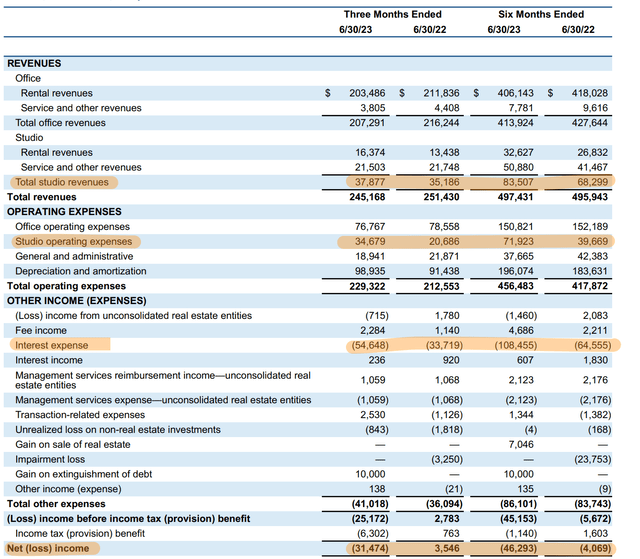

I’ve closed my Series C preferreds position in Hudson Pacific Properties (NYSE:HPP) (NYSE:HPP.PR.C) at a decent gain on the back of the suspension of talks between the actors union and the Alliance of Motion Picture and Television Producers (AMPTT), a trade association representing US television and film production companies including Netflix (NFLX) and Disney (DIS). The dual strikes by unions representing writers and actors have formed a critical headwind for Hudson who generated 17% of its revenue from the studio segment of its portfolio in the six months from the end of its fiscal 2023 second quarter. These have essentially become shadows of their earnings potential for months and the September resolution of the writers’ strike represented hope that this period of disruption to Hollywood movie production, similar in scale to the pandemic-led shutdowns, would come to an end.

Hudson Pacific Properties Fiscal 2023 Second Quarter Supplemental

The impact on Hudson has been material with the REIT’s move to entirely suspend a quarterly dividend that had already been cut in half to $0.13 per share blamed on the ongoing strike. This was announced nearly two months ago and the actors’ strike, which commenced on 14 July 2023, is still ongoing and looks likely to be dragged into 2024. Hudson is different from other REITs in that it also owns Quixote, a provider of sound stages, and production equipment and services to the entertainment industry. Quixote was acquired back in September 2022 for $360 million in a fully debt-funded deal that’s compounded the pain of the strikes. To be clear, the impact of the strikes was always clear, but this was always going to be constrained depending on the timeline. A strike stretching into a second year represents the worst case scenario and ramps up the negative impacts for Hudson.

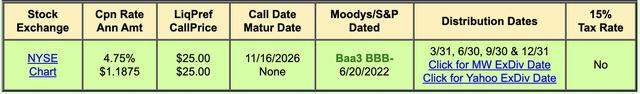

Hudson’s Series C Preferreds

I bought Hudson’s Series C preferreds (HPP.PR.C) around Christmas of 2022 and added to this position when the price dipped to record lows in the summer of 2023 on the back of angst over rising interest rates and the banking crisis. These preferreds are currently trading for $10.45 per share, around a 58% discount to their par value of $25 per share. Further, with a fixed $1.1875 annual coupon they’re sporting an 11.4% yield on cost. Whilst these were rated Baa3 by Moody’s when they were issued in November 2021, Hudson would now be unlikely to get what’s the lowest investment grade rating on the back of the extended strike and a still uncertain outlook for its end.

QuantumOnline

The attraction of the preferreds was always built around the marked discount to their intrinsic value with investors currently able to pick them up for 42 cents on the dollar and with a yield to redemption that sits at 38%. Redemption will come up on or after the 16th of November 2026. The risk and reward paradigm when I entered the position was skewed to the reward side, but the preferreds are currently trading roughly in line with their pre-summer 2023 level despite the REIT’s fundamentals having deteriorated and with a material headwind that has no certain date as to when it will end. It simply made no sense to maintain the position without a repricing to a lower base that would encapsulate the heightened risk specter that now looms over the REIT.

The Financial Picture

Don’t fall in love with your stocks. I had built Hudson’s preferreds to the largest sole position within my portfolio and it had come to form the direct opposite of a sleep well at night stock. The breakdown of what was expected to be a quick resolution to the actors’ strike that will soon enter its 100th day was the final straw. Hudson currently pays its preferred shareholders $5.2 million per quarter, $20.8 million per year. This is not a large expense for a REIT that’s about to make annual savings of $143 million per year, around $36 million per quarter, on the back of the suspension of its common share dividends.

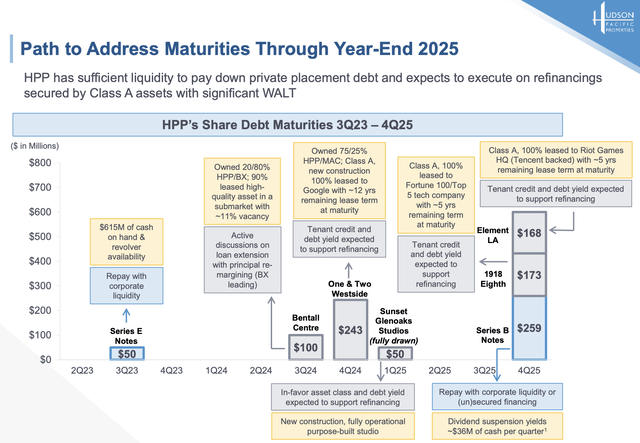

Hudson Pacific Properties September 2023 Investor Update

The REIT has also spelled out how it plans to address its upcoming debt maturities through 2025 with a mix of liquidity on hand, refinancing, and asset divestitures. Critically, liquidity stood at $615 million as of the end of the second quarter with cash and equivalents forming a strong backdrop for the continuation of the preferred dividend. However, this is just too much uncertainty against a backdrop recently described by JPMorgan’s (JPM) Jamie Dimon as the most dangerous time the world has faced in decades. Hudson’s suspension of its commons dividend was a necessary defensive move in light of the continuation of the strike, I’m not sticking around to see if the preferreds are also suspended. I’ll likely revisit the ticker in the new year.

Read the full article here