Overview

My recommendation for MongoDB Inc. (NASDAQ:MDB) is a buy rating, as I expect the business to continue growing at 25% for the next 2 years, driven by the change in sales momentum and its product offerings that benefit from the rise in generative AI adoption.

Business

MDB is a provider of an open-source, NoSQL database for which it holds patents. The utilization of this database facilitates the storage of both structured and unstructured data for businesses. It enables the execution of rapid data queries, seamless scalability on either cloud-based platforms or on-site infrastructure, and efficient integration of novel data schemas. The main source of revenue for MDB is derived from its subscription-based model. This model entails providing enterprise customers with a comprehensive and flexible database solution that is secure. Additionally, MDB offers technical support, maintenance, and professional services as part of this subscription.

The primary product offerings of the company encompass MongoDB Enterprise Advanced, which functions as their proprietary software for managing databases, and MongoDB Atlas, a cloud-based platform that provides Database-as-a-Service (DBaaS). In addition, MongoDB offers the Community Server as open source software; this has helped the company gain traction in the developer community, which in turn has helped it sell more of its commercial offerings.

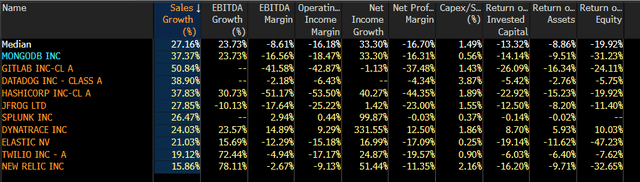

MDB’s historical financial performance has been incredible, growing at more than 40% CAGR for the past 5 years (64% in FY18, 61% in FY29, 58% in FY20, 40% in FY21, 48% in FY22, and 47% in FY23). This amazing feat suggests that the MDB product offering is capturing a large chunk of the market. The amazing feat that MDB has achieved is turning the business profitable on an EBIT basis in FY23 while sustaining a 47% growth rate. This significantly increases the strength of the MDB balance sheet, which has always been in a net cash position since FY15 (current $$760 million in net cash as of 2Q24), as it does not need to burn cash any longer.

Recent results & updates

In the second quarter of 2024, MDB maintained its impressive performance, with reported revenue reaching $423.8 million, surpassing the upper limit of the guidance range set by the management ($388 million to $392 million), demonstrating a robust growth rate of 40%. When we break down the revenue into sub-segments, Atlas revenue experienced a 38% increase, and notably, Enterprise Advanced [EA] revenue exhibited sequential growth, contrary to the earlier expectations of a slight decline.

Furthermore, profitability continued to improve, as MDB disclosed a non-GAAP gross margin of 77.6% and a non-GAAP operating income of $79.1 million, significantly surpassing the management’s projected range of $36 million to $39 million. Consequently, the non-GAAP EPS of $0.93 also exceeded the management’s estimate of approximately $0.43 to $0.46 by a considerable margin.

I anticipate that MDB will maintain a robust growth trajectory, as indicated by management’s observation that consumption patterns in the second quarter remained relatively stable compared to the initial challenges experienced in April 2022. Significantly, management has observed a substantial increase in new workload acquisition during the first half of the year. I anticipate that this will contribute positively to the growth of consumption in the medium term, as these customers gradually reach their typical levels of consumption. A shift in MDB’s sales motion (MDB is dis-incentivizing upfront commitments in favor of driving more workloads to the platform) also bodes well for the future of workload acquisition. By implementing strategies that discourage customers from making upfront commitments, the psychological obstacle for customers to adopt MDB is diminished, as there is no significant initial capital outflow. Consequently, this facilitates the conversion of prospects into paying users by the MDB sales team. Nevertheless, it should be noted that the implementation of this change will result in a decrease in cash flow for MDB in the short term. Nonetheless, this is a net positive change.

Aside from the change in sales motion, the growing adoption of generative AI should also further drive growth for the business. Management specifically highlighted that the Vector Search functionality will play a crucial role in facilitating artificial intelligence workloads, thereby contributing positively to the growth of Atlas consumption in the medium term. Eventually, I anticipate that the vast majority of database vendors will offer Vector functionality, though I anticipate that spending will be concentrated on a select few platforms, most notably MongoDB due to its already substantial developer mindshare. The value proposition is robust, as the incorporation of Vector functionality into a comprehensive data platform enables organizations to circumvent the intricacies associated with a fragmented data architecture constructed through the use of multiple individual solutions. In addition to Vector Search, I hold a favorable view of the Relational Migrator tool. Management has acknowledged that this tool has the potential to significantly contribute to application modernization efforts, which are becoming increasingly relevant as enterprises assess their Generation-AI strategies.

Overall, I believe MDB is in a favorable position to maintain its market share in a highly important and growing industry within the enterprise software space. Given the ongoing focus on digital transformation and the increasing adoption of public cloud, it is my belief that MDB is in a favorable position to benefit from the expansion of new workloads and the migration of legacy applications to new platforms. Furthermore, the recent modifications in the sales strategy, particularly the efforts to minimize friction in acquiring new customers, have started to yield positive results. I expect this trend to persist moving forward.

Valuation and risk

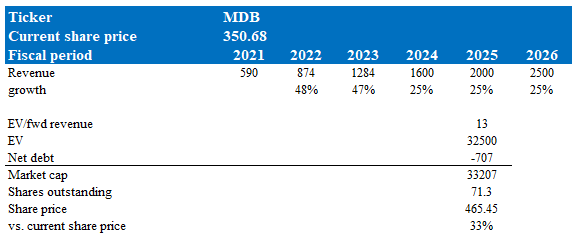

Author’s valuation model

According to my model, MDB is valued at $350.68 in FY24, representing a 33% increase. This target price is based on my growth forecast of 25% over the next 2 years. The rationale for the lower-than-historical growth rate is reflective of management FY24 guidance and also my concern that the negative impact of the current macro environment will linger longer than expected. Nonetheless, the growth is still very strong compared to other infrastructure software peers’.

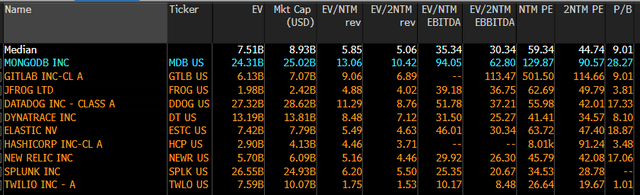

MDB is now trading at 13x forward revenue. While this seems high on an absolute level, note that MDB has always traded at a premium to peers because of its faster growth profile. Over the past 2 years, MDB has traded at around 2.3x peers’ multiple levels. Currently, peers are trading at an average of 5.4x EV/forward revenue, and applying 1.3x to it suggests MDB should trade at 12.4x, which translates to 27% upside.

(Please note my calculation reflects my target price).

Bloomberg

Bloomberg

MDB is not without its dangers. To begin, MDB will feel the effects of any unfavorable shifts in the IT spending environment, such as the one we are currently experiencing. Aggressive reinvestment (in sales and marketing), which will impact near-term profits, is likely necessary if management intends to aggressively drive the business back to 40% growth.

Summary

I recommend a buy rating for MDB due to its strong performance and positive growth outlook. The company is expected to sustain a growth rate of 25% over the next two years, driven by changes in its sales strategy and the increasing adoption of generative AI. MDB is an open-source NoSQL database provider, known for its patents in this field. Its subscription-based model, offering secure and flexible database solutions along with technical support and services, is a major revenue source. The company’s financial performance has been exceptional, with a 40%+ CAGR over the past five years. Recent results in the second quarter of 2024 exceeded expectations, with robust revenue and profitability. A shift in the sales approach and the growing adoption of generative AI bode well for the future.

Read the full article here