Background

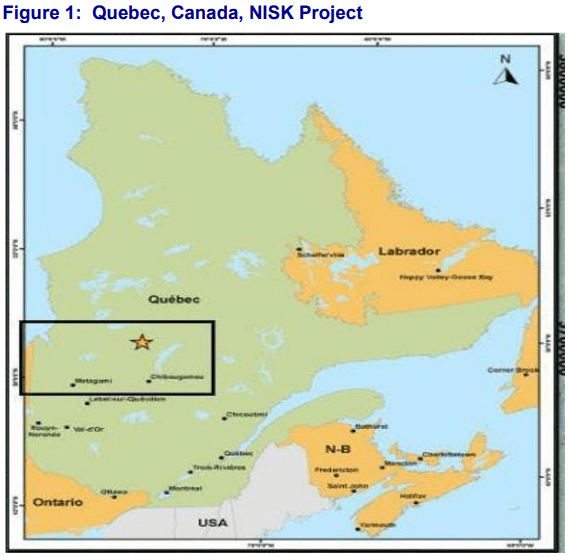

Power Nickel (OTCQB:PNPNF) is a Canadian junior exploration company focusing on high-potential nickel, copper, gold, and other battery metal prospects in Canada and Chile. On February 1, 2021, Power Nickel (formerly called Chilean Metals) completed the acquisition of its option to acquire up to 80% of the NISK project from Critical Elements Lithium Corp.

The NISK property is considered the world’s first carbon-neutral nickel project. It consists of a large land position (20 kilometers of strike length) with numerous high-grade intercepts. Power Nickel is focused on expanding its current high-grade nickel-copper PGE mineralization Ni 43-101 resource with a series of drill programs designed to test the initial NISK discovery zone and to explore the land package for adjacent potential Nickel deposits.

Company Reports

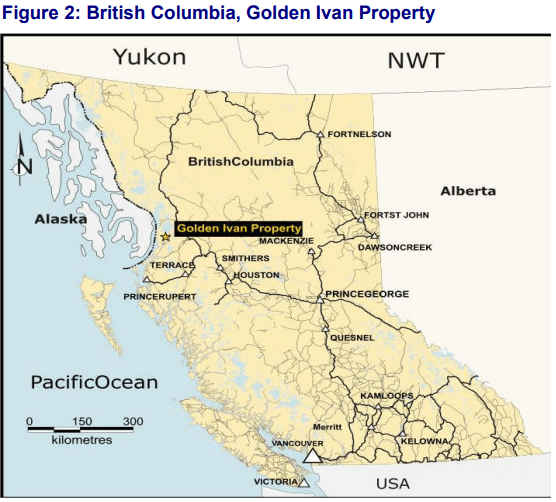

Power Nickel announced on June 8th, 2021, that an agreement has been made to complete the 100% acquisition of its Golden Ivan project in the heart of the Golden Triangle. The Golden Triangle has reported mineral resources (past production and current resources) in a total of 67 million ounces of gold, 569 million ounces of silver, and 27 billion pounds of copper. This property hosts two known mineral showings (gold ore and Magee) and a portion of the past-producing Silverado mine, which was reportedly exploited between 1921 and 1939. These mineral showings are described to be Polymetallic veins that contain quantities of silver, lead, zinc, plus/minus gold and plus/minus copper.

Company Reports

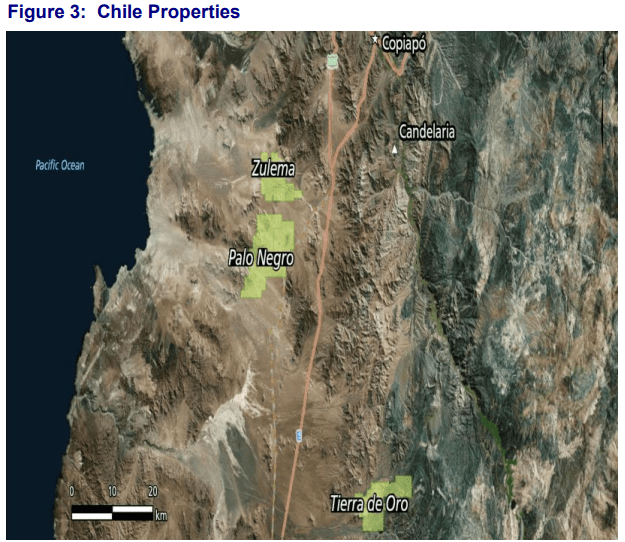

Power Nickel is also 100 percent owner of five properties comprising over 50,000 acres strategically located in the prolific iron-oxide-copper-gold belt of northern Chile. The Company also owns a three percent NSR royalty interest on any future production from the Copaquire copper-molybdenum deposit, which was sold to a subsidiary of Teck Resources Inc. Under the terms of the sale agreement, Teck has the right to acquire one-third of the three percent NSR royalty interest for $3 million at any time. The Copaquire property borders Teck’s producing Quebrada Blanca copper mine in Chile’s first region.

Company Reports

Investment Thesis

NISK is a high-grade nickel-copper sulfide deposit with shallow mineral depth and mineralizations for multiple battery metals, including Nickel, Copper, Cobalt, Palladium, and Platinum.

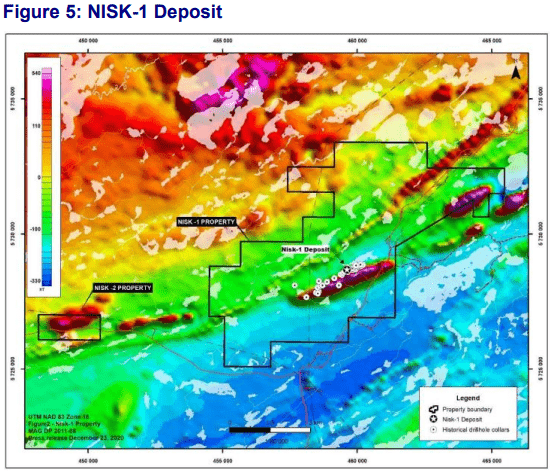

The NISK property is composed of two blocks totaling 90 claims covering an area of 45.9 square kilometers and a length of over 20 kilometers. Located in Quebec, Canada, NISK benefits from a stable political environment with strong government and First Nation partners that offers generous tax credits that cover 50% of exploration costs. The property sits beside a major highway and nearby town Hydro-Quebec substation, across the road supplying low-carbon, inexpensive hydropower.

The NISK project offers strong nickel potential in a well-established area. The NISK property covers a large part of the regional volcano-sedimentary unit, a favorable unit that hosts Nemaska Lithium’s Wabouchi lithium deposit and the Lemarre showing.

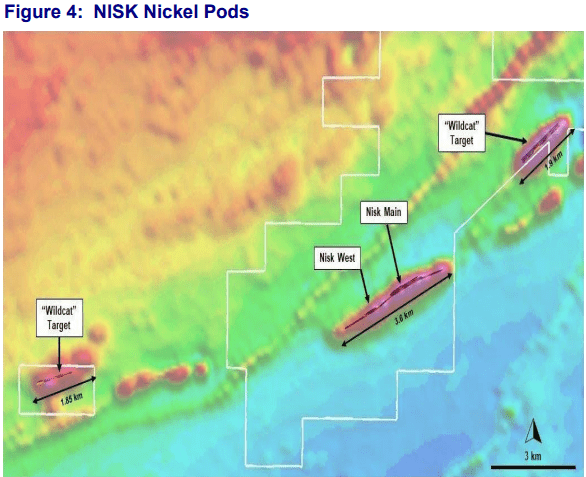

Geophysical surveys show the signature and extent of ultramafic intrusions, some of which have been historically confirmed by drilling. The property is currently known for its magmatic nickel-copper sulfide deposits associated with this ultramafic intrusion potential. Along with high-grade intercepts for Nickel and Copper, there are significant mineralizations for other battery metals, including Cobalt, Palladium, and Platinum.

NISK has four distinct target areas covering over seven kilometers of strike length. The focus has been on the NISK Main target. Historically, nickel sulfide deposits typically have multiple pods, and NISK is no exception. While NISK Main has the potential to build commercial tonnage, there is an opportunity to explore NISK West and two wildcat targets in subsequent drilling.

Company Reports

The NISK-1 deposit is the only mineralized zone with estimated resources on the property.

Company Reports

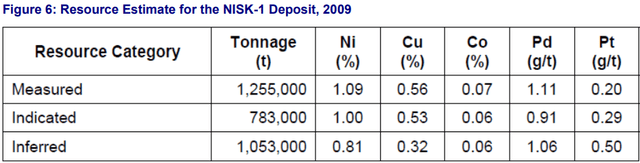

The existing resource estimates at the NISK project derived from the technical report dated December 2009 include the following:

Company Reports

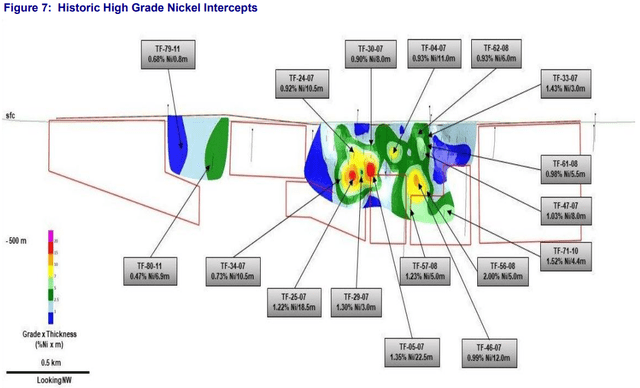

NISK has historically had some very high-grade Nickel intercepts, as shown below. The GradeThickness iso-contours are representative of the nickel distribution only. Power Nickel’s recent drilling program was designed to confirm these historic resources reported in 2009. The drilling program also confirmed that NSIK contains high-grade class-1 nickel with intercepts that include 18.5m of 2.00% NiEQ and 26.6m of 1.98% NiEQ. The results successfully demonstrated the existence of the NISK main mineralized zone the presence of high-grade Ni-Cu-Co-PGE mineralization and appear to be representative of what was expected from the historical work.

Company Reports

The Company’s geology team is currently working to complete an updated NI 43-101 compliant mineral resource due sometime in October. The results are expected to reflect recent drill programs that significantly increase the resource estimate. Power Nickel is targeting 8-10 M Tons for the expected NI 43-101, reaching commercial tonnage status and targeting 20-50 M Tons over the next two years to potentially reach Voisey Bay status.

Recent Developments

- In July 2023, Power Nickel announced plans to optimize its non-core assets while maintaining its focus on the exploration and development of NISK. The spin-out from a public company will see the transfer of the beneficial interest in its Golden Ivan property to Consolidated Gold and Copper Inc. in exchange for common shares of Consolidated Gold and Copper Inc. Through various other wholly owned subsidiaries, the Consolidated Company also holds Power Nickel’s Chilean assets, other than the Copaquire property.

- The Company plans to allocate 25% of the Consolidated shares to Power Nickel’s shareholders, and upon completion, the Company will retain 19.5 million Consolidated shares. In addition, the Company is placing its 3% Royalty on the Copaquire Project for sale. The sale is expected to be for as much as $5 million dollars without any dilution to shareholders. This could add a significant cash runway for the investment thesis to play out.

- Power Nickel CEO Terry Lynch believes splitting off the non-core assets into Consolidated will enable the new entity to separately finance and pursue growth opportunities that may otherwise be overlooked while the Company focuses on NISK.

Valuation and Recommendation

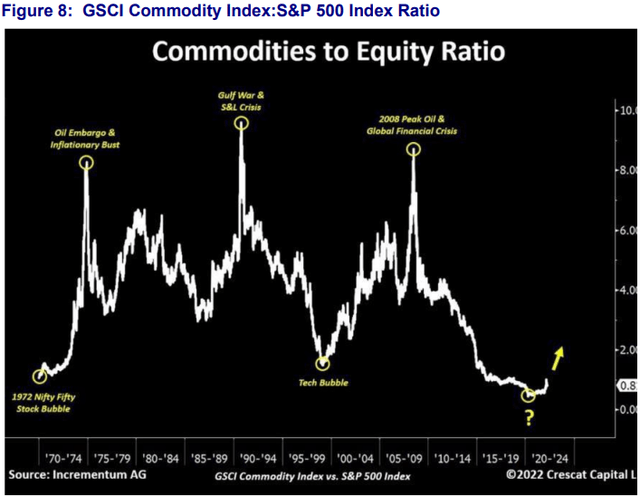

We believe the long-term outlook for nickel has upside. Prices for the commodity are at historic lows at current pricing of approximately $18,260.00 USD/T (LME Nickel Price, October 11, 2023). This pricing translates to an attractive entry point in a trough of a low commodity-to-equity ratio that stands to benefit from a near future rally.

Company Reports

As the shift to cleaner energy intensifies, nickel is increasingly being recognized as a key component of electric vehicle batteries. On average, nickel constitutes approximately 60 kilograms per battery in an electric vehicle. The demand for nickel will also be bolstered by the recently passed Inflation Reduction Act, which mandates the use of North American nickel to qualify for potential subsidies.

Generous tax incentives from mining-friendly jurisdictions are designed to help establish domestic supply chains that allow for low-cost production. Combined, the Quebec and Canadian governments offer tax credits that cover 50% of exploration cost, which means Power Nickel can spend $2 exploring for every $1 invested.

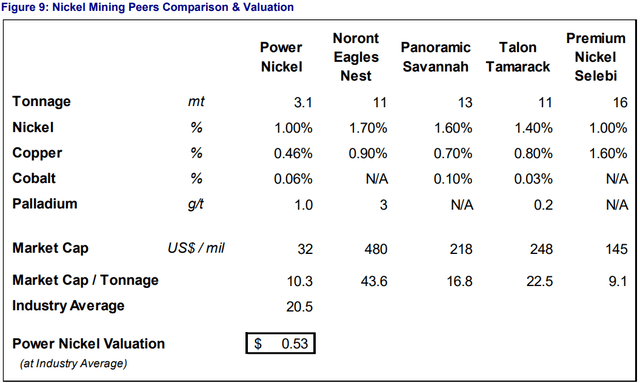

Power Nickel currently trades at a Market Cap-to-Tonnage (T) ratio of only around ten times (Figure 9). On a Market Cap/T valuation, most comparable nickel mining companies are in the 17-44 times range with a peer average of 21 times. While there are some differences between the companies, these valuation ranges demonstrate that Power Nickel trades at a significant discount, and there is ample room for gain. We believe that recent developments of the drill program warrant Power Nickel trading up to the peer average of 21 times, which represents a share price of $0.53 and a higher valuation once the NI 43-101 and PEA are released later this fall and next year, respectively. Assuming the Company continues to make progress at NISK, we will evaluate our price target based on either Company-specific developments or continued improvement in the market conditions for nickel and nickel miners. We believe that while progress at Power Nickel will remain slow and steady, the direction continues to be positive with heavy news flow, thus, we initiate with a BUY-Venture rating with a price target of $0.53.

Company Reports

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here