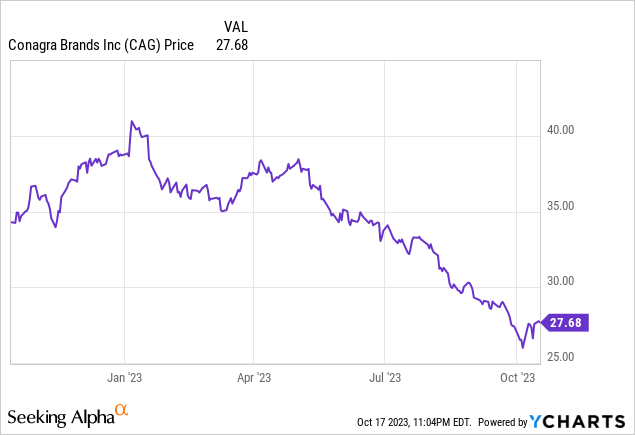

Conagra Brands (NYSE:CAG) might be sitting at 52-weeks lows but the company is struggling with volume declines and a stale portfolio. With low profitability, interest coverage is tight from the 2018 Pinnacle Foods acquisition still and will continue to drag on earnings in the higher interest environment. The company is starting to get my attention at the new valuation but I would like to see volumes recover before I get excited by this mature company’s low P/E.

Latest Quarterly Results

Conagra recently reported their Q1 fiscal year 2024 results on October 5th and the share price shows the continued disappointment. In the quarter, net sales were $2.9 billion with a 0.3% decrease in organic net sales offset by a 0.3% increase from the favorable FX impacts. The 0.3% decrease in organic net sales was driven by a 6.6% decrease in volume and explained by management as largely due to an industry-wide slowdown in consumption and recent consumer behavior shifts. These steep volume declines were partially offset by a 6.3% improvement in price/mix, to keep sales relatively flat overall. In the prior year Q1 2023 quarter, volumes also showed a YoY decline of 4.6% in a worrying trend that goes beyond a couple quarters.

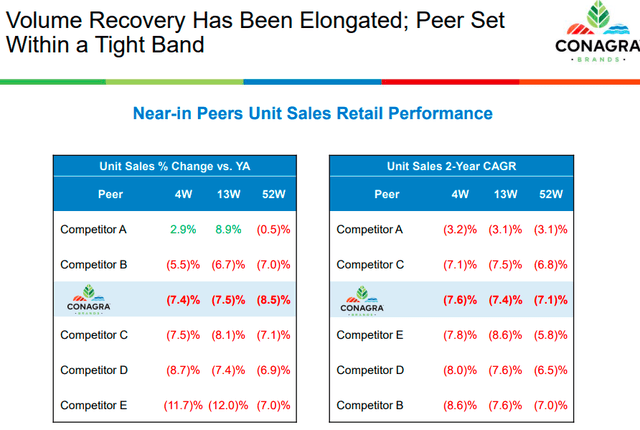

Volumes remain in the dumps, down around 7-8% from prior year averages as can be seen from the below slide in the Q1 FY 2024 presentation. This is in the middle of the peer set Conagra uses but on the low end of certain competitors I have written about recently such as General Mills and Kraft Heinz have volume decreases around the 2% and 7% level, respectively.

Conagra Volumes vs Peers (from company Q1 FY24 presentation)

The company reaffirmed its fiscal 2024 guidance reflecting organic net sales growth of approximately 1.0% compared to fiscal 2023 with adjusted operating margin between 16.0% and 16.5%. EPS guidance from management is for an adjusted EPS between $2.70 and $2.75 which at the midpoint would place Conagra foods at a 10.1x forward P/E for a 9.9% earnings yield. This is a nice adjusted earnings yield which we will compare later in this article to some historical yields based off cash flows and equity returns.

A Mature Company with Mediocre Profits

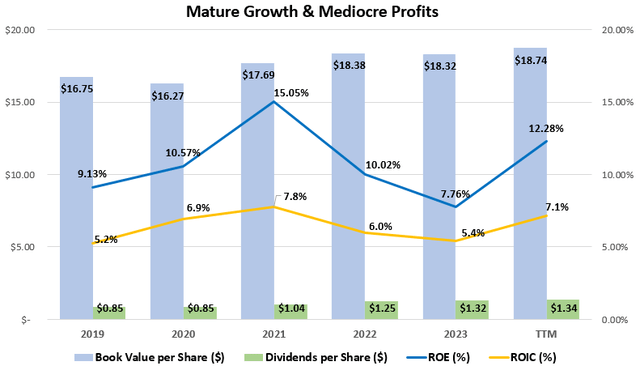

Conagra’s brand portfolio has allowed the company to maintain a mediocre level of profitability and return decent cash flows to shareholders. Since 2018, the company has only achieved average return on equity (ROE) and return on invested capital (ROIC) of 10.8% and 6.4% respectively. This level of profitability is well below my rule of thumb of 15% ROE and 9% ROIC, giving me pause whether, in my opinion, the company is able to maintain its intrinsic value in the future.

Historical Profits and Growth (compiled by author from company financials)

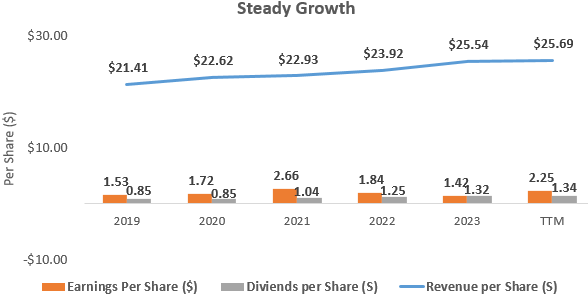

The low ROIC just staying above 5% through the 5-year period is looking to be barely leverageable at today’s current interest rates and I would be worried going forward about the large debt load if rates don’t decrease. In the TTM period, interest expense was $418.5 million, an increase of $35.7 (+9.3%) from fiscal 2022. The increase was driven by a higher weighted average interest rate on outstanding debt in a trend I see set to continue. On the growth side over the same period, revenue growth has averaged only 6.5% annually, with unadjusted diluted EPS increasing 10.1% and dividends growing at 12.1% annualized over the period. Let’s get into shareholder returns now and look at cash flows.

Per Share Growth at Conagra (compiled by author from company financials)

Strong Brand & Huge Excess Cash Flows

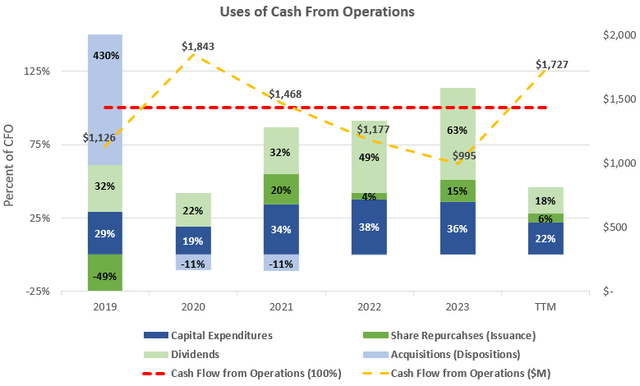

Strong mature businesses with well-known brands such as Conagra Brands are able to generate cash beyond what is needed to fund operations. If we exclude the $10.1B Pinnacle Foods acquisition, capital expenditures have taken up on average 30% of cash flow from operations over the past five years. This would leave 70% to be returned to investors in the form of dividends and share repurchases.

Cash Flow Analysis at Conagra (compiled by author from company financials)

With average cash flow from operations of $1.3 billion over the past three years, this 70% would imply free cash flow to shareholders of $928 million for around a 7.0% free cash flow yield at the current $13.2 billion market capitalization. This is a decently high free cash flow yield at the near 52-week low stock price for Conagra Foods. Adding a conservative growth rate of 3% to represent the company growth alongside global growth could bring this yield above my target 9% rate.

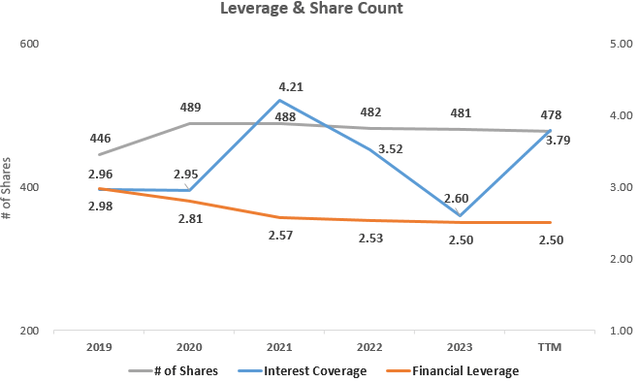

Interest Coverage & Debt

Since 2018, finance leverage at Conagra has decreased slightly to 2.50x as can be seen in the chart below but share repurchases have not been a regular part of shareholder returns which I like to see normally. The company’s interest coverage ratio remains tight at 3.8x in the TTM period due to the low profitability of the assets being leveraged. This is a low level of interest coverage and something I expect to hurt Conagra’s profitability in the years to come as sensitivity to interest expenses changes are more significant from Conagra than competitors. For example, Kraft Heinz (KHC) also has a large debt load but has higher interest coverages levels around 5.5x as of their TTM period since when I last wrote about them.

Capital Structure & Leverage (compiled by author from company financials)

Getting a Sense of Valuation

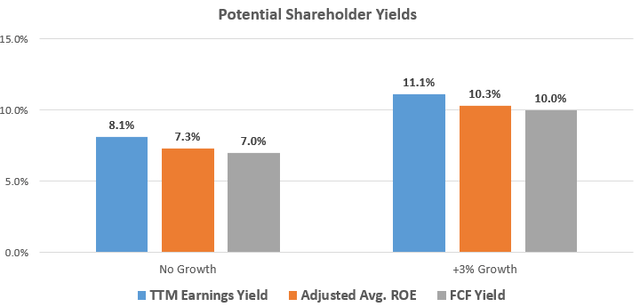

Conagra’s 12.3x TTM P/E ratio can also be expressed as a 8.1% earnings yield, but I also always like to examine the relationship between average ROE and price-to-book value in what I call the Investors’ Adjusted ROE. It examines the average ROE over a business cycle and adjusts that ROE for the price investors are currently paying for the company’s book value or equity per share. Conagra has a mediocre ROE, but potential returns for investors depend on the multiple paid for the book value of equity in the public stock market.

With Conagra earning an average ROE of 10.8% since 2018 and shares currently trading at a price-to-book value of 1.48x when the price is $27.68, this would yield an investors’ Adjusted ROE of 7.3% for an investors’ equity at that purchase price, if history repeats itself. This no growth rate is well below the 9% that I like to see, but adding conservative 3% growth to represent the company growing alongside GDP could move it into my target yield. Below is a table outlining the potential earnings yield estimates from this investors’ adjusted ROE figure as well as the cash flow and earnings yields discussed.

Potential Shareholder Yields (compiled by author from market data and company financials)

Takeaway for Investors

Conagra is a mediocre company that is trading at a good price of 12.3x TTM P/E. The company is having issues with volume growth, albeit, many classic consumer staple brands are as well. Revenue growth has been decent over the mid term but I would like to see volumes come back to life before getting too excited as cash flows are only considering organic capital expenditures to drive growth.

Read the full article here