As part of my idea generation process, I run a number of screens that look for net-net opportunities. I define a net-net as a company whose cash balance minus all liabilities is greater than its market cap. Usually all that I get back from the screen are pre-deal SPACs, blank-check companies, and clinical-stage biotechnology companies with high cash burn. I’m not interested in investing in any of these types of companies. A name that I am interested in from this screen is Vanda Pharmaceuticals (NASDAQ:VNDA). I’m still working through my due diligence process, but the company looks like an excellent value opportunity.

VNDA has two commercial-stage drug products generating over $200mm in annual revenue, a robust clinical pipeline with multiple completed stage 3 drug trials, and nearly $500mm in cash. At the time of this writing, the company trades at a market cap of just $250mm against $387mm in net cash. The market is right to be cautious; VNDA’s top drug is facing competition from generic alternatives for the first time, and revenue is plummeting. I think the market is overreacting; VNDA’s cash burn is modest at worst and there are multiple positive catalysts on the horizon. VNDA is on my buy list as a low-risk, high-uncertainty investment.

Company Background

VNDA is a pharmaceutical company with two commercial-stage drugs on the market and a modest pipeline of clinical-stage drugs in various states of research. Hetlioz has been the company’s primary revenue driver and is used to treat Non-24-Hour Sleep-Wake Disorder (Non-24) and nighttime sleep disturbances in Smith-Magenis Syndrome (SMS). Non-24 primarily affects blind individuals and causes sleep disturbances, as the body’s circadian rhythm is negatively impacted by the lack of visual cues. SMS is a developmental condition that affects children and can lead to cognitive impairment and difficulty sleeping. In both cases, Hetlioz is used to improve patient sleep and restfulness.

Hetlioz generated $160mm in sales in full-year 2022, but revenue is falling due to competition from generic alternatives that are just starting to hit the market due to patent expiration. Q2 Hetlioz revenue was just $22mm, or $88mm annualized. VNDA is pursuing legal action against generic producers Teva Pharmaceuticals (TEVA) and Apotex Inc. for possible patent infringement, but so far the lower courts have all ruled against VNDA and the company is working through the appeals process.

Fanapt is VNDA’s other commercial product and is used to treat patients with schizophrenia. Fanapt is patent-protected from generic competition until late 2027; the patentability of Fanapt was challenged in series of lawsuits that began in 2016, but the courts ultimately upheld that competitors are banned from “manufacturing, using, selling, offering to sell, distributing or importing any generic iloperidone [Fanapt] product.” Fanapt’s total sales in 2022 were $95mm, and in Q2 of 2023 sales were a solid $24mm.

Pipeline and Potential Catalysts

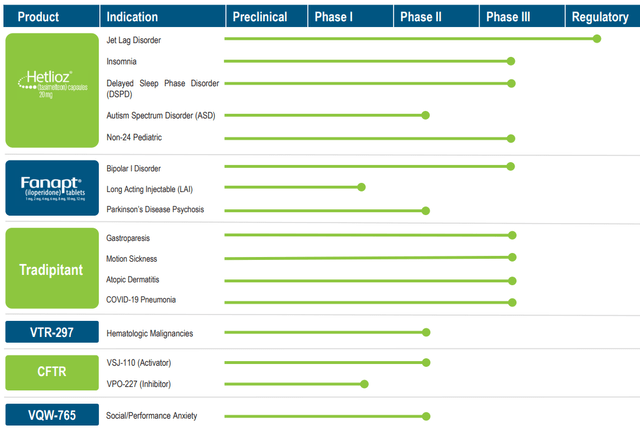

VNDA has a robust drug pipeline, with many candidates having completed Phase III trials:

Company Presentation

There are a number of Phase III trials that are of particular interest. First is using Fanapt to control symptoms of Bipolar disorder. This trial was completed successfully at the end of 2022 and demonstrated that Fanapt was significantly superior to the placebo in treating manic episodes. VNDA is asking the FDA to approve commercial sale of the drug; if granted, this would give VNDA access to an expanded market. The company cites estimates that nearly 3% of the US adult population is affected by bipolar symptoms, and that the addressable market is ten times the size of the schizophrenia market. VNDA has also completed trials for Hetlioz as a treatment for insomnia and delayed sleep phase disorder, as well as for Tradipitant as a treatment for gastroparesis. Management was asked about a timeline for these applications on the last earnings call and had this to say:

“We do not give specific details and interim updates, such as when we submit, when the FDA files and what they could do for data. But what we can tell you, it is that all three applications are progressing without necessarily telling you which ones have been submitted, filed or to be submitted. But given where we are, we expect that a regulatory decision should be able to be rendered in each one and all of them within the next 12 months.“

The Investment Thesis

I believe VNDA is trading too cheaply relative to its cash balance and future earnings potential. The company has $387mm in net cash on the balance sheet, as well as an additional $70mm in deferred tax assets. With such a robust balance sheet, a market cap of $250mm would imply that VNDA is burning a lot of cash, but this is not the case. Through the first six months of 2023 the company has broken even from an earnings perspective and generated over $18mm in operating cash flow.

I think that the market is concerned that Hetlioz revenue and margins will continue to decline; VNDA’s share price is down over 50% since they lost a patent lawsuit that would have protected Hetlioz from generic competition. I think the company’s substantial cash assets can more than cover for a decrease in revenue, at least until there is more clarity around VNDA’s pipeline drugs. If Hetlioz revenue dropped another 50% from Q2 levels and operating expenses remained constant, I estimate this would be about a $50mm hit to annual cash flow. VNDA could burn $50mm in cash for two full years and still be a net-net. It is worth pointing out that the cash alone is generating nearly $20mm annually in interest, thanks to higher yields on short-term investment options.

With VNDA’s short-term downside protected by ample cash assets, there are multiple potential catalysts on the horizon that could boost earnings and market sentiment. As mentioned earlier, within the next year, VNDA expects to receive FDA commercialization rulings on three potential drugs. I believe approval of any of the three would provide a boost to investor confidence and eventually lead to additional revenue.

VNDA is continuing to pursue legal action against TEVA and Apotex to limit the production and sale of their generic versions of Hetlioz. VNDA is pursuing multiple legal strategies, including disputing the timing of when the generics should be made available and challenging TEVA’s marketing practices. I’m not a legal expert and so far VNDA hasn’t had any legal successes, but if any of the ongoing petitions are successful they would likely translate into a short-term boost in Hetlioz earnings. The downside of the lawsuits is that they require VNDA to spend capital on legal fees and might not produce any return on the investment.

At a bare minimum, I think VNDA should trade at the value of its net cash if it can maintain profitability. I argue this is a very conservative assumption; to trade at net cash is to imply the underlying business is worthless, and if the company is generating even marginal net income it shows that the business does indeed have value. A market cap of $387mm translates to a share price of $6.75. The company will likely need one of its potential catalysts to materialize in order to maintain positive cash flow, but VNDA has a lot of shots on goal in the coming year and plenty of cash to keep the ship afloat in the meantime. VNDA is facing real challenges, but the market is far too pessimistic about the company’s future prospects. The risk/reward looks very favorable to me.

Risks

The worst-case scenario for VNDA would be if their FDA applications are all rejected and their legal actions all prove to be unfruitful. In this scenario, the company is likely facing annual cash burn, and will have wasted resources on legal fees. The company’s cash balance will protect the company in the short term, but investors are unlikely to benefit if VNDA’s cash flow dries up. I think management is unlikely to liquidate the company, so the cash cushion just gives the company a longer runway to return to meaningful profitability and won’t be a direct benefit to shareholders. On the positive side, VNDA has so much cash on hand that I don’t see any short-term liquidity issues arising.

Another possibility is that management could squander some or all of its cash on an acquisition that goes bad. Management stated on the last earnings call that their cash balance gives them “… a lot of flexibility to look at potential business development opportunities from the outside. And we have a number of them ongoing. And in terms of types, we’re very focused to first diversify our revenue and support our commercial presence.” While an accreditive acquisition could bolster the company, a poor one would erode the margin of safety provided by the company’s cash assets.

Conclusion

I will freely admit that I am neither a legal export nor a particularly savvy biotech investor, but I think VNDA’s risk/reward ratio is too appealing to ignore. The company’s cash balance is earning meaningful interest income and provides ample downside protection. The company isn’t burning cash (yet) and has multiple catalysts that could materialize within the next 9-12 months. A market cap 35% below the value of the company’s cash balance is a very attractive entry point. I think that VNDA has the potential to trade at $7/share within a year if things go VNDA’s way; if they don’t, I think there will be plenty of time to exit a position without a permanent loss of capital. Heads investors win big, tails they don’t lose too much.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Best Value Idea investment competition, which runs through October 25. With cash prizes, this competition — open to all contributors — is one you don’t want to miss. If you are interested in becoming a contributor and taking part in the competition, click here to find out more and submit your article today!

Read the full article here