Note: I have covered Teekay Corporation (NYSE:TK) previously, so investors should view this as an update to my earlier articles on the company.

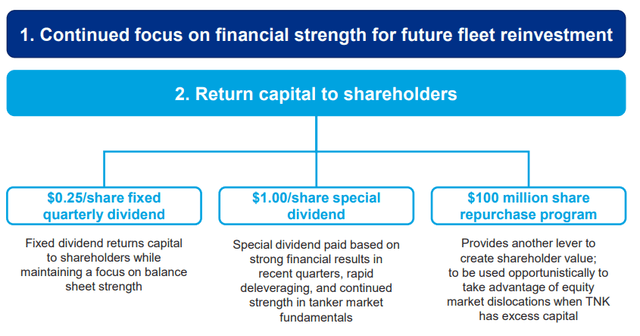

On Thursday, Teekay Corporation (“Teekay”) shares rallied by approximately 12% after subsidiary and main asset Teekay Tankers (TNK) reported record first quarter results and announced the initiation of a $0.25 quarterly dividend. Even better, “given the company’s outstanding financial performance over the last year,” Teekay Tankers decided to pay a special cash dividend of $1.00 per share.

Teekay Tankers Presentation

Remember, Russia’s assault on Ukraine has reshaped the tanker markets as sanctions have led to trade recalibration towards longer distances with refinery dislocation adding further to ton-miles.

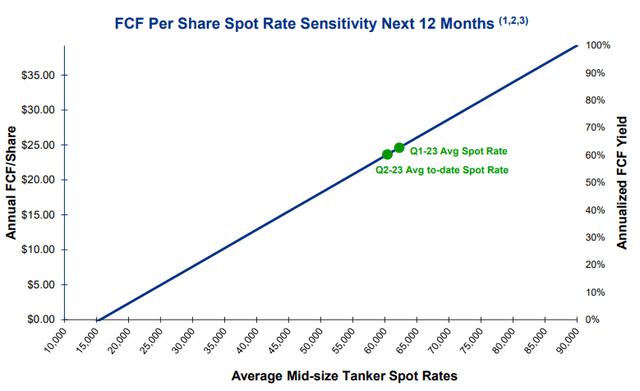

As a result, Teekay Tankers is generating decent amounts of cash with the company’s annualized free cash flow yield approaching 60% at current charter rate levels.

Teekay Tankers Presentation

With Teekay owning close to 9.7 million shares of Teekay Tankers, the company will receive approximately $12.1 million in dividend payments in June, which are likely to be directed towards further share buybacks.

Since reporting earnings last quarter, Teekay Parent has continued to return capital to its shareholders in an accretive manner. Following the completion of our $30 million share repurchase program that was announced in August 2022, we announced a new $30 million repurchase program in March 2023. Since that time, we have repurchased 2.8 million common shares for $15.8 million. Since August 2022, we have repurchased 9.3 million common shares, or approximately 9.1% of the outstanding common shares immediately prior to commencement of the prior program, at an average price of $4.93 per share.

In Q1 alone, Teekay Tankers generated almost $200 million of free cash flow and based on the company’s preliminary first quarter daily time charter equivalent (“TCE”) rates provided in Thursday’s earnings presentation, Q2 cash generation might be at similar levels but with below 50% of available days fixed, there’s apparently some uncertainty for the remainder of the quarter.

That said, the company only needs approximately $8.5 million dollar for the newly announced quarterly dividend so there will be plenty of room for share buybacks or additional special dividends going forward.

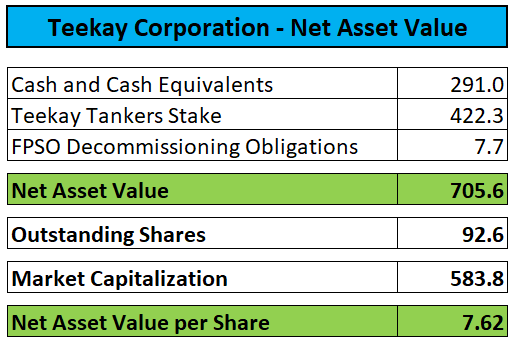

Please note that even after Thursday’s rally, Teekay Corporation still trades at an approximately 20% discount to net asset value (“NAV”):

Company Press Releases and SEC-Filings

Bottom Line:

With shares still trading at a sizeable discount to NAV and Teekay Corporation now expected to receive at least $20 million in dividends from Teekay Tankers over the course of the next thirteen months, I would expect the company to continue its recent share buyback activity. This should result in the TK discount to net asset value narrowing further.

Given ongoing, healthy tanker market fundamentals, I am reiterating my “Buy” rating on Teekay Corporation shares.

Read the full article here