Over the past quarters, I have posted a lot of negative stuff about Realty Income (NYSE:O) here on Seeking Alpha as well as on YouTube.

In short, there are 5 things that I dislike about the company:

- Issue #1: The REIT is getting too big for its own good and this will likely hurt its future growth prospects. Realty Income has historically achieved most of its growth by acquiring new properties but achieving this growth will be far harder in the future since it now owns over 13,000 properties.

- Issue #2: It is now stepping outside of its main circle of competence and acquiring properties in new geographies and property sectors. The REIT market typically punishes such behavior with a lower valuation multiple because most investors prefer REITs to focus on a specific niche and become experts at it.

- Issue #3: Its leases only include limited rent escalations of ~1% in most cases while some of its close peers enjoy faster rent growth in many cases. As an example, W. P. Carey (WPC) has CPI-based rent escalators and as a result, it is today enjoying 4x faster rent growth than Realty Income. Both focus on net lease properties, but W.P. Carey has better leases.

- Issue #4: As a result of its large size, single-property acquisitions are not really moving the needle anymore and so Realty Income is now doing more portfolio acquisitions. I believe that this will dilute the quality of its portfolio over time because portfolios always include some bad assets. I prefer smaller REITs that can be very selective and focus on single-asset acquisitions instead.

- Issue #5: Realty Income has typically been priced at a slight premium relative to most of its peers and that’s despite enjoying a slower growth rate. And so you then need to ask yourself: why buy Realty Income when you could buy a similar but faster-growing REIT at a lower valuation and higher yield?

Realty Income

All of these issues still exist today, but there’s one important thing that has changed. Realty Income’s share price has crashed and as a result, its valuation is now far more opportunistic.

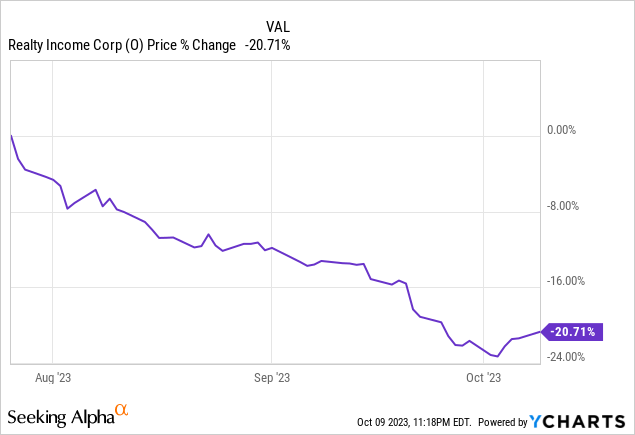

Over the past 2 months alone, its share price has dropped by 22%:

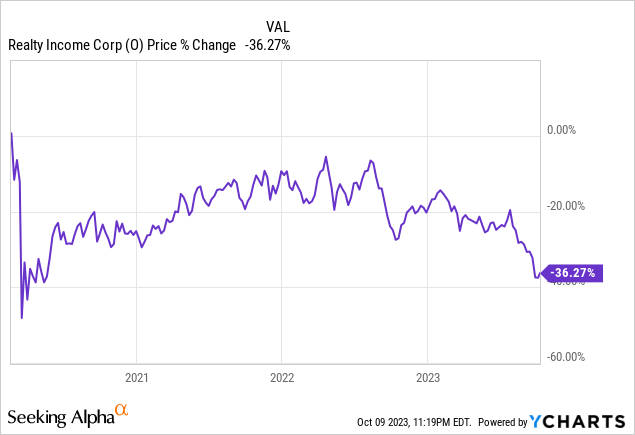

And if you go further back, it is down 36% over the past three years and that’s despite growing its cash flow by roughly 15% since then. What this essentially means is that its valuation has now been cut in half!

I would add that this crash is especially surprising when you consider that Realty Income’s portfolio has actually increased in quality following the spin-off (ONL) of its office properties in 2021.

So the issues that we highlighted earlier still exist, but at least now, this is well-reflected in the company’s valuation and you are getting properly compensated for it.

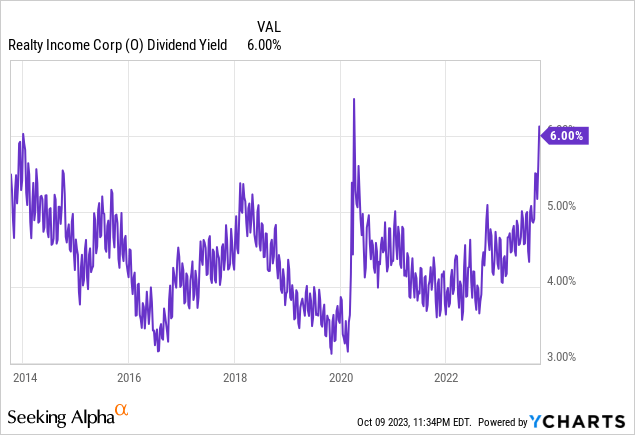

Before this crash, Realty Income commonly traded at 20-25x FFO and only offered a low ~4% dividend yield.

Now compare that to today:

| Typical | Today | |

| FFO Multiple | 20-25x | 12x |

| Dividend Yield | 4% | 6.2% |

Today, Realty Income is priced at a 6.2% dividend yield, which is its highest yield in a decade, and that’s despite also enjoying a historically low payout ratio at just 75%. This means that Realty Income is able to retain nearly 30% of its cash flow to reinvest in growth and pay off debt even as it yields so much:

Its valuation has dropped so much that it is now so low that for the first time in its history, Realty Income is actually priced at a discount to many of its close peers:

| FFO Multiple | Dividend Yield | |

| Realty Income (O) | 12x | 6.2% |

| VICI Properties (VICI) | 12.5x | 5.8% |

| Agree Realty (ADC) | 13.5x | 5.3% |

| Essential Properties Realty Trust (EPRT) | 13.5x | 5.1% |

To be clear, that’s how it should be given that Realty Income has slower growth prospects than most of its peers.

But again, now you are getting richly compensated for it.

A lot of investors have historically used the 5% yield mark as a simple buy signal for Realty Income.

Well… today, you can get it at a 6.2% yield and this yield is safe and set for further growth. While I may sound very negative about Realty Income, there are also a lot of good things to say about it.

Most importantly, the company has an exceptional track record. Its management has proven itself. The balance sheet has low debt and long maturities, limiting the impact of rising rates. And its business model should be able to deliver about ~4% annual FFO per share growth over the long run.

A 4% growth rate is nothing exceptional… but when you yield 6%, that’s all that’s needed to reach double-digital annual total returns.

And that’s assuming that its valuation multiple doesn’t change.

But if like me, you believe that interest rates will likely return to lower levels in the coming years, then the market is likely to also reprice Realty Income at a materially higher multiple and lower yield, leading to significant upside in the coming years.

Simply going from 12x FFO to 18x FFO would unlock 50% upside and that would still price Realty Income at a discount relative to its pre-crash valuation.

So I see it is that: heads, I win, tails, I don’t lose.

If rates come back down as I predict, then Realty Income has the potential to deliver exceptional returns in the coming years. You get a nice yield, steady growth, and significant upside. The annual returns over the coming 5 years could be in the 15-20% annual range.

But if rates remain higher for longer, then the upside will be more limited, but you will enjoy significant margin of safety, and today’s valuation should be low enough to allow you to earn ~10% annual total returns.

That’s a great risk-to-reward coming from a mega-cap blue-chip REIT that’s recession-resistant and well-protected from rising rates.

Bottom Line

All REITs have pros and cons and Realty Income is not an exception.

Our main issue with Realty Income has historically been that it was priced at a premium relative to its peers despite enjoying a slower growth rate.

But this issue is no more.

It is now priced at a slight discount relative to its peers, which are themselves also heavily discounted.

If you are a conservative, income-seeking investor, Realty Income is now finally a Strong Buy, and this is why we own it in our Retirement Portfolio and expect to buy more of it.

Read the full article here