CVS Health Corp (NYSE:CVS) is not necessarily the greatest business in the world, but it is a stock I am quite convinced is a great investment. And I made several strong statements about CVS in the past. For example, in my last article – published in mid-June 2023 – I wrote:

And I see CVS Health as a screaming bargain right now and believe it would be negligent not to talk about the company (and stock) again.

And in the same article I concluded:

I might be wrong, but I easily see the potential for CVS to double in the coming quarters. In my opinion, CVS Health should be worth at least $150 or more and despite the risk of a recession and a potential bear market in the coming quarters, I see CVS as a great investment at this point.

And in an article published in January 2023, I already asked the question if I am wrong with my bullish thesis about CVS as the stock was not really performing as expected.

Psychology & Investing Rules

In the last few weeks, I revised my portfolio for several reasons, and I noticed that I have a few stocks in my portfolio where I am extremely convinced the stock is a great investment mostly due to the extreme undervaluation. I also noted that these companies often don’t fit my criteria for long-term investments, and I was starting to wonder if I actually follow my own investment rules.

My entire investment philosophy is structured around the idea to invest only in high-quality businesses I can hold for the long term. And I am trying to identify these investments by identifying companies with a wide economic moat around the business. It is not always easy to identify which company has a wide economic moat (as it is mostly a qualitative aspect) but there are several quantitative metrics indicating a wide economic moat.

The following article will therefore not only be an article about CVS, but also an article about investing psychology as well as a short guideline to identify companies with a potential wide economic moat around the business.

Bullish Thesis In A Nutshell

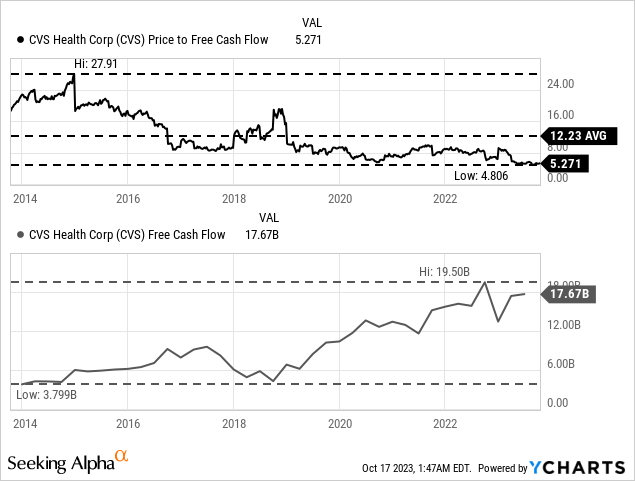

When I must explain the bullish thesis about CVS in only a few sentences, it comes down to the valuation. The bullish thesis is mostly based on CVS growing at least in the low-to-mid single digits and the stock price not matching these assumptions. It is not that CVS has an extremely wide economic moat around its business – it certainly doesn’t, and it is certainly not the high-quality business I am searching for. It is, what Warren Buffett would call a “fair company for a wonderful price”. And we certainly can make the argument for a wonderful price: CVS is valued like a declining business despite growing free cash flow and this is creating a bargain.

The stock is trading for 5 times free cash flow right now and unless a company is heading for serious trouble or bankruptcy, such a valuation multiple is hardly justified. It comes down to two possible scenarios:

- The market is completely wrong and is not seeing what an incredible bargain CVS actually is.

- I am missing something the market is seeing and/or I am too optimistic about CVS’ path forward in the years to come.

We will take CVS Health Corporation as example to question an entire long-term investment strategy as CVS seems to be the perfect candidate. On the one hand, I am so convinced that CVS is a great investment (due to extreme undervaluation) but on the other hand, I have my doubts if investing in CVS for the long-term is a great decision as I am violating several investing rules I have for long-term investments. Let’s take a closer look.

Return on Invested Capital

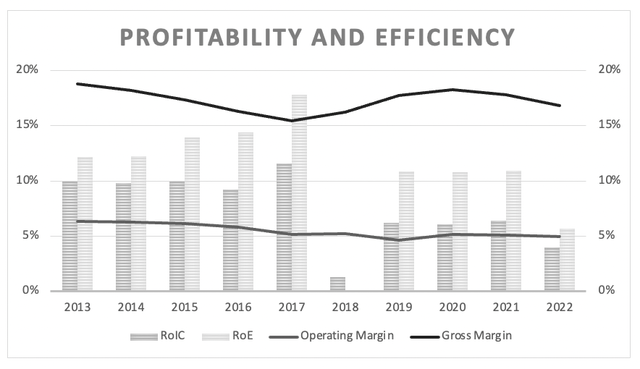

We can start by looking at one of the most important metrics that is indicating a great business with a wide economic moat – the return on invested capital. As threshold I mostly use 10% RoIC over at least 5 or 10 years on average. And CVS Health is not able to report these numbers. In the last ten years, the average RoIC was 7.45% and when looking at the last five years, CVS reported only a return on invested capital of 4.81% on average.

CVS: RoIC and Margins (Author’s work)

This is the first hint that CVS cannot be classified as a great business with a wide economic moat around the business.

Margins

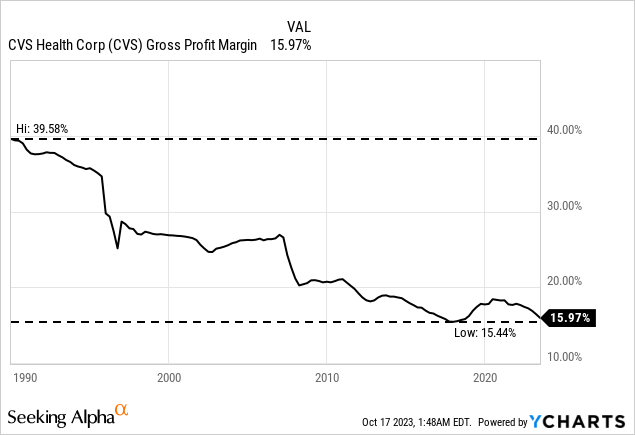

Another number I am looking at are the two important margins – the operating margin as well as the gross margin. Especially the gross margin is important as it can indicate pricing power for a business. Of course, high margins are good – but I am not paying so much attention to high margins, I am rather looking for stability and consistency. A great business can keep its margins at least stable (or is able to improve margins).

When looking at the chart above, CVS was able to keep its margins mostly stable. However, when looking at the operating margin and use stricter standards, the operating margin is slightly declining over the years. And when not only looking at the last ten years but at several decades, we see a constantly declining gross margin, which is not a good sign.

Of course, we must take into account that CVS made several (major) acquisitions in the last few decades and expanded its business. And while expanding the business can be a solid strategy, it sometimes leads to lower margins as different business segments have different margins. Nevertheless, the declining gross and operating margins are not a good sign and should also make us question if CVS is a great long-term investment.

Balance Sheet

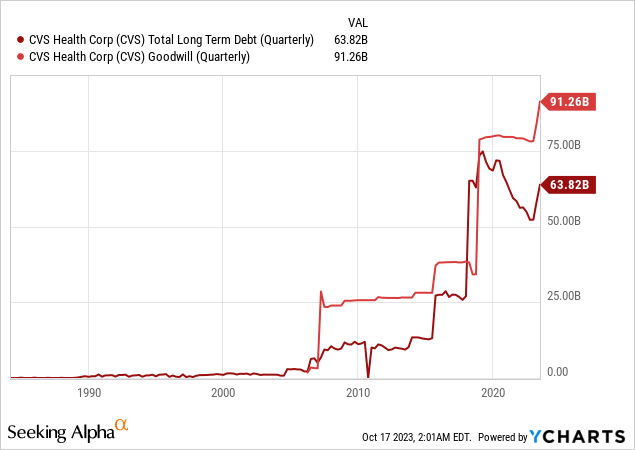

A third warning sign for a business in trouble can be a deteriorating balance sheet. And while I have clear rules for RoIC and the company’s margins, it is more difficult to have certain thresholds for the balance sheet. It is more difficult to define what goodwill or debt levels are acceptable and what levels are not. But I think we can agree that a high-quality business should be able to finance growth without having to take on huge amounts of debt. And management of a great business should make smart acquisitions that don’t lead to extreme levels of goodwill and ultimately to necessary goodwill impairments.

Looking at the absolute numbers, we see constantly increasing amounts for long-term debt as well as goodwill since about 2005. Aside from looking at the absolute numbers we must also put the numbers into context. For a business constantly growing (higher revenue, higher free cash flow, higher stockholder’s equity) it also seems acceptable that several items on the balance sheet will also increase – including long-term debt and goodwill. Hence, we must put the numbers into context.

When comparing the total debt of $63,821 million to the shareholder’s equity of $73,002 million, we get an acceptable D/E ratio of 0.87. On the other hand, a big part of assets is goodwill ($91,260 million) and when subtracting goodwill from assets, CVS would have to report a shareholder’s deficit. When subtracting cash and equivalents ($13,807 million) from total debt, it would take about 3.5 times the current operating income ($14,108 million). These metrics are still acceptable but in combination with the extremely high goodwill, the balance sheet is certainly not great.

Stock Performance

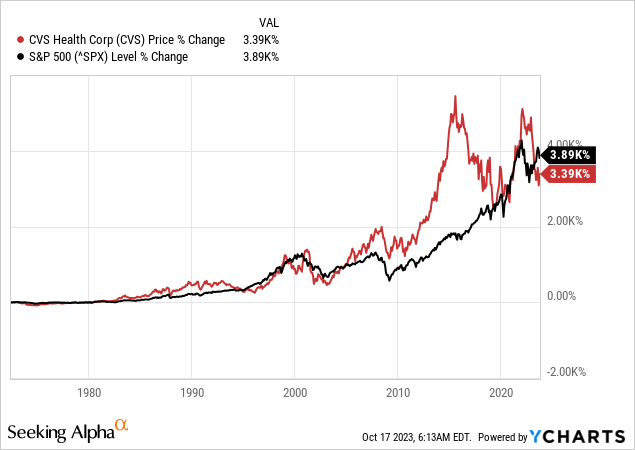

Another sign for a wide moat company is a stock clearly outperforming the index (we usually look at the S&P 500). And there have been times when CVS was beating the S&P 500, but right now we could say that an investment in CVS is in line with an investment in the S&P 500. And investing in individual stocks only makes sense when we are beating the index. If I only achieve returns similar to the index, one could invest in the index as well – the performance is similar, but the risk is much lower.

And especially in case of CVS we have long-term data since the 1970s and over such a long timeframe – about half a century – a company with a wide economic moat should have clearly outperformed the index.

GAAP Accounting

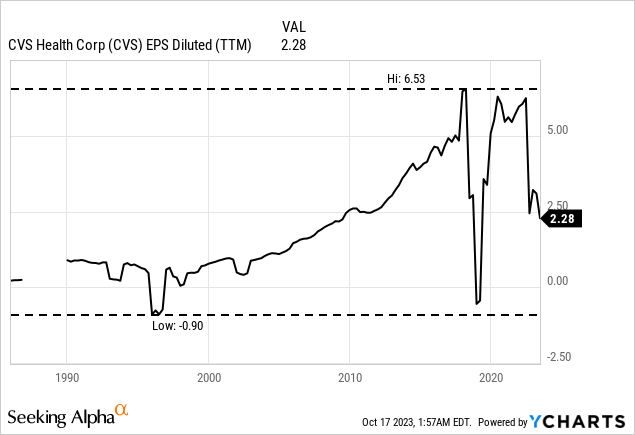

I mentioned several times that I don’t care for adjusted numbers, and I am mostly looking at GAAP numbers (earnings per share or margins). But sometimes I make an exception and look at the adjusted numbers – and CVS is such an exception. Because looking at the GAAP numbers is presenting a messy picture, and it is much easier to look at the adjusted numbers which are indicating bottom line growth.

When looking at the GAAP EPS numbers, we see wild fluctuations and we certainly should not ignore that messy picture and these wild fluctuations. On the other hand, free cash flow is growing with a solid pace (see chart above) and in my opinion free cash flow is the more important metric for the business.

Summing Up

So far, we discussed several – mostly quantitative – metrics to watch out for when trying to identify a great long-term investment. And we must be honest to ourselves: CVS is not really in line with any of these metrics and thresholds I have, begging the question if CVS should actually have its place in any long-term portfolio.

It seems like CVS is the perfect example for Buffett’s fair company for a wonderful price. The main argument to invest in CVS at this point, is the price and not the underlying business. And this can work for several years, but I am not sure if such a business is qualified as long-term investment.

What To Do

The question now is what to do about CVS. I will hold on to my CVS investment and I still would argue it is a (great) buy at the moment as the risk-reward ratio is in our favor (in my opinion). And I am assuming that CVS will be a great investment in the next few years. The reason why CVS might be a great investment is the “reversion to the mean” – we can assume that the price-free-cash-flow ratio will return to more reasonable multiples and the 10-year average of 12.2 (still a low number) seems like a reasonable first target. And such a strategy of betting on a reversion to the mean can generate rather high profits in a short time.

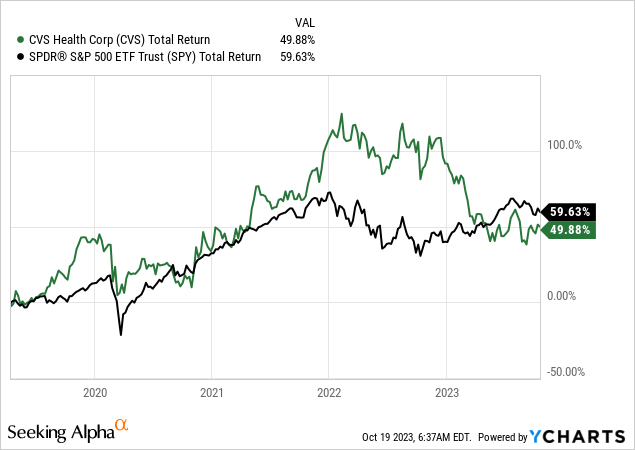

CVS also has not been a terrible investment for me. Since I bought CVS for the first time in April 2019 (I increased my position in the meantime), the stock gained in total 50% (including dividends). And although we slightly underperformed the S&P 500 (SPY), I would still this as a solid investment.

Like I said, I will hold on to CVS and I am still convinced the stock will double over the next few years. We just have to keep an eye on CVS and check on the stock (and business) again and again as it is probably not a stock we should hold forever. Although we can assume a solid performance by CVS – in line with the S&P 500 for example – there might be better investments out there. And we should also not ignore the risk of CVS’ business model suddenly not working anymore: Due to the absence of a wide economic moat (maybe is has a very narrow moat) it is much easier for competitors to pressure the business and for example Amazon (AMZN) can still be seen as a potential candidate for such a competitor).

Lessons For A Long-Term Investor

And while I argued that we can invest in CVS right now and betting on a reversion to the mean, which might generate higher profits in the next few years, we should not see CVS as great long-term investment and a stock to hold for several decades. Maybe we should ask ourselves what types of investments we should make. It is fine to invest in companies like CVS (extremely undervalued stocks) and there is the potential to make huge profits – but we should not brand that strategy as a long-term wide moat strategy.

When looking at my portfolio, I actually could identify a few more stocks that seem to fit that pattern of “ignoring my own rules”. A prominent example might be Fresenius SE (OTCPK:FSNUF) – another investment of mine which I am quite bullish about. The pattern is similar: I know that Fresenius is not the greatest company on earth, but I see the stock as extremely undervalued at this point and assume it must go higher. And similar to CVS, the market also has a different opinion about Fresenius SE and is keeping the stock at much lower prices than I calculate as intrinsic value.

At least my CVS investment and my Fresenius investment have several aspects in common:

- Debt Levels: Both companies have high debt levels that could become problematic – especially in a rising interest environment. And not only do both companies seem to have high debt levels, but the debt also seems to be increasing as both businesses are trying to fuel growth by expensive acquisitions.

- Goodwill: The high number of acquisitions also leads to high levels of goodwill for both businesses and going hand in hand is the risk of goodwill impairments that might be necessary in the future if acquisitions are not leading to expected returns.

- Low RoIC: Both companies have a return on invested capital below my 10% threshold and as RoIC is one of the most important metrics for wide moat companies, this should actually be an exclusion criterion.

- Declining Margins: Both companies have to report rather declining margins over the long term – another bad sign for a long-term investment.

Maybe these are the wrong investments, and I should try to move away from focusing on valuation and not be convinced by extremely low valuation multiples that we are looking at a great investment.

Over the long run we should not bet on companies that generate most of the returns by a reversion to the mean (as this reversion to the mean can only happen once). We should bet on companies being able to grow with a high pace for a long time due to a wide economic moat – driving long-term stock gains.

Conclusion

Like I said, I will hold on to CVS and I still see the stock as a strong buy at this point. And I assume the stock will perform well over the next few years as we will most likely see a reversion to the mean regarding valuation multiples. But in a few years (when the stock reached its fair value or trading for “normal” valuation multiples again) we must take another look and decide if we keep on holding CVS as the company is not fitting the criteria for a wide economic moat company that can qualify as long-term investment we can hold for several decades. And I personally have to decide for myself if I want exclusively to invest in long-term high quality businesses (the wonderful business as Buffett calls it) and adjust my strategy accordingly.

Read the full article here