Swedish telecommunications giant, Telefonaktiebolaget LM Ericsson (NASDAQ:ERIC) faces a challenging landscape with a 10% YoY sales drop, a net loss, and ongoing negative cash flow in its latest Q3 2023 financial report . Uncertainty in the economic market has led to the company refraining from providing 2024 guidance. While Ericsson remains a significant industry player, it’s been losing ground in a highly competitive market dominated by Huawei, and the global telecom equipment revenues are predicted to plateau in 2023.

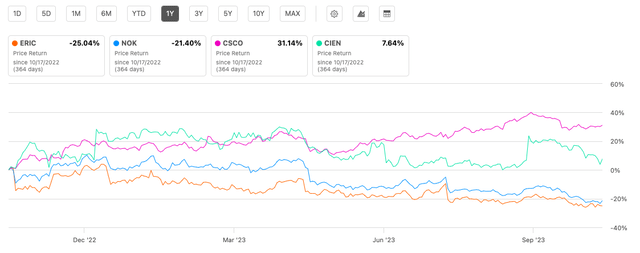

One year stock trend (SeekingAlpha.com)

The company’s stock has declined by 25.04% over the past year, notably underperforming industry peers. The management’s outlook doesn’t suggest substantial growth in the near future. In this downward-trending and uncertain environment, I recommend a cautious “hold” rating, waiting for clearer signals.

Company Overview

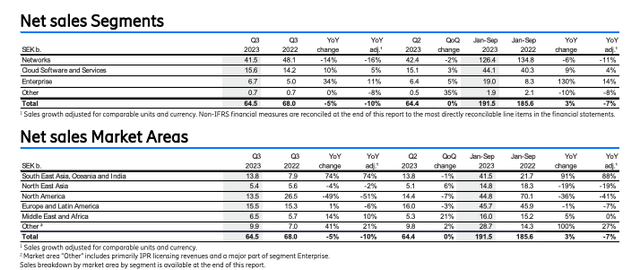

Ericsson, established in 1876, has a rich history in communication technology, ranging from early telephone manufacturing to pioneering 5G advancements. It plays a significant role as a provider of networking equipment and services to the global telecommunications sector, operating across five primary market areas. The company derives its primary revenue from the Networks segment, which caters to both mobile and fixed communication networks. In its recent Q3 2023 report, Ericsson reported an 11% year-on-year decline in its largest segment. Nevertheless, the Enterprise segment displayed notable growth, up by 14% YoY, which helped alleviate the overall decline to 7%. Notably, its largest market, North America, experienced a substantial sales drop of 41%, primarily due to inventory adjustments and a slower deployment pace.

Q3 2023 net sales by segment and market (Ericsson.com)

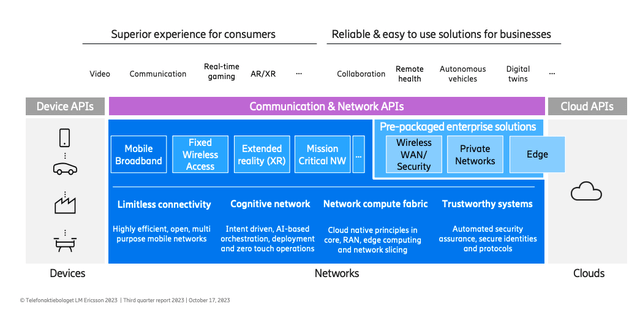

Ericsson’s fundamental business strategy focuses on providing infrastructure, software, and services to telecommunications operators and enterprises, ensuring the delivery of dependable and efficient communication services. Over recent years, Ericsson has made significant investments in the United States through two substantial acquisitions: Cradlepoint in 2020 and Vonage for $6.2 billion in 2022, representing a combined investment of $7.3 billion. These acquisitions are intended to bolster Ericsson’s presence in the US and stimulate innovation within the wireless ecosystem.

Business overview (Investor presentation 2023)

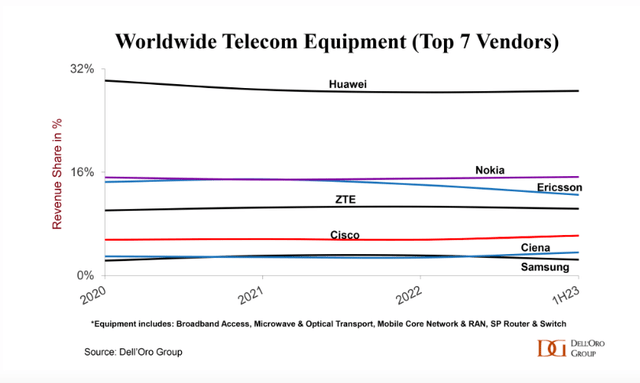

In the fiercely competitive telecom equipment market, Huawei stands out as the undisputed leader, maintaining its position at the helm of the global telecom equipment market. At the same time we can see that Ericsson has been losing market share. This accomplishment is especially noteworthy given ongoing attempts by the US government to curtail Huawei’s market reach and access to cutting-edge technology. Huawei’s stronghold in the industry can be attributed to its top-ranking status in five out of the six telecom segments we monitor. Furthermore, the company continues to exert its dominance in markets beyond North America, contributing significantly to revenues, amounting to 35% to 40% in the first half of 2023.

Telecom equipment (Delloro.com)

Third quarter financial

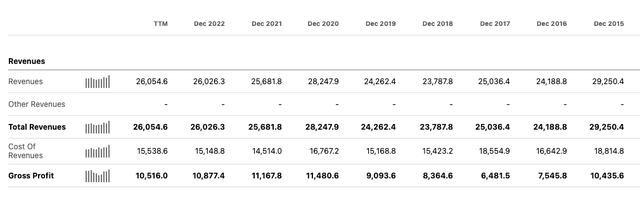

Ericsson has experienced a decade-long drop in revenue, accompanied by diminishing profits in the last three fiscal years. The recently released Q3 2023 results and the full-year forecast indicate an ongoing downward trend. Adding to the concern is a declining cash flow and a balance sheet burdened by debt resulting from costly acquisitions, all of which are negatively affecting the company’s performance.

Annual revenue (SeekingAlpha.com)

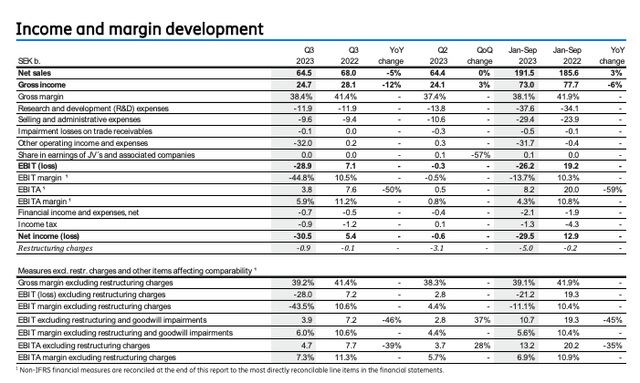

Ericsson’s Q3 2023 financial results showed a mixed performance. Group organic sales fell by 10% YoY, primarily due to a significant 16% decline in organic sales within the Networks segment. However, there was growth in organic sales within the Enterprise and Cloud Software and Services segments. Reported sales also decreased by 5% to SEK 64.5 billion, with a major negative impact being the SEK 31.9 billion impairment charge related to the Vonage acquisition due to changing market conditions. Ericsson reported an EBIT of SEK -28.9 billion, a substantial drop from the previous year. The company remains focused on achieving a long-term EBITA margin target of 15-18%, pending market mix recovery.

Income and margin results (Ericsson.com)

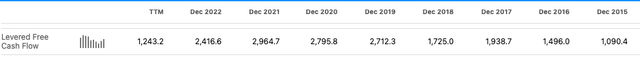

In Q3 2023 Ericsson’s cash position improved, with gross cash increasing by SEK 4.8 billion to SEK 40.5 billion, however this was largely due to increased borrowings. Ericsson extended its revolving credit facility by an extra $0.5 billion to $1.0 billion, using $0.4 billion. Total borrowings grew by SEK 5.0 billion quarter-on-quarter to SEK 38.9 billion, and the average maturity of long-term borrowings decreased to 3.3 years as of September 30, 2023, from 4.1 years a year earlier. Net cash saw a slight decline, dropping by SEK -0.3 billion to SEK 1.6 billion due to negative free cash flow after mergers and acquisitions.

Levered free cash flow (SeekingAlpha.com)

Levered free cash flow has been in decline over the last five years. In Q3 2023 in terms of cash flow, free cash flow before mergers and acquisitions was SEK -0.5 billion, mainly due to reduced cash flow from operations. Net capital expenditures and other investments decreased to SEK -1.3 billion, while lease liability repayments remained at SEK -0.7 billion YoY.

Valuation

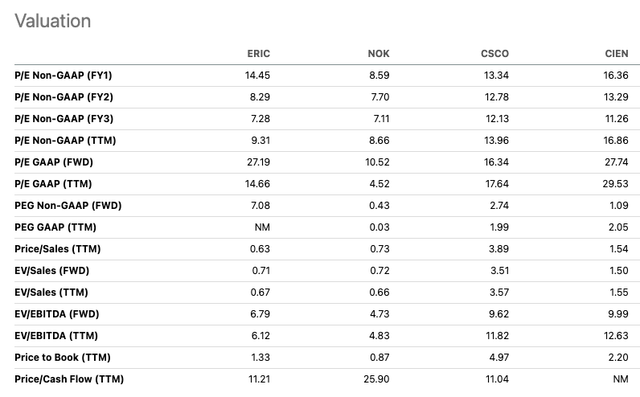

The market has reacted negatively to Ericsson’s Q3 2023 results, resulting in the stock trading below its average price target of $6.17. This performance, declining EBIT, net income, and goodwill impairment are all elements to consider when considering this stock. A comparison with market peers like Nokia (NOK), Cisco (CSCO), and Ciena (CIEN) reveals Ericsson as the least rewarding stock to hold, with a relatively high forward price-to-earnings ratio of 27.19, suggesting a possible overvaluation. Additionally, Ericsson has yet to present clear growth drivers in the near term and has expressed concerns about the adverse impact of economic uncertainty on its business growth.

One year stock trend (SeekingAlpha.com) Relative peer valuation (SeekingAlpha.com)

Risks

Ericsson faces significant challenges. Global economic uncertainties can lead to reduced spending by telecom operators, affecting the company’s revenue. It operates in a highly competitive industry with rivals like Huawei and Nokia. Rapid technological advancements, especially in the transition to 5G, demand substantial research and development investments to stay competitive. Geopolitical tensions and regulatory changes can disrupt global operations, impacting both revenue and profitability.

Final Thoughts

Ericsson’s recent financial performance reflects a challenging phase, marked by declining organic sales and the impact of goodwill impairment on profitability. Although the Enterprise and Cloud Software and Services segments exhibited potential, the broader outlook raises concerns. Given the competitive landscape, economic uncertainties, and technological shifts in the telecommunications sector, I recommend a “wait and see” hold approach rather than making immediate investment decisions.

Read the full article here