The healthcare segment has been an underperformer for the past several quarters. Within the sector, investors can choose various industries, such as the always popular pharmaceuticals, and it is easy to enhance healthcare sector investment exposure through industry-specific ETFs. Due to the diversity of positions and medical devices represented, the iShares U.S. Medical Devices ETF (NYSEARCA:IHI) is a popular means to gain exposure to the US medical device industry. It seems my last review of IHI on Oct 4, 2021 coincided with a topping process in share price at $61. Currently trading at $46, IHI offers both a diversified portfolio and an acceptable valuation. However, IHI’s long-term performance is mixed based on the yardstick used.

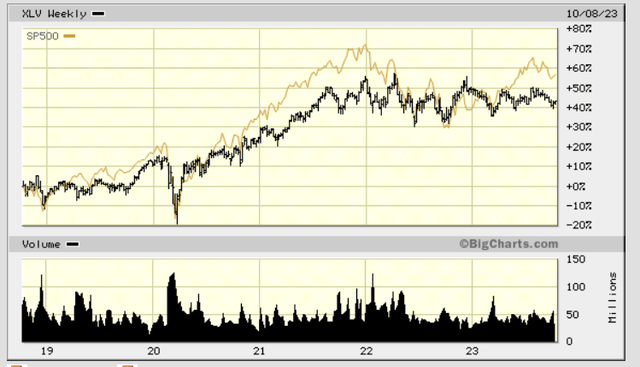

The healthcare sector remained a relative safe haven through the 3rd quarter seasonal weakness, as reflected in the pullback in values by most secular and cyclical growth stocks over the past few months. In contrast to many industrial sectors that have rallied strongly over the past 6 months, healthcare has lagged in the broader market but is showing signs the sector may finally be improving. Since May 2022, the S&P 500 healthcare sector has been in a trading range. The 5-yr weekly chart below of the Health Care Select Sector SPDR Fund (XLV) clearly expresses this range and illustrates the underperformance of the sector. It is important for investors to note that healthcare underperformed the market for 15 months, from a bottom in Sept 2020 to Jan 2022. So far in 2023, the S&P 500 continued to move higher while healthcare remained stuck in a quagmire.

5-Yr Chart XLV vs SPY (bigcharts.marketwatch.com )

The next chart clearly illustrates the underperformance through mid-Sept 2023. The 4-year RBC chart compares the relative performance of the S&P 500 Healthcare Index weekly to the SPY. Technically, the sector appears to have made a bottom in relative underperformance, indicating better times may lie ahead.

Healthcare Relative Performance vs SPY (Royal Bank of Canada)

If the healthcare sector has turned the corner on relative performance, non-pharmaceutical industries could provide interesting opportunities and potentially better value in the longer term. However, non-pharma industry ETFs have largely underperformed in most time periods compared pharma ETFs. Pharma companies will be under profit pressures for the foreseeable future in my view as Medicare pricing seems in jeopardy. Headline news indicates an annual slow rollout of 10 to 20 additional “negotiated” product pricing, implying a growing negative impact on pharma profitability over time. These drugs will be chosen as the “costliest” for Medicare, which also implies some of the most profitable for drug companies. While lower prices for the first ten Medicare drugs are unlikely to take effect until 2026, the impact will only grow afterward as the list of targeted drugs expands, with the program expected to save an estimated $98.5 billion over ten years.

Investors should read this not only a cost savings for Medicare and their own out of pocket expenses but as a $98.5 billion reduction in profitability for some of the most popular and valuable drugs. While pharma is a big part of the healthcare segment, there are multiple sub-industries worthy of investigation.

There are seven non-pharma sub-industries in the healthcare sector. These are: Healthcare Equipment, Healthcare Supplies, Healthcare Distributors, Healthcare Services, Healthcare Facilities, Healthcare Technology, and Managed Healthcare. Listed below are ETFs covering these industries, along with breakdown of industries:

SPDR S&P® Equal-weight Healthcare Equipment (XHE): 70% Healthcare Equipment & Healthcare Supplies, 12% Diversified Consumer Services.

SPDR S&P® Healthcare Services ETF (XHS): 63% Healthcare Providers & Healthcare Services, 12% Healthcare Technology.

iShares U.S. Medical Devices ETF (IHI): 93% Healthcare Equipment & Healthcare Supplies.

iShares U.S. Healthcare Providers ETF (IHF): 90% Healthcare Providers & Healthcare Services.

First Trust Indxx Medical Devices ETF (MDEV): 88% Healthcare Equipment & Healthcare Supplies.

ROBO Global Healthcare Technology ETF (HTEC): 51% Healthcare Equipment & Healthcare Supplies, 49% Healthcare Technology

For pharma ETFs, popular selections include: VanEck Pharmaceutical ETF (PPH), iShares U.S. Pharmaceuticals ETF (IHE), Invesco Dynamic Pharmaceuticals ETF (PJP), and First Trust Nasdaq Pharmaceuticals ETF (FTXH).

Listed below are total annual returns as of Oct 17, 2023, with dividends reinvested, for each of these ETFs for the past 3-yrs, 5-yrs, and 10-yrs, and compared to the largest healthcare ETF, SPDR S&P Health Care Select Sector ETF (XLV).

HC Industry ETF Annual Investment Returns (dividendchannel.com, Guiding Mast Investments)

Surprisingly, only two of these 10 industry-specific ETFs outperformed the most widely owned and diversified sector ETF, XLV, and only from a long-term perspective, i.e., 10-yr total returns. IHI, a market-weighted medical device ETF with a higher allocation to Health Care Equipment and Supplies, has outperformed its equal-weighted cousin, XHE. IHF, leveraged to healthcare providers and healthcare service, seems to be one of the best industries with returns outperforming most pharma and close to returns offered by XLV.

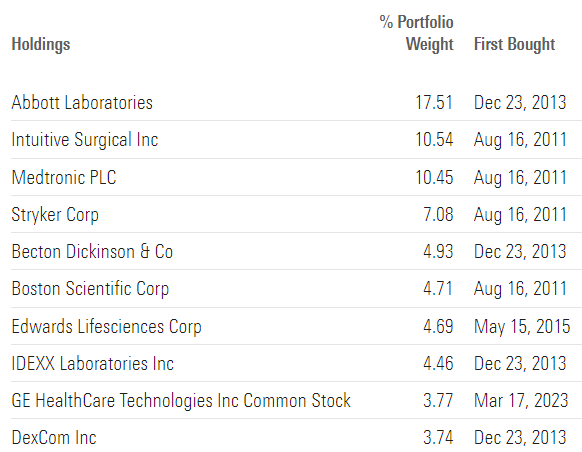

iShares U.S. Medical Devices ETF offers exposure to very popular healthcare names, albeit in a more concentrated portfolio of 54 positions. The top 10 positions comprise 71% of net asset value, with a top four positions weight of 45%. Normally, investors prefer ETFs with a more diversified portfolio, but the four top positions are durable healthcare firms with a strong investor following and multiple years of rewarding shareholders. Below is the list of the top 10 positions, from Morningstar, as of Oct 7, 2023. Listed is the company, the portfolio weight, and the date first bought. As shown, the majority of these have been owned for between 7 and 10 years and support a low annual portfolio turnover rate of just 10%. Interestingly, M* rates the quality of IHI portfolio as substantially higher than the category average.

Top 10 Holdings IHI (morningstar.com)

Diving deeper into the top four positions of Abbott Labs, (ABT), Intuitive Surgical (ISRG), Medtronic (MDT), and Stryker (SYK) produces the following comparison with the overall portfolio of IHI and Morningstar US Healthcare Index. Interestingly, M* rates the quality of IHI portfolio as higher than the healthcare category average. However, three of the top four holdings are rated as only Average (B+) by the SPGMI rating for 10-yr consistency in dividend and earnings growth.

Fundamentals for Top Holdings IHI (morningstar.com, CFRA, Guiding Mast Investments)

While iShares U.S. Medical Devices ETF investment returns over the past few years have not kept pace with either their pharma cousins or the sector, their fortunes should improve. M*’s summary is focused on the quality of IHI portfolio, and over the long haul, quality most always wins. Interestingly, M* raised IHI’s Medalist Rating in Aug 2023 from Bronze to Silver. From M* Oct 10 review:

The portfolio maintains a sizable cost advantage over competitors, priced within the lowest fee quintile among peers. The strategy’s investment process inspires confidence and earns an Above Average Process Pillar rating. Independent of the rating, analysis of the strategy’s portfolio shows it has maintained a significant underweight position in liquidity exposure and an overweight in quality exposure compared with category peers.

The share class led the category index, S&P 1500 Healthcare Index, with a higher Sharpe ratio, a measure of risk-adjusted return, over the trailing 10-year period. Often, higher returns are associated with higher risk. This strategy is no exception, with a standard deviation of 16.2% exceeding the benchmark’s 13.9%. Finally, the share class proved itself effective by generating positive alpha, over the same period, against the category group index: a benchmark that encapsulates the performance of the broader asset class. Even when excluding risk from its performance record, the strategy still held up. This share class surpassed the category index over the past 10-year period, outperforming by an annualized 2.8 percentage points. It has also beaten its average peer by an annualized 5.5 percentage points, over the same 10-year period.

My personal portfolio is currently 40% underweight in healthcare, compared to S&P allocation, and I am looking to add to the sector holdings. I am buying more IHI here and will add aggressively below $41.

Read the full article here