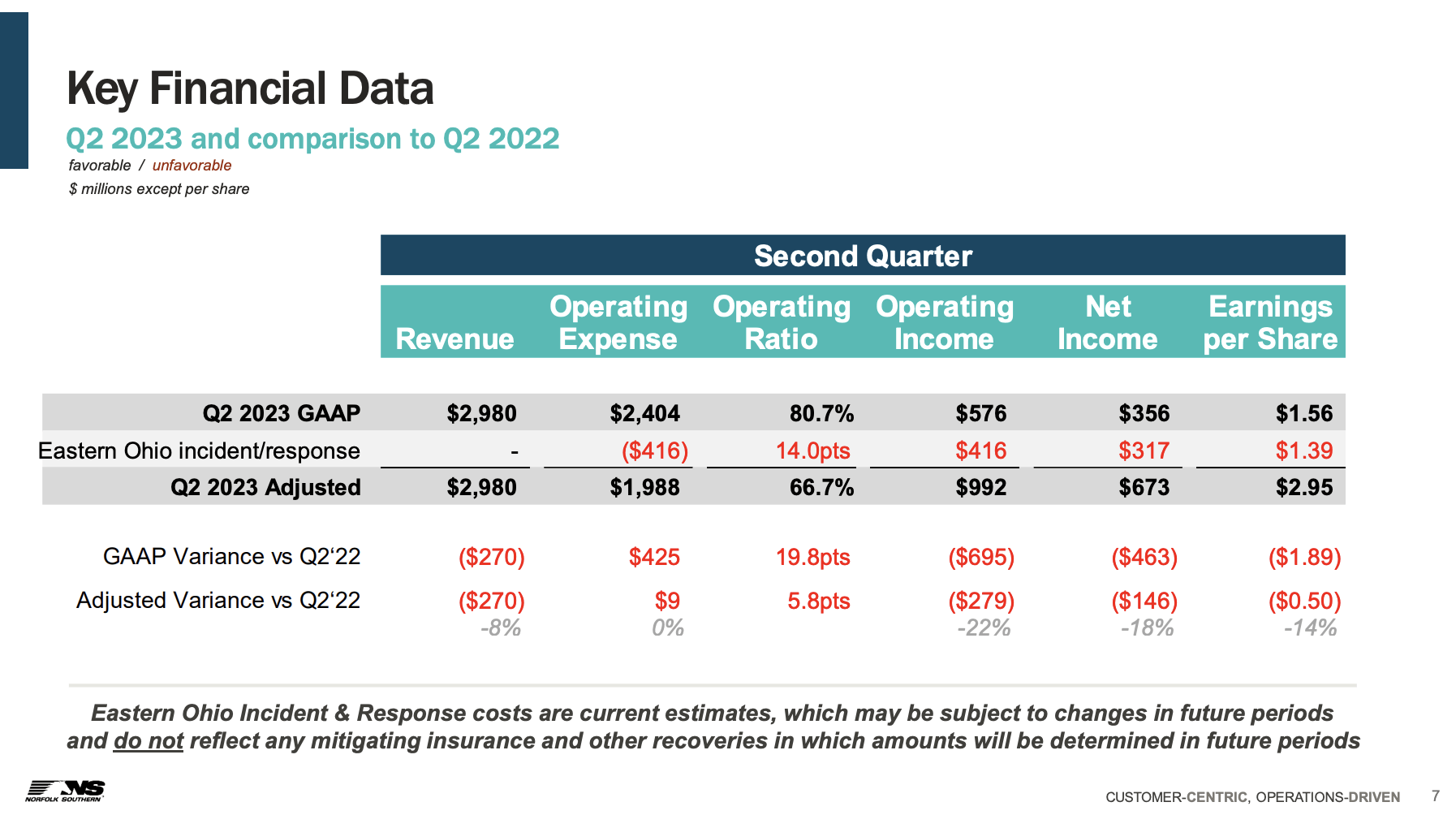

In the second quarter, a lot went wrong.

For example, revenue declined by 8%, as the company encountered 6% lower volumes and 3% lower revenue per unit. It saw declines in all segments, mainly in intermodal, which saw a 23% decline.

Norfolk Southern

On top of that, it saw slightly higher costs. Usually, expenses tend to fall in times of a freight recession. However, sticky inflation and the need to hire more people for efficiency reasons limited the company’s ability to cut costs.

As a result, operating income fell by a whopping 22%, which excludes $416 million in costs related to the East Palestine cleanup. The good news is that the company expects these East Palestine operations to moderate in the fourth quarter, allowing it to go back to normal in 2024.

Norfolk Southern

Due to the mix of weaker revenues and stable costs, the adjusted operating ratio soared to a multi-year high of 66.7%.

Bear in mind that the operating ratio measures how much the company spends on operations as a percentage of total revenues. The lower this number, the better.

There’s Light At The End Of The Tunnel

During the most recent Deutsche Bank Transportation Conference, Norfolk CEO Alan Shaw commented on economic developments and efforts to streamline operations.

For example, the company has been actively working on improving its service quality. According to Mr. Shaw, this effort led to significant outperformance compared to industry peers, making them more competitive in the market.

And you see it, right? If you take a look at our volumes, year-over-year comps relative to the rest of the industry since our service started to improve in late April, we’ve outperformed. So service sells, it might take a while, but service absolutely sells, which is why it’s so important to have that standard of care for operations that I talked about…

Related to this, Norfolk Southern’s optimism was also driven by the potential for cost savings in rail transport.

Shaw highlighted that many businesses were looking to shift their operations from trucking to rail to reduce transportation costs. This shift in demand presents an opportunity for Norfolk Southern to capture more market share and increase revenue.

Earlier this month, FreightWaves confirmed this trend in an article sponsored by CSX (NSC’s competitor).

FreightWaves

According to the article (emphasis added):

Rail providers used this time to increase and fine-tune their offerings, making rail an accessible option for worn-out shippers. For CSX, these efforts included expanding solutions that make it easier for companies that are not situated alongside a rail line to utilize a combination of long-haul rail and first-mile, last-mile trucking options.

[…] The market has since turned and trucking capacity is currently plentiful. The benefits of rail, however, continue to attract shippers regardless of trucking conditions. In addition to financial benefits, rail offers shippers a simple, well-established way to ramp up their focus on sustainability and reduce their greenhouse gas emissions.

Furthermore, and related to these trends, the company anticipates a return of volumes in the fourth quarter, particularly in the intermodal and industrial products segments.

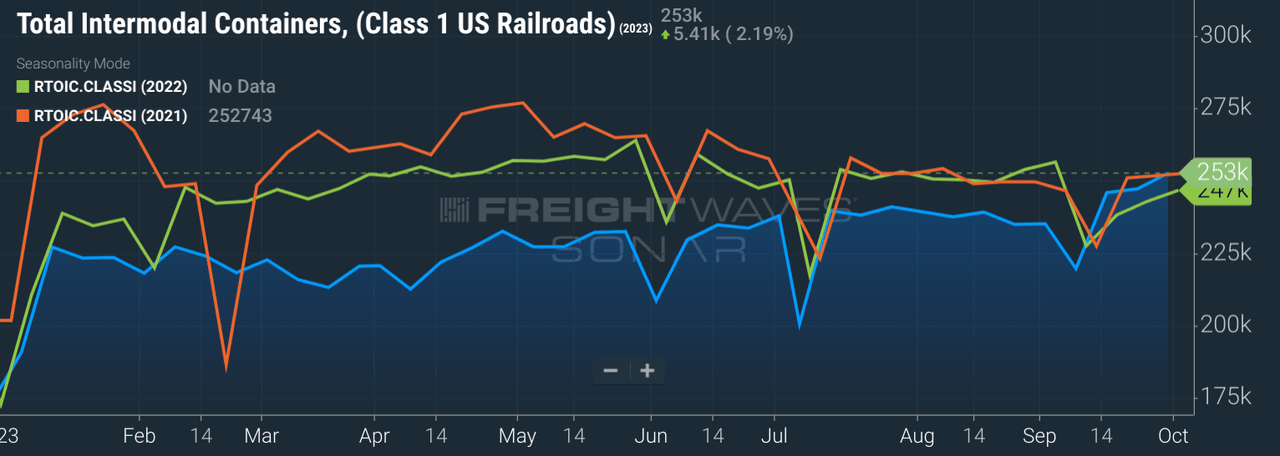

This, too, is somewhat confirmed (we’re in the early stages of a recovery) by FreightWaves data.

According to a report, September was the best month of this year for U.S. intermodal traffic.

U.S. freight railroads originated 1 million containers and trailers in September, a 0.7% increase compared to September 2022. Until now, year-over-year comparisons had intermodal volumes trailing year-ago levels.

FreightWaves

Additionally, metals and construction-related segments are performing well, largely due to the robust construction industry.

However, the energy-related segments, including utility coal, export thermal coal, NGLs, frac sand, crude oil products, and the chemical franchise, are experiencing a decline in volumes, and uncertainty looms as the year progresses.

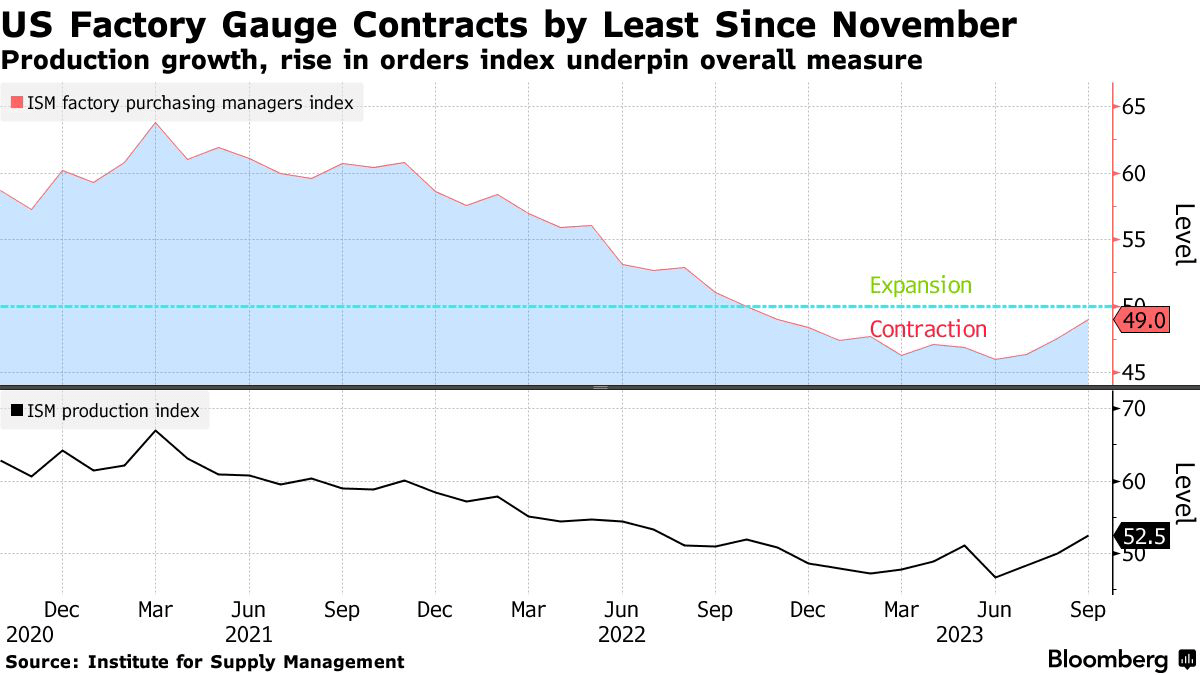

These comments make sense, as cyclical energy demand is not expected to recover until major economic indicators like the ISM Manufacturing Index recover.

Speaking of the ISM Index, this index has been in contraction since 4Q22 and in a downtrend since March 2020. Now, it’s recovering a bit to 49, which is the slowest contraction rate this year.

Bloomberg

This is a very important development for NSC.

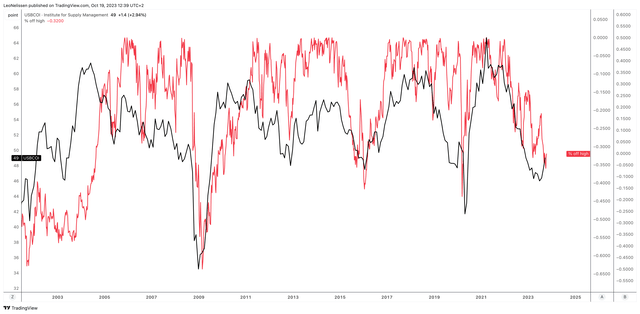

NSC’s stock price is highly correlated to the ISM Index. The chart below compares the total sell-off of the NSC stock price (% below its all-time high) to the ISM Index.

The lower the ISM index falls, the more NSC shareholders will suffer.

TradingView (NSC, ISM Index)

Right now, it’s fair to say that a manufacturing recession has been priced in, which makes the risk/reward of NSC quite attractive.

Norfolk Southern Dividends, Earnings & Valuation

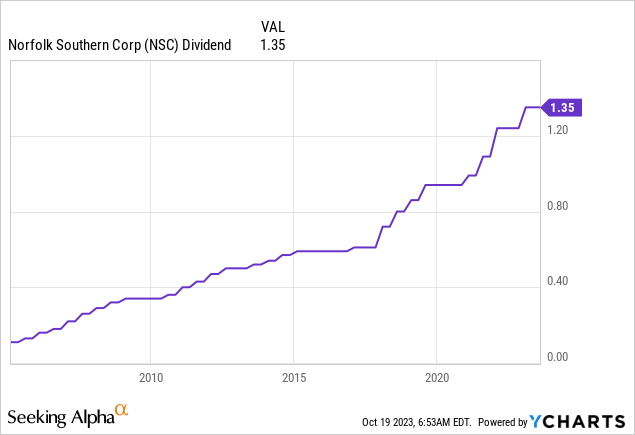

One of the reasons why I like NSC is that its outperforming total returns have come with (somewhat) consistent dividend growth. While NSC is not a company that hikes its dividend every single year, it has awarded its investors with long-term dividend growth.

During poor economic years, it refrains from hiking its dividend. During good years, it rewards investors with aggressive dividend hikes. I like that approach a lot.

NSC currently yields 2.7%. This dividend is protected by a 39% payout ratio, a 2.6x 2024E net leverage ratio, and a BBB+ credit rating (one step below the A-range).

On average, over the past five years, the company has hiked its dividend by 13.2% per year. The most recent hike was on January 24, when the company hiked by 8.9%.

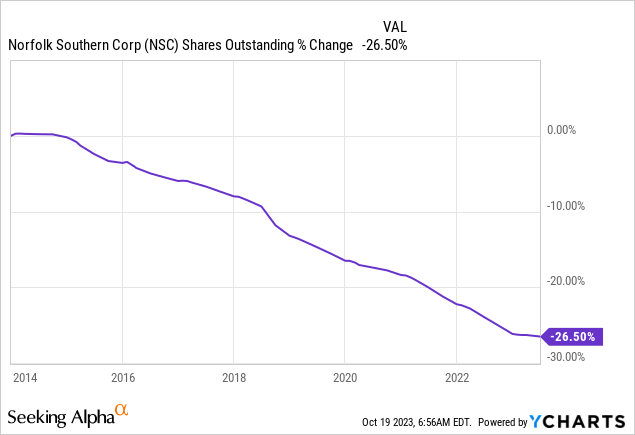

On top of that, NSC has bought back 27% of its shares since 2013, which has added tremendously to its ability to outperform the market.

Having said that, on October 25, Norfolk Southern will report its earnings.

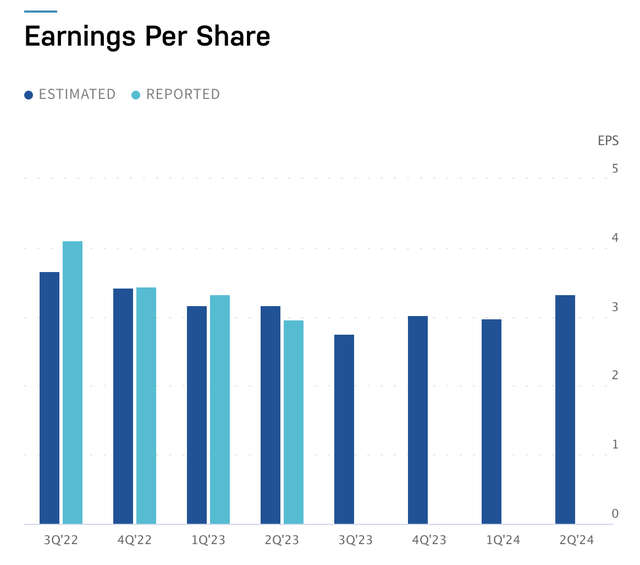

The company is expected to report $2.74 in EPS, with an expectation range of $2.62 to $2.87.

This number is based on eight estimates. Every single one of these estimates has been lowered over the past four weeks, which is an indication that analysts are going into this earnings call with very low expectations.

Last year, the company reported $4.10 in EPS, beating expectations of $3.61 by a wide margin.

Nasdaq

While I cannot make the case that the company will beat earnings again (there are just too many variables to take into account), the risk/reward has gotten good.

As we discussed in this article:

- Economic growth indicators are hinting at slower contraction.

- Intermodal demand seems to be stabilizing.

- The truck-to-rail conversion is going smoothly.

Going into the earnings call, investors need to look for comments regarding the three points above, as well as comments on the cleanup efforts in Ohio and potential long-term deals with companies benefitting from economic re-shoring.

I’m also eager to hear if the company still believes that the fourth quarter could see the start of an intermodal rebound.

If that is the case, we could be looking at a sustainable uptrend in NSC’s stock price – especially if the ISM index bottom is for real.

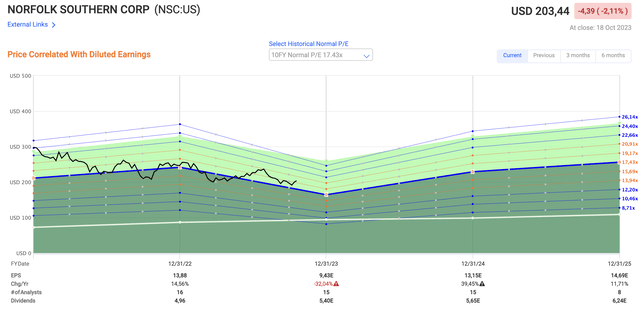

With that said, NSC is trading at 19.7x earnings. The 10-year average is 17.4x.

Despite this difference, it could still translate to an annualized return of almost 14% through 2025.

Why?

NSC is expected to see more than 39% growth in earnings next year, followed by a 12% increase in 2025.

FAST Graphs

So, even if the company’s valuation comes down, it could see high long-term returns.

Furthermore, it needs to be said that these estimates are highly dependent on the economic cycle.

As I just mentioned, analysts have significantly adjusted their expectations. Six months ago, analysts expected just 1% earnings contraction in 2023. Now, that number is 32%!

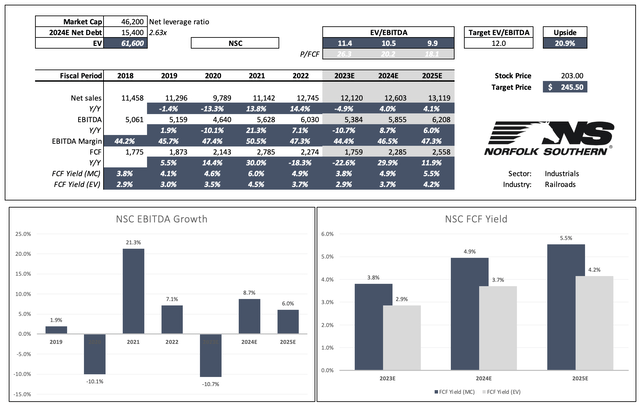

From an EV/EBITDA multiple, the stock is trading at 9.9x 2025E EBITDA. Applying a 12.0x valuation (longer-term median) would give the stock a $245 price target, 21% above the current price. The current consensus price target is $250.

Leo Nelissen (Based on analyst estimates)

Based on everything mentioned in this article, I like the risk/reward of NSC going into earnings. I like it a lot, which is why I have been buying NSC quite aggressively. My position is now almost 4x as large as it was when I bought NSC after the 2020 crash.

However, I am not making the case that we’re out of the woods. While developments are promising, we are still dealing with sticky inflation and the significant risks that come with a mountain of debt maturities.

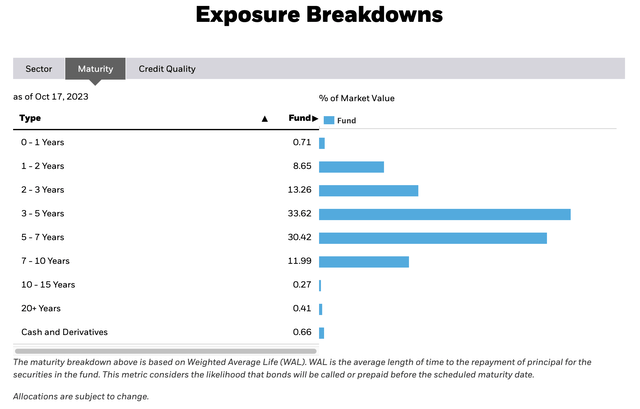

For example, junk bonds (HYG) will see rapidly rising maturities over the next 2-3 years. If rates stay elevated, we could see the real damage elevated rates can do to the economy.

iShares – HYG Maturity Ladder

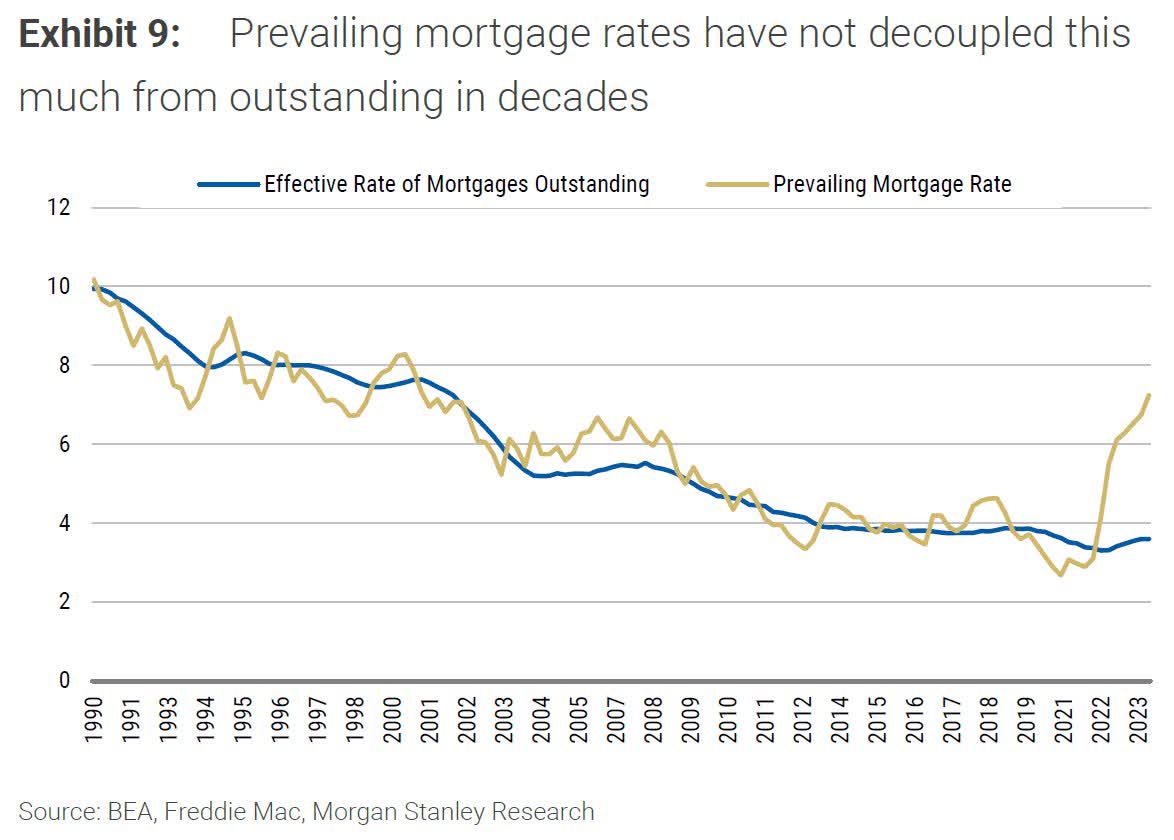

The same goes for the housing market. While rates are elevated, keeping people from selling their homes (creating supply shortages), the average existing mortgage rate is still low.

Morgan Stanley

I’m not saying we’re about to see a full-blown Great Financial Crisis-like recession. However, investors need to be careful. While I’m buying good companies at good valuations (like NSC), I do not expect that we’ll soon enter a strong bull market.

So, although I will continue to give NSC a bull rating, I want people to understand how I assess the risk/reward.

On a long-term basis, I expect NSC to outperform the market. The current valuation offers opportunities. 3Q23 earnings might help if the company is able to improve its operations and win new business.

However, investors need to be careful as we are not out of the woods yet.

Takeaway

Norfolk Southern has faced significant challenges recently, with its stock price down over 30%.

The company has had to deal with slower economic growth, sticky inflation, and a decline in intermodal volumes.

However, there are signs of hope on the horizon. The company has been working on improving service quality, making the company more competitive.

Additionally, the shift from trucking to rail for cost savings presents an opportunity for NSC to gain market share and increase revenue.

Intermodal volumes are showing signs of stabilizing, and the company is expected to report weak Q3 earnings, which could provide insights into its performance and result in a rally if it beats what seem to be very low expectations.

While there are risks to consider, NSC’s valuation and potential for elevated long-term returns make it an attractive prospect despite the current challenges.

So, keep an eye on NSC as it navigates these turbulent times.

Read the full article here