SolarEdge Technologies (NASDAQ:SEDG) is a leading solar energy technology company specializing in inverters with power optimizers. In mid-September, the company announced a new setup “specifically designed for community solar, agri-PV, and small-to-medium scale ground mount utility PV applications.”

As such, the company is a leading competitor of Enphase Energy (ENPH). Both companies have broadened their offerings to other segments, expanding their TAM. As such, it allows SolarEdge to expand its reach to energy storage and e-mobility solutions.

Despite its leadership, management articulated in an early-September conference that it has “lost market share in the US, primarily to Enphase.” However, the US market has been troubling for Enphase and SolarEdge over the past year, given the high-interest rates and NEM uncertainties. In addition, the elevated channel inventory coincided with a weakening in demand, lifting SolarEdge’s execution risks in its critical geographical market.

While the company has focused on Europe to mitigate the recent headwinds, the challenges are still expected to persist in the near term. Despite that, management remains confident in its pricing strategy to address its challenges and is not expected to resort to price cuts to mitigate the demand risks.

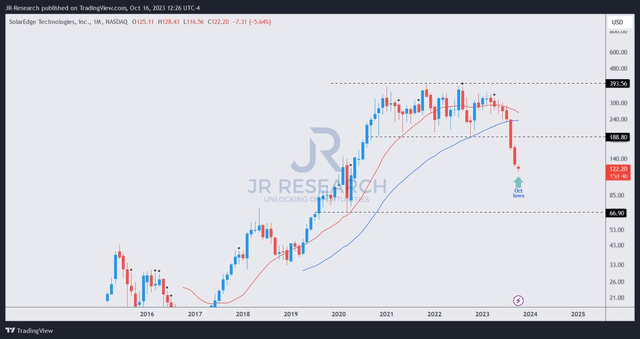

Notwithstanding management’s confidence, the battering in SEDG has likely stunned holders, given the steep plunge from its 2021 highs at the $390 level. That level has proved to be an astute distribution zone for sellers taking profit, as selling pressure has intensified since July 2023. As such, SEDG is down about 70% from its 2021 highs through October 2023’s lows, stunning holders.

Despite that, SEDG has outperformed the S&P 500 (SPX) (SPY) over the past five years, notching a 5Y total return CAGR of nearly 25%. As such, while the late buyers in 2021 suffered, early SEDG holders likely aren’t troubled, although they saw significant gains evaporate over the past two years.

However, SolarEdge’s headwinds and challenges highlighted above aren’t new. The journey ahead could be less daunting, with the Fed expected to be close to its peak rate hikes. Despite that, SolarEdge does see Tesla’s (TSLA) emerging gains in energy storage as a potentially significant competitive headwind that needs to be observed carefully. It remains highly uncertain how SolarEdge’s market share could be affected as Tesla looks to other secular growth drivers to bolster its expensive valuation.

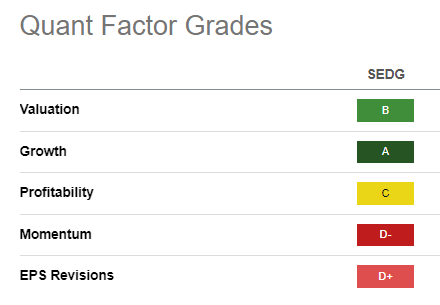

SEDG Quant Grades (Seeking Alpha)

I believe it’s helpful to note that SEDG isn’t aggressively valued, given its “B” valuation grade. Moreover, considering its best-in-class “A” growth grade, it seems attractive. In other words, either the market is “crazy” to not reflect its top-notch growth potential or the market expects crucial underlying challenges that could impact its execution.

Given SolarEdge’s “D+” earnings revisions grade, I believe the market has likely focused its attention on the company’s recent execution. Therefore, a lower valuation is justified unless the company anticipates a significant improvement in competitive and macro headwinds. Despite that, it’s still important to ascertain whether the worst of these challenges has been reflected, suggesting SEDG could be bottoming out or reaching peak pessimism.

SEDG price chart (monthly) (TradingView)

SEDG’s selling momentum seems to have waned in October, although we still have about half a month of price action to assess. In other words, it’s still too early to ascertain whether we could be near peak pessimism.

Despite that, SEDG’s valuation dislocation to its attractive growth metric suggests that buyers could return if they anticipate the headwinds discussed earlier to improve moving forward.

However, SEDG’s price action has dropped below its 50-month moving average or MA (blue line). It has also fallen below its critical support zone at the $190 level, behooving caution.

Unless SEDG buyers could regain sufficient buying momentum to retake the $190 level, any potential reversal might not be sustained. With SEDG potentially falling into a long-term downtrend (unless it retakes the $190 level), investors might want to consider sitting out this bottoming opportunity first.

Rating: Initiate Hold.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Please always apply independent thinking and note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Read the full article here