Introduction

The telecom world has many competitors. They are all trying to win customers by offering the fastest and most reliable network, and the best coverage.

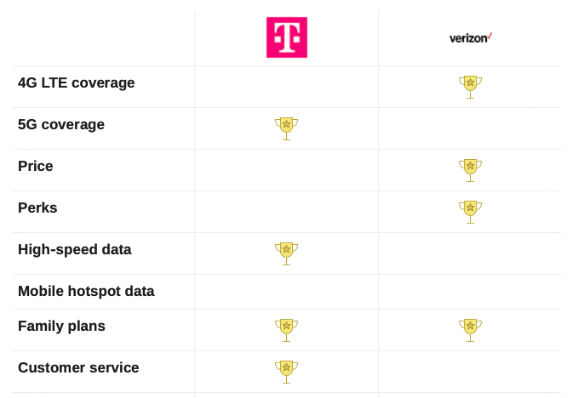

Verizon (NYSE:VZ) is one of the largest network providers in the U.S. and has the best 4G LTE network coverage. Moreover, Verizon has won numerous awards for the fastest network. But when it comes to the new 5G network coverage, T-Mobile excels. T-Mobile (TMUS) ranks third in terms of 4G LTE coverage. Both network providers have unique features that make it interesting for customers.

At Verizon, you get a big discount if you combine the home Internet package with a mobile package. The 5G Home package costs only $35/mo for 5G and 1000 Mbps.

The market seems to disagree with Verizon. The share price has already fallen 23% this year and the dividend yield is now very attractive.

Verizon, like all other network providers, has a large debt pile. The large dividend barely gives it room to pay off the debt. And increased interest rates could make refinancing expensive. Refinancing could have a large negative effect on its profits. I am therefore curious to know whether investors’ fears are well-founded.

In my article, I first compare Verizon to T-Mobile and then calculate how much impact a refinancing could have on earnings and dividends. Then I discuss some risks and conclude.

Verizon VS T-Mobile

Verizon and T-Mobile are among the largest network providers in the US. Each network provider offers a wide range of perks and options to gain customers. T-Mobile has rolled out its 5G network over a large area in the U.S., but that comes with a higher subscription price. Verizon offers a much faster 5G network (up to 1,000 Mbps instead of 182 Mbps), but it is only available in a limited region. T-Mobile is at the forefront of technological innovation.

Verizon offers extras such as the Disney bundle, Apple One and Walmart+ and more at a discounted rate. T-Mobile offers subscriptions including Netflix Basic and Apple TV+. However, the Netflix Basic subscription offers little benefit because the resolution is only 720p. I expect customers are more likely to opt for a subscription with at least 1080p resolution. Verizon is better at offering perks.

T-Mobile vs Verizon (whistleout.com)

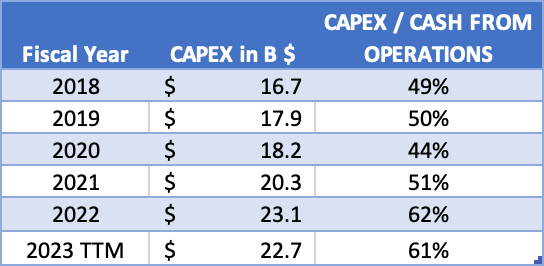

T-Mobile excels in 5G coverage in the US. Verizon will have to invest substantially in expanding its 5G network to keep up. Verizon’s capital spending has increased significantly, while cash flow from operations has grown slowly. This is a worrisome trend.

Verizon’s CAPEX (Analyst’ own table. Data from Seeking Alpha.)

But in my opinion, it is not necessary to always be at the forefront of technological developments. New technology is expensive and unforeseen problems can arise.

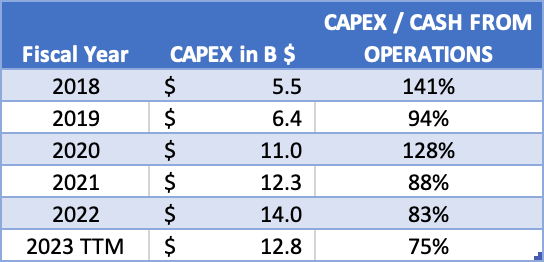

T-Mobile has made huge investments in recent years. We see that its CAPEX/Cash from Operations ratio is much higher than Verizon’s. T-Mobile could do this in part because it does not distribute a dividend.

T-Mobile can raise its prices because it offers a top-notch network. The question is how many consumers will switch to T-Mobile for its faster network.

T-Mobile CAPEX (Analyst’ own table. Data from Seeking Alpha.)

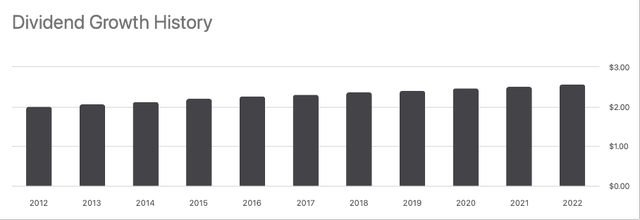

Still, I am happy with Verizon management’s decision to quietly roll out 5G. In doing so, they are maintaining their dividend, which I find very attractive. The dividend is currently $2.66 per share and the dividend yield is huge at 8.7%. Verizon has been paying a steadily growing dividend for years. And that makes the stock ideally suited for income investors. If management cuts the dividend, it could significant affect the share price.

Dividend growth estimates (VZ ticker page on Seeking Alpha)

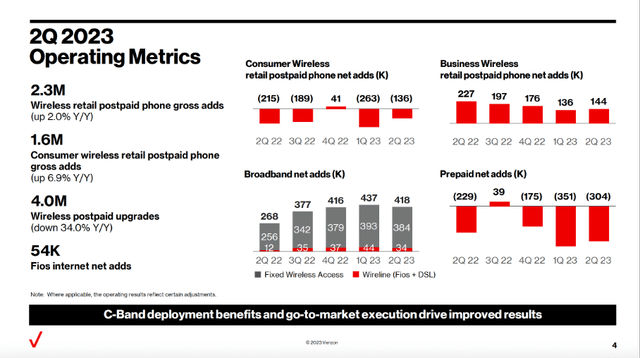

Verizon has had several quarters of consumers (both postpaid and prepaid) switching to competitors. I find this worrisome because Verizon offers discounts when consumers combine their Internet plan with their mobile plan. I think that consumers prefer the faster 5G and therefore are switching to competitors. The fact that Verizon offers hefty discounts apparently does not matter much to consumers.

However, broadband net additions were strong. Consolidated revenue fell only 3.5% year-over-year last quarter. Operating cash flow was up 1.7% and free cash flow was up 11.1% year-over-year in H1. The numbers look neat, despite customers switching to competitors.

VZ 2Q23 Operating Metrics (Verizon’s 2Q23 Investor Presentation)

The Effect Of Refinancing Its debt

Network providers invest a lot to stay up to date to offer the best network. They mostly finance this by taking on debt. Verizon’s debt pile is therefore significant. Short-term debt is $14.9 billion, while long-term debt is $137.9 billion. That makes the total at $152.6 billion, while cash and short-term investments are only $4.9 billion. Verizon has recently benefited from low interest rates and management could refinance its debt at a low rate. TTM interest expense is $4.5 billion, so the average interest rate is only 2.9%.

The large amount of debt is not a concern because the telecom sector is a stable industry. Every month, consumers pay their subscriptions and that provides certainty.

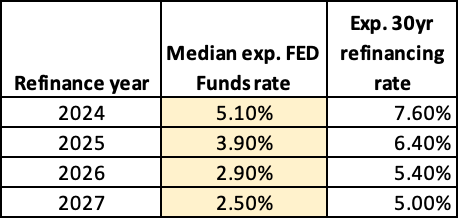

Since interest rates have risen sharply, it will be interesting to see what effect this will have on earnings when debt is refinanced. The Fed’s long-term target for interest rates is 2.5%. For the refinancing calculation, I look at debt maturing through 2027 to see what effect the interest rates will have in the near term.

FOMC members expect another rate hike this year, then interest rates to fall in 2024 and beyond. The 30-year refinancing rate will follow suit. We assume a 2.5% premium to the median Fed funds rate as the refinancing rate. The refinancing rate on the corresponding year could look like the following.

Expected refinancing rate (Analyst’ own expectations)

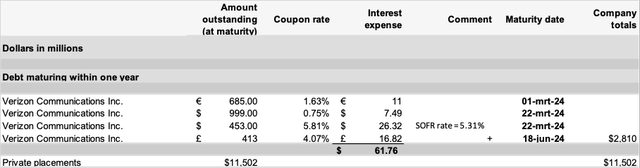

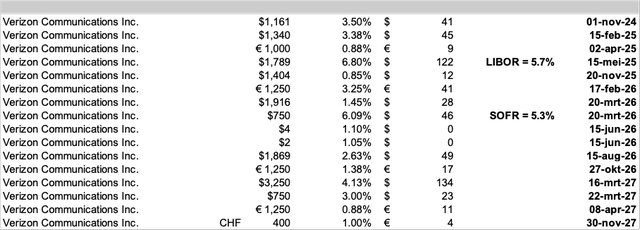

It is easy to view Verizon’s debt schedule because it is on the website. You can also download the spreadsheet version there.

Verizon has a large debt schedule of nearly 300 rows in the years through 2061. Some debts are noted on a foreign currency. So I had to make the “rough” assumption that the currency exchange values are equal. Verizon entered into cross-currency swaps to exchange the cash proceeds and future principal and interest payments into U.S. dollars. Let’s look at the debt maturing within one year.

Verizon’s short term debt maturities (Verizon’s Investor Relations)

There is also a private placement with $11.5 billion outstanding. It is unknown what the coupon rate is and also what the interest expense is.

In the table downloaded from the website, I added an interest expense column and comments. The total interest expense on their debt maturing within a year is about $62 million.

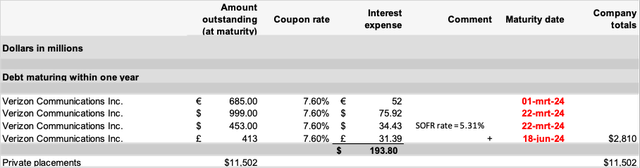

If the debt is refinanced at a 7.6% interest rate, the interest expense increases to about $194 million. This is a large increase of $132 million.

Verizon’s short term debt maturities with refinance rates (Analyst’ own calculations)

The same calculation was made for long-term debt through 2027. Currently, the interest expense on the long-term debt is about $580 million. If Verizon could refinance it at the refinancing rates mentioned earlier, the interest expense after refinancing would be about $1105 million.

Verizon’s long term debt maturities (Verizon’s Investor Relations)

To make a long story short, total interest expense on debt through 2027 is currently $642 million and is expected to increase by $657 million to $1299 million (according to the calculation and assumptions).

The $657 million increase in interest expense will have a small effect on operating cash flow and free cash flow. And earnings will be affected by only 3% (assuming 2022 earnings).

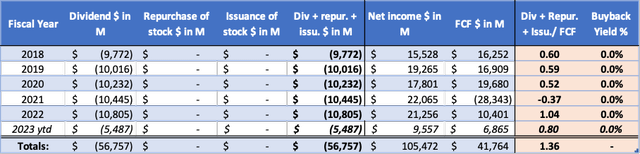

The refinancing also has little impact on dividends. A closer look at the financial highlights shows that dividend payments accounted for about 60% of earnings. In 2021, free cash flow was negative due to a significant $47.6B investment in the acquisition of wireless licenses. Otherwise, I see little to no risk of a dividend cut because of the refinancing.

Verizon’s Financial Highlights (Analyst’ own table. Data from Seeking Alpha)

Risks

In my article, we made several assumptions, especially regarding refinancing rates. The Fed expects inflation to cool down, after which interest rates will follow. But rising oil prices could throw a spanner in the works. Inflation may rise after which the Fed decides to raise interest rates anyway. This could have adverse consequences for Verizon.

Suppose the refinancing rate to 2027 is about 7.6%, then the interest expense increases by $969 million (refinancing to 2027). Yet this will not hurt the dividend (the dividend payout is about 60% of earnings).

What could have a bigger impact on a dividend cut are investments in their 5G network. The fact is that sooner or later Verizon will have to expand the newer 5G network. I expect more investments in the 5G network in the coming years. Because of the small cash amount on the balance sheet, I expect these investments to be financed by debt. If interest rates remain high in the coming years, this could have a big impact on earnings. And if Verizon delays its investments in 5G, it could lose customers fast. But for now, there is nothing to worry about. Inflation is on a downward trend, the economy is expected to cool, so there is a good chance the Fed will cut interest rates.

Takeaway

Verizon and T-Mobile are competitors, but both differ in their management strategies. Verizon offers a neat dividend and is attractively valued in the stock market. T-Mobile is growing steadily because of its heavy investment in 5G but doesn’t pay a dividend yet. Due to its rising share price, T-Mobile seems overvalued compared to Verizon.

Verizon’s valuation is attractive with a PE ratio of only 6.1. In contrast, T-Mobile seems expensive with a PE ratio of 28. Verizon’s stock price has fallen sharply and investors seem less enthusiastic about the company. This is partly justified because Verizon has been losing customers for several quarters. Also, analysts are mixed on earnings projections for the coming years. Verizon’s EPS will remain virtually flat, while T-Mobile’s are expected to rise sharply.

T-Mobile’s growth projections look a lot better. Analysts expect robust earnings growth for the next few years. By 2025, earnings per share will rise to $12.60, bringing T-Mobile’s PE ratio to 11. However, this is still nearly 2x higher than Verizon’s PE ratio.

So which stock is a good investment? I think that Verizon is a better choice now because it offers a high and reliable dividend. The stock is cheaply valued, so there is less risk of the stock price falling further in the event of a financial setback. Falling interest rates can be a catalyst for Verizon, as refinancing debt becomes cheaper (compared to high interest rates for a longer period). Investors are buying Verizon for the large and reliable dividend. The dividend yield should have a premium over treasuries. Therefore, I don’t expect much excitement for this year. But from the year 2024 and beyond, I expect strong returns.

Read the full article here