WisdomTree, Inc. (NYSE:WT) is a leading provider of exchange-traded products or ETPs.

As of December 31, 2022, WisdomTree was the thirteenth largest ETP sponsor globally based on AUM with $82 billion. In contrast, iShares, which is a subsidiary of BlackRock, ranked #1 with AUM of $2.952 trillion as of the end of last year.

Among WisdomTree’s ETPs include both actively managed ETFs and passive ETFs which vary based on their fund objectives.

Given its business, the revenue of WisdomTree depends substantially on how its AUM does and also its average fees on AUM.

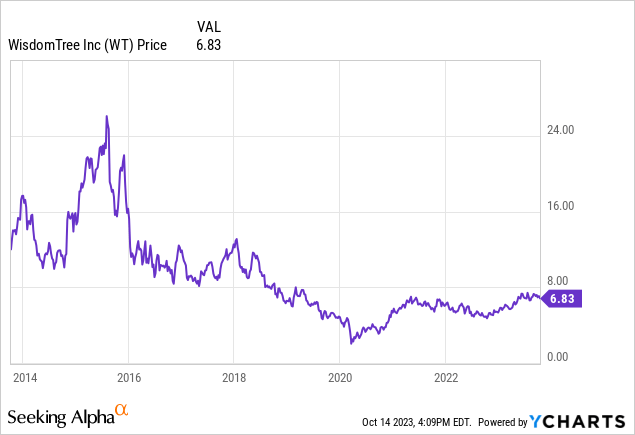

The Stock Price

From 2014 to early 2020, WisdomTree stock performed poorly as the company faced various headwinds including increasing competitiveness in the industry.

As a result of the increasing competitiveness, average fees across U.S. ETFs declined around 40% from 2012 to 2019 according to a 2019 JPMorgan analysis.

From December 31, 2017, to December 31, 2019, WisdomTree also had combined outflows of $13 billion from WisdomTree Europe Hedged Equity Fund and WisdomTree Japan Hedged Equity Fund as investors pulled out of those strategies. As a result, those two funds accounted for a combined 10% of AUM as of December 31, 2019, versus 35% as of December 31, 2017.

Furthermore, WisdomTree didn’t do very well in early 2020 given the start of the pandemic, which caused many asset prices to decline.

Since early 2020, however, WisdomTree’s stock has performed better.

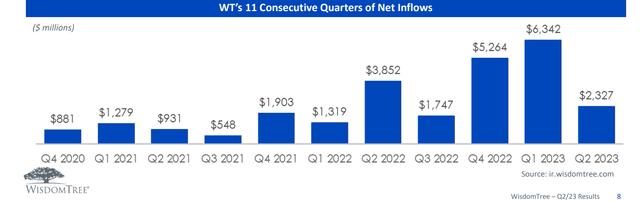

One reason is that WisdomTree’s AUM started increasing as a result of more inflows. In fact, with the increase in Q2 2023, WisdomTree has 11 straight quarters of net inflows globally.

WisdomTree Investor Relations

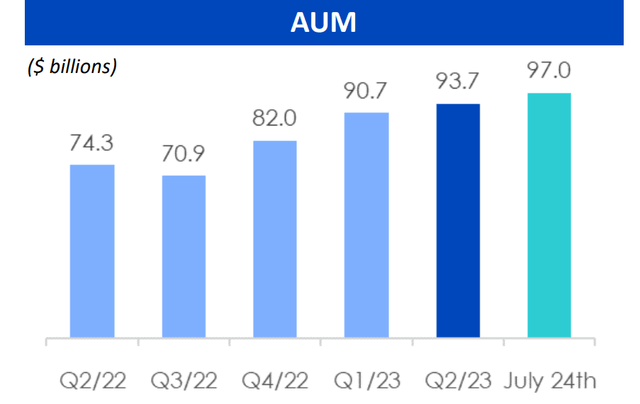

As a result of the net inflows, WisdomTree’s AUM has increased in each of the last three years.

In terms of AUM, WisdomTree had an AUM of $67.4 billion in 2020, $77.5 billion in 2021, and $82 billion in 2022. As of July 24, 2023, the company had an AUM of $97 billion.

In October, WisdomTree said it had 12 consecutive quarters of firm-wide net inflows, with year-to-date net inflows of almost $11 billion, representing 17% pace of annualized organic growth.

Q2 2023

In Q2 2023, WisdomTree had an AUM of $93.7 billion, up 3.5% from Q1 2023’s $90.7 billion.

On July 24, 2023, the company had AUM of $97 billion.

WisdomTree Investor Relations

Quarterly revenues in Q2 2023 were $85.724 million, up from $82.044 million in Q1 2023 and $77.253 million in Q2 2022.

As a percentage, quarterly revenues were up 4.5% from the prior quarter as a result of the higher average AUM. Revenue was up 10.97% year over year.

Comparatively, AUM was up 3.3% quarter over quarter and 26.1% year over year.

Adjusted EPS was $0.09, as opposed to $0.07 per share in Q1 2023 and $0.07 per share in Q2 2022.

Settlement of Contractual Gold Payments

In 2018, WisdomTree bought a European business from ETFS Capital in exchange for fixed payments of 9,500 ounces of gold per year for each year. In 2022, that contractual gold payment was $17.1 million. Given the price of gold changes in dollar terms, the changes in gold prices have affected the value of WisdomTree as well, making the stock harder to value in some ways.

In May 2023, WisdomTree closed on a transaction resulting in a full resolution of WisdomTree’s contractual gold payments obligation to ETFS Capital Limited for around $137 million, which included $50 million in cash and preferred shares convertible into 13.1 million shares of WisdomTree common stock.

As a result, the deal is expected to help expand WisdomTree’s operating margin by 530 basis points and helps increase net income by over $13 million.

Given it increases the diluted float by 13.1 million shares, the deal doesn’t add that much shareholder value in terms of EPS, but it nevertheless removes some uncertainty around the stock and helps the valuation.

Risks

WisdomTree’s inflows in the future might not be as strong as expected given competition.

Average fees on AUM might decline faster than expected given competition.

WisdomTree’s valuation could decrease if growth isn’t as strong as expected or if leading asset manager valuations weaken as a result of economic conditions.

AUM Growth

If WisdomTree continues its substantial AUM growth rate in recent years that more than offset the decline in average fees on AUM, the company’s profits will likely grow.

Furthermore, WisdomTree hopes to improve its margins as it gains more scale as its incremental margins could be higher than its adjusted operating margin in the first half of 2023.

In terms of AUM growth, there is reason to be fairly optimistic in terms of the next few years.

A substantial percentage of WisdomTree’s growth in recent years is due to growth in fixed income. Of the $14.6 billion of net inflows in 2022 for U.S. listed ETFs, $11.179 billion were from fixed income.

In Q1 2023, fixed income accounted for $3.513 billion of the total $6.4 billion in net inflow.

In Q2 2023, fixed income accounted for $1.471 billion of the $2.3 billion in total net inflows.

In the last two years, in fact, almost 70% of net inflows were from fixed income.

In terms of the medium-term future, the fixed income sector as a whole is expected to continue to grow.

According to the Financial Times in July 2023, BlackRock predicts that the total assets in global bond exchange-traded funds will triple to $6 trillion by 2030 from $2 trillion in July. Although the performance of an individual fund will vary based on its fund objectives, the asset class as a whole is expected to benefit once investors feel interest rates may have peaked.

Given the fixed income tailwind, there could be continued AUM tailwind for WisdomTree at least in the next few years.

In terms of average fees on ETFs, however, it seems that it is likely the average fees on ETFs will continue to trend lower in the future as the overall ETF industry realizes more economies of scale.

In the past year, WisdomTree’s average fee on AUM has declined.

In Q2 2022, the company had advisory fees of $75.59 million on an AUM of $74.3 billion, giving it an average fee on AUM of 40.7 basis points.

In Q2 2023, the company had advisory fees of $82 million on AUM of $93.7 billion, giving it an average fee on AUM of 35 basis points.

Nevertheless, there has been some stabilization on average fees on AUM this year.

In October, WisdomTree said its blended total average fee rate for the quarter to date as of September 30, 2023, was 36 basis points. The blended total average fee rate year to date was also 36 basis points.

While the company’s blended total average fee rate has stabilized recently, it is difficult to predict how fast it will decline in the future. If the decline isn’t as much as expected, WisdomTree’s fundamental performance could be better than expected if its AUM continues rising quickly.

Valuation

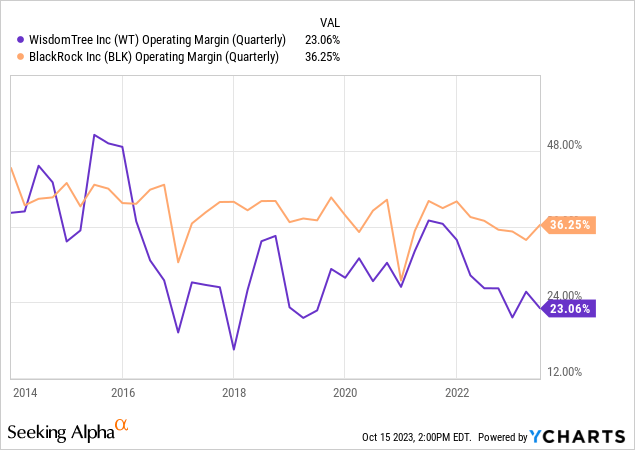

As a company, WisdomTree is somewhat undersized when compared to the industry leaders. This makes it tougher for WisdomTree to realize the same margins as its substantially bigger competitors. Although WisdomTree’s adjusted operating margin is 27.8% for Q2 2023, it is still below BlackRock’s 42.5%.

When compared to the industry leader, BlackRock, WisdomTree’s valuation is also higher.

In terms of EPS estimates, analysts estimate WisdomTree will earn $0.36 per share in the fiscal period ending December 2023, and $0.41 per share in the fiscal period ending December 2024. That gives WisdomTree a forward PE ratio of 19.18 for the fiscal period ending December 2023 and 16.57 for the fiscal period ending December 2024.

In contrast, BlackRock has a forward PE ratio of 17.13 for the fiscal period ending December 2023 and 16.38 for the fiscal period ending December 2024.

Given the lower valuation for BlackRock, it is easier to invest in BlackRock given the substantially larger company has more competitive advantages such as more scale, diversification, and likely a better chance at sustained growth.

Although the premium forward PE valuation versus the industry leader may make sense if WisdomTree were to put itself for sale, management hasn’t indicated it wants to put the company for sale in recent years. The last time the company considered a sale was in late 2018.

WisdomTree’s stock does have upside in the medium term if the company’s AUM growth continues to be strong in the next few years, but whether that happens is more uncertain than whether BlackRock’s AUM will increase by a decent amount over the same period.

As a result, I give WisdomTree a hold/neutral/sideline rating and I would rather invest in BlackRock instead.

Read the full article here