By Andrew Ang, PhD

Originally published on September 29, 2023

When Momentum Loses Momentum

There’s no way to sugarcoat it – the momentum factor’s performance in 2023 has been horrible. In fact, January 2023 was the worst month for momentum since April 2009.1

Poor performance for the momentum factor has led some investors to question its existence and naysayers to come out of hiding to voice their “anti-momentum” views (where were the naysayers in 2022?).

Staying disciplined and focusing on long-term goals can often be the best medicine when any factor falls out of favor.

For “factor believers” (which unashamedly includes myself!) who have looked at the empirical evidence surrounding factors like momentum, 2023 is an unfortunate, but not unexpected, outcome of being a factor investor.

Sometimes the factor you believe in is challenged – there are long-term premiums for factors precisely because investors sometimes have to endure short-term losses. In 2023, that factor has been momentum.

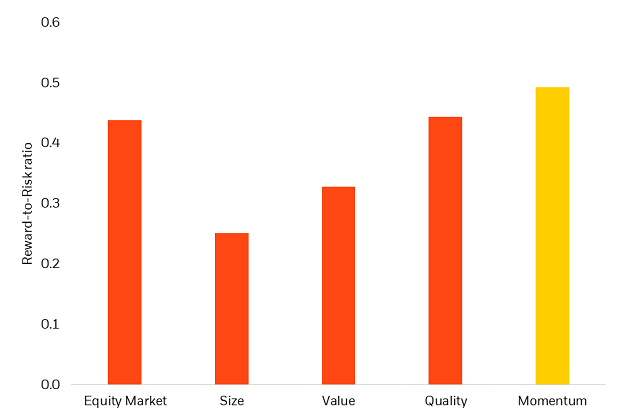

A better reward-to-risk ratio than stocks

It’s important to take a step back from the short-term noise and challenges for momentum and look at the longer-term evidence. Momentum has had better reward-to-risk ratios than other well-established factors like value, size, and quality.

Furthermore, momentum’s reward-to-risk ratio has actually been larger than the equity premium itself.

Exhibit 1: Annualized Reward-to-Risk Ratios

Source: Ken French Data Library. Data from July 1963 – July 2023. Equity premium calculated as Mkt-Rf. Size premium calculated as SMB (small minus big). Value premium calculated as HML (high BTM minus low BTM). Quality premium calculated as RMW (robust minus weak). Momentum calculated as Mom (high prior minus low prior). The reward-to-risk ratio for each factor is the average factor return over this period divided by its standard deviation, annualized by multiplying by the square root of 12.

Using over 60 years of monthly data, the momentum reward-to-risk ratio has been almost double the size premium and 1.5 times the value premium. Thus, in historical returns, there is strong evidence of a momentum premium.

Momentum losses

It is worthwhile to remember that while momentum has underperformed in 2023, it has done so in an environment of positive market returns.

This pattern is not unique to 2023: the worst 10 momentum losses since 1963 have occurred during months where the market return was positive.2

In the worst 10 momentum losses, the winner stocks experience close to zero or positive returns – it is only in the 11th worst loss, during March 1980, that the portfolio of winning stocks exhibited negative returns.3

Exhibit 2: Worst 12 One-Month Momentum Losses

| Monthly returns (%) | |||||

| Rank | Month | MOM Factor | Winners | Losers | Market |

| Worst 1 | April 2009 | -34.3 | 5.7 | 40.0 | 10.2 |

| 2 | January 2001 | -25.3 | -0.8 | 24.5 | 3.7 |

| 3 | November 2002 | -16.3 | 1.0 | 17.4 | 6.1 |

| 4 | January 2023 | -16.0 | 2.8 | 18.8 | 7.0 |

| 5 | January 1975 | -13.8 | 14.9 | 28.7 | 14.2 |

| 6 | May 2009 | -12.5 | 2.2 | 14.6 | 5.2 |

| 7 | November 2020 | -12.4 | 14.1 | 26.5 | 12.5 |

| 8 | March 2009 | -11.9 | 6.8 | 18.6 | 9.0 |

| 9 | July 1973 | -11.6 | 4.9 | 16.5 | 5.7 |

| 10 | May 2003 | -10.7 | 5.8 | 16.5 | 6.1 |

| 11 | March 1980 | -9.6 | -18.8 | -9.3 | -11.7 |

| 12 | April 2003 | -9.3 | 6.3 | 15.6 | 8.3 |

Source: Ken French Data Library. Data from July 1963 – July 2023. MOM Factor shows monthly return of momentum factor. Winners column shows the returns of stocks with highest returns for prior month. Losers column shows the returns of the stocks with lowest returns for prior month. Market column shows market return for month. Market is calculated by combing Rf and (Mkt-Rf) from Ken French Data Library. Indexes are unmanaged and one cannot invest directly in an index. Past performance does not guarantee future results.

The pattern of the market to historically do well when momentum sells off is also reflected in the correlation between the momentum factor and the market return, which is -17%.4 The negative correlation means that the momentum factor has historically been diversifying to portfolios tracking market benchmarks.

The worst momentum losses have generally occurred after a reversal of a strong market trend, causing the “losers”, which is the portfolio of previously downward-trending stocks, to have high returns.5

The momentum strategy takes short positions in losers, so the positive returns to losers results in negative returns to the momentum factor.

We have seen a similar trend in 2023. This year’s momentum losses are partly explained by the release of ChatGPT in November 2022. The technology sector experienced large declines over most of 2022.

With ChatGPT, attention was brought back to certain technology companies associated with generative AI, and these companies in the loser portfolio at the beginning of the year outperformed.

Can you capture the premium?

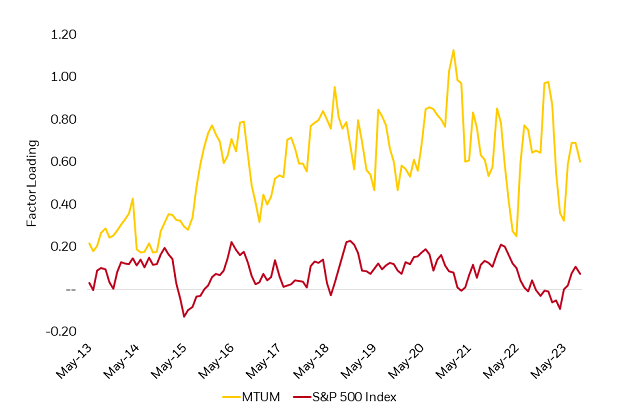

The momentum factor examined so far is a theoretical, long-short portfolio. To measure a portfolio’s momentum exposure, we use a characteristic of a risk model constructed on stocks’ past returns.6 Higher loadings of this momentum characteristic indicate larger exposure to the momentum factor.7

The iShares MSCI USA Momentum Factor ETF (MTUM) seeks to invest in US stocks that have exhibited positive risk-adjusted price momentum over the trailing 6-months and 1-year.

We can compare MTUM’s momentum factor loading to the broad market over time to see if the fund has been able to capture the factor consistently over time.

Exhibit 3: Momentum exposure over time – MTUM vs. S&P 500 Index

Source: FactSet. Exposures calculated using BARRA Global Equity Risk Model for Long-Term Investors (GEMLT) as of 9/1/23. Z-scores are standardized to have a mean of 0 and a standard deviation of 1. Z-scores are statistical measurements that show the number of standard deviations a portfolio’s exposure is away from the mean of the estimated universe. A higher factor loading implies higher exposure to momentum.

As expected, the broad market as represented by the S&P 500 Index has very little exposure to momentum over time. The S&P 500 Index provides exposure to equity beta. MTUM has historically had a positive loading to momentum and has consistently had higher momentum exposure than the broad market.

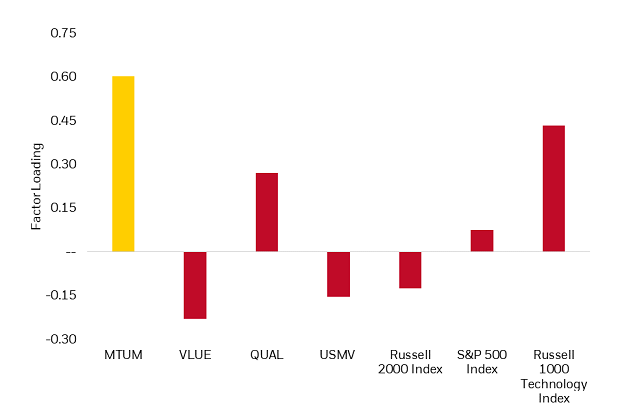

Not surprisingly, MTUM’s momentum loadings are larger than the momentum loadings of other factors. MTUM also has higher momentum loadings than technology.

Exhibit 4: Momentum characteristics

Source: FactSet. Exposures calculated using BARRA Global Equity Risk Model for Long-Term Investors (GEMLT) as of 9/1/23. Z-scores are standardized to have a mean of 0 and a standard deviation of 1. Z-scores are statistical measurements that show the number of standard deviations a portfolio’s exposure is away from the mean of the estimated universe. A higher factor loading implies higher exposure to momentum.

MTUM provides support that thoughtfully constructed momentum funds and indexes can deliver the momentum factor in live portfolios. MTUM has also delivered high momentum loadings despite high turnover8 and without passing through any capital gains taxes.

Conclusion

Factor-based investors that understand the evidence behind factors understand the challenges that momentum has faced broadly this year. Momentum relies on trends in markets.

With the rapidly changing trends we’ve seen recently – from value and energy in rallying 2022, to mega cap growth and AI stocks sharp ascent in 2023 – momentum has had trouble finding its footing this year.

Momentum exists because of investors’ behavioral biases – the action of individual investors tends to exacerbate market trends, and some investors only gradually adjust their beliefs to new information.9

Momentum premiums can also result as a reward for bearing risk – the risk of being whipsawed and short-term underperformance – that others are not willing to bear.10 I believe these economic rationales will persist.

While disappointing, factors are cyclical, and each factor has (and will continue to have) periods of underperformance. As investors, we should focus on the long term and stay the course.

For investors willing to endure cyclical underperformance, momentum ETFs like MTUM may help investors more effectively gain exposure to the long-term momentum premium.

1 Momentum as represented by the momentum factor, MOM, on Ken French Data Library. In January 2023, MOM returned -15.99% which was the worst monthly return since April 2009 where MOM returned -34.3%. The performance of MOM in 2022 was 19.4%. Past performance does not guarantee future results.

2 See also Daniel and Moskowitz (2016), Momentum Crashes, Journal of Financial Economics, who document that momentum drawdowns often occur during market rebounds.

3 Source: Ken French Data Library. Past performance does not guarantee future results.

4 Source: Ken French Data Library. Data as of July 1963 – July 2023.

5 The background to the biggest momentum loss in April 2009 was The Global Financial Crisis in 2008 which sent financial, insurance, and automotive stocks into a tailspin. The US Treasury took equity stakes in these sectors, which spurred a turnaround in April 2009 and as the downtrend reversed, the previously losing stocks rebounded. There was a similar turnaround during the second worst momentum loss in January 2001. The economy went through the internet bull market in the late 1990s where value stocks did badly, and internet and telecommunications sectors had strong gains. The momentum loss in January 2001 is associated with the turnaround in value stocks when the internet bubble burst in 2000.

6 MSCI Barra GEMLT defines momentum by looking at relative strength (RSTR) and Historical Alpha (HALPHA). Source: MSCI Barra Global Total Market Equity Model for Long-Term Investors Descriptor Details as of December 2015

7 See Jegadeesh and Titman (1993), Returns to Buying Winners and Selling Losers: Implications for Stock Market Efficiency, Journal of Finance.

8 In 2022, MTUM had annual turnover of 125% per Morningstar

9 See for example Hong and Stein (1999), A Unified Theory of Underreaction, Momentum Trading, and Overreaction in Asset Markets, Journal of Finance.

10 See Ang (2014), Asset Management: A Systematic Approach to Factor Investing, Oxford University Press.

This post originally appeared on the iShares Market Insights.

Read the full article here