Introduction

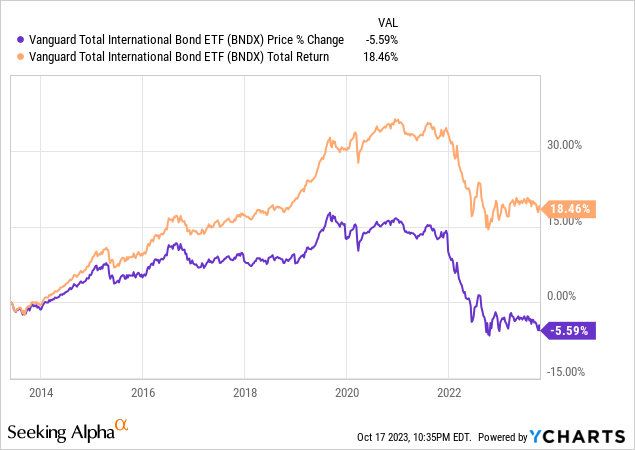

We previously covered Vanguard Total International Bond ETF (NASDAQ:BNDX) back in April 2020 (click here for the article). At that time, it was during the peak of market fear, and we mentioned that the fund should appreciate its fund price as the market fear recedes. It has played out as we expected through the rest of 2020 and much of 2021. However, the fund has since lost over 17% of its value from the peak in late 2021. We believe it is time for us to write another review.

ETF Overview

Vanguard Total International Bond ETF owns a portfolio of investment-grade international treasury and corporate bonds. Its expense ratio of 0.07% is considered cheap as the fund invests in international bonds. The fund has little credit risk as it only owns investment-grade corporate and sovereign bonds. As inflationary pressures in the U.S. and other major markets across the globe subsides, BNDX should enjoy meaningful capital appreciation. We believe this will gradually happen in 2024 and continue through 2025. Therefore, it may be a good chance to own BNDX right now, especially for investors with a long-term investment horizon.

YCharts

Fund Analysis

BNDX has declined significantly since late 2021

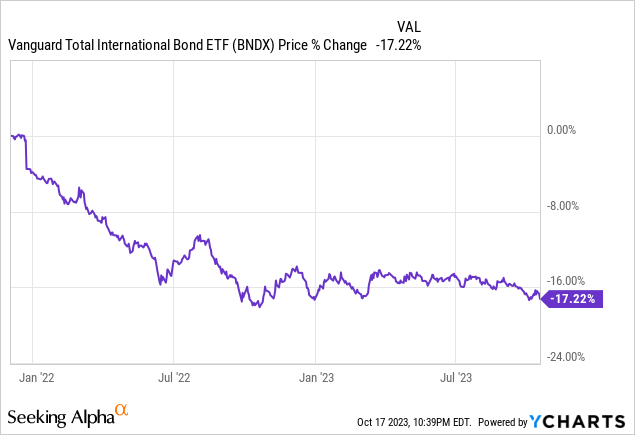

Last year was a challenging year for the bond market. BNDX was no exception. As can be seen from the chart below, the fund has fallen sharply in the first half of 2022 and continued to trend lower in the second half of 2022. Although 2023 has been a better year than last year, BNDX’s fund price continued to trend lower albeit at a slower pace and appears to be testing the trough reached in 2022. Overall, the fund has lost 17.2% of its fund price since late 2021.

YCharts

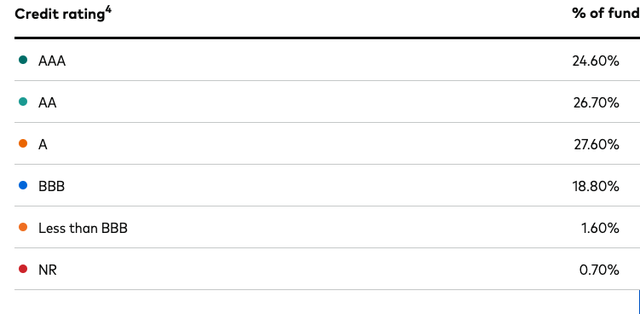

BNDX has low credit risk

The vast majority of BNDX’s portfolio is investment-grade bonds and treasuries. In fact, AAA, AA, A, and BBB bonds represent nearly 98% of its total portfolio. Only about 18.8% of BNDX’s portfolio belongs to the lowest credit rating of investment-grade bonds. Hence, BNDX’s portfolio appears to be quite safe with minimal credit risk.

Vanguard Website

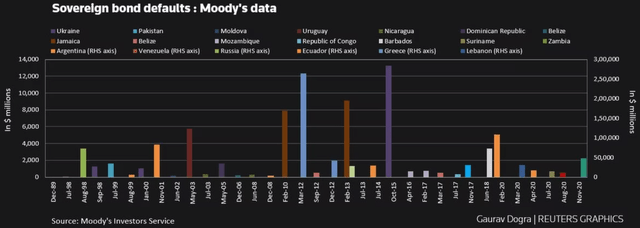

Now, let us examine the credit risk of sovereign bonds in BNDX’s portfolio. Below is a chart that shows the number of sovereign bond defaults in the past 4 decades. These countries usually have non-investment grade credit ratings. The good news is that BNDX’s portfolio does not include sovereign bonds from these countries.

Reuters

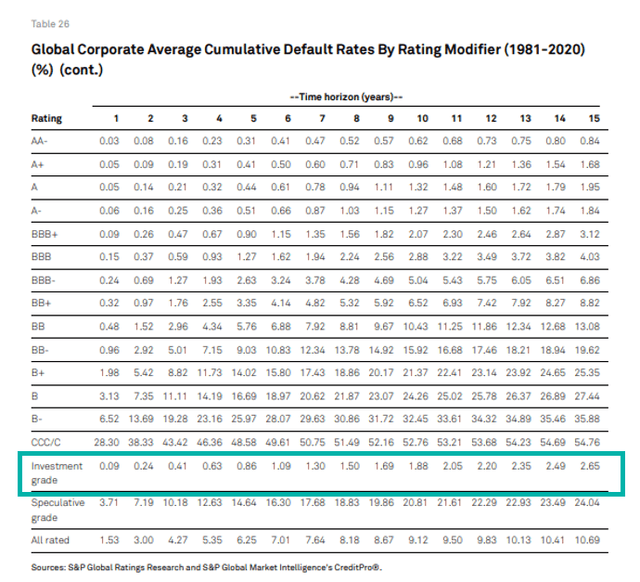

For corporate bonds in BNDX’s portfolio, the risk is also quite low. As can be seen from the chart below, global corporate average cumulative default rates for investment grade bonds over 3, and 10 years are only 0.41% and 1.88%. Therefore, we conclude that credit risk is quite minimal.

S&P Global Ratings Research

However, its yield is not attractive relative to its U.S. peer fund

Although BNDX has a quality portfolio of international investment-grade corporate and sovereign bonds, its 30-day SEC yield is only about 3.5%. This is much lower than the 4.9% SEC yield of its U.S. peer, Vanguard Total Bond ETF (BND), and the 4.8% yield of the 10-year U.S. treasury. We believe this rate difference between BNDX and BND is primarily due to the less aggressive rate hikes by the central banks of many major international markets last year. For example, Euro Area, which accounts for about 40% of the bonds issued in BNDX’s portfolio, has a much less aggressive rate hike trajectory than the Federal Reserve. Japan, which accounts for 14.1% of the bonds issued in BNDX’s portfolio has not even raised its rate nor ended its quantitative easing policy yet.

Should you consider owning BNDX in your portfolio?

For income investors, we see little reason for owning BNDX as its interest yield is less than the interest yield of its U.S. peer BND and the 10-year treasury. However, there may be room for capital appreciation.

We believe there are generally two forces that depict the fund price of BNDX: (1) the strength of the U.S. dollar, and (2) the interest rate of the bond-issuing country. We will take a look at the strength of the U.S. dollar first.

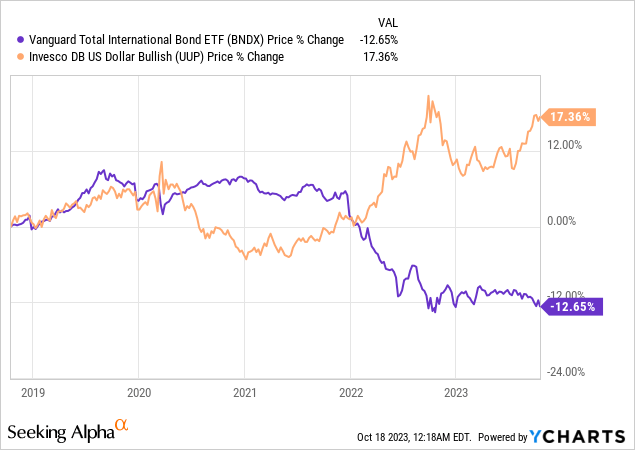

As can be seen from the chart below, BNDX’s fund price is often inversely correlated to the strength of the U.S. dollar.

YCharts

What depicts the strength of the U.S. dollar is often the Federal Reserve’s monetary policy unless there is a major international crisis that results in money seeking safety shelter in the U.S. dollar. For the Federal Reserve to relax its monetary policy, inflation needs to be under control. Fortunately, inflation is showing signs of easing as the annual inflation rate has dropped from above 8% last year to 3.7% last month. As inflation pressure continues to ease, the Federal Reserve will eventually have room to relax its monetary policy. This will likely be an event in late 2024 or 2025 when inflation gradually drops below 3%.

Another force that depicts the fund price of BNDX is the interest rate of the bond-issuing country. Here, we will look at the 3 markets in which BNDX has the highest exposure. As can be seen from the table below, the Euro Area’s inflation rate is expected to drop from the current level of 4.3% to 2.3% and 2.1% by the end of 2024 and 2025 respectively. Similarly, Japan’s inflation rate is expected to trend lower from the current level of 3.1% to 1.9% and 1.6% by the end of 2024 and 2025 respectively. In the U.K., the inflation rate is also expected to drop from the current level of 6.7% to 2.5% and 1.7% by the end of 2024 and 2025 respectively. Since bonds issued from these 3 markets account for over 60% of BNDX’s total portfolio. Declining inflation rates should result in lower interest yields. This should eventually result in a rise in BNDX’s fund price.

|

Current Inflation Rate |

Projected inflation by the end of 2024 |

Projected inflation by the end of 2025 |

Percentage of BNDX’s portfolio |

|

|

Euro Area |

4.3% |

2.3% |

2.1% |

40.0% |

|

Japan |

3.1% |

1.9% |

1.6% |

14.1% |

|

U.K. |

6.7% |

2.5% |

1.7% |

6.7% |

Source: Trading Economics website, Created by author

Investor Takeaway

For income investors, BNDX is not the best choice. However, for investors wishing to capture some capital appreciations outside of the U.S., BNDX may be a suitable choice to consider. The fund should benefit from an eventual weakening U.S. dollar and the drop in global inflationary pressure. Hence, we see meaningful capital appreciation from the current level through 2025.

Read the full article here