Following Citigroup’s (NYSE:C) strong Q3 2023 results, I am encouraged to reiterate a “Strong Buy” recommendation for the U.S. bank’s stock. Presenting results for the September quarter, Citigroup revealed 9% YoY and 18% YoY revenue growth and earnings growth, respectively, beating analyst consensus estimates on both metrics. Moreover, Citi surprised with a better-than-expected outlook, anchored on NIM guidance and supportive credit quality on loans.

Citi’s Q3 Surprises To The Upside

In the third quarter of 2023, Citigroup continued to demonstrate the power of a supportive interest yield backdrop, paired with solid execution of the bank’s restructuring strategy.

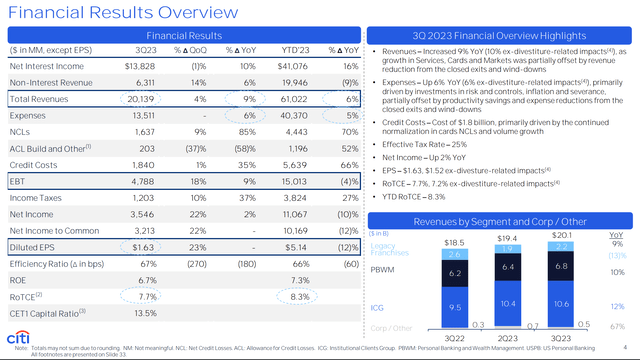

During the period spanning June through September, the bank generated approximately $20.1 billion in total revenues, marking a 9% YoY growth compared to the same period the previous year. On a QoQ basis, revenues jumped 4%, suggesting a 17% growth on a compounded annualized basis. That said, Citi’s topline surpassed analyst expectations by nearly $150 million, according to estimates collected by Refinitiv.

In terms of profitability, Citigroup recorded a quarterly profit before taxes of $4.8 billion, exceeding analyst consensus by almost $300 million, and representing a YoY jump of almost 18% vs. Q3 2022 profitability. That said, Citi’s performance in Q1 2023 reflects a post-tax return on tangible shareholders’ equity (ROTE) of approximately 6.7%, and a cost-to-income ratio of 67%, which is a 180 basis point improvement compared to the previous year. On the cost side, I would like to highlight Citi’s cost-optimization efforts: During the third quarter, Citigroup reduced its workforce by an additional 2,000 positions, bringing the total number of job cuts for the year to approximately 7,000. These headcount reductions have resulted in a total expenditure of $650 million in severance charges YTD, a charge that should be added back to Citi’s adjusted operating income to calculate the company’s structural earnings power.

Citi Q3 reporting

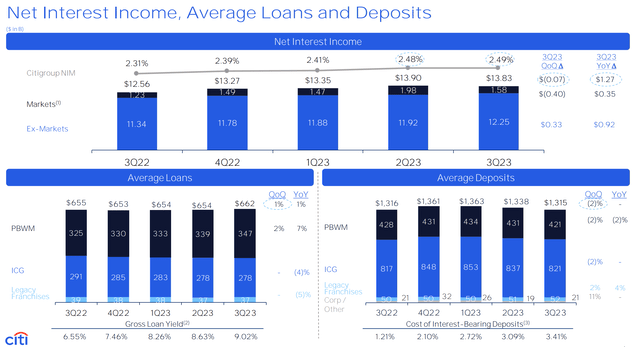

Of course, net interest income remained a key driver of Citi’s topline, contributing about $13.8 billion in revenues. But there are more moving parts to the story than the headline numbers communicate. Most notably, I would like to point out that while funding costs continue to rise, the rate of increase has decelerated, and competitive pressures reducing NIM have abated since the first half of the year. Surprisingly, even with the U.S. government issuing hundreds of billions of dollars in new Treasury bonds, this hasn’t cut out deposits of the banking system. Overall, Citi’s deposits only decreased by about 2% QoQ (in line for both ICG and PBWM).

Citi Q3 reporting

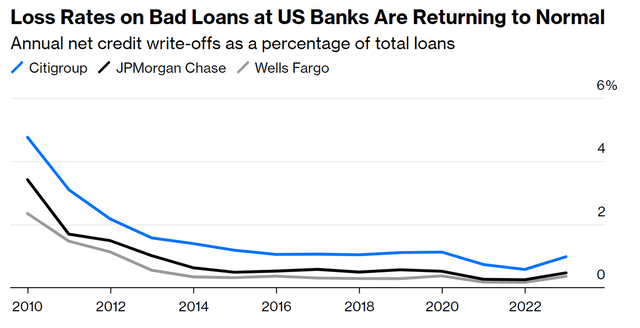

Meanwhile, on the interest income, it is worth pointing out that banks, including Citigroup, have yet to experience significant challenges stemming from loan losses. The anticipated impact of rising interest rates on consumers and the broader economy has not materialized, and this has proven to be highly advantageous for the profitability of large financial institutions.

To give more context, in Q3 2023 Citigroup allocated only $1.8 billion to provisions in likely credit losses, including a credit-reserve increase of $125 million for customer credit cards. Now, while provisions jumped 35% YoY, investors should note that Citi’s write-offs as a percentage of total loans remain in line with trends during the time leading up to the pandemic.

Bloomberg

Income on lending aside, investors will certainly appreciate that Citi’s non-interest revenue was up 14% YoY, jumping to $6.1 billion for the quarter and demonstrating Citi’s position as a financial services conglomerate beyond lending. Specifically, Citigroup leveraged an exceptional environment in rates and currency trading, underpinned by the Federal Reserve’s ongoing discussions on the trajectory of interest rates. The bank’s fixed-income trading segment saw revenues rise 14% YoY, resulting in $2.8 billion of revenues. Furthermore, the bank’s investment banking revenue surpassed expectations, growing 34% YoY, to $844 million. Lastly, Citigroup’s CEO, Jane Fraser, pointed out some encouraging activity in the equity capital markets and highlighted that debt capital markets activity was up 40% QoQ.

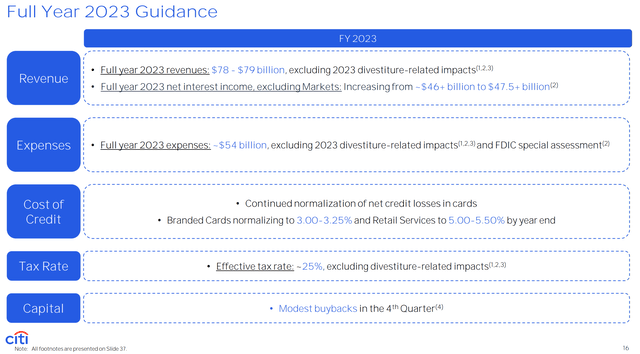

Citigroup has raised its projections for full-year 2023 net interest income. The revised guidance for 2023 net interest income, excluding Markets, now stands at $47.5 billion, up $1.5 billion from the $46 billion estimated earlier (3% increase). At the same time management reiterated the forecasts for full-year expenses and the effective tax rate.

On capital distribution, Citi management anticipates engaging in “modest” stock buybacks in the fourth quarter of 2023, although precise figures were not disclosed. Personally, I expect $500-750 million in buybacks, which would be supported by the banks’ expanding earnings power and 13.5% CET1 as of Q3.

Citi Q3 reporting

Reflecting on Citi’s Q3 2023 performance, and how investors were broadly surprised by the bank’s upward revision in net interest income, I would like to point out that there continues to be a misunderstanding in markets about the timing and limits of peak margins in the banking industry.

The prevailing market notion is that “peak rates mean peak NIM,” and this perception is reflected in earnings forecasts for major banks. However, as I see it, even with “peak rates” banks’ balance sheets and earnings power continue to reprice. Notably, banks like Citigroup still hold lots of assets with low interest rate returns. As these assets mature, banks may roll over this asset book at considerably higher rates, effectively absorbing headwinds from the gradual increase in deposit beta and potentially offsetting future declines in interest rates.

Investor Takeaway

Citigroup continues to post strong financial results, while investors continue to price Citigroup stock as a turnaround story at depressed multiples. Now, while Citi indeed remains a turnaround story to some extent with upside in earnings power, as the bank pushes to expand margins on cost optimization (headcount reduction, digitalization), organizational restructuring (see here), and balance sheet repositioning (sale, or spin-out of underperforming assets, incl. Banamex IPO and sale of the China consumer wealth business to HSBC), investors should not fail to appreciate that Citi is far in the process of improving its earnings and shareholder investment pitch. In fact, on a valuation to earnings relative analysis, Citi trades at a consensus 2024 7x P/E. That is very cheap, in my opinion. And then again, investors should also consider that there remains upside in Citi’s earnings power due to ongoing, major restructuring efforts, which may likely bring Citi’s implied P/E closer to 5x on an adjusted, estimated 22-24% net income margin. In my opinion, Citi’s Q3 results show that it is time to show some love for this bank stock.

Read the full article here