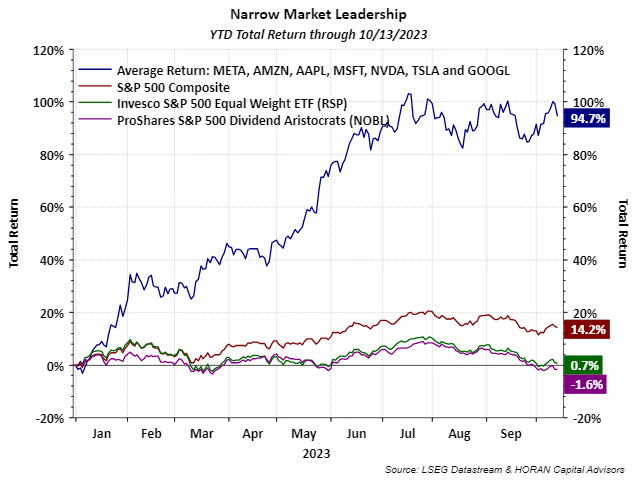

One aspect of the equity market advance this year is investors’ heightened focus on a handful of stocks some are referring to as the “Magnificent Seven.” These stocks are Meta Platforms (META), Amazon (AMZN), Apple (AAPL), Microsoft (MSFT), NVIDIA (NVDA), Tesla (TSLA) and Alphabet (GOOGL). A common theme for these stocks is the companies have a focus on artificial intelligence (A.I.) Partly, as a result of the focus on these seven stocks, other segments of stocks are shunned by investors, specifically dividend-paying stocks. As the below chart shows, year to date through Friday’s market close, the combined average return for these seven stocks is 94.7%. Some of the highest-quality companies as represented by the S&P 500 Dividend Aristocrats ETF (NOBL) have a negative year to date total return of -1.6%. The green line on the below chart represents the S&P 500 Equal Weight ETF (RSP). The .7% total return is essentially the average return of stocks in the S&P 500 Index.

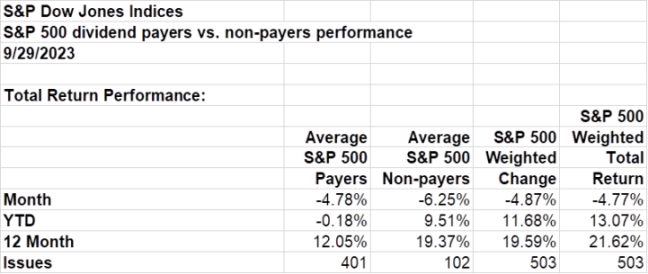

In the S&P 500 Index, 401 stocks are dividend-paying ones and 102 are non-dividend paying stocks. As reported by S&P Dow Jones Indices, the year-to-date average return of the dividend payers is a negative -.18% and the non-payers’ average return equals 9.51%.

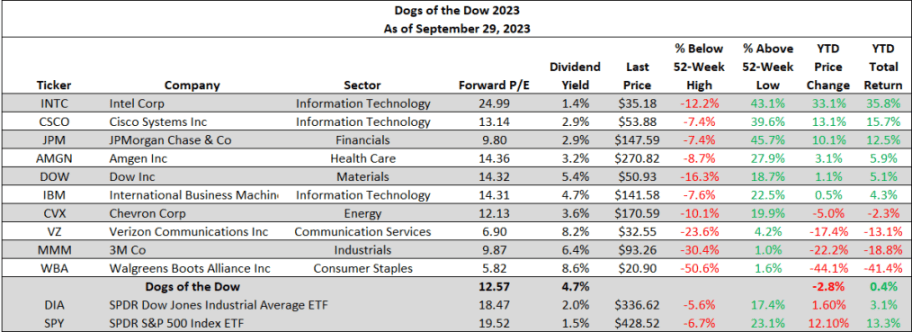

Lastly, as noted in prior blog posts, the Dogs of the Dow strategy has the sole focus of investing in the highest dividend-yielding stocks in the Dow Jones Industrial Average Index. The Dogs of the Dow strategy is one where investors select the ten stocks that have the highest dividend yield from the stocks in the Dow Jones Industrial Index after the close of business on the last trading day of the year. Once the ten stocks are determined, an investor invests an equal dollar amount in each of the ten stocks and holds them for the entire next year. Were it not for the dividend payments, the YTD return for this group of ten stocks would be a negative -2.8% through the end of September. With the dividends, the total return is .4%. The Dogs of the Dow have lost ground so far in October, with a YTD price return of -3.0%.

For investors, trees do not grow to the sky. Certainly, the opportunities in A.I. are real; however, these opportunities can be overhyped in the early development stage. A recent article in the Wall Street Journal, Big Tech Struggles to Turn AI Hype into Profits, highlights some of the challenges. As noted in the article, May Habib, CEO of Writer said, “Next year, I think, is the year the slush fund for generative AI goes away.” I note this as next year investors could see headwinds develop for some of these Mag Seven stocks and higher-quality dividend payers may be a reasonable alternative for one’s portfolio.

Disclosure: Firm and/or family long INTC, CSCO, JPM, AMGN, DOW, VZ, MMM, RSP, AAPL, MSFT, GOOGL

HORAN Capital Advisors, LLC is an SEC registered investment advisor. The information herein has been obtained from sources believed to be reliable but we cannot assure its accuracy or completeness. Neither the information nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. Any reference to past performance is not to be implied or construed as a guarantee of future results. Market conditions can vary widely over time and there is always the potential of losing money when investing in securities. HCA and its affiliates do not provide tax, legal or accounting advice. This material has been prepared for informational purposes only and is not intended to provide and should not be relied on for tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here