Share of MGIC Investment Corporation (NYSE:MTG) have been a strong performer over the past year, rising 35%. Still, shares are only trading around book value, and given the likelihood of extremely low losses on the majority of its insured portfolio and benefit of rising interest rates on investment income, shares still have a single-digit earnings multiple. With about $2.40-$2.50 in earnings power, I believe shares have upside into the low $20’s.

Seeking Alpha

MGIC is a private mortgage insurer (PMI). To qualify for a conforming loan, insured by Fannie Mae or Freddie Mac, homebuyers, among other constraints, must put 20% down. If they cannot, they put less down and buy PMI from a firm like MGIC, which will insure the difference between their down payment and requisite 20%. Each month as some premium is paid down via the mortgage payment, the balance MGIC is insuring declines until the 20% threshold is met.

In the company’s second quarter, MGIC earned $0.68 in adjusted EPS, which was down from $0.81 last year. This is primarily because losses on polices incurred was a negative $18 million from a negative $99 million last year. MGIC has enjoyed negative losses by drawing down insurance reserves due to favorable delinquency and loss rates relative to expectations. It is natural for this to come down as these reserves have been falling, given the strength of the housing market. Loss reserves are now $530 million from $721 million a year ago. Lower reserves mean less scope for reserve releases.

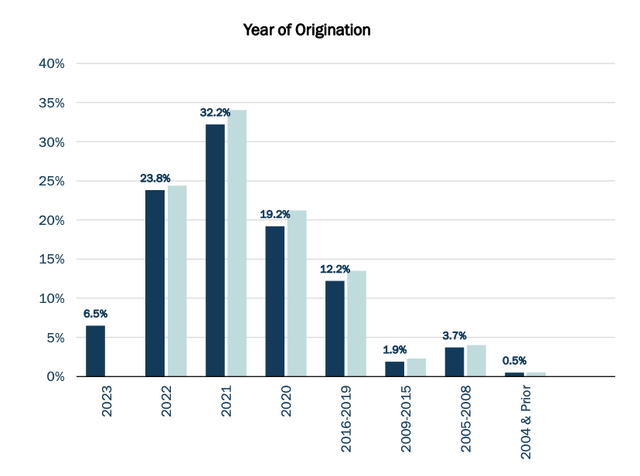

Alongside this, new insurance written of $12.4 billion from $24.3 billion last year, just given the decline in housing transactions, there was less activity to insure. Consistent with the reserve release, delinquencies ticked down from 2.12% to 2.05%. Overall, MGIC has $292.5 billion of insurance in force, up 2% from last year. Given this size, its loss reserves may seem low, but it is important to note when MGIC’s policies were written:

MGIC

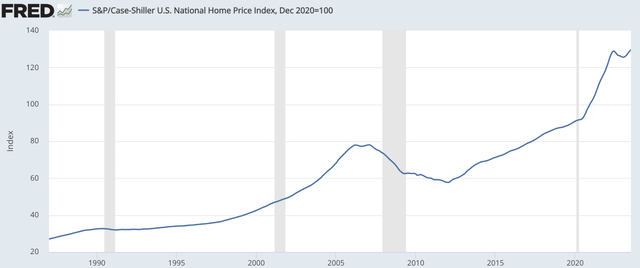

About 37% of MGIC’s policies were written in 2020 or earlier, and a further 32% were written in 2021. Since then, we have seen a dramatic rise in home prices. Since the end of 2020, home prices have risen by 30%. Even if a homeowner were to default, they would almost certainly be able to sell the house for as much as they paid for it, in which case the mortgage balance can be paid off and MGIC faces no loss. It would take a drop similar to the worst of the 2008 housing crash just to bring home prices back to levels seen in 2020. The amount of equity under MGIC’s policies has made material losses even in a meaningful economic downturn extremely unlikely on this legacy 37% of its business.

St. Louis Federal Reserve

Home prices are also nearly 10% higher than the end of 2021, so even that 32% block of business has a healthy equity floor underneath it, though it is not as far from removed from potential losses during a major downturn in the same way 2020 and earlier policies are. Now, this still does leave about 30% of policies that have been issued since 2022, around current home prices. Here though, each month, policies do pay down some principal, and with unemployment firm, delinquencies are low, slowly adding an equity cushion.

My point is not to say that MGIC will never take another loss; rather, a large portion of its insurance-in-force comes against homes where mortgage balances are substantially below market prices, meaning even if a homebuyer cannot make the payment, they can sell the home rather than face a loss-incurring foreclosure from MGIC. This is supportive of lower reserves.

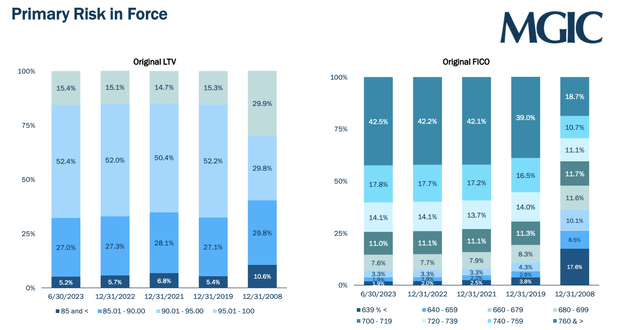

Additionally, underwriting standards for mortgages have become tighter than they were during the last housing downturn, which should mean delinquencies perform better. As you can see below, credit scores of mortgage borrowers are substantially stronger than in 2008, and there are far fewer buyers putting less than 5% down, meaning there is a greater equity cushion to absorb losses.

MGIC

All of this points to an insurance book that is fundamentally stronger and more resilient during downturns than in the past. Still, if there were to be a meaningful economic downturn that drives housing lower, MGIC will see some losses, primarily on recent vintages of insurance. However, I am of the view the housing market can continue to be resilient as it has been thus far in the face of higher interest rates.

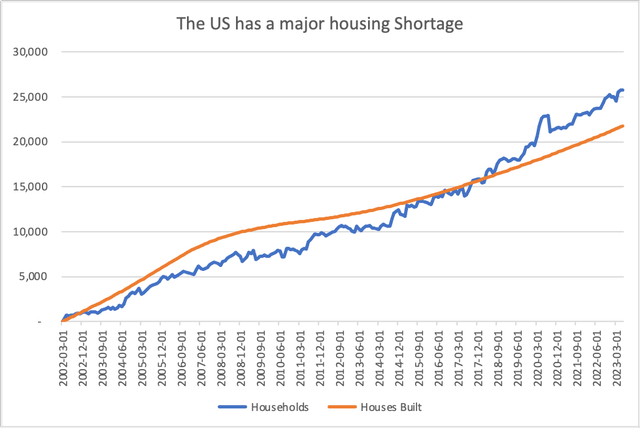

The chart below shows that America has created 4 million more households than new homes over the past twenty years. 2008 was fundamentally different—due to the surge in construction, we had overbuilt housing relative to the population. However because of how little building happened after the financial crisis, population growth has caught up and exceeded home construction.

line chart

This shortage is why, in my view, housing has proven stronger than many expected it would in the face of 7% mortgage rates and why home prices remain near all-time highs. There are many potential buyers waiting in the wings to own a home when they have the opportunity. This pent-up demand is providing meaningful support for the market. Importantly, MGIC does not need home prices to keep rising—just to not fall materially, so that buyers who are strained can sell rather than face a foreclosure.

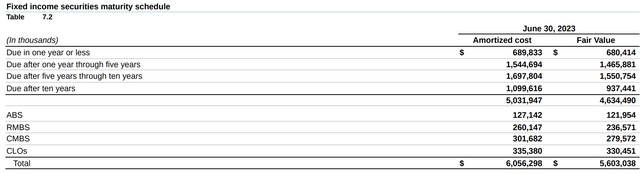

In the meantime, MGIC invests the premiums its customers pay. It has a $5.9 billion investment portfolio in high-quality fixed income securities. In Q2, investment income rose 30% or $12 million to $52 million as it reinvests at higher interest rates. This portfolio has a duration of 4.2 years, and its yield rose from 3% to 3.4%. Accordingly, the portfolio has significant near-term maturities. It will be able to reinvest the $690 million in maturities over the next year at a higher rate, and its ABS/CMBS/RMBS/CLO positions amortize, meaning they repay some principal every month, which can also be reinvested.

MGIC

This makes MGIC a beneficiary of rising rates, and it should continue to see a benefit over at least the next 18-24 months from reinvestment. I would note that its book value of $17.09 (up 14% from last year) includes $-1.26 from unrealized losses on securities bought at lower rates. Given it is a cash flow generating business facing limited insured losses, MGIC can let these gradually pull to par and mature rather than sell at a loss, building book value back higher.

MGIC’s insurance operating company has statutory capital of $5.65 billion and a statutory surplus of $775 million. This enabled the operating company to pay the holdco a $300 million dividend in Q2 and $800 million last year. It is the holdco that returns capital to shareholders. With this dividend, the holdco has $817 million of cash and investments. Thanks to these resources, MGIC spent over $70 million on repurchases in Q2 and just authorized another $500 million program. In July, it raised its dividend by 15% to $0.115.

Given its excess capital position, MGIC will be able to continue to dividend up operating income to fund capital returns. Additionally, it is also scheduled for statutory capital reserve releases of nearly $250 million next year; and $500 million in 2025, based on the run-off of its business. So if housing transactions continue to slow, and its insurance-in-force declines, its capital return capacity grows. Of course, each policy it writes will require some capital to support it, so these full amounts are unlikely to be paid up to the holdco.

Even if we assume no further reserve releases, with interest income rising steadily, MGIC has about $2.40-$2.50 in earnings power. Importantly, given my view on the housing market, and the fact the labor market is holding up strongly, we are unlikely to see meaningful increases in reserves either. That leaves MGIC with about $2.50 in go-forward earnings power and the capacity to buy back $400-500 million in stock over the next year, reducing shares by close to 10% and providing meaningful support.

Given ongoing worries about the durability of the housing market, I would expect shares to maintain a single-digit multiple, but 7x earnings is a compelling entry point, particularly with an increased dividend and strong buyback. I would look for shares to trade toward $20-22.5, providing about 20% upside as MGIC continues to perform well. MGIC is an attractive way to play a resilient housing market, particularly as it does not need home prices to rise—just not to fall materially to deliver strong results.

Read the full article here