Dear readers/subscribers,

I like water companies. I invested in several of them, and I had a significant portfolio stake in water-adjacent business Uponor before it was clear this Finnish outperformer was going to be taken private. Water companies are attractive businesses because, like most utilities, they’re regulated to a high degree. It means less explosive growth and potential, for the most part, but it also means income safety and stability.

During ZIRP, this combination is what caused these companies to significantly outperform and trade at near-ridiculous multiples. It made it hard to estimate just how “low” things were bound to go outside of such an environment. Now we’re seeing what happens to those businesses and how we could value them to see an upside here.

In this case, we’re looking at a pure-play water/wastewater player, the SJW Group (NYSE:SJW).

I’ll go through the company with you and show what would make me interested in investing in the business. To be clear, I do not consider this company to be a “BUY” today.

I would want a better price.

Here is why.

SJW Group – I like water, but I want a good valuation.

So, what exactly is SJW Group?

This.

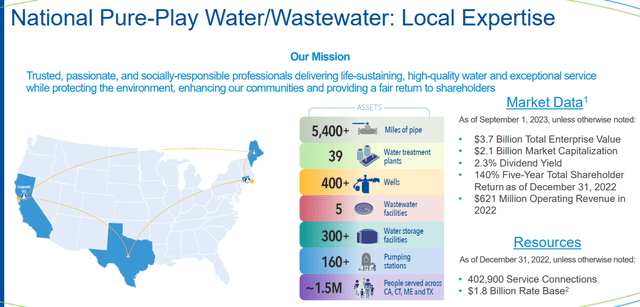

SJW Group IR (SJW Group IR)

The company has an appealing set of assets in what are actually very solid overall geographies. With its near-$2B rate base encompassing over 400 000 connections, this is a significant player, with as low a yield as we’ve grown accustomed to from these sorts of businesses.

The main risk, to begin with, with the part of the company’s thesis, is diversification, or rather the lack of it.

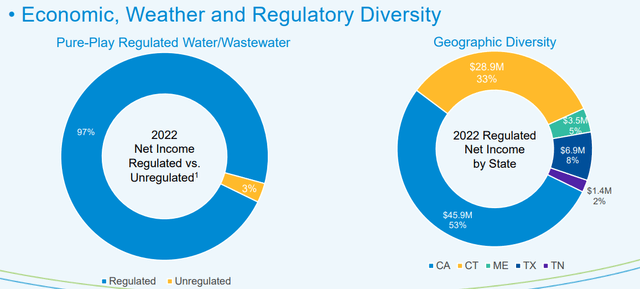

Over 50% of the company is in California – and I’m none too keen on overexposure to California and the way things are going there at this time. There are good companies there, that’s for sure – but I’d like a different mix here, reversing Texas with the California exposure.

SJW Group IR (SJW Group IR)

But that is not how things are – and I can live with that, at the right price. SJW, like other companies, is dependent on delivering solid performance and customer service with what are limited returns – but with the upside that nothing can really happen to those returns, as long as society continues to function. The company is a relatively small player – though not as small as some others in the space that I have looked at.

And not wanting to be too negative, I’ve actually been through the last regulatory outcome in California, and the results weren’t too bad. Adding to this, system improvement charges in Texas are approved, and general rate case and infrastructure investment surcharges in CT and Maine.

As with other water companies, SJW is no slouch when it comes to delivering dividends overtime. 80 years is the time the company will have paid an unbroken dividend tradition during the next year, with increases 55 years running, making SJW a dividend king.

Not a bad thing.

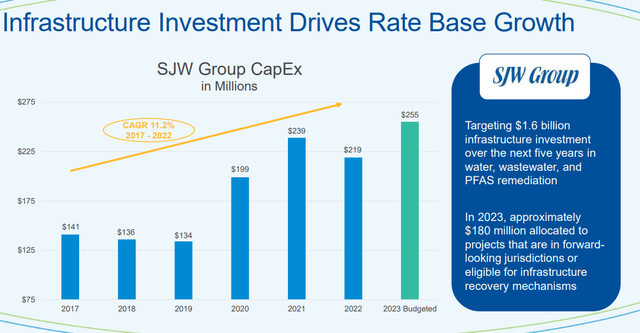

When it comes to continued growth, SJW is hanging its hat on a $1.6B five-year plan for investment in water and wastewater infrastructure as well as PFAS remediation (still to be approved by regulators). The company does advertise its constructive and mostly positive relationship with state commissions, but having some experience in this field, I would argue that these ties have yet to be truly tested and may be within the next 5 years.

Aside from this, SJW also focuses on opportunistic M&A, which is another positive, because, unlike other water companies, SJW looks at national perspectives and footprints for potential growth.

Historically, the company has been pretty conservative investing in the infrastructure, but this is ratcheting up, and quickly.

SJW IR (SJW IR)

Most of the company’s expected growth is expected to come from inorganic growth from small, very small, and medium-sized community water systems which are being added to the company’s portfolio, such as the recent set of additions in Texas. Specifically in Texas, the company has seen significant connection growth in the last 15-20 years, with more than 27,000 wastewater and water connections.

But opportunities for more additions still exist, with more than 8,400 community water systems in the 4 states where the company is most active, and another 16,000 publicly owned wastewater systems ripe for inclusion in companies such as this.

More advantages exist. The company has strong access to the capital markets with its A-rating in terms of credit, a $350M line of credit with less than 30% of that currently utilized, and a market cap of $2.1B, which is 3x+ the size of the water companies I otherwise look at and invest in, such as York Water (YORW).

The company’s debt/market cap isn’t class-leading, especially when you consider it was at sub-33% in 2018, and now carries at 57.3%. It’s completely the wrong time, as I see it, to go debt-heavy here, but at the same time, credit markets don’t seem worried for the company here.

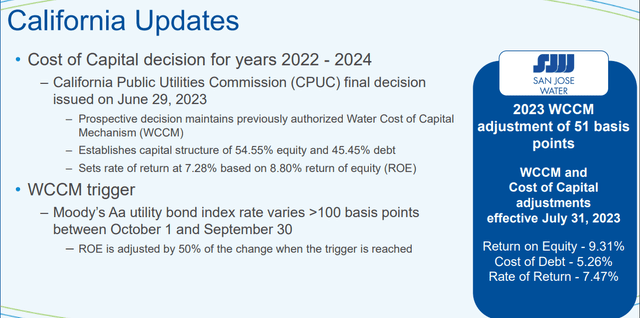

In short, SJW’s advantage plays to its local knowledge relationships and experience with regulators, having 232,000+ connections in San Jose, 100,000+ in Connecticut, 34,000+ in Maine, 26,000+ in Texas, and are growing even now. The most recent rate decisions hail out of California, and they look like this.

SJW IR (SJW IR)

Not the best, but certainly not the worst – and frankly, a few bps better than I had it in my expectations based on macro and other water companies in the same area or in California overall.

Overall, SJW is a solid business with a good portfolio of wastewater and water-based assets. What challenges the company does, and is currently facing, are challenges faced by most water companies, with the exception perhaps of the PFAS cleanup, which provides at least a small complication to investors here.

The other challenge for an SJW investment is primarily how this company is valued outside of ZIRP – because we’ve been in ZIRP for so long. It’s been over a decade since we’ve been at these rate levels, and it’ll likely be several years before we see them meaningfully decline again.

This begs the question of how we should value the company, and that’s what the primary challenge is here. Some analysts argue that the PFAS issue is the primary risk to look at here – I say this isn’t irrelevant, but valuation as well as keeping an eye on escalating costs is one of the core issues here.

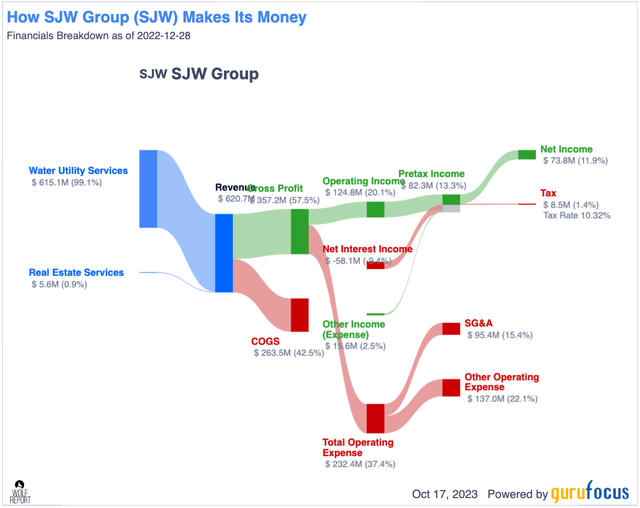

SJW is a well-run business. The company has among the better gross margins in its industry, even if this turns into relatively average margins as we move down to EBIT and net margins. The company, while having above-average debt for a company in this sector and to its peers, has a well-working business model with the following specifics.

SJW Revenue/net (GuruFocus)

No one can accuse SJW of not being profitable or not making a very good amount of money from its revenues.

However, at the heart of the matter lies the company valuation, and this is where we run into challenges with this company.

SJW – Why the valuation presents a problem

The problem is that the company has presented an 18x+ P/E for as long as we’ve had favorable interest rates. The last time the company was at any sort of decent valuation was back in 2015. After that, not only do we have uncharacteristic EPS volatility, but we also have a 25-30x+ P/E valuation for a company that while being a dividend king, yields no more than 2.5% and only presents an upside if we allow a premium.

Even today, if you take a look at the numbers unless you forecast at 25-31x P/E on a normalized basis, this is an investment that gives you less than 15% annualized RoR for the next few years. At anything sub-25x P/E, this turns below 12% annualized, and below 23x, it’s single digits. That’s a tall order, even if the company is currently forecasted to grow at a high rate due to expansion – 8% EPS growth per year.

But before you cheer for this, I want to point out that the company in fact misses estimates a quarter of the time on a 1-year basis with a 10% margin of error. This is very rare for a water company or a good utility, because their entire business model, part of their entire investment case is based on being forecastable and resilient – something which SJW is only so-so if we look at those earnings and forecast accuracy numbers (Source: FactSet).

I do not view this company as currently, in this market or for the medium to longer term, as deserving of this sort of premium. I’d be interested in buying it at a long-term 24-25x P/E, which to me implies a PT of $54/share. This is the lowest PT for the company that I can find any analyst holding. The current S&P Global analysts following the company, 5 of them, give the company a range starting at $58/share and going to $82/share, with an average of $72. So my discount here is considerable. However, despite this PT average, only one out of those analysts is at a “BUY”, with 3 at a “HOLD” and one at “SELL”. So the conviction that these analysts show is on the lacking side and leaves something to be desired.

So while I can see myself at a price where I would be interested in investing in SJW, it’s nowhere near where the company Is today.

Because of that, I give it a “HOLD”.

Thesis

- SJW is a solid dividend king, a water company utility business with over $1.8B in market cap even after the drop. The company has a well-covered dividend yield and operates in attractive markets, delivering products and services that people cannot be without, which makes it a good investment at the right price.

- However, SJW has the same issues as most water companies we find today on the market – most of them are still overvalued relative to what they should be worth in a declining market. SJW also adds to this by having some issues in terms of cost increases and environmental cleanup, which adds to what I believe to be an overvaluation.

- At this particular time, I do not believe the company to be a “BUY” – I give the company a PT of $54/share, which is one of the lowest available price targets for this company – but there are too many good options available on the market today.

Remember, I’m all about:

1. Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

2. If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

3. If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

4. I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansions/reversions.

This means that the company fulfills every single one of my criteria, making it relatively clear why I view it as a “BUY” here.

Thank you for reading.

Read the full article here