Sleep Number Corporation (NASDAQ:SNBR) is navigating market headwinds, yet these challenges highlight its commitment to wellness technology by integrating sleep science into its product range. In my view, SNBR’s approach to melding tech-savvy wellness into its business model is both innovative and timely. This is because, amid macroeconomic pressures, particularly chip shortages, the company has maintained its focus on product innovation and bolstered its marketing efforts. This dual approach and projections of a chip surplus in 2024 suggest a positive future outlook for SNBR. While looking at SNBR’s financials reveals the company’s high leverage, my analysis indicates that its valuation is about right, leading me to rate it a “hold” at present.

Business Overview

Sleep Number Corporation, based in Minneapolis, operates primarily in the U.S., specializing in sleep solutions and services. With its 5,000 employees, the company offers a range of products under its proprietary brand, including beds, pillows, and sheets. Moreover, SNBR showcases its innovative prowess through its Flexfit adjustable bases and Climate 360 smart beds. SNBR has morphed from a mere bedding company to a wellness technology front-runner. Their ethos is evident in their commitment to enhancing societal health through improved sleep. Their product range, particularly the AI and ML-enabled smart beds, highlights their focus on personalization and adaptability. With collaborations with renowned institutions like the Mayo Clinic and the American Cancer Society, SNBR reinforces its commitment to understanding sleep as a crucial facet of overall health.

In my opinion, what sets SNBR apart is its holistic approach to sleep wellness, integrating sleep science, technology, and a deep-rooted community of “Smart Sleepers.” Their transition from a traditional mattress retailer to a leader in wellness technology demonstrates adaptability and a forward-thinking vision. SNBR invests in customer engagement and referral programs to foster brand loyalty and drive repeat business.

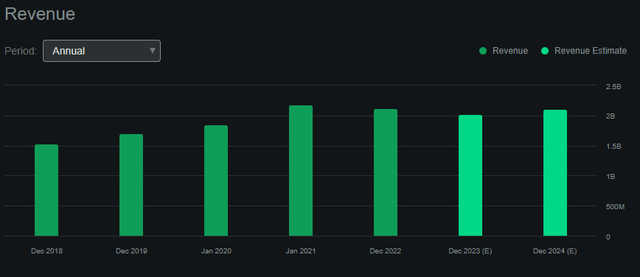

Seeking Alpha.

The firm’s revenue generation primarily comes from direct sales to consumers through diverse channels, including retail, online, and direct communication platforms. Notably, in 2023, SNBR faced a contraction in sales, largely influenced by a challenging macroeconomic environment and historically low consumer sentiment, which pressured demand. And I believe the supply chain issues, especially the semiconductor chip supply constraints, have significantly impacted SNBR’s sales.

Turnaround Strategies

Nevertheless, SNBR’s Q2 showed challenges, with net sales at $459 million, marking a 16% decline from the previous year. However, it’s pertinent to mention that the demand was only marginally below expectations. Even under such circumstances, SNBR successfully delivered nearly 77,000 Smart Bed units, boasting an ARU of just under $6,000. The second quarter EPS of $0.03 is noticeably lower than the previous year’s $1.54. Yet, it’s essential to contextualize those results with the semiconductor chip shortage in the past year’s figures. However, in late 2023, the chip shortage is quickly becoming a glut, which could help SNBR’s results going forward. And this could be just what SNBR needs to recover from its dismal 2023 performance so far. After all, an 8% drop in YTD net sales is not trivial.

Additionally, the company’s efforts, including spending controls and strategic pricing, seem aimed at mitigating these impacts. SNBR’s EBIT, while decreasing from $67.9 million in 2022 to $50.7 million for the TTM, underscores that the firm remains operationally profitable even in trying periods. So overall, I think SNBR’s decisions to adjust staffing and tempering store expansions suggest the company has an adequately measured approach.

Moreover, I think SNBR’s significant dependence on retail stores, accounting for roughly 87% of their sales, presents both opportunities and challenges. This model offers the advantage of tailored customer interactions but also leaves the company vulnerable to shifts in consumer shopping patterns. Given the current trajectory favoring online shopping over brick-and-mortar experiences, there’s a potential risk for the company. However, normalizing chip prices could be advantageous for SNBR. Plus, SNBR’s pricing methodology, marketing tactics, and spending controls give me a cautiously optimistic perspective on their future. Also, even SNBR projects EPS just slightly below last year’s third-quarter EPS of $0.22 and a Q4 gross margin close to 60%. This suggests a level of confidence in their strategies during these challenging times.

SNBR’s website

Hence, I believe the company’s efforts to navigate these challenges, as evidenced by introducing new products and advertising campaigns, demonstrate a proactive approach to reignite consumer demand and alleviate supply chain pressures. Concretely, in 2023, SNBR introduced the next generation of its smart beds, which evolved from the original SNBR 360 smart beds. These new smart beds incorporate advancements based on over 19 billion hours of proprietary, longitudinal sleep data collected from the previous models of the 360 smart beds. The next-generation smart beds were designed to support the sleep and accessibility needs of individuals across different age groups. These beds have enhanced tailoring and craftsmanship, starting at around $1,099. The features of these new smart beds were developed based on research conducted by SNBR. Alongside the smart beds, SNBR also launched Lifestyle Furniture as part of its new product offerings in 2023.

Also, the “Sleep Next Level” campaign, initiated with a significant investment of over $100 million across various platforms, underscores SNBR’s deliberate move into the market. Their collaboration with prominent personalities such as Gabrielle Union and Dwyane Wade aims to leverage their widespread appeal to bolster the brand’s image. I believe that teaming up with the globally acknowledged agency, 72andSunny, underlines SNBR’s intent to stay relevant and impactful in the market. The beds, which are strategically priced starting at $1,099, balance affordability and luxury. This pricing approach targets a wide range of consumers, making it a compelling choice. Furthermore, SNBR’s recent foray into Lifestyle Furniture indicates a possible diversification approach. Such an expansion serves dual purposes: reducing risks related to dependence on a single product line and addressing the varied needs of their existing customer base. Additionally, cultivating customer loyalty ensures store traffic and repeat business and capitalizes on word-of-mouth marketing, which, I believe, remains an incredibly effective advertising avenue.

Therefore, I feel SNBR’s potential resurgence is closely tied to how effectively it addresses its supply chain constraints and leverages its innovative products to rebuild customer trust. The company recently adjusted its full-year 2023 diluted EPS projection to between $1.25 and $1.75. I believe this revised estimate indicates the firm’s optimism about improving performance during the latter half of the year. Such a shift in expectations is likely due to an anticipated uptick in demand, which upcoming product releases and marketing initiatives should spur. While there are undeniable challenges ahead for SNBR, the company’s holistic approach, which encompasses product variety, targeted advertising, and community outreach, combined with its financial flexibility, suggests a business that is not only weathering the storm but is also developing the skills to navigate it effectively. Although it will take time to validate these strategies’ success, SNBR is on the right track.

Valuation Analysis

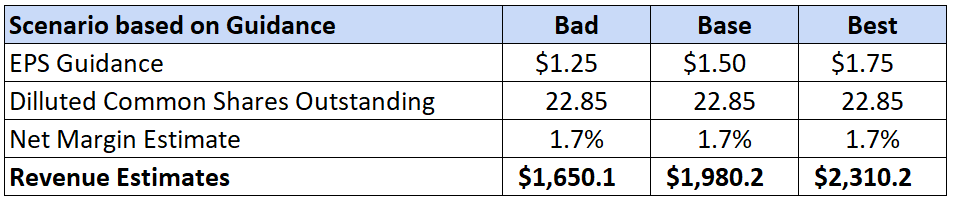

After analyzing SNBR’s financial outlook, I’ve based my revenue estimation on their current guidance, which indicates an EPS of $1.25 to $1.75 for 2023. Considering net margin assumptions and the present shares outstanding, I can reasonably infer the revenue expectations set forth by the management for this fiscal year. I’ve devised three potential scenarios for SNBR. In my opinion, the base case scenario provides the most realistic valuation given the provided guidance and underlying assumptions. This perspective is especially crucial when considering an investment decision or understanding the company’s potential growth trajectory.

Author’s elaboration.

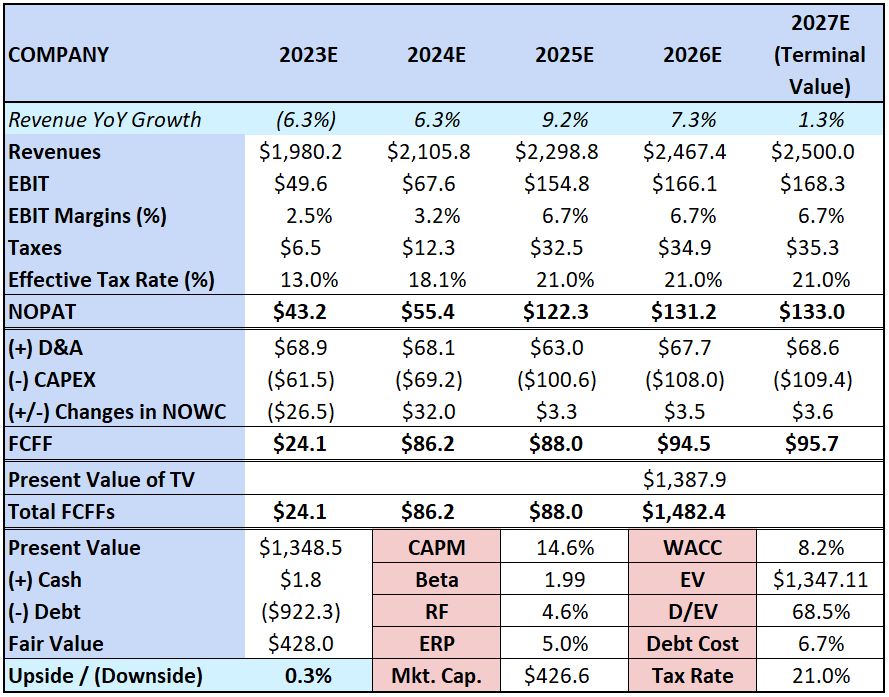

Notably, from a valuation perspective, SNBR is considerably leveraged. This inherently amplifies its returns both when the market moves favorably and adversely. This characteristic is mirrored in the company’s elevated beta, influencing its CAPM discount rate. To provide some context, SNBR has about $922.3 million in debt. Combined with a market cap of $426.6 million, it results in an enterprise value of roughly $1.35 billion. It’s worth noting, however, that SNBR has secured some competitively priced debt. If the company refrains from accumulating more debt, the current cost stands at approximately 6.7%. Given these circumstances, SNBR’s WACC will likely be lower than its CAPM. This is one of the primary factors that enhances SNBR’s valuation because a lower WACC can imply a higher enterprise value under certain valuation methodologies.

Author’s elaboration.

As you can see, my valuation model suggests that the company is reasonably valued, with an estimated base case scenario of $1.50 EPS and projected revenues of $1.98 billion for 2023. I infer from these numbers that by 2024, the company might recover the revenues it lost and align with its revenue CAGR since 2013, which stands at 9.2%. Thus, gradually adjusting this growth to a terminal revenue run rate of $2.5 billion, with an EBIT margin of 6.7%, seems plausible. Such assumptions are consistent with SNBR’s historical margins and growth rates. Hence, I believe these are apt for establishing a base-case scenario. It’s essential to note that if SNBR’s performance deviates from this base case, the implied fair value will undoubtedly change. Considering the company’s high leverage, its valuation can be extremely sensitive to such shifts. Therefore, if one believes that SNBR will operate closer to its guidance’s lower boundary, it could be perceived as overvalued. However, based on the current data and circumstances, I feel that assigning SNBR a “hold” rating seems prudent.

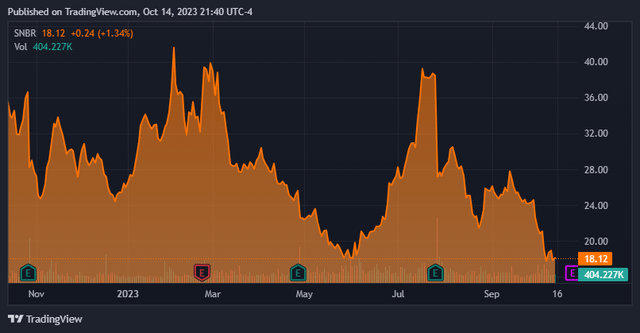

TradingView.

Q3 Preview

In discussing the financial outlook for SNBR as we approach the third quarter of 2023, it’s prudent to leverage base case estimates to project the company’s Q3 performance. I anticipate that SNBR will report approximately $1.98 billion in revenues for the entire year of 2023. Given that SNBR has already disclosed revenues of $985.3 million, it follows that a substantial portion of the yearly revenue, around $994.9 million, by my calculations, is expected to be realized in the latter half of this fiscal year. It’s worth noting that historically, the financial performance of SNBR has shown a certain level of seasonality, with Q4 often seeing a boost due to holiday shopping, which naturally increases retail store traffic. Based on historical trends, a reasonable distribution of the remaining revenue between Q3 and Q4 might see 45% allocated to Q3 and 55% to Q4. Under such a distribution, SNBR is projected to report revenues of about $447.7 million in the upcoming Q3.

Consequently, we can also apply a net margin estimate of 1.7% alongside the known diluted shares outstanding, yielding an implied EPS of approximately $0.34 for Q3. This projection serves as a tangible benchmark. If SNBR reports figures surpassing these estimates, it may warrant a more optimistic outlook for the company. Thus, Q3 will be a significant indicator of SNBR’s resilience and strategic adaptability amidst current market challenges and could potentially set a positive precedent for Q4. Suppose the performance exceeds the estimated $447.7 million in revenues and $0.34 EPS. In that case, it might reflect a commendable turnaround sign, thereby providing a strong entry into the lucrative holiday quarter. This, in turn, could renew a more optimistic sentiment towards SNBR’s growth trajectory. I believe such a scenario would reflect positively on SNBR’s operational efficacy and potentially bolster investor confidence, likely benefiting SNBR’s share price.

Conclusion

SNBR has shown resilience amidst challenging circumstances, particularly in its focus on incorporating wellness technology and sleep science into its offerings. This suggests an innovative and forward-looking approach. External market factors have presented challenges, yet the company’s dedication to product innovation and strategic marketing remains apparent. With the potential alleviation of chip shortages, there’s a reason to be optimistic about SNBR’s future prospects. Although SNBR carries significant leverage, based on my valuation analysis, I believe its current valuation aligns closely with its intrinsic value. For this reason, I think a “hold” recommendation at current levels is appropriate.

Read the full article here