Since my last article on Under Armour (UAA) (NYSE:UA) written in June, titled “Finding Hope Amidst Under Armour’s Challenging Outlook,” as I predicted, the stock has not fallen below the $6.50 support ($6.00 for UA). In fact, as I emphasized in my article, despite consistently holding a bearish view on the stock (indeed, I issued a “sell” rating at the beginning of March 2023 for “Under Armour: Still In Troubled Waters“), the price has scarcely dipped below that threshold, as most of the company’s problems were already priced in.

Under Armour Article (Seeking Alpha)

So, after a decline of over 23% from my initial “sell” rating, what should we expect now?

In my previous article, I highlighted the paradox that the challenges facing Under Armour’s brand could potentially save the company in the context of low growth and reduced demand. In this article, I will analyze some aspects of the latest quarterly report that I find noteworthy and explain why the upcoming quarterly report will be pivotal in determining whether the price will return to the support of $6.50 per UAA ($6.00 per UA) or if it could rise again to the $8.00 zone.

The latest quarterly report did not bring very comforting results

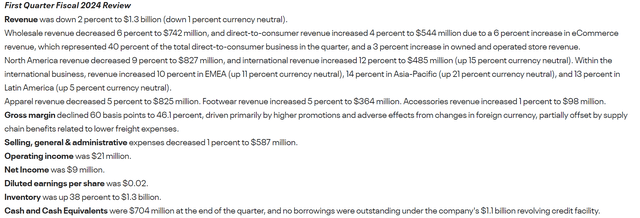

UAA Q1FY24 (UAA Press Release)

When we delve into Under Armour’s Q1FY24 results, three key points stand out, indicating that the issues I discussed are far from being resolved.

Firstly, a 2% drop in revenue to $1.3 billion is concerning, but what truly strikes me is the substantial decline in sales in North America, UA’s primary market, where revenue plummeted by a staggering 9% (totaling $827 million). For a company like Under Armour, such declines, especially in a crucial market, are unsustainable, particularly when compounded by existing brand image concerns.

This leads to the second point: a 0.6% decrease in gross margin, now at 46.1%. Although the press release mentions some mitigation through lower freight costs, the primary driver was the company’s promotional activities.

This brings me to the third point: a 38% surge in inventory, totaling $1.3 billion. While promotional techniques are commonly used in the industry to manage increasing product volumes, they often come at the expense of profits. This strategy is particularly effective in urgent situations or when there’s a need to swiftly release products, such as ahead of a new collection launch. However, as I’ve previously highlighted, for Under Armour, this approach may risk having counterproductive effects.

Under Armour typically applies heavy discounts even in normal circumstances, which adversely affects the brand’s perception, positioning it as “less premium” compared to its competitors. Furthermore, unlike its rivals, Under Armour encountered inventory issues early in 2023, undermining attempts to reduce discounts and enhance brand perception.

Finally, a point in Under Armour’s favor was Nike’s quarterly (NYSE:NKE) report, as it missed its revenue estimates for the first time in two years, experiencing a 2% sales drop in North America. However, the fundamental issue persists: while Nike can afford a decline of this nature and implement inventory reduction strategies (via product discounts), Under Armour lacks the capacity to both rectify these issues and establish a solid foundation for sustained future growth.

That’s why next quarter’s results will be very important

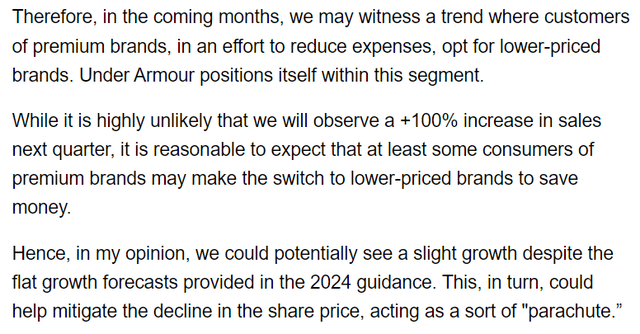

In my previous article, I put forth an idea suggesting that Under Armour’s challenges could paradoxically slow down the decline of its shares. According to this idea, consumers, grappling with increased spending and reduced purchasing power due to inflation, might redirect their expenditure from premium brands towards those in lower categories. Here, Under Armour is positioned exceptionally well: offering excellent quality products, albeit heavily discounted, with a brand not typically considered top-tier. In essence, Under Armour could become the go-to choice, striking an ideal balance between quality and affordability.

Here’s a brief excerpt from my previous article where I discussed this concept.

UAA Article (Seeking Alpha)

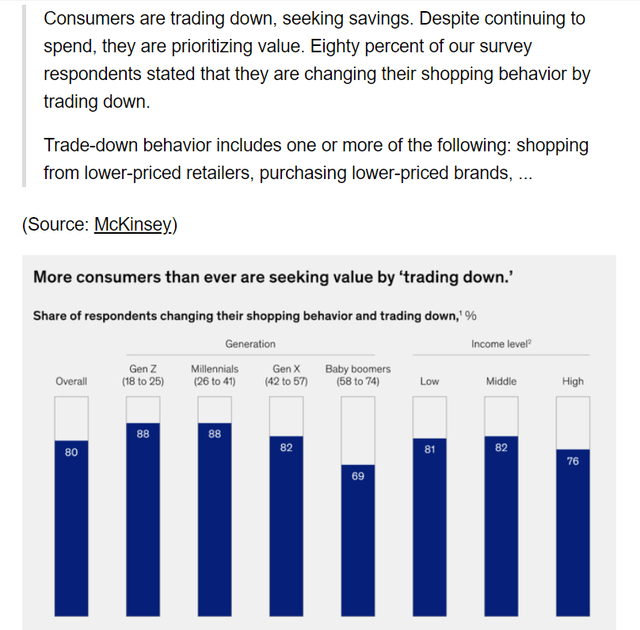

Another intriguing aspect revolves around the target demographic of this shift. According to the McKinsey report I referenced in my previous article, the groups most inclined to cut back spending in this manner are Millennials and Gen Z (88% of survey participants), a segment where Under Armour has historically faced challenges in promoting its products.

UAA Article, McKinsey Study (Seeking Alpha)

A survey conducted by the Jefferies Group further underscores this point:

In a survey of more than 600 US consumers with outstanding student debt, nearly 90% of respondents expressed at least “somewhat concerned” sentiments about meeting all their monthly expenses. Half of them said they were “very concerned.”

Jefferies found that over half of the respondents intend to spend less on apparel and accessories. Restaurants and footwear ranked as the second and third most frequently mentioned categories where consumers plan to cut spending.

(Source: Yahoo Finance)

This survey can be viewed from two perspectives: on one hand, a reduction in spending in the sector might slow down footwear companies (indeed, after this news, many companies in the sector saw losses on the stock market). On the other hand, it could also suggest that people, especially the demographic I mentioned earlier, might shift to Under Armour’s attractive prices.

So, there’s no need to explain why the next quarterly results are so important for Under Armour. If my idea makes sense, we might see the results be better than expected and see more sales in North America.

Bottom Line

As mentioned earlier, much hinges on Under Armour’s upcoming quarterly reports. Based on my expectations, in the event of results surpassing estimates, which I personally anticipate, the stock may reach $8.00 for UAA and $7.50 for UA. These levels represent the closest resistance to the current price. This would imply a return to a PE ratio of around x10, with a potential upside of about 14% from the current price. If there were a miss in results or any other disappointing news, I still have reservations about the price dropping below $6.50 for UAA and $6.00 for UA. However, it would be even more challenging for the company to deliver improved results in subsequent quarters.

Nevertheless, despite a potential upside of 14% compared to, in my opinion, a limited downside to the $6.50 support, the company is dealing with significant structural issues primarily related to brand policies and discounts. Therefore, I do not recommend buying the stock for the long term unless substantial policies are enacted in this regard. Notably, this aspect is entirely absent from the latest quarterly report. Indeed, even if we might witness a short-term rally, it is unlikely to have a substantial following. For these reasons, I maintain my hold rating, with a short-to medium-term price target of $8.00 for UAA and $7.50 for UA.

Read the full article here