Symbotic’s (NASDAQ:SYM) business continues to progress, with deployments being scaled and systems moving into production. Maturing supply partnerships and a large backlog should ensure growth remains robust in the near-term. The recently announced GreenBox JV should also help to support growth going forward. These positives need to be weighed against the fact that Symbotic’s valuation is extremely high, with many years of high growth already embedded in the stock price. Once the initial build out of automated warehouse infrastructure is complete, Symbotic will find it difficult to generate enough free cash flow to justify its share price, although this may take several years to become apparent.

Symbotic

Symbotic recently launched a joint venture with SoftBank that aims to enable the company to address the long tail of its market in an asset light manner. Symbotic believes that the GreenBox joint venture increases its addressable market by roughly 500 billion USD. GreenBox will be responsible for sales and Symbotic will operate the systems. While this potentially sets Symbotic up to generate greater returns on investments and achieve a higher valuation, it could also potentially weaken the company’s competitive position.

Symbotic’s technology enables it to place multiple tenants in a single facility by reducing errors and making it easier to control inventory. Multi-tenanting allows smaller organizations to benefit from economies of scale, helping to reduce the burden of logistics expenses. Warehouse costs for smaller organizations are typically 2–3 times higher than for larger organizations, potentially making Symbotic’s technology highly attractive to this customer group. Supporting this notion, Symbotic has stated that the launch of the GreenBox business was in response to customer demand.

The joint venture is with SoftBank, which acquired around 4% of Symbotic’s shares for 28 USD per share. This came from the CEO reducing his family’s stake in Symbotic and does not impact existing shareholders. Symbotic provided GreenBox with an initial 35 million USD funding but expects cash flow from GreenBox to be positive net of any capital needed to support growth. Symbotic owns 35% of the GreenBox business and also stands to benefit from high margin system revenue from GreenBox, which is backed by SoftBank. Symbotic has a non-cancelable contract with GreenBox for the purchase of 7.5 billion USD of Symbotic Systems. Even in the event that no systems are ordered through GreenBox, Symbotic still stands to receive 2 billion USD in cash payments backed by SoftBank. While the GreenBox business should help to support growth going forward, it is not expected to be operational until sometime in 2024.

Symbotic’s management team also recently stated that the Breakpack business is progressing well. This is basically a new business and has had teething issues as a result, but is reportedly on track. Breakpack refers to the process of splitting cases of product into individual units, which can then be combined into mixed SKU cartons. This is necessary to efficiently handle slower moving SKUs without creating excess inventory. Breakpack work is often still performed manually, but technology is increasingly allowing automated distribution centers to manage this activity. Symbotic is working with Walmart (WMT) on applying learnings from the first system to improve on the second system.

Financial Analysis

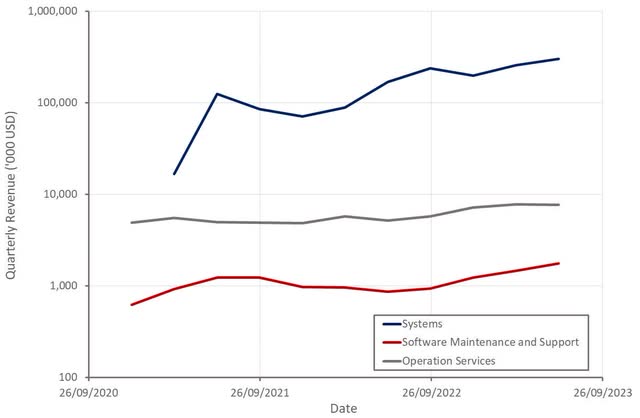

Symbotic’s revenue increased 78% YoY in the third quarter to 312 million USD. Recurring revenue is increasing as deployments move to production, although Systems continue to dominate revenue. Symbotic initiated six new system deployments during the third quarter and advanced one system to full operation. There are now 10 fully operational systems and 33 systems in the process of deployment. Deployments with Walmart continue to progress, and Symbotic recently started the second of five deployments with UNFI.

The speed at which deployments occur is expected to increase over time on the back of partnership initiatives and ongoing efforts to standardize the platform and streamline processes. System deployments started today are expected to take slightly under two years to complete. Longer term, Symbotic hopes to reduce this timeline to around six months. Symbotic has stated that it is pleased with its outsourcing partners and that its supplier ecosystem is ramping, supporting continued growth. This implies that Symbotic is currently supply constrained, which should be obvious given the size of the company’s backlog. The positive implications of this should not be overestimated, though, as the real test for Symbotic lies in whether it can continue to create growth after it has finished deploying systems within large customers like Walmart.

Symbotic currently expects 290-310 million USD revenue in the fourth quarter of FY2023, although this guidance is likely highly conservative. Assuming Symbotic continues to scale its ability to deploy new systems, revenue in the fourth quarter is more likely to come in around 350 million USD.

Symbotic’s backlog at the end of the third quarter was still 12 billion USD, although the GreenBox JV adds around another 11 billion USD to the backlog. Given that this additional backlog currently represents the relationship with SoftBank more so than end market demand, it should probably be considered separately.

Figure 1: Symbotic Revenue (source: Created by author using data from Symbotic)

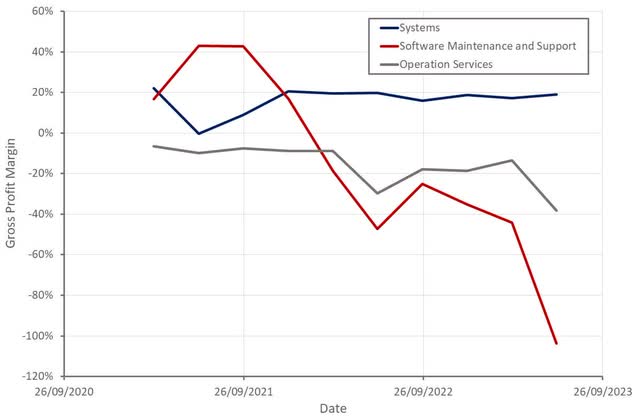

While Symbotic’s gross margins have been flat in recent quarters, the company continues to expect margins to improve over time. The rate at which Symbotic’s business is expanding and the shift to outsourcing partners has reportedly created redundant costs, which are expected to abate over time. Steel prices are also a headwind at the moment, although the impact of this has waned somewhat over the past few quarters. Current results also reflect significant costs associated with lower margin innovation projects. As the relative importance of these projects declines, Symbotic’s margins should improve. Symbotic’s margins should also be supported by the growing importance of recurring revenues, which are expected to have gross profit margins in excess of 60% longer term.

Figure 2: Symbotic Gross Profit Margins (source: Created by author using data from Symbotic)

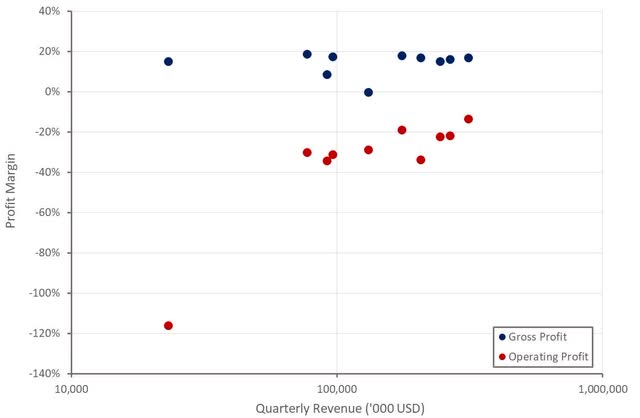

While Symbotic’s gross profit margins are relatively low and yet to show signs of increasing, operating profit margins continue to improve due to the operating leverage inherent in the business. Given enough scale, this will eventually lead to profitability, although investors should still look for gross profit margins to improve as the business matures.

Figure 3: Symbotic Profit Margins (source: Created by author using data from Symbotic)

Conclusion

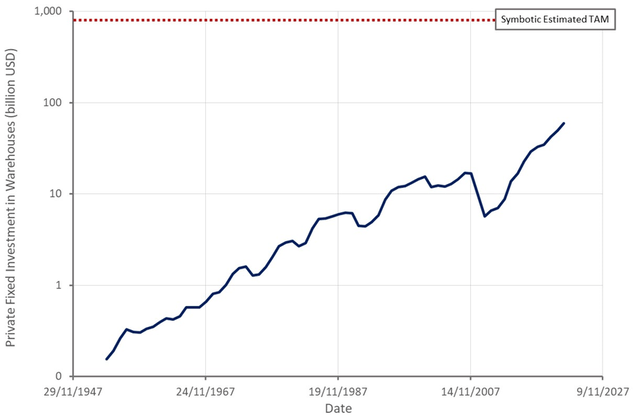

Symbotic has estimated the size of its addressable market based on the total potential spend on its systems over the next 15 years. The company is initially focused on the general merchandise, ambient grocery, ambient food distribution, consumer packaged food, and apparel verticals in North America. Symbotic believes that its SAM for these verticals in North America is around 133 billion USD. This expands to 393 billion USD when considering adjacent verticals and the European market. Asia is currently excluded from estimates.

Figure 4: Private Fixed Investment in Warehouses in the US (source: Created by author using data from The Federal Reserve)

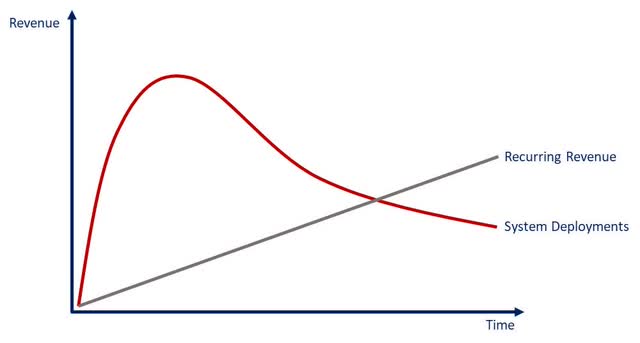

Symbotic’s TAM is deceptive, though, as the company sells systems with long lives (25-30 years). This is problematic as recurring revenue is only modest, and System revenue will eventually stagnate/fall once the initial build out of infrastructure is complete. While Symbotic indicates it has a large addressable market, the annual revenue opportunity is probably under 50 billion USD at maturity. Symbotic’s business is still relatively small, though, meaning that this situation likely won’t become apparent for several years.

Figure 5: Illustrative Revenue (source: Created by author)

Read the full article here