Solar power stocks fell hard in after-hours trading on Thursday following a warning from solar-equipment maker

SolarEdge Technologies

that demand in Europe has slumped significantly.

SolarEdge (ticker: SEDG) stock was down 26% in premarket trading Friday. Competitor

Enphase Energy

(ENPH) was down 16%.

Sunrun

(RUN) and

SunPower

(SPWR), which are solar developers, were down 9% and 10% respectively.

“During the second part of the third quarter of 2023, we experienced substantial unexpected cancellations and pushouts of existing backlog from our European distributors,” said SolarEdge CEO Zvi Lando in a statement. The company will report its full third-quarter earnings on Nov. 1, but its problems are clearly significant enough that it felt the need to warn shareholders.

Analysts at

Citi

lead by Vikram Bagri slashed their price target for the stock to $187 from $248 after the warning. Shares traded at about $114 on Thursday. Citi said the bear case for the stock is about $60.

Rooftop solar stocks have struggled in recent months. U.S. demand has waned because of high interest rates and less-generous state solar policies.

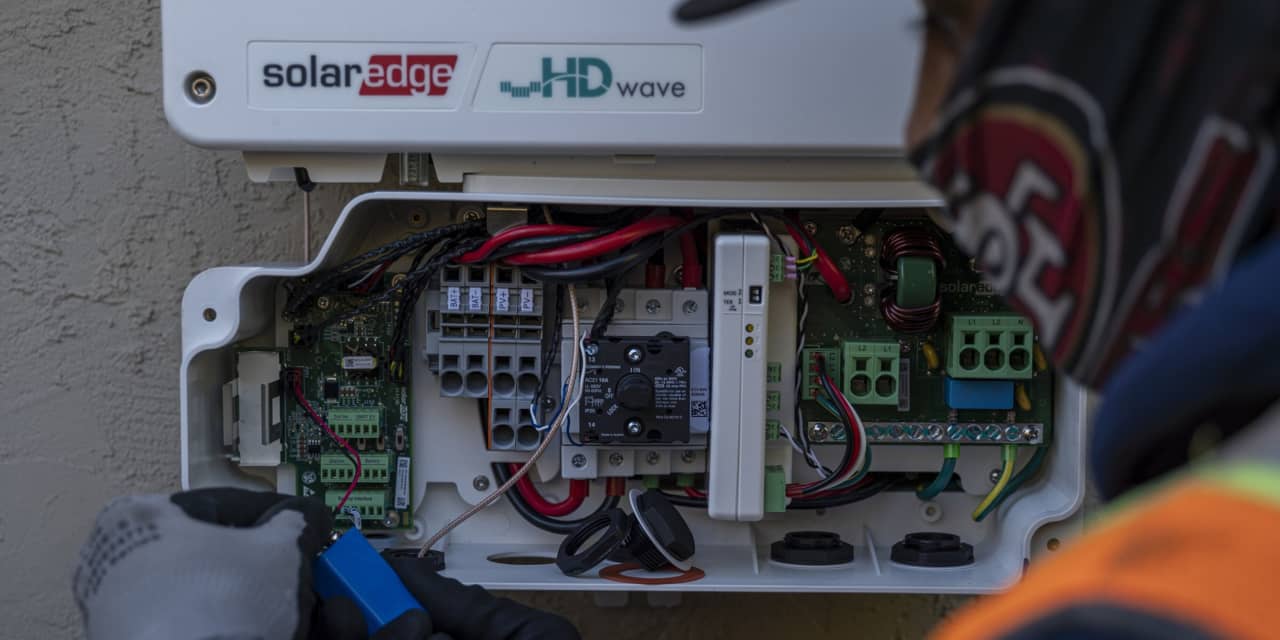

SolarEdge makes a piece of equipment called an inverter that turns direct current from a solar panel into alternating current that can be used in a home. The company cut its guidance for third-quarter revenue to a range of $720 million to $730 million, down from a previous forecast of $880 million to $920 million. Wall Street had been expecting $909 million.

Its operating income is now expected to be in a range of $12 million to $31 million, compared with management’s prior estimate of $115 million to $135 million.

SolarEdge said that solar installations typically pick up in late summer and September in Europe, but that hasn’t happened this year. And the problem looks like it will persist.

“Additionally, the Company anticipates significantly lower revenues in the fourth quarter of 2023 as the inventory destocking process continues,” SolarEdge said.

Write to Avi Salzman at [email protected]

Read the full article here