I started this review of Jubilee Metals Group PLC (“JMG”) (OTCPK:JUBPF) with a negative bias. The market has shown them no love this year and the share price is down more than 50% on my previous positive article on the company. I have never had any qualms about giving a company a negative review if it was deserved.

Few companies survive when the pawpaw hits the fan. Even fewer companies survive when the pawpaw hits the fan on many fronts. JMG managed much more than surviving. They held on to tread water on Revenue, stayed profitable, invested heavily in expansion, increased production, and made significant progress on their strategic plan. Pretty good.

I told the story of the company in my previous article here. I explained their growth strategy and the move to copper production. I also reviewed the financial history and progress of the company. My expectations for JMG on operational performance as well as the commodity price targets were optimistic but with the pawpaw in the fan in infrastructure, production, and on commodity prices no positives were realized, and the share price suffered.

The market harshly punished JMG for events mostly external to the business as the fundamental business and growth strategy are not readily understood from financial reporting. I will shift my focus to the financial data and the financial numbers of the growth strategy in this article. More about that later.

So, what were the papaws?

Price collapse in Platinum Group Metals (PGM).

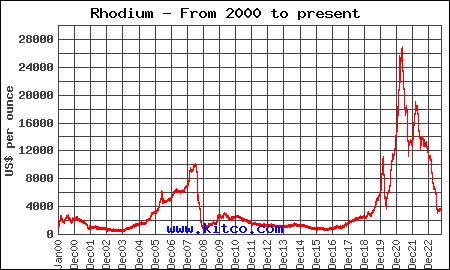

The three most important minerals in the JGM PGM basket are Platinum, Palladium, and Rhodium. Here are the price charts.

Kitco

The platinum price has been in decline since early 2021, essentially reverting to the mean of around $900 per ounce. Both the platinum and palladium prices are thoroughly dominated by the demand for autocatalysts for internal combustion engine-driven automobiles. The international shift to electric vehicles, which do not need autocatalysts, poses a serious price and demand risk to both platinum and palladium which can’t be mitigated. Hydrogen fuel cell technology (the video is worth watching) has not yet reached maturity where it can positively impact price formation or fill the autocatalyst demand gap. The consequence is that both platinum and palladium prices will remain under pressure until fuel cell demand can displace autocatalyst demand (if at all).

Kitco

The palladium price has taken an even worse beating with most of that beating impacting the JMG FY2023 reporting period.

Kitco

The fantastic windfall profits in rhodium are now also in the past with the price collapsing from a high of almost $30,000 per oz in March 2021 to trade around $4,000 per oz presently. Again, a good chunk of this drop took place during the JGM FY2023 reporting period. Autocatalysts are also the dominant source of demand for rhodium but less so than platinum and palladium.

JMG is well placed to weather the demand decline in the PGM basket. It will be a slow process and given the low-cost production of JMG, will see other suppliers exit the market long before profitability at JMG fails. We’ll discuss it further when looking at the numbers.

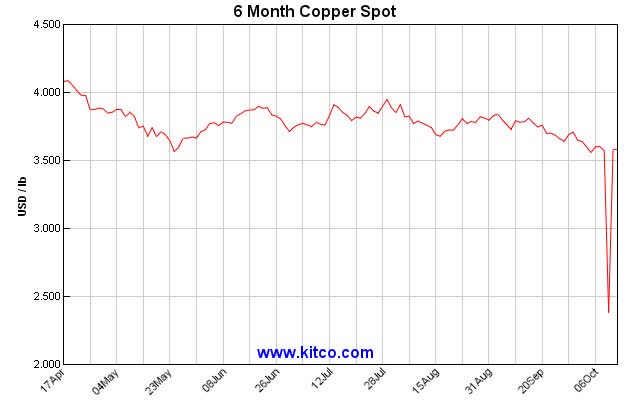

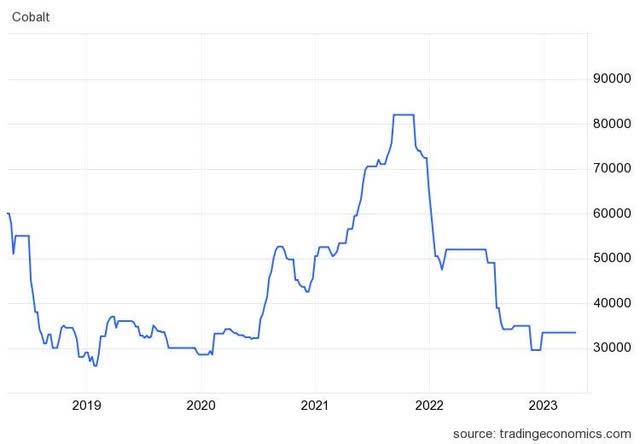

Decline in copper prices and a collapse in the cobalt price.

Let the charts tell the story.

Kitco Kitco tradingeconomics.com

The drop in the copper price has not been as dramatic as the price collapse of cobalt and the copper price is still holding the higher ground. The copper price bounced back to above $3.5 per lb when it tested the downside. Cobalt, however, collapsed from over $80,000 USD/T to around $30,000 USD/T which saw JMG close the cobalt circuit and place it on care and maintenance until cobalt prices recover.

Electricity supply shortages from ESKOM, the South African government enterprise electricity utility.

The woes of ESKOM are well known to all investors in South Africa as its failures have impacted everything in the economy. It seems that the electricity supply has now stabilized at a relatively low level removing some supply uncertainty though “reliability” is not a word compatible with ESKOM.

“For the first time, every longer-term measure of PAR – the monthly average (PAR-28), quarterly average (PAR-91) and yearly average (PAR-364) – have all converged at around 79%. “It means that South Africa’s power availability has stagnated at around stage 3 – or 5 hours of outages per day – over the medium and long terms,” Jordaan said.”

New low for load shedding in South Africa.

JMG has been shielded from these ESKOM blackouts until the 2023 FY reporting period due to an arrangement that they will not suffer any blackouts unless blackouts reach stage 6. The stages rank from 1 to 8 based on the amount of load shedding required with stage 1 the lowest and stage 8 the highest. ESKOM, for the first time, crossed the stage 6 threshold in the 2023 FY reporting period. JMG has implemented backup electricity supply measures to mitigate against ESKOM failures. Electricity supply stabilized at around stage 3 is good news for JMG giving them a buffer up to stage 6.

Water and electricity supply stresses in Zambia.

JMG has secured a private supply of water in Zambia to provide for all its water needs and has also secured an electricity supply from the Zambian utility to resolve this matter. I have previously discussed the extent of toxic mining waste in Zambia and the Zambian government is keen to assist JMG to clean up this historical environmental calamity.

“In developing countries such as Zambia, large areas have been affected by past and ongoing mining and smelting of minerals, resulting in chronic exposure to heavy metals by soil, water, plants, animals and humans. It has been reported that human exposure to excess heavy metals might result in several health disorders, including skin lesions, cardiovascular disease, cancer of different organs, and reproductive defects.”

Evaluation of heavy metal contamination in copper mine tailing soils of Kitwe and Mufulira, Zambia, for reclamation prospects, Dusengemungu, L., Mubemba, B. & Gwanama, C., Scientific Reports, Nature.com, 4 July 2022.

It is expected that JMG will get ongoing government support in Zambia for its growth strategy.

Inflation, resulting in cost pressures.

Production cost pressures are well managed but both the chrome and PGM business segments show production cost increases though JMG has reduced operational costs back to 2018/19 levels. Production cost per unit in the copper business has declined as economies of scale and efficiencies, even at these low levels of production, are achieved.

Significant costs to provide backup electricity solutions.

The use of diesel generators as backup electricity had a direct and telling impact on production costs at the PGM business. The expectation of the electricity supply stabilized at level 3 will alleviate the need to use a backup electricity supply.

Higher leverage combined with higher interest rates resulted in higher finance costs.

The combination of lower prices, constrained production growth, and higher costs while maintaining capital expenditure to advance the growth strategy has increased the use of interest-bearing borrowings and together with higher interest rates has materially increased financing costs. It is interesting that the bulk of the funding costs were reported in the chrome and PGM business segments.

Exercising historically issued share warrants diluted EPS.

JMG has ceased its warrants funding strategy and has indicated that it will fund its growth strategy organically without going to the market to dilute shareholdings. The number of shares in issue has stabilized.

The only company-specific pawpaw was the historic warrants issued. All the other papaws were external to JMG, and they had no control over these external developments yet responded efficiently and successfully to all the challenges.

Financial reporting

JMG’s financial reporting is constantly improving, and they expect to shortly introduce quarterly reporting which will give us a front-row seat to the unfolding growth dynamic. I have done a complete revision of the earlier financial model given the improved reporting. The new model aligns with the JGM divisional business approach of essentially three businesses in one. The chrome business, the PGM business, and the copper (and cobalt) business.

The Financial Statements are not yet fully embracing this divisional approach and I had to reconstitute them in the financial model with significant digging into the Annual Financial Statements to achieve the separation of the businesses especially given the policy of JGM to cross-subsidize between the businesses and to report in that format.

This separation of the businesses allowed me to isolate and pinpoint the sensitive variables that will define the future success of JMG. The strategic important variables are in order of priority:

- The copper business. This is the growth future of the company. The gross profit margins on chrome range from around 13% to around 16% and given the volatility in commodity prices are on the lower side, though not to be ignored given the volumes. The PGM margins are great but declining, costs have been increasing, and prices have been falling. It is expected that these trends will continue in the PGM business. The copper business, however, is expected to trend on higher gross profit margins, higher commodity prices, tremendous operational growth opportunities, and economies of scale on costs. The chrome business is a relatively stable and mature business, the PGM business is a sunset business, but the copper business is a sunrise business. I will return to the copper business after the scenario analysis.

- Production volumes. The infrastructure difficulties hurt most in production growth. JGM imported the inefficiencies of governments into their business. It is still on my Wishlist that JGM would apply the same innovation ethos which they apply to their production circuits, to implementing long-term electricity supply solutions away from reliance on government supply and away from costly short-term solutions such as using diesel electricity generation back-up to mitigate government supply shortages. The best solution would however still be to have a stabilized reliable electricity supply from ESKOM below stage 6 load-shedding.

- Cost inflation. JGM has fantastic production cost advantages which mostly shield them from cost inflation but too much cost inflation and those advantages will disappear. Cost inflation combined with a loss of economies of scale production advantages, as was experienced in FY 2023, are highly disruptive.

The severity of commodity price drops was by far the most important variable and the impact of infrastructure disruptions and cost pressures was much less. Still, JGM performed much better than what the market is giving them credit for, which will be illuminated in presenting the results of scenario analysis using the new financial model.

JGM Share Price Valuation Scenarios

It is the purpose of the financial model to engage in “what-if” scenarios to establish realistic expectations for share price performance. The input variables will be defined by the stated objectives of the scenario. The scenarios will run for 5 years from FY 2024 up to and including FY2028. It is deliberate to do this evaluation on a five-year basis as all the strategies in play are long-term strategies with a need to look beyond short-term fluctuations and events. The scenarios are tethered to reality and will not be tested as outliers. The financial model meets my quality requirement, and I will therefore post it at the end of this article for your download. You can then test your own “what-if” scenarios, also interrogate and audit the data and math used in the construction of the model.

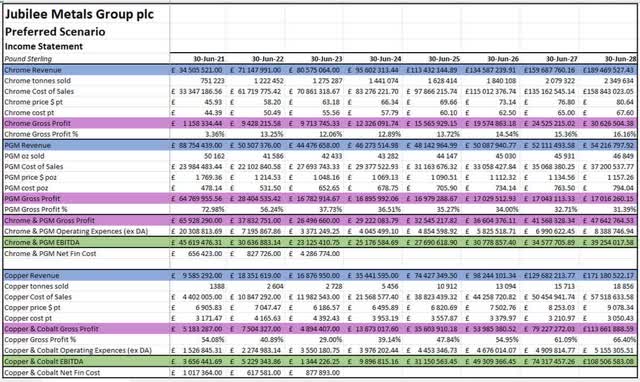

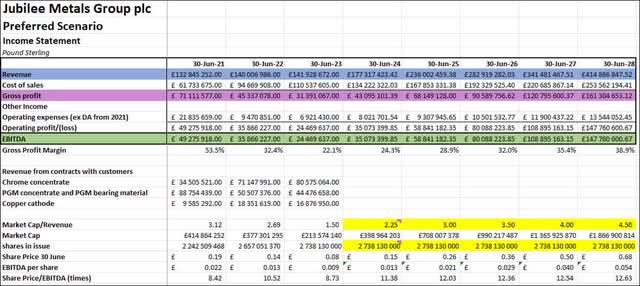

The first evaluation will be my “Preferred Scenario” in which I define the chrome business as mature but still having scope to grow, the PGM business as stagnating and increasingly subject to cost pressures but PGM prices have dropped to levels where supply will be constrained and avoid further price declines, and the copper business as growing into JMG targets and beyond with reasoned copper price increases due to significant long term copper demand growth.

The second evaluation will be a “Negative Scenario” in which I still follow the general divisional business characteristics, but the chrome business grows slower than expected and chrome prices decline slowly over the period with stagnating slow-growing costs, the PGM business in decline with falling production and lower prices as well as higher costs, and the copper business still in a growth trend but at a slower pace.

The third evaluation will be a “Positive Scenario” in which the chrome business experiences good growth inside a mature business profile with fair price and cost escalations, the PGM business stagnates in a low growth with higher costs generally environment, and the copper business growing robustly with higher prices achieved and solid economies of scale cost reductions achieved.

I will discuss my preferred scenario in detail and the alternative scenarios just briefly on the basis of the revenue and profit charts. You can discover them in full by downloading the model and investigating the alternative outcomes while also testing your own scenarios.

Results: Preferred Scenario

The logic builds better when one starts at the business segments. There is nothing out of the ordinary about the input variables which I had used. None of the input variables are outliers, all are reasonable and in line with historic data on the markets and JMG. Discussing each input variable outside the model will not be useful, it’s all available in the download.

Sarel Oberholster, Data: JMG AFS FY 2023

The importance of the chrome business as an anchor is very clear when looking at the chrome business segment. The capacity to expand towards 2mil tons per annum production is mostly in place so the only surprise here is how solid the growth potential in chrome still is. The vulnerability in the gross profit percentage is also well demonstrated so protecting profitability in chrome is very important.

“We are already putting out guidance for 1.45 million tons of chrome concentrate in our current financial period with an aspirational target of breaching 2 million tons of chrome concentrate, it will make us the biggest, if not, one of the biggest in the world in producing chrome concentrates.”

Earnings Call, 11 October 2023.

The company made it clear in its earnings call that they are aware of the gross profit vulnerability and discussed its strategy to improve the gross profit margin. JMG traditionally produced chrome on contract at fixed margins but they are changing the approach to more flexible profit-sharing arrangements, with more price risk but potentially much higher margins.

“So that means higher margins that’s with a fixed margin arrangement and as we increase further going forward towards 2 million, we are targeting that all these additional tons of chrome being placed in the market will be placed at market prices and much higher margins.”

The stagnation in both revenue and profitability of the PGM business is clear in the numbers yet it will still make a substantial contribution to both for the periods under review. Note also the significant increase in net finance costs allocated to the combined chrome and PGM businesses.

The company guidance at the earnings call for the production of copper is 5,850 tons for FY 2024. I have projected 5,456 tons for FY 2024 and yet the revenue and profit contributions from copper are already skyrocketing. JMG’s immediate longer-term growth target to capacity is 14,000 tons of copper production but they have also announced a modular copper production expansion strategy.

The modular expansion strategy is well explained in the AFS FY 2023, page 24.

“Jubilee developed breakthrough modular circuit designs targeting the recovery of copper from these reefs;

– Modular circuit design offers potential for rapid deployment based on learnings form the South African operations;

– Modules range from 15 000 to 50 000 tonnes per month processing capacity at lower capital of US$ 2.5 million for a 15 000 tonnes per month module;

– Modules targeted as part of Roan upgrade with two further modules considered under current long term offtake agreements being negotiated.”

My projections for the copper business are conservative and can easily be exceeded yet are still spectacular. Profitability will be exceptional.

The potential for expansion in copper production is almost without limit at present as the annual production footprint of JMG in the copper market is minute compared to for example the top ten copper producers.

Freeport-McMoRan produced 1.53 million metric tons (“MT”) of copper in 2022 in first place with Antofagasta in 10th place producing more than 646,000 MT of copper in 2022. Top 10 Copper-producing Companies (Updated 2023), INN, Melissa Pistilli, Apr. 18, 2023.

The JMG targeted 14,000 tonnes is a drop in the ocean presently which speaks to the potential to roll out many production modules before they can even challenge for the number ten spot.

Copper demand is also heading in a direction of severely constrained supply.

“Copper supply gap

According to McKinsey, global electrification is expected to increase annual copper demand to 36.6 million tonnes by 2031, compared to the current demand of roughly 25 million tonnes. However, the consultancy firm forecasts copper supply to be around 30.1 million tonnes, leaving a gap of 6.5 million tonnes by the start of next decade.”

The global copper market is entering an age of extremely large deficits, Rick Mills – Ahead of the Herd, Mining.com, July 25, 2023

The final point I want to make on the copper business is about the technology and IP owned by JMG. This is the strong moat that Warren Buffett is always looking for. JMG has captured this opportunity with in-house IP and technology honed through experience. Processing mining waste with such low copper content profitably is a technological challenge not yet overcome by any potential competitor. JMG hogs this space with not even a competitor on the horizon. The opposite is rather true, larger producers are increasingly looking to JMG to process marginal reserves and reefs of particularly chrome deposits given their proven competence and excellence in this field.

Consolidating the segmented businesses shows the growth potential even from this low base of decimated prices. The scenario does not cater to any commodity market stresses or supply shortfalls which could be a significant additional tailwind. Any such developments will contribute additional windfall profits for JMG.

Sarel Oberholster, Data: JMG AFS FY 2023

JMG is expected to rapidly grow revenue from £141mil to £415mil. Profitability is expected to shine with EBITDA growing from £24.5mil to £147.8mil. The share price is expected to exceed the magic 10x multiple from the current price of around £0.06 (you can probably get it below 6 pence presently) to reach £0.68 per share.

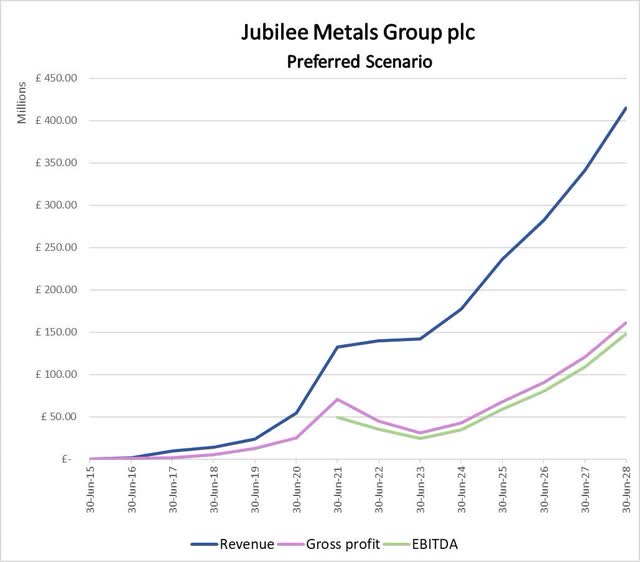

Charting the revenue and profit data shows how the markets are misjudging the performance of this company and over-emphasizing short-term developments that are already on their way out simply as a result of already implemented growth strategies.

Sarel Oberholster

The production growth already announced and guided for FY 2024 pivots the company back onto its exceptional growth path. Revenue and profits accelerate relentlessly as the copper business gains traction while the chrome business anchors the company for growth and stability.

Results: Negative Scenario

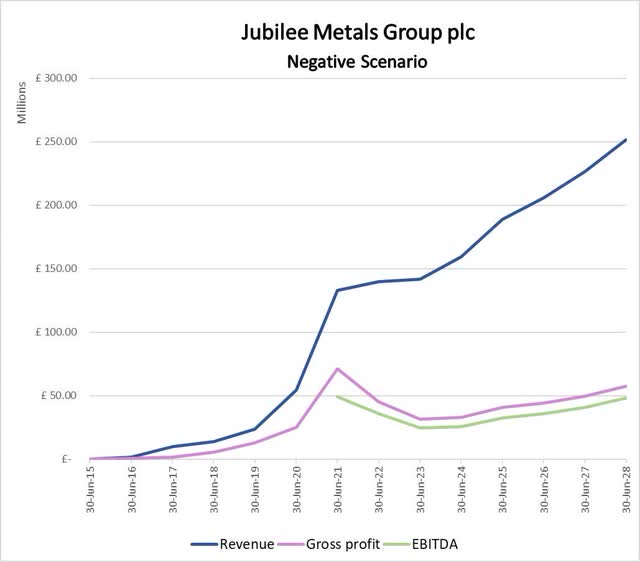

I repeat the dynamics for this scenario for ease of reference. The second evaluation will be a “Negative Scenario” in which I still follow the general divisional business characteristics, but the chrome business grows slower than expected and chrome prices decline slowly over the period with stagnating slow-growing costs, the PGM business in decline with falling production and lower prices as well as higher costs, and the copper business still in a growth trend but at a slower pace.

Sarel Oberholster

The negative scenario, which is fairly harsh, can’t derail the growth strategy but impedes its potential as can be expected if production is throttled and commodity prices restrained and reduced even in an inflationary environment. The share price produced in this scenario grows from the current around £0.06 to £0.18 for only a 3x multiple increase over the period.

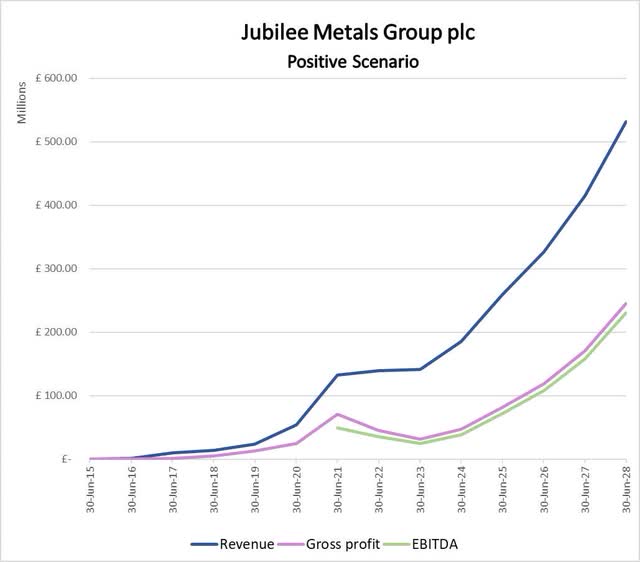

Results: Positive Scenario

The third evaluation will be a “Positive Scenario” in which the chrome business experiences good growth inside a mature business profile with fair price and cost escalations, the PGM business stagnates in a low growth with higher costs generally environment, and the copper business growing robustly with higher prices achieved and solid economies of scale cost reductions captured.

Sarel Oberholster

The results of the Preferred Scenario were already exceptional so this outcome is academic but still interesting as it reiterates the potential for substantially better profitability should better-than-expected conditions prevail. The share price would advance to just short of £1.00 for a more than 16x multiple increase in the share price over the next five years to 2028.

Risks

The risks faced by JMG remain the same as those discussed above. JMG is a price taker on its mineral production with no ability to dictate to the market at which price they will sell and will always be exposed to price fluctuations. Infrastructure events will remain a risk, but it is a manageable risk. Inflation and cost pressures are real and JMG has proved that they can mitigate such risks through efficiencies. Inflation is a double-edged sword that can also generate higher prices for the company’s minerals. The risk of interest rates and leverage is not of any concern as yet and should be more than eliminated in the growth strategy but must still be kept under a watchful eye especially in case the company faces more headwinds.

Conclusion

I have shared the disappointment of the market with the setbacks experienced by JMG. I closed all my holdings when they published the operational update and took the loss. I have only lately started to accumulate shares again with great care and cheeky bids. I felt a need to really discover the financial standing of the company as the reporting of net, cross-subsidized, prices can be confusing and opaque. I also needed the caution of solid math-based modeling separating the various business units into better-understood entities. The results of the financial modeling surprised me. I did not expect a robust comeback. I half expected a slower recovery. I certainly did not expect the recovery already be “baked in”. The strength of the copper business and the exceptional potential of the growth strategy were another positive surprise. JMG is knocking on the roof with its chrome strategy but the blue skies inherent to the copper growth strategy were inspiring. The financial model is available for download. Check the numbers. Check the logic. The numbers tell a story that 10,000 words in an article can’t. I am comfortable with my Preferred Scenario share price outcomes and expect the share price to at least double (more if you get in below 6 pence) over the next 12 months and to go on to become a ten-bagger over the next five years.

Financial Model on Jubilee Metals Group plc for download

Share_Price_Valuation_Model_for_Jubilee_Metals_Group_plc.xlsx

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here